-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Financial Accounting Services You Can Count On

Behind every successful business decision is accurate financial data. Our financial accounting services ensure your records are organized, compliant, and always up to date, giving you the clarity needed to plan confidently. From detailed reporting to seamless cash flow management, we provide insights that empower smarter choices. Gain the confidence to grow with a partner you can rely on!

Outsourced Financial Accounting Services We Offer

- Budget Monitoring

- Audit Readiness

- Debtor & Creditor Analysis

- Balance Sheet

- Income Statement

- Cash Flow Statement

- General Ledger

- Trial Balance

- Statement of Changes in Equity

Challenges We Tackle for You

Financial accounting doesn’t have to be complicated. Our services simplify every step, from managing cash flow to preparing accurate budgets, giving you clear insights to make confident decisions effortlessly.

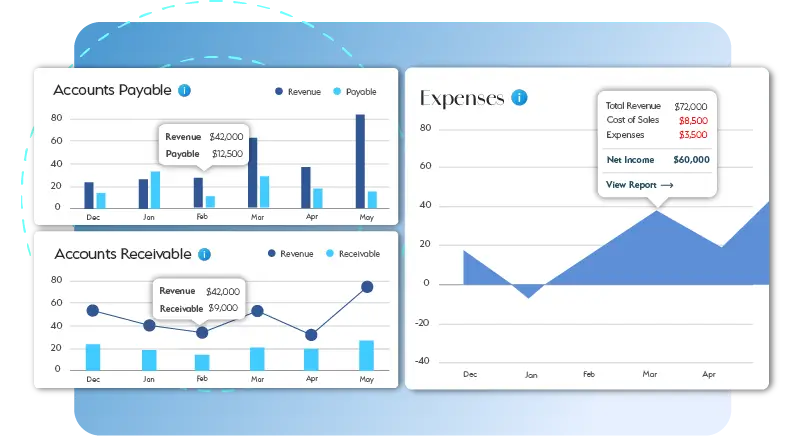

Delays in Financial Reporting

Delays in financial reporting can hinder critical business decisions. We specialize in delivering timely and accurate reports, including profit and loss statements, balance sheets, and cash flow statements.

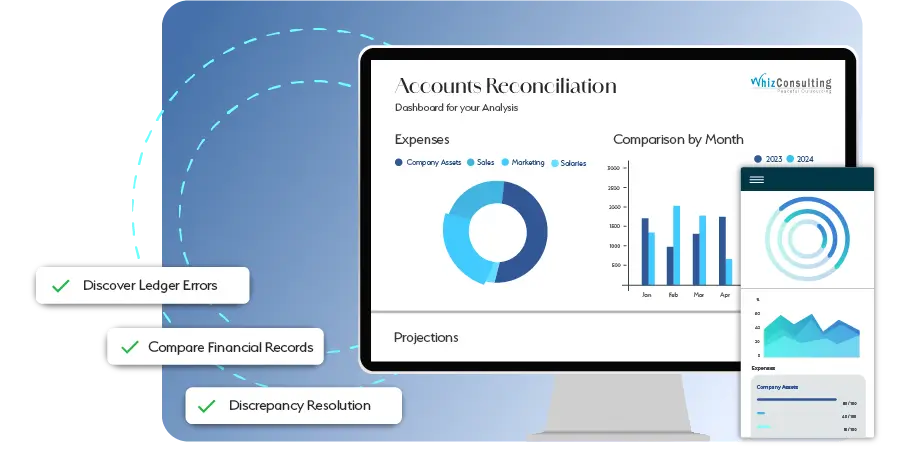

Audit Preparedness

Audits can be stressful, especially when records are incomplete or disorganized. We ensure your financial records are audit-ready by maintaining compliance and accuracy at all times.

Delayed or Inaccurate Reporting

Outdated or incorrect reports can hinder timely decisions. We deliver real-time, accurate KPI tracking to keep your business agile and informed.

Shaping the Future Together

Financial accounting is more than just numbers-it’s the backbone of informed decision-making and sustainable growth. Our services focus on delivering clarity, accuracy, and actionable insights to empower your business. With a commitment to excellence, we ensure your financial operations are seamless, enabling you to stay ahead in a competitive landscape.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Financial accounting involves recording, summarizing, and reporting a company’s financial transactions to create financial statements such as income statements, balance sheets, and cash flow statements. These reports are used to evaluate the financial health of a business.

Financial accounting focuses on preparing reports for external stakeholders, such as investors and regulatory authorities. Management accounting, on the other hand, provides internal insights to help business managers plan and make operational decisions.

Financial reports are typically generated monthly, quarterly, and annually, depending on the business’s needs and regulatory requirements. Regular reporting ensures transparency and aids in timely decision-making.

Outsourced financial accounting services provides businesses with access to skilled professionals who ensure compliance, accuracy, and timely reporting. It streamlines financial operations, reduces costs associated with in-house teams, and allows companies to focus on their core activities. With expert handling of financial tasks, businesses gain clarity, scalability, and confidence in their decision-making processes.

Yes, outsourcing financial accounting is safe when you partner with a reputable and trusted service provider. These providers implement robust data security measures, including encryption, secure servers, and strict confidentiality agreements, to protect sensitive financial information.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

What Are Outsourced Financial Accounting Services?

In today’s fast-paced business world, managing financial operations can be challenging and time-consuming. For businesses seeking efficiency and accuracy, financial accounting outsourcing is an effective solution. By delegating financial tasks to experts, companies can focus on growth and innovation while ensuring their financial records are accurate and compliant.

The Benefits of Financial Accounting Outsourcing

Outsourced financial accounting services involve hiring external professionals to handle tasks like bookkeeping, financial reporting, and tax preparation. These services include everything from maintaining daily transaction records to preparing detailed financial statements. With the help of skilled experts, businesses can ensure that their financial processes run smoothly and efficiently.

Get a CallOutsourcing provides access to professionals who specialize in financial accounting advisory services. These experts bring years of experience and a deep understanding of accounting regulations, ensuring accurate and compliant financial records.

Maintaining an in-house accounting team can be expensive. Outsourced accounting and financial services eliminate the need for recruitment, training, and salaries, providing cost-effective solutions for businesses of all sizes.

With outsourced financial accounting, businesses receive accurate and timely financial reports, including income statements, balance sheets, and cash flow analyses. These reports are crucial for making informed decisions and staying compliant with regulations.

By outsourcing financial tasks, businesses can dedicate more time to core operations and strategic growth initiatives. This helps improve productivity and drives long-term success.

Expert financial accounting advisory services go beyond basic bookkeeping. They provide strategic insights and customized solutions to help businesses optimize cash flow, manage expenses, and plan for the future. With advisory support, companies can make data-driven decisions that align with their goals.