Table of Content

Share This Article

- Reading Time: 5 Minutes

- Published: August 29, 2023

- Last Updated: February 15, 2025

Bank reconciliation is a critical process in accounting that allows you to ensure your financial records match those of your bank. It might seem like a daunting task, but with the right approach, you can perform bank reconciliation like a pro! Not only does it help you to identify discrepancies and prevent fraud, but it also gives you an accurate picture of your business’s cash flow. In this blog, we will take you through each step involved in performing bank reconciliation and provide tips on how to make the process smoother. Whether you are a seasoned accountant or just starting out, this post will equip you with everything you need to know about reconciliation in accounting.

What Do You Mean by Bank Reconciliation?

Bank reconciliation is the process of matching your company’s financial records with those of your bank statement. This ensures that all transactions are accurately recorded and accounted for. Bank reconciliation is important because it helps you identify discrepancies between your records and the banks, such as unauthorised transactions or errors in recording. It also allows you to detect and prevent future losses. This process involves reviewing each transaction on both sets of records, comparing them line by line, reconciling any differences, and making adjustments where necessary. This can be a time-consuming task but is essential for maintaining accurate financial statements.

Generally, businesses should do bank reconciliations on a monthly basis. Reconciling the books right after the end of the month is convenient, as banks send statements at the end of each month. Ideally, you should reconcile your bank account as regularly as possible, and if you have a business with a high level of transactions, you might as well conduct it daily. Doing so will give you an updated understanding of your business cash flow, which helps you guide decisions about spending and budgeting.

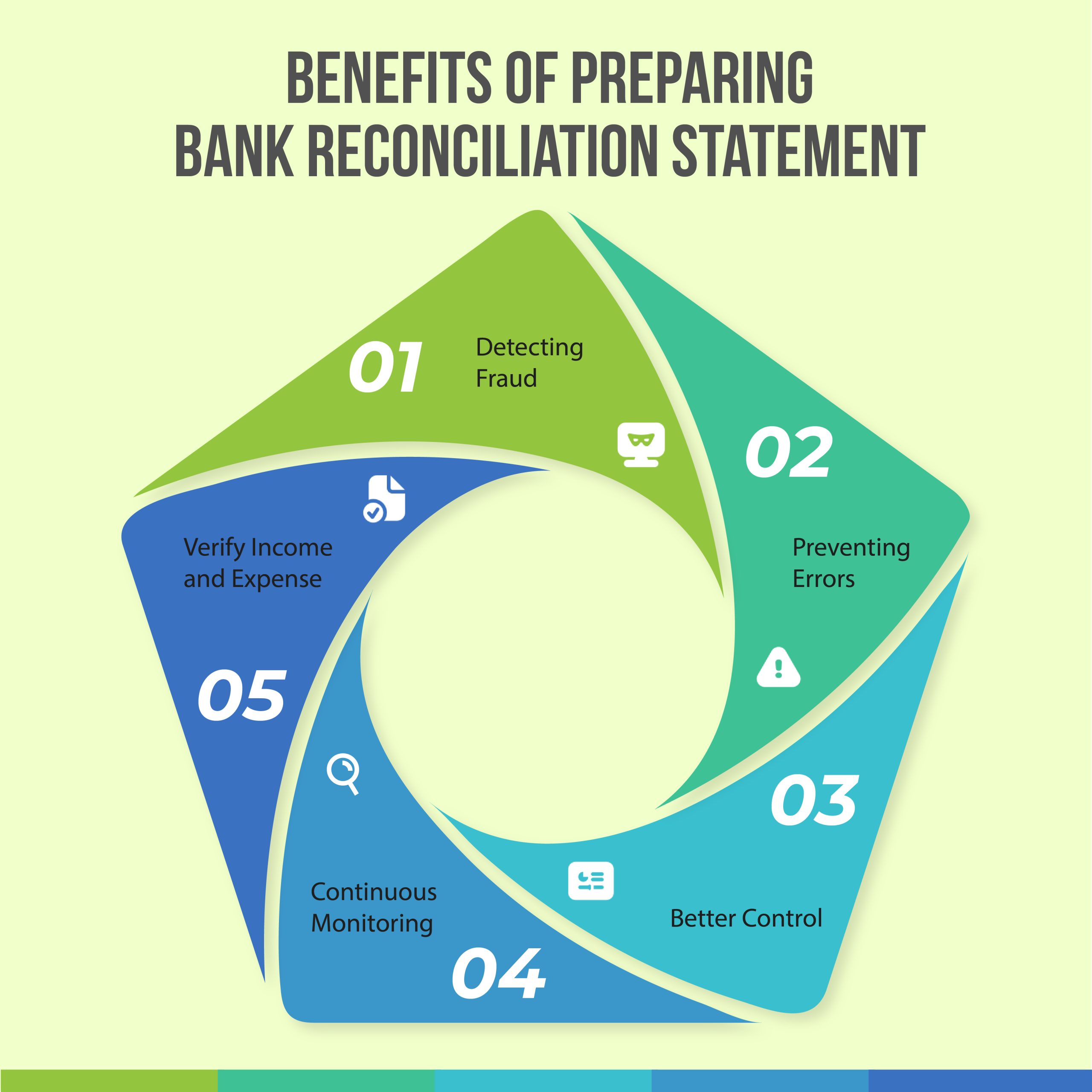

5 Benefits of Preparing Bank Reconciliation Statements

Detecting Fraud:

By reconciling bank statements with accounting records on a regular basis, companies can identify any discrepancies or suspicious activities in their accounts. This process helps in the early detection of fraudulent transactions and prevents further losses to the business.

Preventing Errors:

Bank reconciliations also help prevent errors by highlighting inconsistencies between bank balances and accounting records. This allows businesses to correct any errors before they become larger problems down the line.

Better Control:

Businesses gain greater visibility into their financial operations by comparing cash inflows and outflows across different accounts. This information enables them to make more informed decisions about budgeting, managing cash flow, or investing money where it is needed most.

Continuous Monitoring:

To maintain accuracy over time requires continued monitoring of financial transactions through frequent reconciliation checks. Doing so ensures that any new issues will be caught quickly without causing major repercussions for businesses later on.

Verify Company Income And Expense:

Verifying income and expenses is essential for any organisation looking to stay viable long-term in today’s competitive marketplace. Reconciling bank statements provides an accurate picture of how much revenue is coming in versus what is going out every month – allowing managers to project future growth rates based on this data.

What Are the Steps to Prepare a Bank Reconciliation Statement?

Get Bank Statement:

The first step to preparing your bank reconciliation statement is to get your bank statements. This document summarises all the transactions in your account during a specific period, including withdrawals, deposits, and fees.

Get Company Ledger:

The next step is to get a company ledger. The company ledger contains all the financial transactions made by the business, including payments and receipts. It is essential to know that the information given in the ledger is accurate and updated before proceeding towards preparing a bank reconciliation statement.

Check All Bank Deposits and Withdrawals:

After obtaining the bank statement and company ledger, the next step in preparing a bank reconciliation is to check all the deposits and withdrawals. This involves comparing the transactions recorded by the company to the bank statements.

Check Income and Expenses:

When preparing a bank reconciliation statement, it is crucial to check the income and expenses of the company. This is important in order to ensure that all the transactions are properly recorded and accounted for.

Check If There Are Any Double Payments or Missing Transactions:

It is crucial to check if there are any double payments or missing transactions. Checking double payments and missing transactions during reconciliation can help prevent costly errors from affecting your business operations.

Do The Needful Adjustments:

By following the above steps, you can easily prepare a bank reconciliation statement. However, it is important to remember that even after going through all the steps and making adjustments, sometimes there may still be discrepancies between your records and the bank’s records. In such cases, it is advisable to investigate further by contacting your bank or seeking professional help from an accountant.

Conclusion

Performing bank reconciliation is a vital aspect of accounting that every business owner or accountant should take seriously. It ensures the accuracy and completeness of financial statements, which in turn helps businesses make informed decisions. By following the steps outlined above and keeping in mind our tips for performing bank reconciliation, you can streamline your accounting processes and have better control over your finances. Reconciling your accounts regularly ensures that you always have accurate financial information.

You can leverage technology to automate the process and save time while ensuring accuracy. Moreover, with online accounting services available in the market, you no longer have to perform this task manually. You can get help from online accounting services providers and get your bank reconciliation process conducted without compromising accuracy and compliance.

All in all, by reconciling your accounts regularly and thoroughly reviewing all discrepancies between your records and the bank statement each month, you will be able to detect errors early on before they become bigger problems down the line. With these practices in place, you’ll be well on your way to becoming a pro at performing bank reconciliation!

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.