Table of Content

Share This Article

- Reading Time: 16 Minutes

- Published: July 12, 2024

- Last Updated: February 15, 2025

As a business owner or startup, are you having trouble handling complex accounting duties while trying to expand your business? Keeping your financial affairs in order is critical, but it can be difficult without the correct assistance. This is where NetSuite accounting comes into play—a powerful, cloud-based system that simplifies financial management. This comprehensive guide to accounting in NetSuite will explore the platform’s robust features, including real-time data access, automated billing, multi-currency management, and customisable reporting. Designed to meet the needs of businesses of all sizes, NetSuite offers tools that improve accuracy, efficiency, and compliance with global standards. So, let us dive into this guide to discover key features, best practices, and benefits of expert providers to maximise the potential of NetSuite for your accounting needs.

What is NetSuite?

NetSuite is a major cloud-based enterprise resource planning (ERP) software that gives firms a single platform for tracking their essential operations. Accounting, inventory management, customer relationship management (CRM), and e-commerce are among the many features it offers. NetSuite, which is designed to streamline and automate company processes, enables businesses to improve efficiency, cut operational expenses, and obtain real-time visibility into their financial and operational performance. NetSuite’s scalable and customisable solutions make it suited for organisations of all sizes and industries, giving them the ability to react to changing business needs and growth. NetSuite accounting, in particular, stands out because it automates financial operations, ensures compliance, and provides extensive financial reporting, making it an essential tool for effective financial management.

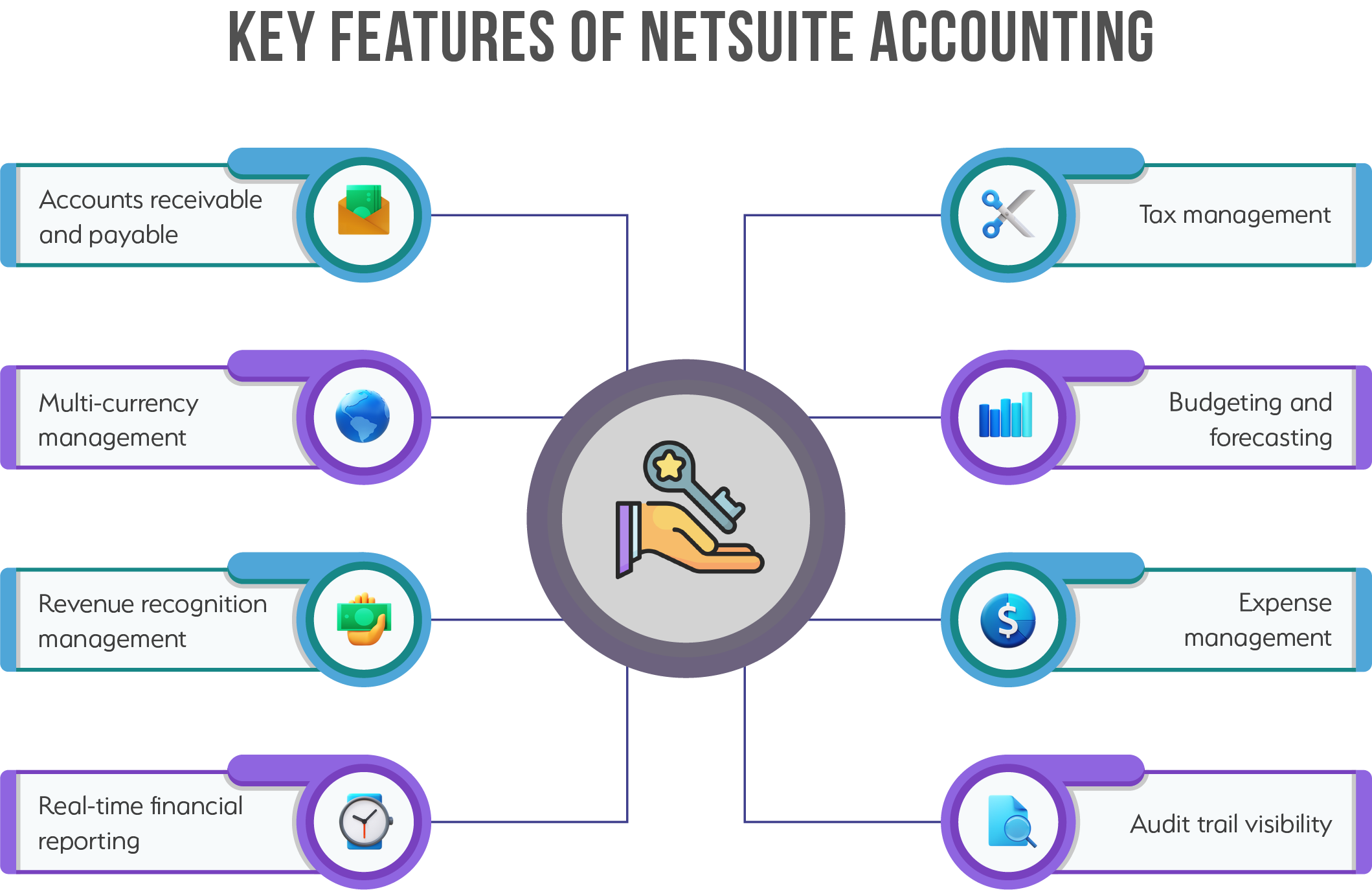

8 Key Features of NetSuite Accounting

-

Accounts Receivable and Payable:

Accounts receivable and payable in NetSuite provide accounting experts with strong capabilities for streamlining financial procedures. NetSuite’s automated billing, collections, and vendor payments assure precision as well as effectiveness when managing both incoming and outgoing payments. This not only improves cash flow management but also gives real-time financial insights, which are critical for strategic decision-making.

-

Multi-currency Management:

Accounting professionals who handle global transactions rely heavily on NetSuite’s multi-currency management capabilities. This tool enables the easy processing of invoices, payments, and financial reports in several currencies while maintaining accuracy and compliance with international requirements. It improves financial insight and reduces the complexity of managing global money.

-

Revenue Recognition Management:

NetSuite’s revenue recognition management automates revenue monitoring and reporting, simplifying the challenges of adhering to accounting requirements. This guarantees that revenue is recognised correctly and in accordance with predefined criteria and timescales. The tool also provides detailed insights into revenue streams, allowing for more precise financial planning and strategic decisions.

-

Real-time Financial Reporting:

NetSuite’s real-time financial reporting provides accounting experts with up-to-date knowledge about their financial data. This function enables the production of dynamic reports and dashboards, which provide a clear and up-to-date perspective of financial performance. Businesses that have rapid access to precise financial data can make informed decisions more easily and efficiently.

-

Tax Management:

Accounting professionals benefit from NetSuite’s tax management tools, which ease the complex process of dealing with taxes. By automating tax calculations, filings, and reporting, it assures precise adherence to both local and international tax laws. This not only decreases the likelihood of errors but also keeps firms up to date on changing tax legislation.

-

Budgeting and Forecasting:

NetSuite’s budgeting and forecasting capabilities help accounting professionals create realistic financial strategies and estimates. These solutions provide real-time data and advanced analytics, allowing firms to predict future financial performance and make educated strategic decisions. Businesses with greater insights into financial patterns can more effectively manage their resources to attain their financial objectives.

-

Expense Management:

NetSuite’s expense management solutions make managing and monitoring business expenses easier. Automating expenditure reporting, approval protocols, and reimbursements promotes accuracy and efficiency, allowing firms to maintain greater financial control and monitoring of their spending.

-

Audit Trail Visibility:

NetSuite’s audit trail visibility gives accounting professionals a complete record of all financial activities. This feature promotes transparency and responsibility by providing for precise tracking of modifications and user actions. Such visibility is critical for ensuring adherence and executing thorough audits effectively.

Streamlining Accounting with NetSuite

-

Automation of Routine Tasks:

NetSuite specialises in automating repetitive accounting operations, including journal entries, invoicing, and account reconciliation. This automation minimises manual burden, freeing accounting professionals to concentrate on more strategic duties. The method also reduces human errors, resulting in more accurate financial reporting. Furthermore, automated workflows can be tailored to particular business operations, increasing operational effectiveness.

-

Centralised Financial Data:

Centralised financial data dramatically improves accounting efficiency with NetSuite. NetSuite fosters consistency and removes data silos throughout the organisation by consolidating all financial data into a single, unified platform. This method enhances accuracy, avoids unnecessary data entry, and enables real-time access to vital financial information. As a result, businesses may make more timely, informed decisions, improving entire financial oversight and planning for strategy.

-

Customised Workflow:

NetSuite flexible workflow engine enables firms to customise procedures to meet their individual requirements. This customisation expands to approvals, invoicing and other financial procedures, resulting in a simplified and optimised workflow that is tailored to the specific dynamic of each firm. The potential to fine-tune these processes means that when business demands change, NetSuite can adapt, delivering a future-proof approach for adaptive financial management.

-

Enhanced Collaboration:

Enhanced cooperation is critical for streamlining accounting using NetSuite. The platform’s integrated capabilities enable teams to collaborate effortlessly while sharing real-time data and insights. This better collaboration means that every stakeholder has access to the most recent financial data, avoiding confusion and errors. As a result, firms can increase the effectiveness and precision of their accounting operations, resulting in more informed decisions and enhanced overall financial management.

-

Scalability:

NetSuite is intended to develop alongside your business. Either extending product lines, accessing new markets, or boosting transaction volumes, NetSuite’s scalable architecture easily handles increased financial intricacies. This scalability assures that firms remain compatible with their financial systems, preventing expensive and disruptive software modifications as the company grows.

-

Mobile Access:

Mobile access substantially increases accounting efficiency with NetSuite. It allows accounting experts to access financial data and do activities from anywhere using their smartphones or tablets. This flexibility increases productivity and guarantees that crucial financial data is easily accessible for fast decision-making. As a result, organisations can maintain smooth financial processes and respond promptly to changing conditions, increasing overall effectiveness and productivity.

Customisation Options for NetSuite Accounting

-

Flexible Charts of Accounts:

With NetSuite, companies can create a chart of accounts that best suits their reporting requirements and organisational framework. Businesses have the ability to generate comprehensive accounts, categorise them in several ways, and even divide them according to divisions, regions, or projects. With this flexibility, financial reports can be produced that are more incisive and customised to meet particular management or regulatory needs.

-

Customisable Dashboard and Reporting:

NetSuite users can design customised dashboards and reports that highlight the KPIs most pertinent to their positions and duties. These customised reports include real-time data on cash flow, income, expenses, and more, making better financial analysis and decision-making possible. The report designer’s drag-and-drop interface facilitates report creation, and the scheduling and distribution features streamline the sharing of crucial financial insights.

-

Tailored Workflow Management:

The workflow engine in NetSuite can be tailored to match a company’s particular procedures. These include defining precise user permissions, personalising transaction forms, and automating approval processes. By ensuring that the system is in line with the business’s operating flow, this kind of customisation boosts productivity and lowers the possibility of mistakes.

-

Industry-Specific Solution:

NetSuite provides industry-specific solutions because it recognises that every sector has distinct accounting requirements. These customised features ensure that the accounting activities comply with industry norms and procedures by catering to the nuances of various industries, including retail, manufacturing, non-profit, and many more.

-

Integration Capabilities:

The flexibility of NetSuite to interact with numerous third-party systems and apps is one of its most potent customisation possibilities. This implies that companies can integrate NetSuite with other enterprise systems, e-commerce platforms, and CRMs already in place to create a unified and integrated work environment. These kinds of interfaces guarantee data consistency across all corporate functions in addition to streamlining processes.

-

Customs Fields and Forms:

With NetSuite, companies may add custom fields to transactions, records, and forms, capturing particular data that is crucial to their business processes. This degree of personalisation guarantees that all important data is captured and readily available within NetSuite while also expanding the system’s capability.

Integration of NetSuite with Other Business Systems

-

Unified Business Operations:

Integrating NetSuite with other applications, like CRM, e-commerce platforms, or HR administration solutions, results in a more cohesive business environment. This interconnection guarantees that data flows smoothly between departments, removing data silos and lowering human data entry. It leads to a more comprehensive perspective of the firm, which aids strategic decision-making and improves the client experience.

-

Enhanced Data Accuracy and Consistency:

When NetSuite is integrated with other applications, data accuracy increases considerably. Automatic data synchronisation between systems decreases the probability of errors that are common with manual data entering. Uniform data across platforms guarantees that every unit can use the most up-to-date and correct information, which is critical for financial reporting and analysis. This integration also improves operational efficiency by offering a uniform picture of corporate processes, allowing for more informed decision-making and future planning.

-

Streamlined Processes and Improved Productivity:

Integration automates and simplifies business operations. For example, sales data from a CRM system can be automatically updated in NetSuite, facilitating billing and revenue recognition. Additionally, integrating e-commerce systems can help automate the order-to-cash process. This automation not only saves time but also enables employees to concentrate on more important activities rather than laborious data entry.

-

Customisable Integration Solutions:

Automatic data syncing between systems decreases the chance of errors that are common with manual data entering. Accurate data across platforms guarantees that all departments use the most updated and correct data, which is essential for financial reporting and evaluation. NetSuite provides a range of integration options to meet diverse business requirements. This flexibility enables businesses to select the solution that best meets their individual needs and technological stack, hence increasing operational efficiency and decision-making abilities.

-

Real-time Data Access and Reporting:

Integration makes real-time reporting and data access possible. Decision-makers have access to all business operations’ current information, improving their capacity to react swiftly to market shifts and company demands. Real-time data is crucial for financial reporting, forecasting, and planning.

8 Best Practices for NetSuite Accounting

-

Regular Data Review and Cleanup:

Regular data analysis and cleansing in NetSuite accounting greatly increases data accuracy and reliability. Businesses can ensure the authenticity of their records by regularly reviewing financial data and identifying and correcting problems. Routine cleansing eliminates old or unnecessary information, improving data quality and system performance. Such a proactive strategy promotes better decision-making and ensures compliance with accounting regulations.

-

Leverage Customisation Wisely:

Wise use of customisation in NetSuite accounting can significantly improve efficiency and effectiveness. Personalising the system to suit business demands results in more relevant and efficient procedures. However, it is critical to strike a balance between customisation and system complexity in order to prevent overcomplication and reliability. Deliberate customisation promotes better data management, faster workflows, and more precise financial reporting.

-

Utilise NetSuite Reporting and Analytics:

Using NetSuite’s reporting and analytics features is critical for maximising the platform’s accounting abilities. These technologies provide comprehensive insights into businesses’ financial performance, providing real-time data and customisable reports. This allows for enhanced decision-making and strategic planning. Consistent use of NetSuite’s advanced analytics guarantees reliable tracking of key indicators, aiding in identifying trends and opportunities to enhance financial management.

-

Ensure Proper User Training and Support:

Comprehensive user training and continuing assistance are required for effective NetSuite accounting use. When users are properly trained, they may operate the system more effectively and precisely, maximising its potential. Regular assistance helps to fix issues promptly, guaranteeing smooth operations and reducing downtime. With adequate training and support, users can take advantage of all of NetSuite’s features, resulting in improved accounting and reporting.

-

Implement Strong Internal Control:

Strong internal controls are required for effective NetSuite accounting. Such controls protect financial data by assuring correctness and combating fraud. Businesses that establish clear procedures and guidelines can preserve regulatory compliance while also improving overall financial integrity. Ongoing audits and monitoring strengthen these controls, encouraging accountability and accurate financial reporting.

-

Stay Updated on New Features:

Regularly investigating new features of NetSuite can dramatically improve your accounting operations. By using the most recent functionality, your company can benefit from advanced tools and upgrades that increase productivity and accuracy. This proactive strategy ensures that your financial management meets evolving standards. Furthermore, remaining updated about upgrades enables your team to continuously improve operations and preserve a competitive advantage.

-

Conduct Regular System Review and Audit:

Routine system reviews and audits are essential for maintaining top-notch NetSuite accounting practices. These evaluations uncover discrepancies and inefficiencies, ensuring the accuracy and reliability of your financial data. Regular audits also confirm adherence to internal policies and regulatory requirements, bolstering financial integrity. By consistently assessing system performance, businesses can refine their accounting processes and proactively mitigate potential risks.

-

Go to Experts:

Consulting with an expert NetSuite accounting services provider is an excellent way to optimise NetSuite accounting. Specialists can provide useful insights and specialised solutions to help you make the best use of the platform’s potential. Their knowledge guarantees that your deployment is effective and follows best practices, reducing errors and increasing productivity. Your company can improve its financial management and strategic planning by seeking professional help.

Why Do You Need an Expert NetSuite Accounting Services Provider?

-

Specialised Knowledge and Experience:

Specialised knowledge and experience make an expert NetSuite accounting services provider invaluable. These professionals deeply understand NetSuite’s capabilities, optimising your accounting processes for efficiency and accuracy. Their expertise tailors solutions to meet your specific business needs, enhancing overall financial management.

-

Handling Complex Task:

Handling complex tasks requires an expert NetSuite accounting services provider. These professionals manage intricate accounting functions such as multi-currency management and revenue recognition, allowing your internal team to focus on core business activities. Their expertise ensures that complex tasks are executed accurately and efficiently, enhancing overall financial management.

-

Staying Updated:

It is essential to stay updated with the latest NetSuite features and best practices. An expert NetSuite, accounting services provider, ensures your business leverages the most current tools and improvements, maximising efficiency and effectiveness. Their knowledge keeps your accounting processes aligned with industry advancements, enhancing overall performance.

-

Enhanced Compliance:

An expert NetSuite accounting services provider ensures enhanced compliance. They help maintain adherence to regulatory standards, reducing the risk of errors and penalties. Their expertise ensures your accounting practices are always up-to-date with the latest legal and industry requirements.

-

Improved Decision Making:

An expert NetSuite accounting services provider facilitates improved decision-making. They provide precise and timely financial data, enabling well-informed strategic decisions. Their insights help you understand financial trends and performance, guiding your business toward better outcomes.

-

Greater Financial Stability:

Greater financial stability is achieved with an expert NetSuite accounting services provider. Their expertise ensures accurate financial management, reducing errors and enhancing reliability. This leads to more consistent financial performance and supports long-term business growth.

Quick Read: Want to learn more about the benefits of NetSuite accounting? Read our blog, “9 Reasons Why You Should Switch to NetSuite from Your Traditional Accounting Software”, and learn how this potent platform can maximise productivity, boost precision, and simplify your financial management procedures.

How To Get the Right NetSuite Accounting Services Provider?

-

Research Providers:

Finding the best NetSuite accounting services provider requires thorough research. Look for organisations with a proven track record and particular NetSuite expertise, with a focus on those with industry experience. Check customer reviews and feedback to determine their dependability and service quality. Consider the variety of services they provide and their ability to personalise solutions to your specific business needs.

-

Certifications:

Ensure the provider has certified NetSuite professionals who have undergone rigorous training and testing. These certifications demonstrate their expertise and commitment to staying current with the latest NetSuite features and best practices. A certified provider is more likely to deliver high-quality, reliable services tailored to your business needs.

-

Evaluate Technical Expertise:

Evaluate their experience deploying and managing NetSuite systems and look for a track record of successful projects. Enquire about their experience with organisations comparable to yours to ensure they understand your unique requirements. A provider with extensive technical understanding can efficiently optimise your accounting procedures using NetSuite.

-

Check References and Reviews:

Checking references and reviews is an important step in selecting the right NetSuite accounting services provider. Reach out to current or past clients to gather feedback on their experiences, focusing on the provider’s reliability, quality of service, and responsiveness. Online reviews and testimonials can also provide valuable insights into the provider’s reputation and performance. This due diligence helps ensure you choose a provider that is trustworthy and capable of meeting your business needs.

-

Review Pricing and Contracts:

Compare the price structures of several providers to ensure they offer reasonable rates within your budget. Check the contract provisions for flexibility, service level agreements, and any hidden expenses. Clear pricing and contracts help you receive the most value while avoiding unexpected charges.

Final Words

Adopting NetSuite accounting can transform your business by streamlining financial operations, enhancing accuracy, and boosting overall efficiency. This robust platform offers a comprehensive suite of tools tailored to various accounting needs, making it ideal for businesses seeking advanced financial management capabilities. With features like real-time data access, customisable reports, and seamless integration with other business systems, NetSuite empowers businesses to make informed decisions and achieve greater financial stability.

Additionally, working with expert NetSuite accounting service providers ensures you fully leverage the platform’s potential, leading to optimised processes and sustainable growth. Choosing an ideal NetSuite partner entails assessing their experience, technical expertise, certifications, references, and reviews. Partnering with Whiz Consulting can dramatically improve how you use NetSuite to reach your accounting goals. Embracing the advantages of this strong platform, combined with the assistance of a qualified accounting partner like Whiz Consulting, can help you take your business operations to new levels.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.