Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: November 2, 2023

- Last Updated: February 15, 2025

Every business requires a prudent financial plan, depending on its size, structure, operations, and nature. Errors in recording are probable wherever the accounting department is involved, especially with accounts receivable and accounts payable. Accounts payable (AP), often considered the backbone of any organisation, can perplex and overwhelm businesses. However, it is a critical component that directly impacts a company’s financial health and reputation. So, effective accounts payable management is crucial, whether through experienced in-house accountants or by engaging reliable outsourced accounts payable services. But managing accounts payable requires a thorough understanding of its concept, functioning, and facilitators. Whether you are a business owner, finance professional, or simply curious about this critical financial process, “The ABCs of Accounts Payable” is invaluable. It aims to enhance your understanding and enable you to make informed decisions for your organisation’s financial success. So, let us dive deeper to confidently navigate the accounts payable world.

What is Accounts Payable?

Accounts payable is a fundamental aspect of financial management that refers to the outstanding liabilities a business has incurred for goods received or services rendered from a vendor. In simple terms, it represents the money owed by an organisation to its suppliers or vendors for purchases made on credit. When a company receives an invoice from a supplier, it records the amount owed as accounts payable until the payment is made. Accounts payable include various expenses, such as inventory purchases, utility bills, rent payments, and professional services fees. Effective accounts payable management involves reviewing and verifying invoices, ensuring accurate payment allocation, tracking payment due dates, and maintaining good supplier relationships. By strategically managing accounts payable, businesses can optimise cash flow, maintain strong vendor relationships, and improve their financial stability.

Importance of Effective Accounts Payable Management

Provide Valuable Insights:

By closely monitoring and analysing accounts payable data, businesses can gain a deeper understanding of their spending patterns, identify areas for cost savings, and negotiate better terms with suppliers. Additionally, the accounts payable process plays a crucial role in maintaining strong vendor relationships, ensuring timely payments, and avoiding late payment penalties or damaged supplier relationships.

Get Possible Terms from Their Suppliers:

By managing payment terms, actively seeking early payment discounts, and maintaining good relationships with suppliers, companies can improve cash flow, reduce costs, and potentially gain a competitive advantage. Efficient accounts payable practices also enhance the company’s reputation and credibility, which may lead to more favourable terms and conditions in future business transactions.

Track and Manage Supply:

AP processes ensure businesses clearly understand their financial position by tracking all outstanding invoices and payments. This information can be used to make informed decisions about cash flow, budgeting, and pending credits.

How Do Accounts Payable Work?

Accounts payable is a liability on the company’s balance sheet, representing the amount of money that needs to be paid to external parties. Therefore, learning how this process works is crucial to make it more effective. Here is how the accounts payable process typically works:

Purchase:

The process begins when a business purchases goods or services from a supplier. This could involve creating a purchase order (PO) specifying the purchase details, including quantities, prices, and delivery terms.

Invoice Receipt:

Once the goods or services are delivered, the supplier sends an invoice to the company. The invoice includes details such as the amount owed, payment terms, and applicable discounts or late fees.

Invoice Verification:

The accounts payable team then verifies the invoice against the corresponding purchase order and any receiving documentation, such as a packing slip or proof of delivery. They ensure that the invoice matches the agreed-upon terms and that the goods or services were received as expected.

Approval:

Depending on the company’s internal policies and procedures, the invoice may need to go through an approval process. Appropriate individuals, such as managers or department heads, review and approve the invoice before it moves forward with payment.

Record-Keeping:

The approved invoice is recorded in the company’s accounting system, often using a dedicated accounts payable module. The system will capture key details such as the invoice number, date, amount, and vendor information.

Payment Processing:

Once the invoice is approved and recorded, the accounts payable team proceeds to make payment to the vendor. This can be done through various methods, such as issuing a cheque, initiating an electronic funds transfer (EFT), or using online payment platforms.

Reconciliation:

After payment, the accounts payable team reconciles the payment with the original invoice and updates the relevant records to reflect the payment. This ensures accurate tracking of outstanding balances and helps in the financial reporting process.

Accounts Payable Ageing:

Throughout the process, the accounts payable team maintains an aging report, which provides a snapshot of outstanding invoices and their respective due dates. This report helps monitor cash flow and manage vendor relationships effectively.

By following this process, businesses can ensure timely and accurate payment of their obligations while maintaining good relationships with their vendors.

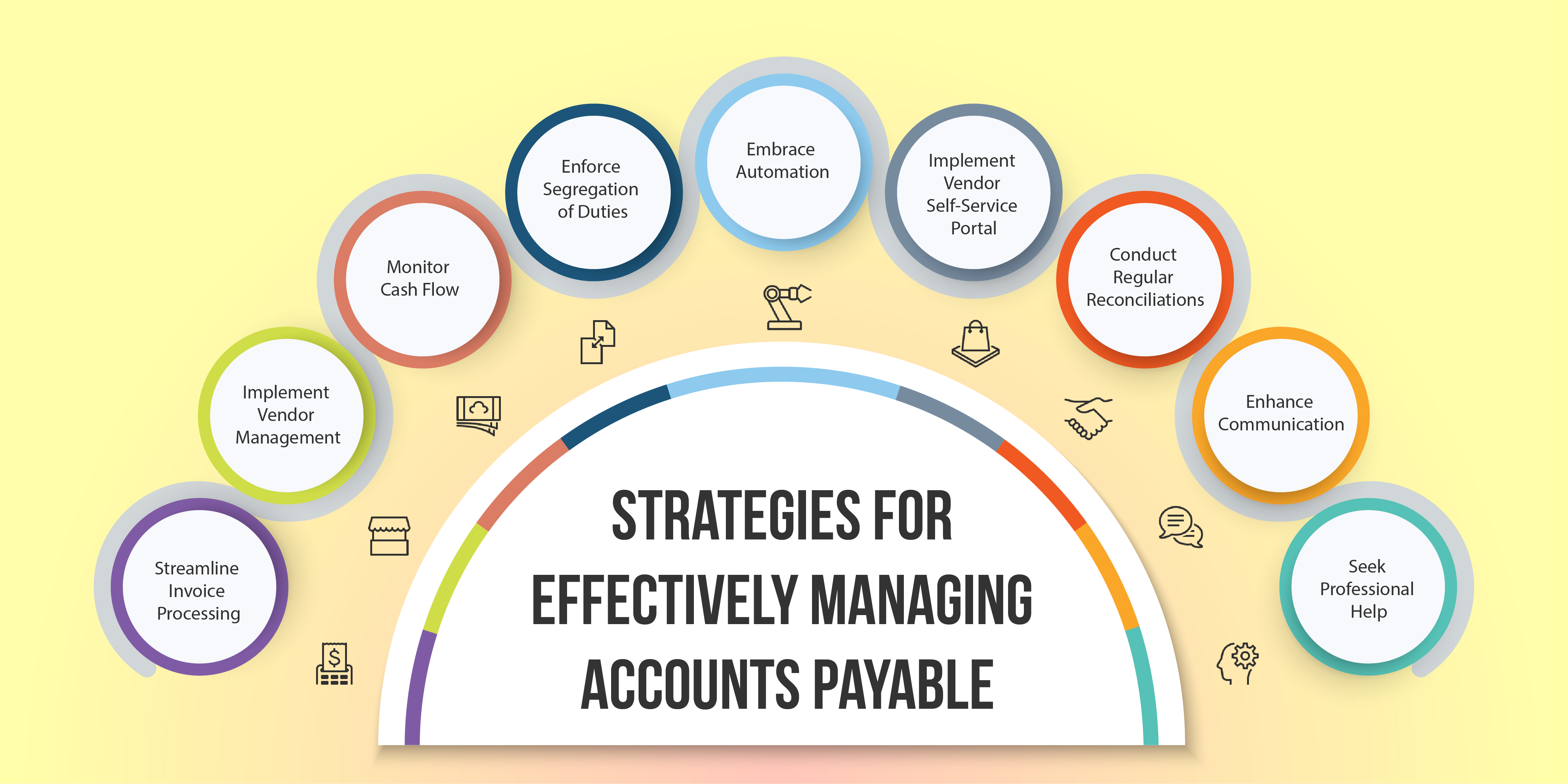

Optimal Strategies for Effectively Managing Accounts Payable

When it comes to managing accounts payable, whether you are managing it in-house or outsourcing it to professional service providers, implementing optimal strategies can make all the difference in ensuring smooth operations. Here are some key practices to consider:

Streamline Invoice Processing:

Establish a clear and efficient process for receiving, reviewing, and approving invoices. Utilise technology solutions such as automated invoice capture and data extraction to minimise manual errors and accelerate processing time.

Implement Vendor Management:

Maintain an organised vendor database with accurate contact information, payment terms, and preferred communication channels. Regularly review vendor contracts and negotiate favourable terms to optimise relationships.

Monitor Cash Flow:

Keep a close watch on cash flow projections and plan payment schedules accordingly. This ensures timely payments while optimising available working capital.

Enforce Segregation of Duties:

Assign different individuals to manage various stages of the accounts payable process, such as invoice receipt, approval, and payment. This segregation of duties reduces the risk of fraud and enhances accountability.

Embrace Automation:

Leverage accounts payable automation software to streamline the entire process, from receiving electronic invoices to automating payment workflows. This significantly reduces manual efforts and increases accuracy.

Implement Vendor Self-Service Portal:

Provide vendors with access to a secure online portal where they can submit invoices, check payment status, and update their information. This self-service approach saves time, improves transparency, and reduces the need for constant communication.

Conduct Regular Reconciliations:

Perform periodic reconciliations between your accounts payable records and vendor statements to identify discrepancies or unpaid invoices. This practice helps maintain accurate financial records.

Enhance Communication:

Foster open lines of communication with vendors by promptly addressing inquiries, resolving disputes, and providing timely payment updates. Strong vendor relationships contribute to smoother processes and potential cost savings.

Professional Help:

Seeking professional help from third-party service providers and hiring specialised accounts payable service providers or going for offshore accounting can be an optimal strategy for effective accounts payable management. These professionals have the expertise and resources to streamline processes, improve accuracy, and ensure timely payments, allowing businesses to focus on core activities and maximise efficiency.

By adopting these best practices, businesses can optimise their accounts payable management, reduce operational costs, enhance financial accuracy, and build stronger vendor relationships.

How Can Outsourcing Help in Effective Accounts Payable Management?

Outsourcing can greatly assist in effective accounts payable management by bringing several benefits to the table. Firstly, it allows businesses to tap into the expertise of professional accounting professionals specialising in accounts payable processes. They can streamline workflows, ensure accuracy, and implement best practices. Additionally, outsourcing reduces the burden on internal resources and frees up valuable time, enabling businesses to focus on core activities and strategic initiatives. It also provides access to advanced technology and software solutions that aid in automating manual tasks, improving efficiency, and optimising payment processes. You can further increase the benefits of outsourcing by choosing offshore accounting. This approach allows businesses to maximise efficiency, cost-savings, and effectiveness in managing their payables while benefiting from the advantages offered by offshore accounting services.

How to Find the Right Outsourced Service Provider?

Finding the right outsourced accounts payable services provider requires careful consideration. Here are some steps to help you in the process:

Determine Your Specific Needs:

Assess your business requirements, including the volume of invoices, payment processing frequency, and any specific industry or compliance considerations. This will help you identify the outsourced service provider that can cater to your unique needs.

Research And Evaluate Potential Providers:

Conduct thorough research to identify reputable outsourced service providers with experience in accounts payable management. Look for their track record, client testimonials, and industry expertise. Evaluate their capabilities, technology infrastructure, and security measures.

Seek Recommendations and Referrals:

Reach out to colleagues, industry associations, or professional networks for recommendations. Hearing about others’ positive experiences can help narrow down your options and find reliable providers.

Check References and Conduct Due Diligence:

Ask for references from prospective providers and reach out to their existing clients to gather feedback on their performance, reliability, and customer service. Additionally, verify their compliance with relevant regulations and data security practices.

Consider Cost and Scalability:

Compare pricing structures among different providers and ensure they align with your budget. Also, assess their scalability to accommodate your future growth and changing needs. Furthermore, considering offshore accounting can be a viable option for businesses seeking a more cost-effective solution. Outsourcing to countries like India, the Philippines, or Mexico can provide significant cost savings without compromising quality.

By following these steps, you can find the right outsourced service provider that aligns with your business requirements, delivers high-quality accounts payable services, and fosters a successful long-term partnership

Conclusion

Accounts payable is considered as the backbone of any business, as it straightaway impacts the cash flow management of any business. Businesses can make sure that money is managed properly and efficiently by using an efficient accounts payable system, allowing them to focus more on building their business rather than stressing about possible cash flow issues. Understanding the ABCs of accounts payable is crucial for any business aiming to maintain financial stability and operational efficiency. By grasping the fundamental concepts and implementing best practices, businesses can streamline invoice processing, optimise cash flow, and foster strong vendor relationships. Furthermore, embracing automation or hiring outsourced accounts payable services can greatly enhance accounts payable management, resulting in cost savings, increased accuracy, and improved financial control. With a solid understanding of the ABCs of accounts payable, businesses can navigate the complexities of this critical process with confidence and ease.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.