Table of Content

Share This Article

- Reading Time: 20 Minutes

- Published: June 25, 2024

- Last Updated: February 15, 2025

Real estate accounting is a critical component of the property industry, assuring accurate financial supervision and conformity to regulatory standards. According to Australian Bureau of Statistics data, the real estate business contributes significantly to the country’s economy, accounting for 13.3% of GDP. This guide aims to clarify the complexities of real estate accounting, namely the management of rental income, operational expenses, depreciation, and capital gains. A good understanding of fundamental accounting principles is vital for improving strategic financial planning and operational success. It presents readers with an in-depth analysis of critical real estate accounting practices, tailored insights for the Australian market, and expert advice for effectively handling the financial environment of the real estate business. So, let us dive in.

What Is Real Estate Accounting?

Real estate accounting is a subset of accounting that centres on the financial transactions related to real estate properties. It entails recording revenues and expenses, determining property values, and allocating costs for tax purposes. Key responsibilities involve handling tenant-related transactions such as leases, rent collections, and evictions, along with generating financial reports on the performance of real estate investments. Furthermore, real estate accounting assures adherence to applicable rules and regulations, such as those regulating taxation on properties and rental agreements. This type of accounting is vital for property investors and managers because it provides crucial insights that help with making smart decisions and financial planning in the real estate industry.

Basics of Real estate Accounting

-

Unique Transactions:

The fundamentals of real estate accounting revolve around unique transactions. These include the documentation of property acquisitions and sales, which represent large capital transactions that differ from conventional corporate operational expenses. Furthermore, managing capital improvements and repairs necessitates separate accounting methods, which are frequently capitalised rather than expensed, affecting both the property’s value and depreciation rates.

-

Property Valuation:

Property value is a critical component of real estate accounting, allowing for proper financial analysis and reporting. It entails identifying a property’s market worth using characteristics such as location, condition, and market trends. This valuation influences a variety of financial decisions and reports, most notably computing depreciation, assessing property taxes, and calculating gains or losses on property sales. Accurate property assessment assures compliance with accounting requirements and supports strategic investment planning.

-

Expense Tracking:

In real estate accounting, expense tracking records every dollar spent on upkeep and repairs, from planned maintenance to last-minute fixes. By meticulously recording these expenses, property managers and accountants may create accurate financial accounts that accurately reflect the true cost of property ownership. This approach improves overall financial performance by helping with tax preparation and offering insight into potential cost-saving opportunities.

-

Revenue Recognition:

When revenues from property sales or rentals may be formally recorded is known as revenue recognition in real estate accounting. Certain accounting rules that specify the circumstances in which revenue is deemed earned serve as a guide for this procedure and guarantee accuracy in financial reporting. One accurate indicator of financial position is the rental income, which is recorded as it is earned, whereas revenue from property sales is recognised at the time of closing.

-

Depreciation Calculations:

In real estate accounting, the calculation of depreciation is a technique used to spread out the cost of tangible assets over their useful lifespan. In the context of real estate, this means distributing the cost across a number of years for structures and improvements—land excluded. This accounting procedure lowers the property owner’s taxable income annually and aids in representing the wear and tear on real estate assets. It is also essential for tax benefits.

-

Loan Management:

The main objective of loan management in real estate accounting is to track and handle the financial components of mortgages and other property-related loans. This methodical technique ensures that all loan-related transactions are accurately recorded to support the financial evaluations required for refinancing choices and loan agreement compliance.

Types of Real Estate Transactions

-

Sales and Purchases:

Real estate transactions that entail the transfer of property ownership between parties are primarily classified as sales and purchases. The properties involved in these deals are usually both business and residential, including office buildings and retail spaces, as well as houses and flats. In order to handle finance, negotiations, and local real estate law compliance, the procedure frequently calls for the assistance of real estate brokers, attorneys, and financial institutions.

-

Rental and Leases:

In real estate accounting, transactions involving monthly payments from renters to property owners are centred around rentals and leases. To guarantee precise tracking of revenue and costs related to property management, these financial transactions must be painstakingly documented. When recognising assets and liabilities in accordance with accounting standards, accountants must also consider the effects of leases on the balance sheet. In addition, managing security deposits and figuring out depreciation for leased buildings are crucial steps in this process that need close attention to detail.

Which Real Estate Accounting Method Should You Use?

Selecting the appropriate real estate accounting approach is contingent upon several factors, including your company’s scale, financial objectives, and regulatory needs. In real estate, the following are the two main accounting techniques used:

-

Cash Basis Method:

This is a simple method where transactions are only recorded when money is exchanged. It is right for independent investors or smaller real estate companies. In cash-basis accounting, income is recorded as soon as it is received, and costs are recorded as soon as they are paid. Although this approach gives a clear image of the company’s cash flow at any moment, it might not accurately represent the company’s long-term financial situation.

-

Accrual Basis Method:

Accrual basis accounting is more sophisticated and is typically preferred by larger companies. It tracks income and expenses as they are incurred or generated, independent of the timing of the cash transaction. Long-term financial picture accuracy is increased with this strategy, particularly for organisations with large volumes of payables and receivables. Because it conforms to generally accepted accounting principles (GAAP), larger businesses are required to utilise it when requiring financial statements for external purposes, such as reporting to shareholders or seeking financing.

Selecting the best method necessitates considering administrative capabilities to oversee the selected accounting style, financial transparency needs, and regulatory constraints. Due to its comprehensive financial insights, accrual-basis accounting frequently ends up being the favoured option for many real estate businesses, particularly those seeking to expand or get outside funding.

Why Do Real Estate Agents Need Accounting?

-

Maximising Business Revenue:

Accounting for real estate agents is necessary in order to optimise business income by making sure that all financial aspects of their operations are closely monitored and evaluated. Agents can maximise their financial strategy by identifying successful projects and eliminating unnecessary expenditures with the help of effective accounting. Agents can better predict future income, plan for sustainable growth, and improve their decision-making process by keeping accurate records. Additionally, organised financial data helps agents show their competence and dependability, which draws in new business and investment opportunities.

-

Evaluating Expenditures:

Agents who closely monitor their costs can spot areas where they can cut costs and prevent overpaying in areas where the returns are insufficient. Proper accounting also aids in accurate budget planning and cost planning for upcoming expenses like marketing campaigns, property upkeep, and administrative costs. This financial restraint enables agents to reinvest in areas that improve their market presence and service offerings, hence supporting long-term business growth and profitability.

-

Minimising Business Debt:

Real estate agents can reduce their business debt by using effective accounting, which gives a comprehensive picture of their assets and liabilities. Proper bookkeeping enables cash flow monitoring, which guarantees agents can pay bills on time and do not be fined or charged interest. Agents are also able to predict possible revenue and make well-informed decisions on debt procurement and repayment thanks to strategic financial planning, which is based on sound accounting principles. In order to support long-term business growth and preserve a sound balance sheet, proactive liability management is crucial.

-

Estimate Value of Your Real Estate:

Keeping thorough financial records offers a strong basis for determining real estate values with accuracy. Agents can examine the financial history of individual properties, including rental income, maintenance expenses, and capital renovations, with this technique. These kinds of data are priceless for estimating future trends and valuing the state of the market. Using this data, agents can ensure that pricing strategies are both competitive and accurately represent the value of the property, providing customers with well-informed advice.

-

Helps You Devise Business Strategies:

Real estate agents can create strong business plans by conducting in-depth financial analyses made possible by effective accounting. Agents can evaluate financial trends and historical performance to find profitable markets and investment opportunities. Allocating resources and focusing marketing efforts on areas that have the potential for growth are made possible by this strategic strategy. In the end, these insights help businesses make wiser decisions, giving them a competitive advantage in the booming real estate sector.

-

Stay Updated with the Market:

Meticulous accounting makes it easier to stay updated with the real estate industry by recording and analysing financial patterns and data. With ongoing monitoring, agents are better able to sense changes in customer demand, property valuations, and investment viability. By utilising up-to-date financial data, agents can stay adaptable and proactive in a dynamic sector by modifying their operational plans and sales tactics to better suit current market conditions.

Accounting vs Bookkeeping for Real Estate Agents

| Bookkeeping | Accounting |

| Keeping Track of Transactions: Records daily financial transactions in an organised way, including rent receipts, commission payments, maintenance expenses, and sales. | Financial Analysis: Evaluates the performance and health of the company’s finances by interpreting and analysing financial data. |

| Organisational Focus: Makes sure that every financial transaction is accurately and thoroughly recorded to support traceability. | Strategic Decision Making: Uses accounting report-derived financial insights to plan ahead and make wise business decisions. |

| Preparation for Analysis: Offers the database required for more in-depth financial assessment and reporting | Tax Planning and Preparation: Estimates future tax liabilities, creates tax returns, and calculates depreciation. |

| Regulatory Compliance: By maintaining correct and current records, one can contribute to the upkeep of compliance with financial regulations. | Investment and Financial Planning: Oversees general financial planning and assesses the profitability and viability of real estate ventures. |

Principles of Real Estate Accounting

-

Cost Principle:

The cost principle in real estate accounting states that all assets, including real estate, must be recorded at the original purchase price, which includes the acquisition cost as well as any additional costs required to bring the property into use.

-

Revenue Recognition:

Real estate businesses undoubtedly have to abide by rules about when to recognise “revenue.” At the time of the sale, the revenue from the sale of real estate might be recorded. Additionally, it takes place when the buyer bears all major risks and benefits. However, rental income is another option. In this instance, you can gradually recognise the revenue as you earn the money throughout the span of the lease.

-

Matching Principle:

This rule, which is crucial for accurately reporting profitability, states that costs, like maintenance expenditures or agent commissions connected to particular property transactions, must equal the income they produce within the same reporting period.

-

Fuel Disclosure:

This concept requires that all financial statements present a thorough and transparent picture of the real estate organisation’s financial operations and conditions to guarantee that all interested parties have access to the pertinent data for making decisions.

-

Conservatism:

When making financial assessments and decisions, accountants are compelled by conservatism to select options that minimise projected profits instead of inflating them, so protecting themselves from possible future losses.

-

Materiality:

According to this accounting concept, all material information that could affect how users of financial statements make decisions has to be properly and completely disclosed.

-

Historical Costs:

Refers to the valuation of property and real estate assets based on their initial acquisition cost rather than their current market worth, which ensures financial reporting consistency.

-

Economic Entity Assumption:

This principle is essential for real estate companies that might have multiple properties and intricate ownership structures. It treats the business as an independent entity from its owners or other businesses.

-

Depreciation:

Recognises the gradual loss of value of real estate assets due to wear, tear, and obsolescence, allowing for the methodical and sensible allocation of asset costs over their useful lifespan.

Tax Consideration in Real Estate Accounting

-

Property Taxes:

Property taxes are recurrent annual or semi-annual fees in real estate accounting that landowners are required to pay according to the assessed worth of their property. These taxes impact the cash flow and profitability of real estate investments, and they are important and need to be carefully tracked and handled.

-

Depreciation:

An important tax factor is depreciation, which lets property owners write off a part of the purchase price of their real estate every year to account for wear and tear on the asset. The non-cash deduction has the potential to drastically lower taxable income, making real estate investment more financially appealing.

-

Capital Gain Taxes:

Capital gains tax is imposed on the profit made on the sale of real estate when it is sold for more than it was originally purchased. This tax is an important factor in timing and investment strategy since the rate varies depending on the length of ownership. Long-term gains are generally taxed at a lower rate.

-

Expense Deduction:

Real estate accounting allows deductions for a range of costs related to the upkeep, management, and operation of real estate. These include utilities, mortgage interest, management fees, and repair expenditures. Precise tracking of these deductions is necessary to minimise taxable income and maximise financial results.

Common Real Estate Accounting Mistakes to Avoid

-

Commingling Funds:

In real estate accounting, combining personal and business finances can result in serious financial uncertainty and even legal problems. Separate accounts must be kept for company and personal transactions to guarantee accuracy in financial reporting and adherence to tax laws.

-

Failing To Track Expenses:

Incomplete cost accounting can harm a company’s profitability, leading to errors in financial reporting and missing tax deductions. Real estate companies must implement systems for monitoring and classifying each expense associated with property management and operations.

-

Neglecting To Reconcile Accounts:

Bank statements and accounting records must be regularly reconciled to find and fix mistakes or inconsistencies. Monthly reconciliations should be completed to avoid misstatements of financial positions and missed irregularities.

-

Overlooking Depreciation and Amortisation:

Overstated assets and net income might result from a typical error of not factoring in the amortisation of loans and property depreciation. Calculating these correctly can have a big impact on investment performance analysis and tax liability.

-

Not Maintaining Proper Documentation:

The foundation of trustworthy real estate accounting procedures is sound documentation. It becomes difficult to undertake accurate financial analysis, secure loans, and defend against audits without complete documents, such as contracts, receipts, and financial statements.

Best Practices for Real Estate Accounting

-

Maintaining Accurate and Up-to-date Records:

A key component of real estate accounting best practices is keeping accurate and current records. This procedure makes sure that every financial transaction is recorded in real-time, making it possible to analyse a property’s financial health quickly and accurately. Updating financial records on a regular basis makes it easier to spot inconsistencies and allows for quick adjustments in response to shifting market conditions or operational requirements. Accurate records also help a company look more credible to lenders, investors, and other stakeholders and are essential for complying with tax laws and regulations. In general, thorough record-keeping increases productivity and assurance while making financial decisions.

-

Separating Business and Personal Finances:

Keeping personal and corporate finances apart is crucial for efficient real estate accounting. This procedure makes it easier to track business-related transactions and aids in the establishment of clear financial limits by guaranteeing that all costs and revenues are correctly credited to the appropriate accounts. Real estate professionals can avoid the problems of commingling cash, which can make financial analysis and tax preparation more difficult, by keeping separate bank accounts and credit cards for business use.

-

Using Accounting Software and Tools:

The effectiveness of financial management in real estate can be significantly improved by utilising accounting software and tools. By automating crucial procedures like financial statement production, tenant billing, and transaction recording, these digital solutions greatly minimise manual labour and the possibility of errors. These solutions, which have real estate-specific capabilities like portfolio management and lease tracking, offer deep insights that are essential for making well-informed decisions. Furthermore, a more unified approach to property management is made possible by their capacity to interact with other business systems, which improves overall operational flexibility.

-

Itemise All Incoming and Outgoing Transactions:

In real estate accounting, itemising all incoming and outgoing transactions guarantees accurate financial tracking. From rental income and utility payments to maintenance costs and commission payments, every financial activity may be clearly classified thanks to this meticulous technique. This level of detail not only helps with more accurate financial reporting and analysis but also helps with audit preparation, guaranteeing that each and every transaction is transparent and justified. Better financial forecasting and budget management are also supported by this approach, which is essential for maintaining the profitability of real estate investments.

-

Learn Local Requirements:

Comprehending and following regional regulations is crucial for real estate accounting. The way real estate transactions and financial records are handled is strongly impacted by the specific financial rules, tax laws, and reporting requirements that apply to each location. Real estate professionals can minimise their tax obligations, assure compliance, and steer out of legal hotspots by keeping up with these regional nuances. This information not only puts the company in a safe, legal position but also puts it in a position to benefit fully from local tax breaks and incentives.

-

Digitise Your Business:

Digitising your real estate businesses can greatly improve accounting accuracy and efficiency. Real estate professionals can expedite data entry, storage, and retrieval processes by abandoning paper-based systems and embracing digital solutions. Digital platforms make it simpler to share and collaborate on financial data, guaranteeing that information is available in real-time to all parties involved. Furthermore, the integrity of financial records is further protected by the built-in compliance checks and error detection procedures that are frequently included with digital products.

-

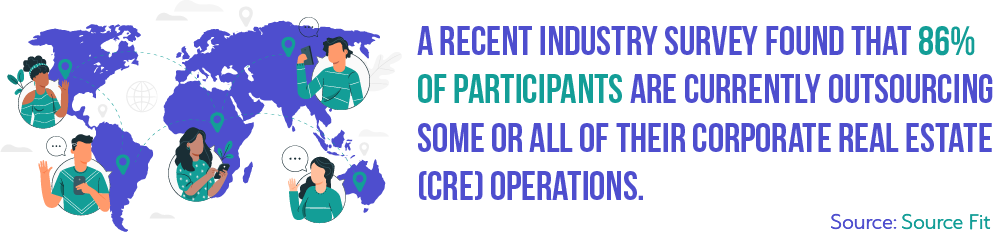

Outsource to Professionals:

Choosing outsourced real estate services providers for accounting tasks can greatly improve your business’s financial management’s precision and efficiency. These experts provide specialist knowledge and a current understanding of tax optimisation and compliance geared towards the real estate industry. Property managers and agents can minimise the risk of financial problems and concentrate more on their primary business, which includes property acquisitions and client interactions, by assigning accounting tasks to outsourced real estate accounting services providers. Moreover, these service providers frequently provide scalable services that can change to meet the evolving requirements of an expanding real estate company.

Benefits of Outsourced Real Estate Accounting Services

-

Expertise and Experience:

By hiring outsourced real estate accounting services, you may work with experts who have vast experience and specialised knowledge that can benefit your company. These specialists are knowledgeable about the particular financial environments and legal specifications of the real estate sector. With their extensive experience, you can be guaranteed that your accounting procedures are not only in compliance but also optimised for maximum ROI and tax benefits. In order to navigate intricate transactions and strategic financial planning, this level of competence can be extremely important.

-

Cost Efficiency:

Outsourced real estate accounting services can result in significant cost savings by eliminating the requirement for in-house accounting staff. This strategy reduces direct labour costs, including pay, benefits, and training. It also lowers overhead expenses like office space and IT infrastructure that come with keeping an accounting department running.

-

Focus on Core Business Activities:

With outsourced real estate accounting services, business owners and managers can focus on important tasks like property management, customer service, and business development. Real estate agents can also delegate financial responsibilities to outside experts, allowing them to focus more of their time and resources on improving their core operations, which will ultimately lead to growth and increased client satisfaction.

-

Access to Advanced Technology:

Real estate accounting services give you access to cutting-edge technology without requiring you to make a big investment in pricey systems and software. These service providers make use of state-of-the-art accounting technologies that give improved security features, simplified data management, and thorough analytics. With this access, real estate companies may take advantage of the most recent developments in technology, which enhances financial reporting accuracy and enables better-informed decision-making.

-

Risk Reduction:

Outsourced real estate accounting services significantly lower the risk of financial discrepancies and non-compliance with regulations. By employing experts who stay current with the latest accounting standards and tax laws, these services ensure that all financial practices are up to standard. This proactive approach not only safeguards the business from potential penalties and legal issues but also instils confidence in the accuracy of financial reporting.

-

Improved Financial Reporting and Analysis:

Outsourced real estate accounting services enhance the quality and accuracy of financial reporting and analysis. By leveraging the expertise of seasoned professionals, these services provide detailed, compliant financial statements and insightful analyses that help real estate businesses make informed decisions. This improved financial clarity and precision enable property managers and investors to track performance effectively and strategise for future growth.

-

Better Time Management:

Business owners and managers may devote more of their important time to strategic growth and client engagement when they outsource accounting for real estate business. Real estate agents can streamline their daily schedules and increase overall production by assigning time-consuming accounting duties to experts. Improved time management results in more effective resource utilisation and enables companies to give priority to tasks that directly affect their bottom line.

How To Get the Right Real Estate Accounting Service Provider for Your Business?

-

Check Your Requirements:

Clearly state the accounting services that you need. This could involve managing compliance, bookkeeping, financial reporting, tax preparation, or a mix of these. Being aware of your unique needs will make finding a service provider that meets your demands easier.

-

Research Providers:

Seek out accounting firms with a strong track record in accounting for the real estate sector, or that specialise in the field. It will be beneficial if they have experience managing the unique difficulties and transactions that real estate enterprises face.

-

Check Qualifications and Certifications:

Make sure the accounting service provider employs certified experts, such as CPAs (Certified Public Accountants), who are able to lawfully and professionally handle financial records and tax concerns.

-

Consider Technology and Tools:

Examine the service provider’s tools and technology. Make sure the accounting software they use is secure, up-to-date, and compatible with your current systems.

-

Evaluate Communication and Support:

Effective communication is essential. Select a service provider who is eager to communicate on a frequent basis and is responsive. When you need advice or have problems, they ought to be amiable and willing to help.

-

Ask for Reference:

Contact other real estate companies that have worked with them and get recommendations. Client testimonials, whether recent or old, can offer insightful information about a service provider’s dependability, calibre of work, and capacity for keeping commitments.

-

Discuss Pricing:

Familiarise yourself with the company’s charge structure to ensure it fits into your budget. Services priced much less than the going cost should be avoided, as the quality of the service may suffer as a result.

Are You Ready to Entrust Your Real Estate Accounting Concern in Experts’ Hand?

Real estate accounting is an essential part of handling property-related finances, assuring precision, compliance, and financial strategy. Understanding the complexity of real estate transactions, from property acquisitions to rental management and tax compliance, necessitates specialised expertise, which can be intimidating for many. Businesses that consider hiring outsourced real estate accounting services get access to expert knowledge, innovative technology, and optimised financial procedures. Outsourcing to competent specialists is clearly a wise step for any real estate business, as it has the potential to improve financial transparency, reduce risks, and free up valuable time to focus on its primary operations.

As you reflect on your business’s future and financial management requirements, consider the numerous advantages of outsourcing your real estate accounting worries to professionals. By doing so, you will be able to confidently and precisely navigate the market’s complexity. So, if you are ready to take this step and search for an expert accounting services provider, then contact us. We at Whiz Consulting offer high-quality accounting and bookkeeping services tailored to meet the special needs of the real estate industry, promising that your business’s financial affairs are handled expertly.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.