Table of Content

Share This Article

- Reading Time: 12 Minutes

- Published: January 30, 2023

- Last Updated: February 14, 2025

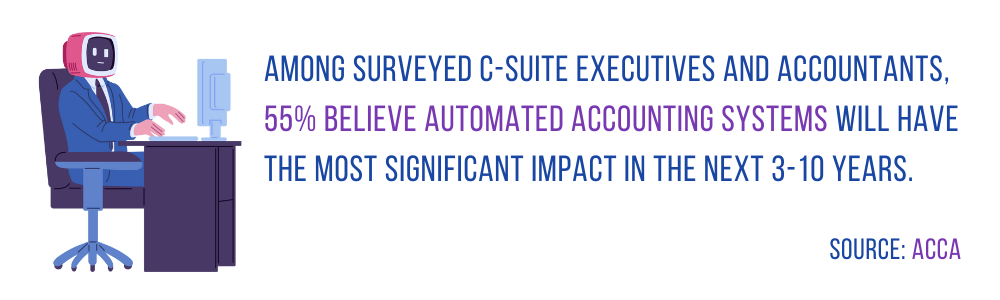

Businesses of all sizes are always looking for ways to increase efficiency and reduce costs, but it can be difficult to know where to start. One way you can do this is by automating tasks that take up a lot of time and resources. Accounting is a field that has traditionally been slow to embrace automation. After all, when transactions involve money – accuracy and security are of the utmost importance. However, in recent years, technological advancements have opened up the possibility for automation in accounting and finance with minimal effort and oversight. Both accounting services providers and businesses have embraced automation in recent years. If you also want to take advantage of accounting automation and want to learn more about accounting automation, then this blog is perfect for you. Read on to find out more about how automation can make accounting easier than ever before, explore the various tasks that can be automated in accounting, and discuss how they can help streamline business operations.

What is Accounting Automation?

Accounting automation is the process of automating accounting tasks and transactions. This can include anything from invoicing and billing to managing expenses and tracking inventory. Automation can help improve accounting departments’ efficiency, accuracy, and compliance. It can also help free up time for accountants and business owners to focus on more strategic tasks. Most virtual accountants use accounting automation to help businesses achieve their full growth potential. Accounting automation is made possible with various technologies such as Optical Character Recognition (OCR), Robotic Process Automation (RPA), Cloud Computing, Artificial Intelligence, and Machine Learning. With a flawless accounting automation system in place, you can save yourself tons of time and money.

What Are The Benefits of Accounting Automation?

There are many advantages of implementing accounting automation into your business.

-

Save time:

Perhaps the most obvious benefit is that it can save you considerable time. This is because once a system is set up, it can often run independently without the need for constant supervision. In fact, Gartner reports that implementing RPA for accounting can save up to 625 hours annually for the company’s finance department.

-

Data Accuracy:

With accounting automation, you no longer need to manually input data or calculate figures – the software will do all this for you. This not only saves you valuable time but also reduces the likelihood of human error.

-

Save costs:

Automation can process more records in less time and at a lower cost. Therefore, you do not need to hire a large accounting team to take care of your accounting, saving costs on hiring. Plus, the reduced error means a reduction in the costs involved in correcting those errors.

-

Increase visibility and transparency:

Accounting automation can help you to become more efficient and organized in your record-keeping. Once all your financial data is stored electronically, it will be much easier to track and manage. You can easily generate reports and gain insights into your business finances with just a few clicks. This level of visibility and transparency can be invaluable for making informed decisions about your business.

-

Holistic financial insights:

Accounting automation offers holistic financial insights, which are required for effective corporate management. Automating typical operations allows firms to produce real-time financial reports that provide a complete picture of their financial health, allowing for faster and more informed decision-making. Additionally, automation decreases the inaccuracies associated with manual data entry, resulting in more accurate and dependable financial data. This increased precision and speed enables organisations to optimise their financial plans while enhancing overall operational efficiency.

-

Unified business data ecosystem:

Accounting automation helps to create a unified business data ecosystem by combining several financial operations and data sources on a single platform. This interface enables seamless data flow between departments, guaranteeing all stakeholders have access to consistent and up-to-date financial data. As a result, firms may make more unified and strategic decisions, boosting efficiency and agility.

-

Customer-Centric Insights:

Automated accounting systems provide valuable insights into client preferences and spending trends. This extensive financial data enables firms to tailor their offers to better meet client requests, increasing happiness and loyalty. As a result, businesses can increase revenue while also gaining a competitive advantage.

-

Strategic forecasting and planning:

Accounting automation improves strategic forecasting and planning by delivering real-time financial data and analytics. This enables organisations to quickly modify their plans based on realistic financial forecasts and market trends. As a result, organisations can make smarter decisions, allocate resources more efficiently, and plan for upcoming difficulties and possibilities.

-

Efficient auditing and compliance:

Accounting automation improves auditing efficiency and guarantees compliance by keeping correct, up-to-date financial records. This technology reduces human error and gives auditors solid data, making the audit process more rapid and effective. Furthermore, automated solutions can assist firms in remaining compliant with evolving financial regulations by constantly upgrading to reflect new compliance requirements.

-

Better Security:

Automated accounting systems improve security by employing advanced data protection mechanisms and lowering the likelihood of human mistakes. Automated systems protect crucial financial information using encryption and secure access restrictions, preventing unauthorised access and data breaches. This higher level of security is critical to ensuring the authenticity and confidentiality of financial information.

Overall, implementing accounting automation into your business has many advantages. If you are looking to save time and money, improve efficiency, and gain better visibility into your finances, automation may be the right solution for you.

Can Accounting be Fully Automated?

With the advent of powerful and sophisticated accounting software, the question arises: will accounting be fully automated? While it is possible to automate many accounting aspects, some tasks still require a human touch. For example, most businesses will still need someone to review and approve financial statements before they are released. Additionally, businesses may choose to have a human accountant oversee the automated processes to ensure accuracy and compliance with regulations.

Which Accounting Tasks Can be Automated?

With so many accounting tasks that need to be done daily, it can be hard to keep track of everything. By automating certain tasks, accountants can save time and money while ensuring accuracy and compliance with regulations. But which tasks should be automated? Let us take a look at which automated accounting tasks can be useful for your business.

-

Invoicing:

Customers can be automatically billed according to their purchase history or contract terms.

-

Accounts Receivable:

Automated software can keep track of payments and delinquent accounts, issuing reminders as necessary.

-

Accounts Payable:

The software can automate the process of paying bills, including issuing payments and tracking spending.

-

Payroll:

A large volume of payroll amounts is repetitive and can be easily automated, helping you calculate each employee’s net pay, payment, and transaction recording.

-

Expense Management:

Automation can eliminate the need to track employee expenses and long waits for approvals and record such expenses.

-

Reconciliation:

While reconciliation requires a human touch for accuracy, it can be partially automated to reduce the time it takes.

-

Budgeting and Forecasting:

Automated software can help create and track budgets and generate reports on past spending and future trends.

-

Financial Reporting:

Automated software can compile financial data into easy-to-read reports for management or shareholders.

How to Get Started With Accounting Automation?

The stages of automation of the accounting process will differ from one company to another. One simple way to incorporate accounting automation is to opt for cloud accounting software over traditional desktop accounting software. The cloud accounting software lets you plug and play with different apps in real time from anywhere in the world. Find a tool that fits your needs. Many popular accounting tools can only be accessed via the cloud.

If you are considering implementing automation in your accounting process, be sure to do some research to find the best solution for your needs. Here are some tips to help you successfully implement such a solution:

- Define your business requirements and objectives: What do you hope to achieve by automating your accounting processes? Be sure to communicate these requirements and objectives to all stakeholders.

- Do your research: There are many different accounting automation software on the market. Take the time to find one that meets your specific needs.

- Make a plan: Once you have selected the right software solution, develop a plan for how you will implement it within your organization. Be sure to involve all relevant stakeholders in this process.

- Test, test, test: Before going live with your new system, be sure to test it thoroughly. This will help ensure a smooth transition and avoid any disruptions to your business operations.

- Train employees and provide ongoing support: After implementing the new system, train employees on how to use it effectively. It is also important to have someone available to provide ongoing support as needed.

Challenges You Might Face When You Decide to Automate Accounting

Resistance to change:

Resistance to change is a common issue when introducing accounting automation in an organisation. Employees frequently fear that new technology may disturb their routines or jeopardise their roles, which causes concern and reluctance to accept automated systems. This reluctance can greatly impede the changeover process, postponing the benefits of enhanced efficiency and accuracy that automation promises. To address these challenges, management must provide comprehensive training and promote the long-term benefits of automation, emphasising how it may improve rather than replace human functions.

Skill transition and training:

Skill transition and training are essential challenges when introducing accounting automation in an organisation. The emergence of new technologies mandates that staff enhance their abilities, with a concentration on data analytics and automated systems instead of traditional bookkeeping. This move may necessitate major expenditure in training programmes and may temporarily lower productivity as employees adjust to the new tools. To effectively address these difficulties, firms must plan wisely, provide extensive training opportunities, and establish a supportive culture that encourages continuous learning and skill development.

Data accuracy and validation:

When selecting to automate accounting, maintaining data quality along with accurate validation might be difficult. Automation is strongly dependent on the initial correctness of data inputs and the proper configuration of processing algorithms. Any inaccuracies in these areas can cascade across the system, resulting in erroneous financial reports. Therefore, stringent checks and continual monitoring are required to ensure the trustworthiness of financial data.

Integration and compatibility:

A notable hurdle in accounting automation is assuring interoperability and compatibility with existing systems. Many firms struggle when their new accounting software does not integrate effectively with other operational tools, disrupting processes and data consistency. To avoid these integration challenges, automation systems must be carefully chosen to be compatible with present technological infrastructures.

Initial investment and ROI:

While automation has long-term benefits, the initial expenditure can be prohibitive for some organisations, particularly smaller ones with limited resources. Assessing the Return on Investment (ROI) and demonstrating the prospective cost savings, efficiency improvements, and better accuracy over time are critical in justifying the initial expenditures of automation.

Maintenance and updates:

Automated systems need ongoing maintenance and updates to maintain their effectiveness and security. Overlooking regular updates might lead to system vulnerabilities and out-of-date functionality. A comprehensive plan for sustaining and upgrading automated systems is required to keep them working seamlessly and efficiently.

Complex software interface:

Adopting new technologies in accounting frequently involves negotiating complex software interfaces. Employees may be presented with complex tools that, while powerful, are not simple to use or intuitive. This level of complexity might result in a high learning curve, decreased productivity, and potential pushback from employees used to simpler systems. To successfully deal with this difficulty, software must strike a balance between complex features and ease of use, as well as substantial training and support to ensure that all users are at ease and proficient with the new tools.

Data migration and integration complexities:

When switching to automated accounting systems, firms frequently face data transfer and integration challenges. Integrating historical financial data into new systems can be risky for data loss or inaccuracies, and establishing seamless interaction with existing software platforms can be technically difficult. These intricacies necessitate rigorous planning and, in many cases, the knowledge of IT specialists to assure data integrity and effective communication between systems. The proper execution of the process is critical to avoiding financial reporting delays and maximising the automation technology’s capabilities.

How to Choose The Right Automation Tool?

When it comes to automating your accounting process, there are a few things you need to consider to choose the right tool for the job. The first thing you need to consider is what type of accounting system you use. There are many different accounting automation tools out there, so you must ensure that the accounting automation software you choose is compatible with the software you use.

Another important thing to consider is what features you need from an automation tool. Some tools offer more comprehensive features than others, so it is important to figure out which features are most important to you and your business. Once you understand what you need, you can start looking at different options and compare them side by side.

Finally, the cost is always a factor when choosing any business tool. Automation tools can range in price from very affordable to quite expensive, so again, it is important to figure out your budget and find something that fits within that budget. Considering all of these factors, you should be able to narrow down your options and find the right automation tool for your needs.

Which Tasks Cannot be Automated?

While many tasks can be automated, a few can only partially be automated, and certain cannot be automated at all. For example, record keeping cannot be fully automated as accounting relies heavily on accurate and up-to-date records. This task must be done manually, as automation cannot guarantee accuracy. Another task that cannot be automated is analysis and reporting. Accountants must be able to interpret data and figures in order to provide insights and recommendations. This is something that a machine cannot do. Also, automated accounting systems can generate reports. However, these are often basic and lack the detail that is required by clients or management, and accountants are still needed to produce high-quality tailor-made reports manually.

What Are The Risks Associated With Automated Accounting?

There are a few risks associated with automated accounting. One risk is that if there is a problem with the software or the data, it could result in inaccurate financial reports. This could lead to problems in making decisions based on those reports. Another negative impact of automation on accounting is that it could be difficult and costly to fix if something goes wrong with automation. Finally, there is always the potential for fraud or error when using any type of automation, so businesses need to be aware of the disadvantages of automation in accounting and have controls in place to prevent it from happening.

Conclusion

As businesses become more digitized, many accounting tasks can be automated using the software. This can save time and improve accuracy. When considering which accounting tasks to automate, it is important to weigh the costs and benefits. Automating simple tasks can save time and reduce errors, but more complex tasks may require more time and effort to set up. Ultimately, the decision of which accounting tasks to automate will depend on the specific needs of the business.

If you want to take advantage of accounting automation, contact us and talk to our accounting experts. They can guide you in implementing the best accounting automation policies and selecting the right automation tool to help you save time, money, and resources while achieving business growth!

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.