Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: October 31, 2023

- Last Updated: February 15, 2025

For many business owners, the idea of managing their bookkeeping can be daunting. Bookkeeping involves tracking all day-to-day financial transactions of the business, including payments to suppliers, revenue from sales, and employee salaries. It is a crucial process that ensures businesses remain financially healthy, but it can also be time-consuming and complex. That is why many businesses outsource their bookkeeping process to professional bookkeeping service providers. In this blog, we will cover everything about bookkeeping services, including what it is, why it is important, its scope, and how professional bookkeeping services can help businesses maintain accurate financial records and make informed financial decisions. Let us get started to know in detail.

What is Bookkeeping?

Bookkeeping is the process of recording, organising, and maintaining an organisation’s financial transactions. It involves keeping track of all financial transactions, including sales, purchases, receipts, and payments. Bookkeeping helps maintain a record of all financial activities within a business, which can be used to prepare financial statements, tax returns, and other important reports. Overall, bookkeeping is a critical component of effective financial management and plays a crucial role in the success of any business.

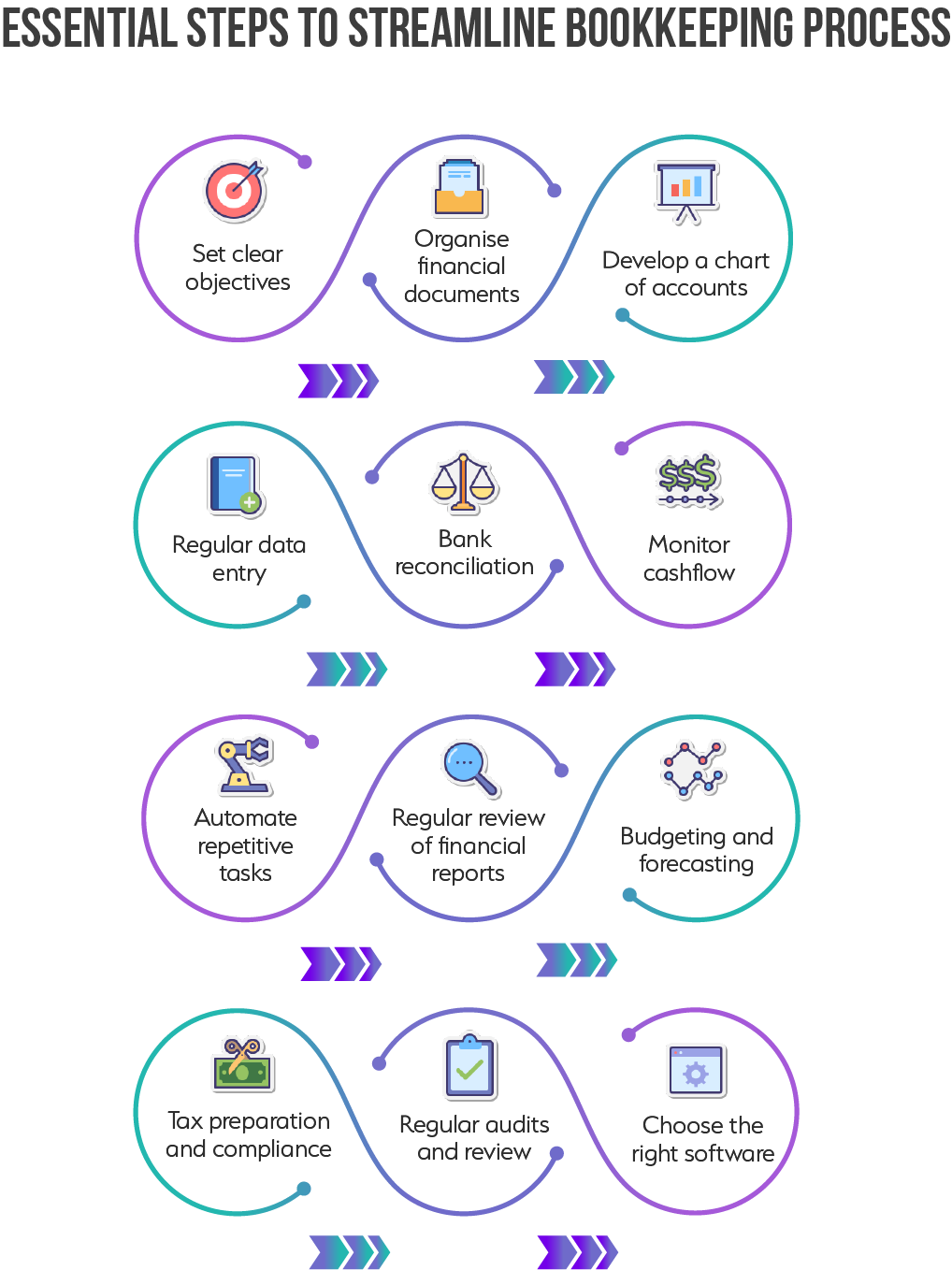

12 Essential Steps to Streamline the Bookkeeping Process

1. Set clear objectives:

Clear objectives are imperative to streamline the bookkeeping process. By setting clear objectives, businesses can enhance the accuracy of their financial records, increase efficiency, and prioritise work. This method minimises mistakes, follows rules, and encourages sound decision-making. An efficient bookkeeping system is characterised by well-defined objectives.

2. Organise financial data:

Putting financial data in order is crucial to making bookkeeping processes more efficient. Businesses can minimise data entry errors and expedite decision-making by keeping well-organised, current records. This systematic structure streamlines tax preparation, expedites financial evaluations, and enhances overall financial management. Accessibility and clarity are ensured by properly organised financial data, which helps firms stay on top of their finances and react quickly to enquiries.

3. Develop a chart of accounts:

Creating an organized chart of accounts is essential to making the bookkeeping process run more smoothly. Classifying transactions into different accounts improves uniformity and transparency in financial reporting. This organization streamlines audits and supports strategic financial preparation and evaluation by improving the tracking of financial operations, the integrity of financial records, and compliance with accounting standards.

4. Regular data entry:

Maintaining accurate and current financial records through timely and consistent transaction recording makes it easier to conduct trustworthy analysis and make decisions. This process minimises last-minute entry errors and stops document accumulation. Businesses can support proactive management and proactive planning by establishing and adhering to a planned data entry routine that enhances bookkeeping efficiency, ensures compliance, and provides real-time financial information.

5. Bank reconciliation:

The bookkeeping process can be streamlined with the help of bank reconciliation. To verify correctness, it entails comparing bank statements with the business’s records. Frequent reconciliation helps keep accurate financial records and protects against fraud by spotting inconsistencies and errors. This procedure guarantees precise cash flow recording, facilitating efficient financial management and data-driven decision-making.

6. Monitor cash flow:

Keeping an eye on cash flow is crucial to making bookkeeping more efficient. Businesses are able to comprehend their financial health and operate more effectively by routinely tracking money movement. Identifying financial difficulties, handling responsibilities, and capitalising on prospects are all made possible by efficient cash flow monitoring, all without sacrificing liquidity. Ultimately, this method improves financial planning and decision-making by guaranteeing a balance between revenue and expenses, supporting the fulfilment of short-term responsibilities, and facilitating long-term growth strategies.

7. Automate repetitive tasks:

By utilising automation tools, businesses may effectively handle data input, invoicing, and payroll with greater precision and fewer human mistakes. This improves compliance and frees employees to concentrate on key responsibilities like maintaining accurate financial records. Automation also improves the workflow of bookkeeping, enabling prompt updates and reactions to changes in finances.

8. Regular review of financial reports:

Regularly evaluating financial data streamlines the bookkeeping procedure. This entails checking cash flow, balance, and income statements for consistency and identifying any trends or disparities. Consistent analysis provides insights into financial health, support for strategic planning, and adherence to accounting rules. This proactive strategy improves operational effectiveness and financial transparency.

9. Budgeting and forecasting:

These procedures aid in business financial planning by estimating revenue and expenses according to historical data and industry trends. Although forecasting projects’ future financial conditions allow for proactive strategy revisions, effective budgeting distributes resources sensibly. By routinely using these tools, one can improve decision-making and connect financial objectives with corporate strategy by avoiding overspending, optimising investments, and planning for unforeseen expenses.

10. Tax preparations and compliance:

Remaining updated with tax regulations and keeping thorough documentation guarantees that companies stay out of trouble and optimise their deductions. Businesses can maintain compliance and effectively manage their liabilities by incorporating tax management into their regular bookkeeping practices. This strategy keeps overall financial stability, streamlines audits, and avoids year-end surprises.

11. Regular Audits and reviews:

These reviews guarantee accuracy and adherence to accounting rules through early detection of inconsistencies and prompt rectification. In addition to supporting regulatory compliance, this technique improves transparency among stakeholders. Routine evaluations enhance a strong financial management system and build trust, which also increases operational effectiveness and strategic decision-making.

12. Choose the right software:

Good software increases productivity by streamlining processes, improving accuracy, and providing real-time insights. When making your choice, consider compatibility, usability, scalability, and security. The correct solution facilitates thorough financial management and supports well-informed decision-making by integrating seamlessly with corporate activities.

Importance Of Bookkeeping

1. Keep Track of Financial Records:

Maintaining track of financial records is crucial for businesses to maintain accurate financial statements and formulate well-informed decisions. Bookkeeping helps ensure that all financial transactions are properly and accurately recorded.

2. Better Financial Decisions:

By maintaining accurate financial records, owners and managers can make informed decisions about budgeting, cash flow, and investments. Having up-to-date financial information is essential for businesses to keep a competitive edge in their industry.

3. Facilitates Tax Preparation:

Bookkeeping facilitates tax preparations by ensuring all financial data is properly recorded and organised. This provides a clear overview of the business’s financial situation, making it easier to file taxes on time.

4. Provide Valuable Insights:

Bookkeeping provides valuable insights into a business’s financial performance, which can help owners and managers prepare budget forecasting for the future.

5 Methods of Doing Bookkeeping

There are various methods of doing bookkeeping in business, and adopting the correct method can help businesses manage their finances more efficiently and effectively. Let us look at some of the commonly used methods of bookkeeping:

1. Manual Bookkeeping:

Manual bookkeeping is the traditional method of recording financial transactions using pen and paper or a spreadsheet. This approach requires a high level of attention to detail, accuracy, and strong record-keeping skills. While it can provide a sense of control and familiarity, manual bookkeeping can be time-consuming and prone to errors, especially for larger businesses with high transaction volumes.

2. Virtual Bookkeeping:

Virtual bookkeeping is the process of conducting bookkeeping tasks on an online platform or through a remote bookkeeper. Virtual bookkeepers typically work off-site and provide services to clients through secure online portals.

3. Computerised Bookkeeping:

Computerised bookkeeping is a more modern approach to managing financial transactions using digital software and automated tools. This method offers a faster, more accurate and more efficient way to record financial data and generate reports. Computerised bookkeeping systems can also be integrated with other business software, such as point-of-sale or inventory management systems, to streamline workflows and avoid manual data entry.

4. Cloud-Based Bookkeeping:

Cloud-based bookkeeping helps manage financial records and transactions using accounting software that stores data on remote servers. This approach allows businesses to access their financial information from anywhere with an internet connection, making it ideal for remote teams or businesses with multiple locations. Additionally, cloud-based bookkeeping offers advanced security features that protect sensitive financial data from loss or theft.

5. Outsourced Bookkeeping:

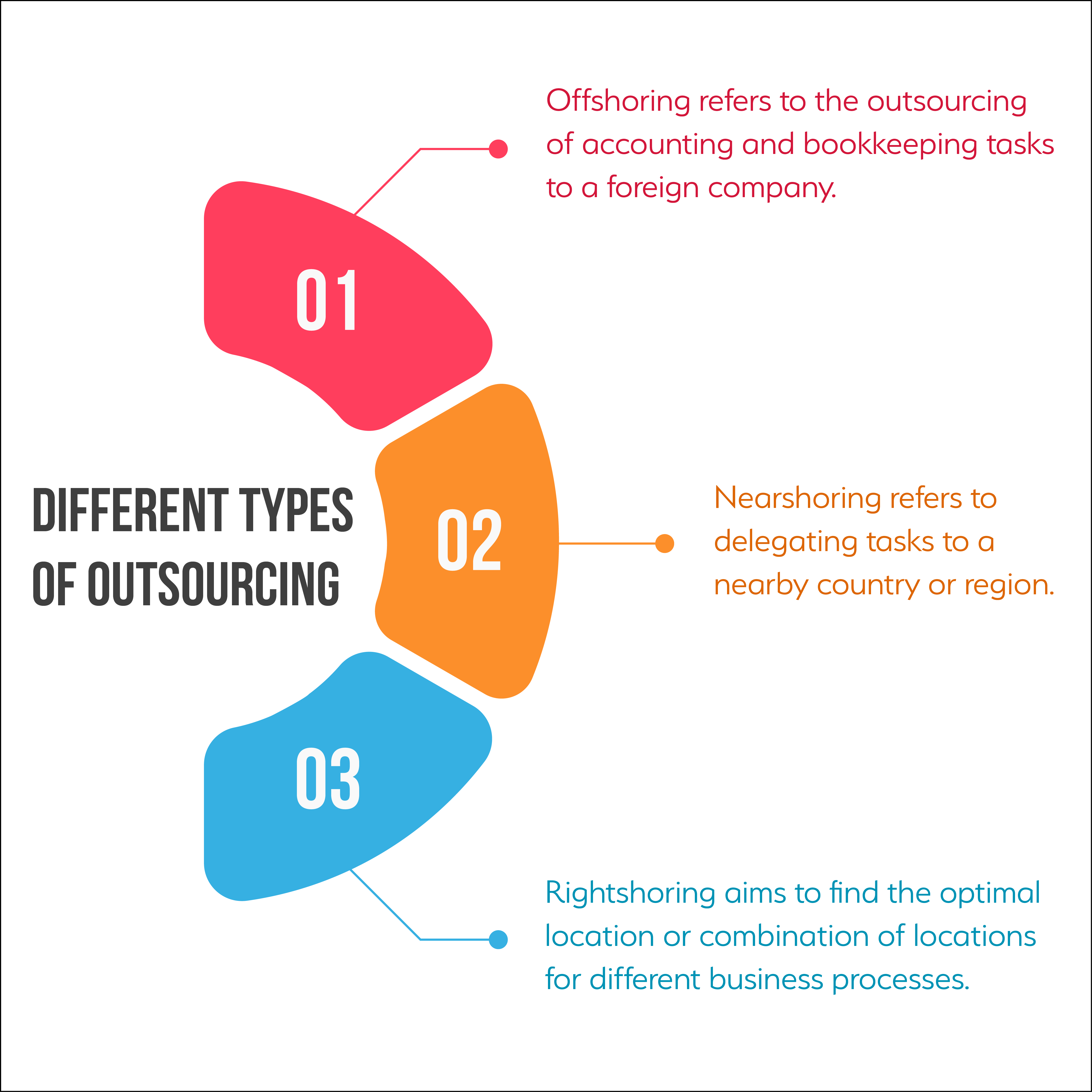

Outsourced bookkeeping involves hiring an external firm or individual to manage a company’s financial records and transactions. This approach provides businesses access to skilled professionals who are well-versed in accounting and financial management. By outsourcing bookkeeping tasks, businesses can reduce their overhead expenses, as they do not need to pay for a full-time in-house bookkeeper or invest in expensive software. Businesses can outsource their accounting and bookkeeping tasks in 3 ways:

- Offshoring: Offshoring is the practice of moving business processes or functions to a different country, typically one with lower labour costs. This strategy aims to reduce expenses while taking advantage of specialised skills and expertise available in offshore locations. This type of outsourcing is popular in industries such as manufacturing, IT, and customer support. Examples of offshoring include hiring outsourced bookkeeping services from countries like India, the Philippines, China, etc.

- Nearshoring: Nearshoring refers to the outsourcing of business processes or functions to countries that are closer in proximity or within the same region as the company’s home country. The main purpose of nearshoring is to take advantage of cost savings while maintaining geographic and cultural proximity, which can facilitate easier collaboration, communication, and travel.

- Right Shoring: Right shoring is a newer approach that aims to strike a balance between offshoring and nearshoring. It focuses on finding the most appropriate location for specific business processes based on factors such as cost, quality, proximity, expertise, and other considerations. Right shoring takes into account the strategic fit of each operation and considers whether it is best suited for outsourcing abroad, domestically, or near the company’s headquarters.

By understanding these 3 types of outsourcing, businesses can make informed decisions about effectively delegating tasks and operations to external providers. Additionally, outsourced accounting and bookkeeping services typically offer flexible pricing models, allowing businesses to scale up or down as needed based on their changing financial needs. Overall, outsourced bookkeeping can help businesses save time and money while ensuring accurate and timely financial reporting. Let us dive deeper to learn more about its benefits.

10 Benefits of Outsourced Bookkeeping Services

1. Cost-Effectiveness:

Firstly, it eliminates the need for in-house staff and the associated overhead costs such as salaries, benefits, and office space. Secondly, outsourcing allows businesses to only pay for the specific services they need rather than investing in an entire finance department. This can help reduce overall costs and free up resources for other important business activities.

2. Time-Saving:

By relying on an outside service provider, businesses can delegate time-consuming bookkeeping tasks such as data entry, payroll, and reconciliations. This can free up staff time for more high-level tasks and strategic planning while also ensuring that financial records are accurate and up to date.

3. Enhanced Accuracy:

Outsourced bookkeeping services can enhance accuracy using trained professionals with specialised experience in accounting and finance. This can help ensure that financial data is accurately recorded, categorised, and reconciled, reducing the risk of errors and discrepancies. Additionally, outsourcing can provide an extra layer of oversight and ensure compliance with accounting standards and regulations.

4. Professional Expertise:

By partnering with a reputable provider, businesses can access the expertise of trained accounting professionals with up-to-date knowledge of accounting and related financial regulations. This expertise can be especially valuable for businesses that lack the resources to hire a full-time accounting staff.

5. Focus On Core Business Activities:

By delegating financial tasks to an outside provider, businesses can free up staff time and resources to focus on core business activities that generate revenue, such as sales, marketing, and product development. This can help increase efficiency and profitability by allowing businesses to focus on their strengths and competitive advantages.

6. Scalability:

Outsourced bookkeeping services allow businesses to tap into a broader range of accounting services as needed without the expense and hassle of hiring and training new staff. This can help businesses adapt to changing needs and scale up or down without disrupting operations.

7. Access to Latest Accounting Technologies:

Professional bookkeeping firms invest in the latest accounting software and technologies to streamline processes, improve accuracy, and ensure data security. By hiring outsourced accounting and bookkeeping services, businesses can benefit from these advanced tools without the expense of purchasing and maintaining them themselves.

8. Confidentiality and Data Security:

Outsourced bookkeeping services can enhance confidentiality and data security. Professional bookkeeping firms have policies and procedures to protect the confidentiality of financial data, such as restricting access to sensitive information and maintaining secure systems and networks. This can help prevent data breaches or unauthorised access to financial records.

9. Fraud Prevention:

Professional bookkeepers can implement internal controls and prevention measures to reduce the risk of financial fraud or embezzlement risk. Additionally, outsourcing provides an extra layer of security by ensuring that financial records are independent and subject to regular review, helping detect any suspicious activities early on.

10. Integration of Automation:

Advanced software solutions are often used by outsourcing companies to automate repetitive operations, including data entry, transaction categorisation, and reconciliations. Thanks to automation, businesses may now obtain financial data and insights more quickly, improving accuracy and lowering the possibility of human error. As a result of this efficiency, company employees can concentrate on strategic tasks that bring greater value to the company and make better decisions.

How Does an Outsourced Team Stand Out from In-house Staff?

A bookkeeper who understands your business’s needs and requirements is crucial for accurate and efficient financial management. While many in-house bookkeepers are generalists, an outsourced bookkeeping team include specialists with knowledge and expertise in diverse industries. Here are 5 reasons why an outsourced bookkeeping team is a better choice over an in-house staff:

1. Industry-Specific Knowledge:

An outsourced bookkeeping team consists of specialists who possess an in-depth understanding of your industry’s unique financial challenges and requirements. This allows them to provide tailored support and advice to businesses.

2. Customised Services:

A specialist bookkeeping team can offer customised services to meet your business’s specific needs, such as managing payroll, tracking inventory, or preparing reports tailored to your business metrics.

3. Efficient Workflow:

Hiring professional accounting and bookkeeping services enables you to streamline workflows and ensure compliance with industry-specific regulations, saving time and money and reducing risks.

4. Ensure Accuracy:

With expertise in your industry, an outsourced bookkeeping team can help reduce errors and ensure accuracy in financial reports and statements.

5. Better Decision Making:

Specialist bookkeepers provide valuable insights into financial performance, enabling businesses to make informed decisions and ultimately leading to more successful outcomes.

In this way, an outsourced bookkeeping team stands out from an in-house staff. The team of highly skilled accounting experts possess sufficient knowledge and experience in various industries. They are also well-versed in different accounting software, which helps ensure speed and accuracy in accounting and bookkeeping tasks. Some of the commonly used accounting software include QuickBooks, Xero, MYOB, Zoho Books, Business Central, and Reckon.

Key Considerations When Selecting a Bookkeeping Service Provider

1. Determine Your Business Needs:

It is important to identify the specific accounting tasks you need help with. You should also consider your budget, the size of your business, and any industry-specific requirements.

2. Experience and Qualifications:

You should look for service providers with years of experience and expertise in your industry and relevant qualifications such as certifications or advanced degrees.

3. Reliable and Trustworthy:

You need a provider who manages your finances with the utmost confidentiality, accuracy, and attention to detail. The provider’s reliability can be assessed from their ability to meet deadlines as well as trustworthiness can be assessed based on customer reviews, references, and a background check.

4. Pricing Structure:

The next thing is to understand the costs involved and ensure that they fit within your budget. By carefully evaluating the pricing structure, you can ensure that you are receiving value for money and that your chosen bookkeeping services provider is affordable in the long term.

5. Communication and Support:

You should look for a provider with open communication channels who responds to your needs and queries. By selecting a bookkeeping service provider with strong communication skills, you can ensure a seamless and successful partnership.

4 Tips to Improve Your Business’s Bookkeeping Process

Hiring an in-house team or relying on outsourced bookkeeping services depends upon the specific needs and requirements of businesses. No matter the choice, there are some common tips that can be followed to improve the bookkeeping process. Let us highlight some of them:

1. Establish a Clear Bookkeeping System

Develop a well-defined bookkeeping system that outlines the processes and procedures for recording and organising financial transactions. This system should include a standardised chart of accounts, defined roles and responsibilities, and clear guidelines for data entry, reconciliation, and reporting.

2. Regularly Reconcile Accounts:

Reconciling your bank accounts is crucial for ensuring that your records match the bank’s records accurately. Set a regular schedule to reconcile your accounts, ideally on a monthly basis. Compare your bank statements to your accounting records, investigate any discrepancies, and make necessary adjustments. By doing this consistently, you can identify and resolve any errors or fraudulent activities promptly.

3. Implement Internal Controls and Security Measures

Protecting your financial data is of utmost importance. Establish internal controls and security measures to safeguard sensitive information and prevent unauthorised access. This includes implementing strong passwords, restricting user access based on roles and responsibilities, regularly backing up data, and conducting periodic audits to identify any potential risks or irregularities.

4. Regularly Review Financial Reports

Regularly reviewing financial reports is crucial for gaining insights into your business’s financial health. Schedule time each month or quarter to review balance sheets, profit and loss statements, cash flow statements, and other relevant reports. Analyse trends, identify areas of improvement and make informed decisions based on the information provided by these reports.

Future of Bookkeeping Trends

1. Cloud-based bookkeeping:

Future bookkeeping will be heavily influenced by cloud-based accounting, which provides real-time access to financial information from any location. This technology guarantees easy integration with other apps, lowers IT expenses, and improves security. It offers safe, current financial monitoring and facilitates effective cross-location communication. Cloud-based technologies are crucial for updating financial procedures and enhancing accessibility and data management as companies continue to adopt digital solutions.

2. Use of Artificial Intelligence (AI):

Artificial intelligence (AI) is automating difficult jobs like data entry, error detection, and financial analysis, which is revolutionising the bookkeeping industry. Artificial intelligence (AI) improves productivity and accuracy, lowers human error, forecasts financial trends, and provides insightful information for strategic planning. There has been a change towards more strategic, technologically advanced financial management with the introduction of AI into bookkeeping.

3. Virtual Bookkeeping:

The future of bookkeeping is being swiftly shaped by virtual bookkeeping, which provides a scalable and adaptable solution for businesses of all sizes. With the use of digital technologies and cloud-based platforms, bookkeepers may now operate remotely from any location to handle financial information and complete their jobs. In addition to cutting overhead expenses by eliminating the requirement for actual office space, virtual bookkeeping also allows for real-time updates and cross-location collaboration. This strategy improves financial data accessibility, which helps firms keep aware of their financial situation and make fast decisions based on the most up-to-date information.

4. Outsourced Bookkeeping Services:

With their cost-effectiveness and professional financial management, outsourced bookkeeping services are set to become a major trend in the bookkeeping industry. Businesses gain from having access to specialised expertise and technology without having to pay for an internal team. This strategy guarantees compliance, lowers expenses, and enhances the quality of financial reporting. Additionally, it enables companies to scale operations flexibly while concentrating on their core competencies and leaving the more sophisticated financial record-keeping to be handled by other experts.

Conclusion

In conclusion, understanding the basics of bookkeeping services is crucial for businesses of all sizes. Bookkeeping serves as the foundation for financial management and decision-making, ensuring accurate recording, tracking, and reporting of financial transactions. By hiring outsourced bookkeeping services, businesses can streamline their operations, reduce errors, and maintain compliance with tax regulations. It is important to establish clear bookkeeping processes, embrace automation, regularly reconcile statements, and implement internal controls to ensure the integrity and security of financial data. With an experienced team of accounting professionals and the implementation of best practices, businesses can effectively manage their finances and drive their growth and success.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.