Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: January 6, 2021

- Last Updated: February 10, 2025

Are you having trouble keeping up with your business’s tax obligations? You are not alone. Many small businesses in Australia find the Business Activity Statement (BAS) complicated and time-consuming. However, mastering your BAS statement can have a significant impact on cash flow management and compliance.

Getting a handle on BAS does not have to be difficult, from calculating the correct figures to determining when to lodge. With the appropriate guidelines and some expert advice, you can eliminate the uncertainty from your tax filing and avoid costly blunders. Let’s get started and make BAS a simple part of your daily Australian business operations!

What is a Business Activity Statement?

A Business Activity Statement (BAS) is an important document that Australian firms use to disclose their tax obligations to the Australian Taxation Office (ATO). It is often presented on a monthly or quarterly basis and covers a variety of taxes, including GST, Pay as You Go (PAYG) instalments, PAYG withholding, and other tax responsibilities.

The BAS statement assists businesses in accurately calculating and reporting the taxes owed or the refunds they are entitled to. To avoid penalties and ensure compliance with Australian tax regulations, submit your BAS statement on time. Businesses can complete and submit their BAS online via the ATO’s site, or through an accountant or tax agency.

Many small businesses struggle to navigate the business activity statement, which is why professional accounting services may be useful in managing tax reporting efficiently and effectively, ensuring that all responsibilities are completed on time.

How does BAS work?

Now you know what is BAS, let’s go through the concept of how BAS statement works. Business activity statements work by allowing businesses to report their taxable sales, purchases, and other tax obligations like Goods and Services Tax (GST) and PAYG withholding to the Australian Taxation Office (ATO).

Businesses fill out the BAS form with this information, and the ATO uses it to determine how much tax is owed. After submission, businesses must pay the required tax by the due date to avoid penalties. BAS can be lodged online or through an accountant, ensuring that all necessary financial details are accurately reported and managed according to Australian tax regulations.

How does BAS relate to GST?

The BAS statement is closely tied to GST, as it’s the form businesses use to report and pay their GST obligations to the Australian Taxation Office. GST is a value-added tax applied to most goods and services sold in Australia. When your business is registered for GST, you must charge GST on your sales and claim credits for the GST paid on your purchases. The difference between the GST collected and claimed is reported on your BAS. Based on this, you either pay the net amount to the ATO or receive a refund.

BAS Statement taxes include:

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) income tax

- Fringe Benefits Tax (FBT)

- Fuel Tax Credits (FTC)

- Luxury car tax (LCT)

- Wine Equalisation Tax (WET)

How Often Do You Lodge a Business Activity Statement?

Monthly Lodgement:

Businesses with a GST turnover of $20 million or more are required to lodge their BAS on a monthly basis. However, businesses with a lower turnover may also choose to report monthly if they prefer more frequent reporting and payment.

Quarterly Lodgement:

If your business has a GST turnover of less than $20 million, you are eligible to lodge your BAS statement quarterly. This is the most common option for small and medium-sized businesses, providing a good balance between managing cash flow and compliance obligations.

Annual Lodgement:

Smaller businesses with a GST turnover of less than $75,000 (or $150,000 for non-profits) can choose to lodge their BAS annually. However, this option is generally not recommended as it can lead to cash flow issues when it comes time to make your GST payment, as businesses may unintentionally spend the GST collected throughout the year.

If your BAS lodgement date falls on a public holiday or weekend, you will have until the next business day to submit your form and make the necessary payment, ensuring compliance without penalty.

In certain situations, such as natural disasters, the Australian Taxation Office (ATO) may provide extensions to BAS lodgement deadlines. In these cases, or if you face other extenuating circumstances, consulting BAS accounting services can help ensure you meet your obligations on time.

How to Calculate BAS?

To collect and calculate GST accurately for your BAS (Business Activity Statement) in Australia, you can follow these essential steps:

Step 1: Select Your Accounting Method

Your first task is to decide between cash accounting and accrual accounting for recording transactions. This decision impacts when you report and collect GST:

Cash Accounting: Record GST when payments are actually received or paid. This simpler method is often suitable for smaller businesses since it reflects cash flow directly.

Accrual Accounting: Record GST when invoices are issued or received, regardless of payment status. This method provides a more accurate, long-term picture of finances but may be more complex.

Your choice of method will determine the timing of when GST amounts are included in your BAS statement.

Step 2: Determine GST-Applicable Sales and Purchases

Identify all transactions subject to GST, separating them from non-taxable or GST-free items. For example, in a café, GST would apply to most menu items and supplies like coffee beans and milk. However, certain items like fresh fruit or specific medical supplies may be GST-free. It’s crucial to include only GST-applicable sales and purchases to ensure accuracy in your GST calculations.

Keep detailed records of all invoices and receipts related to taxable transactions to simplify the calculation process.

Step 3: Calculate Collected and Paid GST, and Determine Net GST

With your GST-applicable transactions identified, calculate the GST collected from sales and the GST paid on purchases.

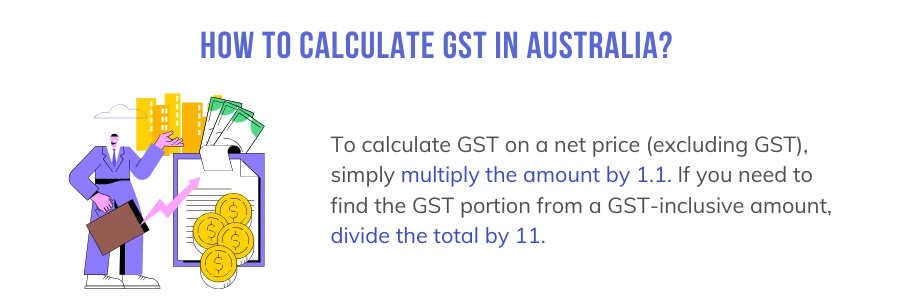

Calculate GST Collected: Multiply each GST-inclusive sale by 1/11 to determine the GST portion. For instance, if your total sales amount to $1,100 (including GST), the GST collected would be $100.

Calculate GST Paid: Similarly, divide the GST-inclusive purchase total by 11. If your total purchases are $550, the GST paid would be $50.

Next, determine your net GST by subtracting the total GST paid from the total GST collected. Using the example above, with $100 collected and $50 paid, your net GST would be $50, which is the amount you would report and pay to the Australian Taxation Office (ATO).

Step 4: Lodge Your BAS and Manage Payments

Submit the calculated net GST through your BAS statement, which can be done via the ATO’s Business Portal or through accounting software that links to the ATO. Based on your net GST, you’ll either make a payment to cover GST owed or receive a refund if your GST paid exceeds GST collected.

Step 5: Maintain Detailed GST Records

To stay compliant with ATO regulations, keep accurate records of your GST transactions, preferably using tools like spreadsheets, or accounting software like QuickBooks or Xero. Proper record-keeping helps manage GST credits and simplifies future BAS lodgements.

How to Lodge a BAS?

When it comes to lodging a BAS statement in Australia, understanding what is Business Activity Statement can help you choose the best option to ensure you meet your tax obligations. Here’s a guide to the main methods:

Lodging Online

Most businesses in Australia choose to lodge their business activity statement online because it’s quick, easy, and offers added benefits. You can lodge through:

- myGov: Ideal for individuals and sole traders, allowing them to manage their tax and superannuation in one place.

- Online services for business: A secure ATO platform designed to manage your business tax affairs.

- SBR-enabled software: Directly lodge from your accounting or payroll software, which is often tailored to specific industries and provides a secure connection to the ATO.

Lodging BAS statement online can offer you a two-week extension on the due date, help you avoid mistakes with automated checks, and possibly speed up any refunds.

Using a Tax or BAS Agent

If you prefer professional assistance, a registered tax or BAS agent can lodge, vary, and pay on your behalf. They use their own secure electronic channels, can view your BAS notices, and manage reminders. Although they handle your BAS statement, you can still access your BAS information through your myGov or Online services for business accounts.

To find a registered BAS agent, visit the Tax Practitioners Board’s website.

Lodging by Mail

While online methods are popular, lodging by mail is still an option. If you receive a paper BAS statement form, complete it and mail it back using the pre-addressed envelope provided. If the envelope is misplaced, mail it to:

- Australian Taxation Office

- Locked Bag 1936

- ALBURY NSW 1936

If you make a mistake on your paper form, you can use white-out to correct it.

Lodging a Nil BAS

If you have nothing to report for a period, you can submit a ‘nil’ BAS statement. This can be done online or through an automated phone service by calling 13 72 26. Just have your busines activity statement document identification number (DIN) handy.

Receiving Your BAS

How you lodge will influence how you receive future BAS statements. Online lodgement automatically shifts you to electronic statements, which will be accessible 21 days before the due date.

Conclusion

Small firms may struggle to navigate the complexities of Business Activity Statements, but understanding the rules and processes can lead to more efficient tax administration. Regular and correct BAS statement filings are critical for meeting tax responsibilities and maintaining compliance with Australian rules.

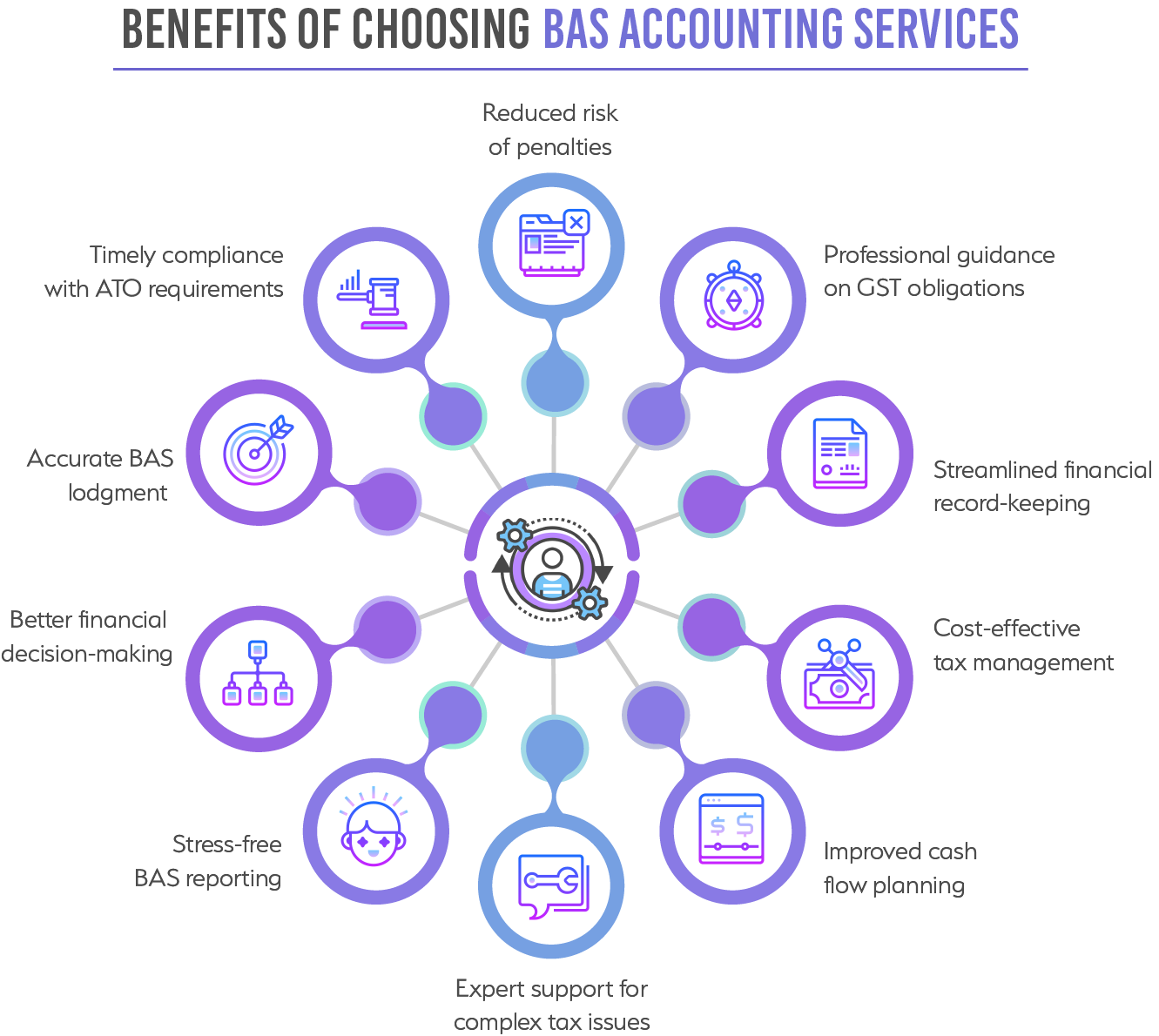

Engaging BAS accounting services can be a beneficial step in handling tax filing, giving business owners peace of mind and allowing them to focus on growth. As you now understand what BAS is and its purpose in GST reporting, following the proper procedures and requesting professional assistance when necessary will make BAS lodgement a much more doable chore.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

A BAS statement includes various tax obligations, such as GST, PAYG instalments, PAYG withholding, and other tax credits. Businesses must lodge this form regularly to report and pay these taxes. Accurate BAS accounting services help ensure compliance with these requirements.

In accounting, BAS refers to the Business Activity Statement, which businesses use to report their tax obligations to the ATO. It covers GST, PAYG, and other taxes. Understanding what is BAS statement is essential for effective financial management and compliance.

No, a BAS statement does not include income tax payable. It mainly covers GST, PAYG withholding, and other taxes related to business activities. While BAS accounting services handle these taxes, income tax is reported separately in annual tax returns.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.