Table of Content

Share This Article

- Reading Time: 30 Minutes

- Published: April 10, 2024

- Last Updated: February 15, 2025

As the digital landscape is continuously evolving and growing, the e-commerce sector has experienced unprecedented growth, reshaping the way businesses operate and manage their finances. With an expected revenue of USD 37 billion in 2023, this vibrant sector, 14th globally, encompasses a diverse range of businesses, from clothing and footwear to books, cosmetics, and food and beverage.

Australians’ penchant for online shopping is evident, with a staggering AUD 52.7 billion spent in 2022, yet this represents only 12.6% of the total retail market, indicating ample room for expansion. For solopreneurs eyeing growth opportunities in this flourishing domain, understanding the nuances of e-commerce accounting is crucial. As online transactions continue to soar, the demand for specialised ecommerce accounting services has become more pronounced than ever. This expert guide aims to shed light on the evolving landscape of e-commerce accounting, providing insights and strategies to navigate the financial intricacies of your online business.

What Exactly Is Ecommerce Accounting?

Ecommerce accounting is a specialised branch of accounting that focuses on the unique financial needs and challenges of online businesses. It encompasses the tracking, recording and analysing of financial transactions that occur in the digital marketplace. This includes sales expenses, inventory management, and tax obligations specific to e-commerce operations. Unlike traditional brick-and-mortar businesses, ecommerce accounting must also account for online payment gateways, digital marketing costs, and the complexities of cross-border transactions. With the rise of online shopping, e-commerce accounting has become an essential tool for online entrepreneurs to manage their finances effectively, ensure compliance with tax laws, and make informed business decisions.

Difference Between Ecommerce Accounting and Other Business Accounting

-

Transactional Volume:

Due to the nature of online sales, ecommerce businesses often experience a higher volume of transactions, requiring more robust accounting systems to manage the influx of data.

-

Source of Transactions:

Transactions in ecommerce originate from various online platforms and payment gateways, necessitating specialising tracking and reconciliation processes.

-

Data Collection and Integration:

Ecommerce accounting relies heavily on the seamless integration of data from multiple sources, including websites, marketplaces, and financial software, to ensure accurate financial reporting.

-

Inventory Management:

The dynamic nature of online sales demands more sophisticated inventory management techniques in e-commerce accounting, including real-time tracking and valuation of goods.

-

Multi-currency Transactions:

Ecommerce businesses often engage in cross-border transactions, requiring the ability to manage and account for multiple currencies.

-

Customer Feedback and Interactions:

Ecommerce accounting may also incorporate data from customer interactions and feedback, which can influence financial decisions and strategies.

-

Technology Integration:

Ecommerce accounting typically involves, a higher degree of technology integration, utilising advanced software and tools to automate and streamline financial processes.

Ecommerce Accounting Vs Ecommerce Bookkeeping

-

Ecommerce Bookkeeping:

-

Ecommerce Accounting:

Different Methods of Doing Accounting for Ecommerce Businesses

-

Accrual Accounting:

Accrual accounting is a widely adopted method for managing finances in e-commerce businesses. This approach recognises revenue and expenses when they are incurred, regardless of when cash transactions actually occur. For e-commerce businesses, this means that sales are recorded at the time of transactions, even if payment is received later. Similarly, expenses are recognised when they are incurred, not necessarily when they are paid. This method provides a more accurate picture of a company’s financial position and performance, as it reflects the true economic activity of the business during a specific period. Accrual accounting is particularly beneficial for e-commerce businesses with complex transactions, deferred payments, or extended credit terms, as it offers a clearer understanding of their financial health.

-

Cash Basis Accounting:

Cash basis accounting is a straightforward method often used by smaller e-commerce businesses for its simplicity. In this approach, revenue is recognised only when cash is received, and expenses are recorded only when cash is paid out. This means that transactions are not recorded only when cash is paid out. This means that transactions are not recorded until there is an actual exchange of cash, making it easier for businesses to track their cash flow. For e-commerce businesses with straightforward transactions and minimal inventory, cash-based accounting can provide a clear and immediate understanding of their financial position. However, it may not always present an accurate picture of long-term financial health, as it does not account for receivables or payables that have not yet been settled in cash.

-

Hybrid Accounting:

Hybrid accounting is a method that combines elements of both accrual and cash basis accounting, offering flexibility for e-commerce businesses. This approach allows businesses to account for their inventory and sales on an accrual basis, ensuring accurate tracking of goods sold and revenue earned while managing other aspects of their finances, such as expenses, on a cash basis. Hybrid accounting can be particularly beneficial for e-commerce businesses with a mix of online and offline operations or those that want to maintain a clear picture of cash flow while also adhering to accrual accounting principles for inventory management. By leveraging the strengths of both methods, hybrid accounting provides a balanced and adaptable approach to financial management for e-commerce enterprises.

-

Inventory Accounting Methods:

Inventory accounting methods are crucial for ecommerce businesses to accurately value their inventory and cost of goods sold (COGS). One common method is the First-In, First-Out (FIFO) approach, where the earliest acquired items are sold first, reflecting current market prices in COGS. Another method is the Last-In, First-Out (LIFO) approach, where the most recently acquired items are sold first, often used to reduce taxable income in rising-price environments. The Average Cost method calculates COGS based on the average cost of all items in inventory, providing a middle ground between FIFO and LIFO.

Also Read: E-commerce Accounting Basics You Must Know

How to Get Started with Ecommerce Accounting?

Getting started with ecommerce accounting in Australia involves several key steps to ensure compliance with regulations and effective financial management:

-

Register Your Business:

Obtain an Australian Business Number (ABN) and register for Goods and Services Tax (GST) if your annual turnover is expected to exceed $75000.

-

Choose an Accounting Method:

Based on your business needs and legal requirements, decide whether to use cash-basis, accrual, hybrid, or inventory accounting.

-

Select Accounting Software:

Choose accounting software tailored for e-commerce, such as Xero, QuickBooks, NetSuite, or Zoho Books, which can integrate with your online sales platforms and payment gateways.

-

Set Up Charts of Accounts:

Create a chart of accounts that includes categories specific to e-commerce, such as online sales revenue, payment processing fees, shipping costs, and inventory.

-

Implement Inventory Management:

Adopt an inventory management system that aligns with your chosen inventory accounting method (FIFO, LIFO, or Average Cost) to track stock levels and cost of goods sold accurately.

-

Understanding Tax Obligations:

Familiarise yourself with Australian tax laws, including GST, income tax, and import duties, if applicable. Ensure that your accounting system can handle tax calculations and reporting.

-

Maintain Accurate Records:

Keep detailed records of all financial transactions, including sales, expenses, and tax payments. Regularly reconcile your accounts to ensure accuracy.

-

Seek Professional Advice:

Consider consulting with a professional e-commerce accountant or bookkeeper who specialises in e-commerce to ensure compliance with Australian accounting standards and tax regulations.

Common Ecommerce Accounting Mistakes to Avoid

-

Not Separating Personal and Business Finances:

One of the most common e-commerce accounting mistakes is failing to separate personal and business finances. This can lead to confusion, inaccurate financial records, and potential tax complications. It is crucial to maintain distinct accounts for personal and business transactions to ensure clear financial tracking and reporting. By keeping these finances separate, ecommerce business owners can better manage their cash flow, make informed business decisions, and simplify tax preparation and compliance.

-

Incorrect COGS Calculations:

Incorrect calculations of the Cost of Goods Sold (COGS) are a common mistake in e-commerce accounting that can significantly impact a business’s financial health. Accurate COGS calculations are essential for determining gross profit and understanding the true cost of inventory sold. Errors in COGS can result from incorrect inventory valuation, failing to account for all associated costs or improper allocation of expenses. To avoid this mistake, e-commerce businesses should ensure they use a consistent and appropriate method for inventory accounting and regularly review and update their COGS calculations.

-

Not Staying Tax Compliant:

Not staying tax-compliant is a major mistake that e-commerce businesses must avoid. This error can occur if businesses fail to register for required taxes, such as GST, neglect to file tax returns on time, or inaccurately report income and expenses. Such lapses can lead to substantial penalties, audits, and damage to the business’s reputation. To avoid this, e-commerce businesses should stay informed about their tax obligations, maintain accurate financial records, and seek professional advice to ensure compliance with all relevant tax laws and regulations.

-

Putting off Bookkeeping till Tax Time:

Putting off bookkeeping until tax time is a common mistake that can create significant challenges for e-commerce businesses. Delaying bookkeeping can lead to a backlog of unrecorded transactions, making it difficult to accurately assess the financial health of the business. This procrastination can also result in missed deductions, inaccurate tax filings, and increased stress during tax season. To avoid this, e-commerce businesses should prioritise regular e-commerce bookkeeping practices, ensuring that financial records are up-to-date and ready for tax preparation.

-

Incorrect Inventory Levels:

Incorrect inventory levels can have serious implications for a business. Overstating or understating inventory can lead to inaccurate financial statements, affecting decisions related to purchasing, pricing, and sales strategies. It can also result in stockouts or excess inventory, both of which can harm customer satisfaction and profitability. To avoid this, e-commerce businesses should implement robust inventory management systems and regularly reconcile physical stock with accounting records to ensure accuracy.

-

Overlooking the Importance of Cash Flow Forecasting:

Overlooking the importance of cash flow forecasting in e-commerce accounting can jeopardise a business’s financial stability. Effective cash flow forecasting helps businesses anticipate and manage their future financial position, ensuring they have sufficient funds to cover expenses and invest in growth opportunities. Neglecting this crucial aspect can lead to cash shortages, missed payment obligations, and limited business growth. To avoid this, e-commerce businesses should regularly perform cash flow forecasting and adjust their financial strategies accordingly.

Why Is Cash Flow Forecasting Important for Ecommerce Businesses?

-

Navigating Volatility:

Ecommerce businesses, unlike their brick-and-mortar counterparts, are subject to rapid shifts in sales volume due to factors such as promotional events, product launches, or seasonal trends. Accurate forecasting enables these businesses to anticipate and strategically prepare for such variations in demand.

-

Inventory Management:

A precious cash flow forecast enables e-commerce businesses to make informed decisions regarding inventory procurement. Overstocking can result in unnecessary holding costs and potential wastage, whereas understocking may lead to lost sales opportunities.

-

Marketing Budgeting:

Forecasting helps allocate funds effectively for marketing campaigns, ensuring that there is enough cash flow to support promotional activities without compromising others without financial strain.

-

Operational Planning:

It aids in planning for operational expenses, such as staffing, shipping, and technology upgrades, ensuring the business can maintain smooth operations without financial strain.

-

Future Growth and Expansion:

Accurate cash flow forecasting enables businesses to identify opportunities for growth and expansion, ensuring they have the necessary funds to invest in new ventures or markets.

-

Risk Management:

By proactively identifying potential financial shortfalls, businesses can develop strategies to manage or mitigate risks. This may involve securing additional funding, implementing cost-reduction measures, or diversifying revenue streams to ensure financial stability and sustainability.

How To Create a Cash Flow Forecast for Your Ecommerce Business?

-

Decide How Far You Want to Plan Out:

When creating a cash flow forecast for your ecommerce business, it is important to decide how far ahead you want to plan. Typically, short-term forecasts cover a period of one to three months and are useful for managing daily cash flow and immediate financial decisions. On the other hand, long-term forecasts, which can last one to three years, are valuable for strategic planning and securing financing or investment. Your choice should align with your business goals and the level of uncertainty in your market.

-

List Your Expected Income:

Listing your income is a crucial task as it includes all anticipated revenue sources, such as online sales, returns, and any other income streams. Ensure that your estimates are realistic and based on historical data or market analysis to maintain accuracy in your forecast.

-

List Your Expected Outgoings:

For a comprehensive cash flow forecast for your e-commerce enterprise, meticulously itemise your projected expenditures. This encompasses all foreseeable financial obligations, including costs associated with stock acquisition, delivery charges, promotional activities, and operational expenses like leasing, utility bills, and payroll. Precise estimation of these outgoings is pivotal for gauging the financial vitality of your business and guaranteeing the availability of adequate cash flow to meet these financial commitments.

-

Work Out Your Running Cash Flow:

It is vital to ascertain your ongoing cash flow in a timely this entails determining the net cash flow for each interval by deducting your anticipated total expenditures from your anticipated total revenues. By keeping a close eye on your ongoing cash flow, you can effectively oversee your business liquidity, guaranteeing your ability to fulfil financial commitments and pinpoint potential cash deficits or surpluses.

Important Financial Reports to Track for Your Ecommerce Business

-

Income Statement:

This report provides a comprehensive overview of your e-commerce business’s financial performance over a specific period, typically a month, quarter or year. It details revenue streams, such as sales and services, and subtracts expenses, including costs of goods sold, operating expenses, and taxes, to calculate net profit or loss. This statement is crucial for assessing profitability, identifying trends, and making informed decisions about pricing, cost control, and growth strategies.

-

Balance Sheet:

The balance sheet offers a detailed snapshot of your company’s financial position at a particular point in time. It lists assets, such as cash, inventory, and accounts receivable, liabilities like loans and accounts payable, and equity, which represents the owner’s investment in the business. This report is essential for evaluating financial stability, solvency, and the company’s ability to meet its short-term and long-term obligations.

-

Cash Flow Statement:

A cash flow statement tracks the inflows and outflows of cash and cash equivalents, highlighting your business’s liquidity and ability to generate cash to fund operations, invest in growth, and repay debts. It is divided into three sections: operating activities, investing activities, and financing activities. The cash flow statement is vital for understanding cash movements, managing cash flow, and planning for future financial needs.

-

Accounts Receivable Ageing Report:

The AR ageing report categorises outstanding customer invoices by their due dates, typically in 30-day increments. It helps you monitor the status of receivables, identify overdue payments, and assess the effectiveness of your credit and collection policies. By analysing this report, you can take proactive steps to improve cash flow by following up on overdue accounts and adjusting credit terms if necessary.

-

Inventory Management Reports:

Coming to inventory management reports provide detailed information about your inventory levels, turnover rates, and the cost of goods sold. They help you track stock movements, identify slow-moving items, and optimise inventory levels to meet demand without overstocking. Effective inventory management is crucial for maintaining healthy cash flow, reducing carrying costs, and maximising profitability.

-

Sales Tax Report:

A sales tax report summarises the sales tax collected and owed for a specific period based on the sales transactions in your e-commerce business. It is essential for ensuring compliance with tax regulations, accurately filing tax returns, and avoiding penalties and interest for late or incorrect payments.

-

Customer Lifetime Value (CLV) Report:

This report estimates the total revenue a business can expect from a single customer throughout their relationship. It takes into account factors such as average purchase value, purchase frequency, and customer retention rate. Understanding CLV helps businesses make informed decisions about marketing, sales, and customer service strategies to maximise profitability and long-term growth.

-

Cost of Goods Sold (COGS):

One of the most important financial reports is the Cost of Goods Sold (COGS), which calculates the direct costs associated with producing the goods sold by your e-commerce business, including materials, labour, and manufacturing overhead. COGS is a critical metric for determining gross profit, setting prices, and managing margins. By analysing COGS, you can identify opportunities to reduce production costs and improve overall profitability.

-

Gross Margin Report:

This report compares revenue to the cost of goods sold to calculate gross margin, which is a key indicator of your business’s financial health. It helps you assess the profitability of your products and services, make pricing decisions, and evaluate the efficiency of your production processes. A healthy gross margin is essential for covering operating expenses and generating profits.

Top Strategies for Efficient Ecommerce Accounting

-

Prioritise Good Bookkeeping:

Maintaining accurate and up-to-date financial records is essential for any e-commerce business. Good e-commerce bookkeeping practices provide a clear picture of your financial health, enable informed decision-making, and ensure compliance with tax regulations. Regularly updating your books helps in tracking revenue, expenses, and profits, making it easier to identify trends and areas for improvement.

-

Set a Defined Workflow Structure:

Establishing a structured workflow for your e-commerce accounting processes is crucial for efficiency and consistency. Define clear roles and responsibilities, set deadlines for financial tasks, and implement standardised procedures for invoicing, payments, and reconciliation. A well-organised workflow reduces errors and ensures timely financial management.

-

Select the Right Chart of Accounts:

A chart of accounts tailored to your e-commerce business helps in categorising transactions effectively. Choose accounts that reflect your revenue streams, expense categories, assets, liabilities, and equity. A well-structured chart of accounts simplifies financial reporting and analysis, aiding in better financial planning and decision-making.

-

Track Income and Expenses:

Keeping a close eye on your income and expenses is vital for managing cash flow and profitability. Use specific e-commerce accounting software to categorise and record every transaction, ensuring that you have accurate data for financial analysis. Regular tracking helps in budgeting, forecasting, and identifying opportunities to reduce costs and increase revenue.

-

Regularly Reconcile Your Accounts:

Reconciliation is the process of comparing financial records with bank statements and other external sources to ensure accuracy. Regular reconciliation helps detect discrepancies, prevent fraud, and maintain the integrity of financial data. It is a key practice for ensuring your financial statements are reliable and up-to-date.

-

Select The Right Inventory Management Structure:

Effective inventory management is critical for e-commerce businesses. Choose a structure that aligns with your business model, whether it is first-in-first-out (FIFO), last-in-first-out (LIFO), or weighted average cost. Proper inventory management helps in optimising stock levels, reducing carrying costs, and improving cash flow.

-

Monitor Cash Flow:

Cash flow is the lifeblood of your e-commerce business. Monitor it closely to ensure you have enough cash to cover operating expenses, invest in growth, and handle unexpected financial challenges. Use cash flow forecasts and budgeting to plan for future cash needs and maintain financial stability.

-

Understand Tax:

Navigating tax regulations can be complex, but it is crucial for compliance and financial planning. Stay informed about sales tax, income tax, and other relevant tax obligations for your e-commerce business. Seek advice from a professional ecommerce accountant or bookkeeper to ensure that you are meeting all tax requirements and taking advantage of available tax benefits.

-

Efficient Month-end Closing:

Streamlining your month-end closing process ensures that your financial statements are accurate and timely. Implement checklists, automate reconciliations, and review financial reports for anomalies. An efficient month-end closing provides valuable insights into your business’s performance and aids in strategic decision-making.

-

Automate Where Possible:

Leveraging technology to automate bookkeeping & accounting tasks can save time and reduce errors. Invest in accounting software for e-commerce that integrates with your e-commerce platform, automates invoicing and payments, and provides real-time financial reporting. Automation frees up time for strategic analysis and helps you focus on growing your business.

Best 4 E-commerce Accounting Software for Businesses in Australia

-

NetSuite:

NetSuite is widely regarded as one of the best accounting software for ecommerce businesses in Australia. Its comprehensive suite of features includes robust financial management, inventory tracking, and customer relationship management, all seamlessly integrated into a single platform. NetSuite’s cloud-based architecture ensures real-time access to financial data, allowing Australian ecommerce businesses to make informed decisions quickly. Additionally, its ability to integrate with various ecommerce platforms and payment gateways makes it an ideal choice for businesses looking to streamline their operations.

-

QuickBooks:

QuickBooks is recognised as the top accounting software for e-commerce businesses in Australia due to its comprehensive features and user-friendly interface. One specific feature that sets QuickBooks apart from other software is its advanced inventory management system. This system allows e-commerce businesses to track inventory levels, set reorder points, and manage orders seamlessly across multiple sales channels. Additionally, QuickBooks integrates effortlessly with popular e-commerce platforms such as Shopify and WooCommerce, making it easier for businesses to synchronise their sales data and financial transactions.

-

Xero:

Xero stands out as one of the top four e-commerce accounting software, offering a range of features tailored to the needs of online retailers. One distinctive feature of Xero is its robust integration with over 800 third-party apps, including popular e-commerce platforms like Shopify, Magento, and BigCommerce. This integration allows for seamless synchronisation of sales data, inventory, and financial transactions, ensuring accuracy and efficiency in accounting processes. Additionally, Xero’s user-friendly interface and cloud-based system provide easy access to financial information from anywhere, at any time.

-

Zoho Books:

Zoho Books is a highly regarded accounting software for e-commerce businesses. It is known for its versatility and ease of use. A unique feature that distinguishes Zoho Books from other software is its comprehensive client portal. This portal allows customers to view their invoices, make payments, and track their order history directly within the system, enhancing the overall customer experience.

Top 5 Ecommerce KPIs to Track

-

Gross Profit Margin:

This ecommerce KPIs (key performance indicator) measure the percentage of revenue that exceeds the cost of goods sold (COGS), indicating the efficiency of your production and pricing strategies. A higher gross profit margin suggests that your e-commerce business is effectively managing its production costs and pricing its products profitably.

It is calculated using the formula: Gross Profit Margin = (Revenue – COGS) / Revenue × 100%.

-

Net Profit Margin:

The net profit margin KPI for e-commerce platforms reflects the percentage of revenue that remains as profit after all expenses have been deducted, providing insight into your business’s overall profitability. Monitoring this metric helps you understand how well your business is controlling its costs and maximising its revenue.

The formula for calculating net profit margin: Net Profit Margin = Net Profit / Revenue × 100%.

-

Average Order Value:

AOV is an important e-commerce KPI that measures the average amount customers spend per order. Tracking AOV helps e-commerce businesses evaluate their pricing strategies and marketing effectiveness, aiming to increase the value of each customer transaction.

It is calculated by dividing total revenue by the number of orders: AOV = Total Revenue / Number of Orders.

-

Customer Lifetime Value (CLV):

This KPI estimates the total revenue a business can expect from a single customer over the course of their relationship. Understanding CLV is crucial for making informed decisions about customer acquisition and retention strategies, ensuring that the cost of acquiring customers is justified by their long-term value.

The formula for CLV: CLV = Average Order Value × Purchase Frequency × Customer Lifespan.

-

Customer Acquisition Cost (CAC):

CAC is one of the crucial e-commerce KPIs that measures the average cost to acquire a new customer, encompassing marketing and sales expenses. Keeping track of CAC helps e-commerce businesses evaluate the efficiency of their marketing efforts and ensure that they are acquiring customers at a sustainable cost.

It is calculated using the formula: CAC = Total Acquisition Costs / Number of New Customers.

Also Read: The Right E-commerce Platform for Your Business

What Is an Ecommerce Dashboard?

An e-commerce dashboard is an essential analytical tool designed to provide a comprehensive and consolidated view of the e-commerce KPIs and metrics critical to the success of an online retail business. It integrates data from various sources, including sales transactions, marketing campaigns, inventory levels, and customer interactions, presenting it in a visually appealing and user-friendly interface. This dashboard allows business owners, managers, and stakeholders to monitor the health and performance of their e-commerce operations in real-time, enabling swift and data-driven decision-making.

By offering a holistic view of the business, an e-commerce dashboard helps in identifying trends, patterns, and anomalies in sales, marketing effectiveness, website traffic, conversion rates, and customer behaviour. It aids in setting benchmarks, tracking progress towards goals, and pinpointing areas that require attention or improvement. The dashboard’s ability to visualise complex data in an easily digestible format is invaluable for making informed strategic choices, optimising operations, and enhancing profitability.

Furthermore, an e-commerce dashboard can be customised to suit a business’s specific needs and objectives, allowing for the tracking of metrics that are most relevant to its unique context. It serves as a central hub for accessing real-time insights, facilitating collaboration among teams, and fostering a culture of continuous improvement. Ultimately, an e-commerce dashboard is a vital tool for any online retail business aiming to stay competitive, agile, and customer-focused in the dynamic e-commerce landscape.

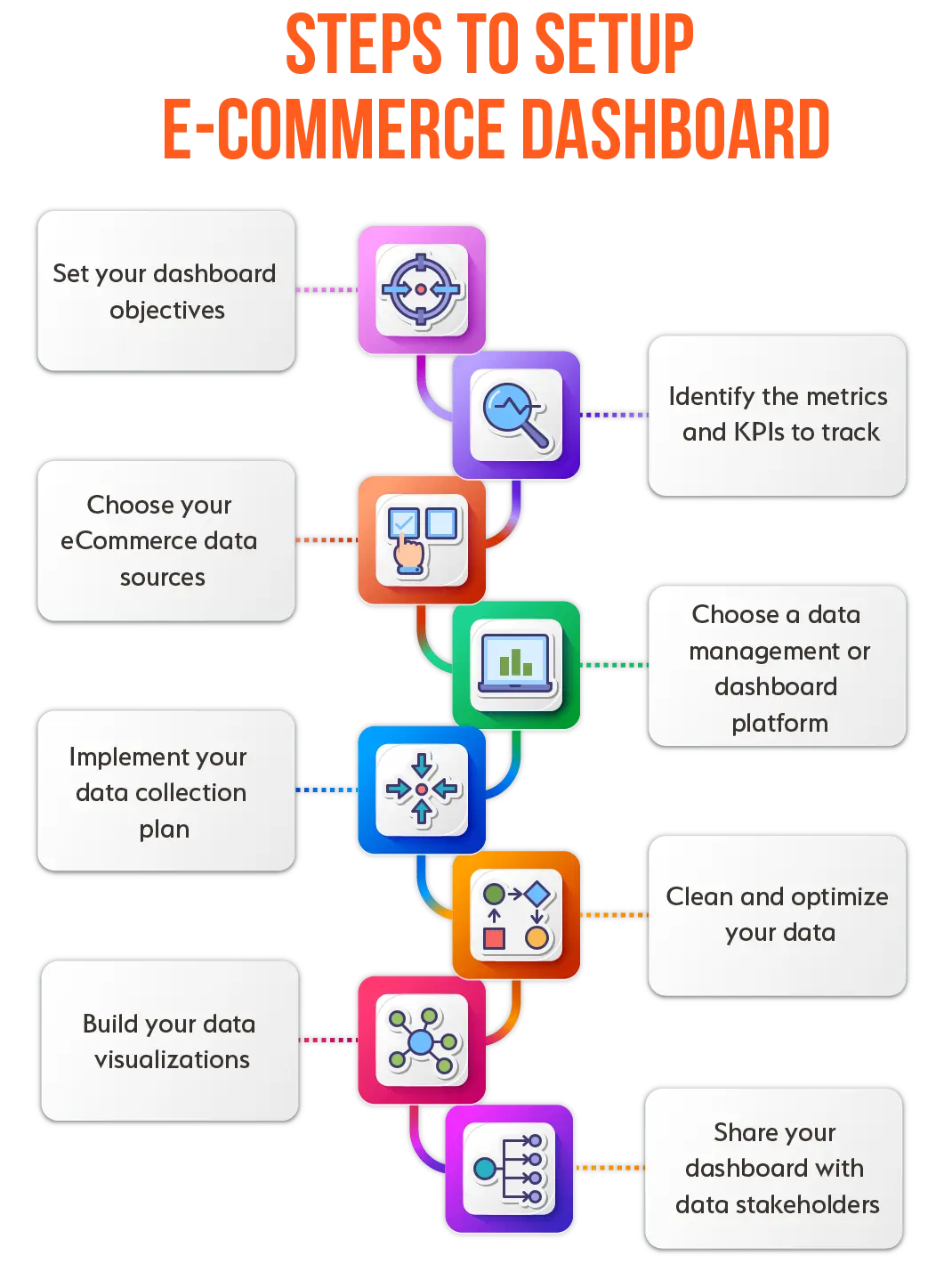

How to Set up an E-commerce Dashboard?

-

Set Your Dashboard Objectives:

Begin by defining clear objectives for your e-commerce dashboard that align with your overall business goals. These objectives might include increasing sales, enhancing customer satisfaction, reducing costs, or improving inventory management. Having specific objectives will guide the selection of metrics and KPIs and ensure that your dashboard is focused and actionable.

-

Identify The Metrics and KPIs to Track:

Based on your objectives, select the key metrics and KPIs that will provide insights into your business performance. For an e-commerce business, these might include conversion rates, average order value, customer acquisition cost, retention rates, and revenue growth. Choose metrics that are relevant, measurable, and directly tied to your objectives.

-

Choose Your Ecommerce Data Sources:

Identify the data sources that will feed into your e-commerce dashboard. These could include your e-commerce platform (such as Shopify or Magento), CRM software, marketing analytics tools, social media platforms, and financial systems. Ensure that these sources provide accurate and timely data.

-

Choose A Data Management or Dashboard Platform:

Select a platform that can integrate with your data sources and provide the features you need to create and customise your e-commerce dashboard. Popular options include Google Data Studio, Tableau, Power BI, and Looker. Consider factors such as ease of use, scalability, and the ability to create interactive and visually appealing dashboards.

-

Implement Your Data Collection Plan:

Develop a plan for how data will be collected, stored, and updated. This might involve setting up APIs, webhooks, or data pipelines to ensure that data flows seamlessly from your sources to your dashboard. Regularly check that data is being collected accurately and resolve any issues promptly.

-

Clean And Optimise Your Data:

Before using the data in your e-commerce dashboard, clean it to remove any errors, duplicates, or irrelevant information. Optimise the data by organising it in a structured format, ensuring it is ready for analysis. This step is crucial for maintaining the integrity and reliability of your dashboard.

-

Build Your Data Visualisations:

Create visualisations that effectively communicate the insights from your data. Use charts, graphs, and tables that are easy to understand and interpret. Customise the visualisations to highlight the most important information and ensure they align with your dashboard objectives.

-

Share Your Dashboard with Data Stakeholders:

Once your e-commerce dashboard is complete, share it with key business stakeholders, such as team members, managers, and investors. Provide them with access to real-time data and insights, enabling them to make informed decisions based on the latest information. Regularly update and refine your dashboard to ensure it continues to meet the needs of your business and stakeholders.

Role of an Accountant or Bookkeeper in E-commerce Accounting

-

Managing Financial Records:

An e-commerce accountant and bookkeeper meticulously maintains comprehensive financial records for e-commerce businesses, ensuring that all sales, expenses, inventory transactions, and other financial activities are accurately recorded. This meticulous record-keeping is essential for tracking the financial performance of the business, facilitating audits, and providing a reliable basis for financial analysis and decision-making.

-

Ensuring Accuracy and Compliance:

They play a critical role in ensuring that financial transactions are recorded in accordance with generally accepted accounting principles (GAAP) and relevant tax regulations. By maintaining accuracy and compliance, e-commerce accountants and bookkeepers help minimise the risk of financial errors, penalties, and legal issues, thereby safeguarding the business’s reputation and financial integrity.

-

Analysing Financial Data:

Accountants and bookkeepers delve deep into e-commerce businesses’ financial data to identify trends, pinpoint areas of concern, and assess overall financial health. Their analysis aids in budgeting, forecasting, and strategic planning, enabling business owners to make informed decisions based on a clear understanding of their financial situation.

-

Advising on Tax and Financial Strategy:

They provide expert advice on tax planning and compliance, helping e-commerce businesses navigate complex tax laws and take advantage of available tax incentives. Additionally, they offer strategic financial advice to optimise cash flow, manage debt, and plan for future growth, contributing to the long-term success of the business.

-

Providing Insights for Business Optimisation:

By interpreting financial data, e-commerce accountants and bookkeepers offer valuable insights and recommendations for improving operational efficiency, reducing costs, and enhancing revenue streams. Their expertise supports the development of strategies for inventory management, pricing, and customer acquisition, ultimately driving profitability and sustainable growth for the e-commerce business.

Is Outsourcing Your E-commerce Accounting a Good Idea?

-

Expertise and Specialisation:

When outsourcing e-commerce accounting processes, businesses can benefit from the specialised knowledge and expertise of accounting professionals. These experts are well-versed in the nuances of e-commerce accounting, including handling complex transactions, managing sales tax, and understanding the financial implications of online sales channels. This level of specialisation ensures that the accounting is handled accurately and in compliance with relevant regulations.

-

Cost-efficiency:

Outsourcing e-commerce accounting functions can be more cost-effective than maintaining an in-house accounting team. It eliminates the expenses associated with hiring, training, and providing benefits to full-time employees. Additionally, businesses can avoid the costs of accounting software and infrastructure, as these are typically provided by the outsourcing firm. This cost-efficiency allows businesses to allocate more resources to other areas that directly contribute to growth.

-

Focus on Core Business Activities:

By outsourcing e-commerce accounting tasks, e-commerce businesses can concentrate on their core activities, such as product development, marketing, and customer service. This focus is crucial for staying competitive and driving growth. Outsourcing frees up time and energy that can be better spent on strategic initiatives and enhancing the customer experience.

-

Scalability and Flexibility:

E-commerce businesses often experience fluctuations in sales volume, which can impact their accounting needs. Outsourcing provides scalability, allowing businesses to easily adjust the level of accounting support based on their current requirements. This flexibility ensures that businesses can efficiently manage peak seasons or unexpected changes without the constraints of fixed staffing levels.

How To Find the Right Outsourcing Accounting Firm for Ecommerce Business?

-

Define Your Needs:

Start by assessing your e-commerce business’s accounting requirements. Consider factors such as the volume of transactions, complexity of operations, and specific financial reporting needs. This will help you identify the type of e-commerce accounting services you need, such as bookkeeping, tax preparation, financial analysis, or payroll services.

-

Research and Shortlist Firms:

Look for accounting firms that specialise in e-commerce businesses. You can start your search online, ask for recommendations from other e-commerce entrepreneurs, or consult industry associations. Create a shortlist of firms that seem to have the relevant expertise and experience.

-

Evaluate Expertise and Experience:

Check the credentials and qualifications of the firms on your shortlist. Look for firms with certified an e-commerce accountant who has experience working with e-commerce businesses. Review their case studies or client testimonials to understand their ability to handle e-commerce accounting complexities.

-

Consider Technology and Integration:

Ensure that the accounting firm is proficient in using modern e-commerce accounting software and technologies that can integrate seamlessly with your e-commerce platform. This is important for efficient data transfer, real-time financial tracking, and accurate reporting.

-

Assess Communication and Availability:

Communication is key when going for outsourced ecommerce accounting services. Choose a firm that is responsive and available to address your queries and concerns promptly. Discuss their communication channels and ensure they align with your preferences.

-

Inquire About Security Measures:

Given the sensitive nature of financial data, it is essential to choose a firm that prioritises data security. Inquire about their data protection policies, encryption methods, and security protocols to safeguard your financial information.

-

Request a Proposal and Compare Costs:

Ask for detailed proposals from the shortlisted firms outlining their e-commerce accounting services, fees, and terms of engagement. Compare the costs against the services offered to determine which firm provides the best value for your e-commerce business.

-

Schedule Consultations:

Arrange meetings or consultations with the top contenders to discuss your business needs in detail. This will give you a better sense of their approach, professionalism, and compatibility with your business.

-

Check References:

Before making a final decision, ask for references from the firm’s current or past e-commerce clients. Contact these references to gain insights into their experiences and satisfaction levels with the firm’s services.

-

Make an Informed Decision:

Based on your research, evaluations, and interactions, choose the accounting firm that best aligns with your e-commerce business’s needs, budget, and expectations.

Wrapping Up

Managing the accounting aspects of an e-commerce business can be a complex endeavour, particularly for those operating in the competitive Australian market. With the unique challenges of online sales, such as handling multiple payment gateways, managing international transactions, and dealing with varying tax rates, it is essential to have a robust accounting strategy in place. This expert guide in e-commerce accounting can be invaluable in navigating these intricacies, providing insights into best practices and helping businesses make informed financial decisions. Furthermore, the dynamic nature of e-commerce requires businesses to be adaptable and responsive to changes in the market. This includes staying updated on the latest accounting software and technologies that can automate and streamline financial processes.

Selecting the appropriate accounting software and hiring experienced ecommerce accountants are crucial steps for any e-commerce business. It is likely that you are aware of the challenges associated with e-commerce accounting and are seeking solutions, but as a business owner, you may find it difficult to focus on these issues due to other pressing concerns. However, there is a solution to this dilemma. You can opt to engage a third-party accounting service provider that specialises in handling the finances of e-commerce businesses. These outsourced ecommerce accounting services providers possess teams of experts who have experience managing the accounts of various businesses, which can lead to savings in time, resources, and money while also implementing the best accounting practices for your business.

So, if you are searching for expert outsourced service providers, consider contacting Whiz Consulting. At Whiz Consulting, we provide professional accounting and bookkeeping services to businesses across various sectors, including e-commerce, helping them to manage their accounts and finances efficiently. Allow your business to benefit from the top-notch services it deserves, ensuring enhanced productivity and profitability.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.