-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Master Financial Operations with Virtual CFO Services

We turn your financial management into a foundation of clarity and control. Our Virtual CFO services focus on optimising budgets, streamlining cost management, and ensuring resource efficiency. By simplifying intricate financial processes, we enable you to concentrate on driving your business forward and achieving strategic goals. Let us handle the complexities of financial oversight so you can lead with confidence and achieve remarkable outcomes.

Outsourced Virtual CFO Services We Offer

- Accounting & Bookkeeping

- Financial Analysis

- Tax Planning

- Business Valuation

- Funding Evaluation

- Business Acquisition & Mergers

Challenges We Tackle for You

At Whiz Consulting, we understand the importance of precise financial oversight and strategic guidance in overcoming common business challenges. Our Virtual CFO services are tailored to address these key areas:

Limited Strategic Financial Guidance

Relying only on past data can restrict your business’s potential to thrive in a competitive market. Our Virtual CFOs provide advanced forecasting, financial modeling, and strategic analysis to help you anticipate opportunities and plan for sustainable growth.

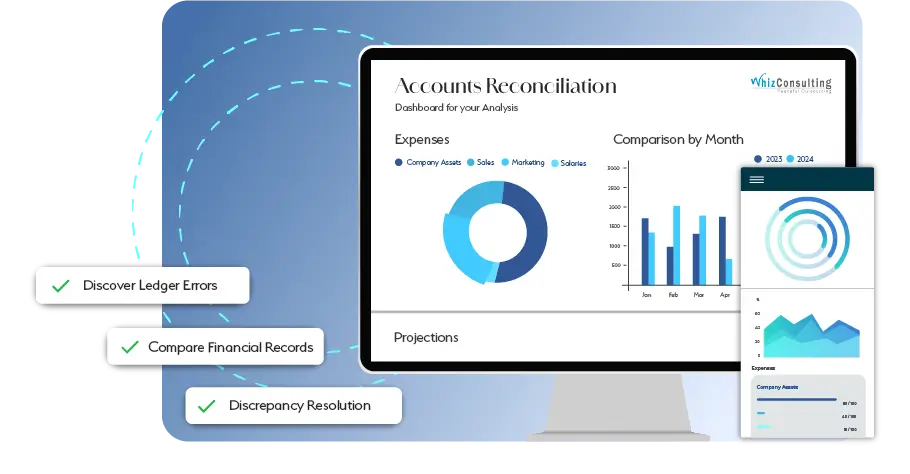

Inconsistent or Inefficient Financial Reporting

Delayed or inaccurate financial reports can disrupt decision-making and lead to compliance risks. Our experts establish streamlined financial reporting processes, ensuring timely, accurate, and compliant reports that empower you to act with confidence.

Hurdles in Cash Flow Management and Budgeting

Struggling with cash flow unpredictability or unstructured budgeting can jeopardise financial stability. Our Virtual CFOs deliver comprehensive cash flow management strategies and detailed budgeting solutions, helping you maintain financial balance and achieve your business objectives.

Empowering Strategic Growth with Virtual CFO Expertise

Facing financial uncertainty? Our Virtual CFO services provide clarity and expert guidance to drive confident decision-making. We turn complex financial data into actionable insights through detailed analysis, forecasting, and planning. Acting as your trusted financial partner, we ensure accurate management, mitigate risks, and enhance profitability, helping your business achieve sustainable growth and unlock its full potential.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch Now

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

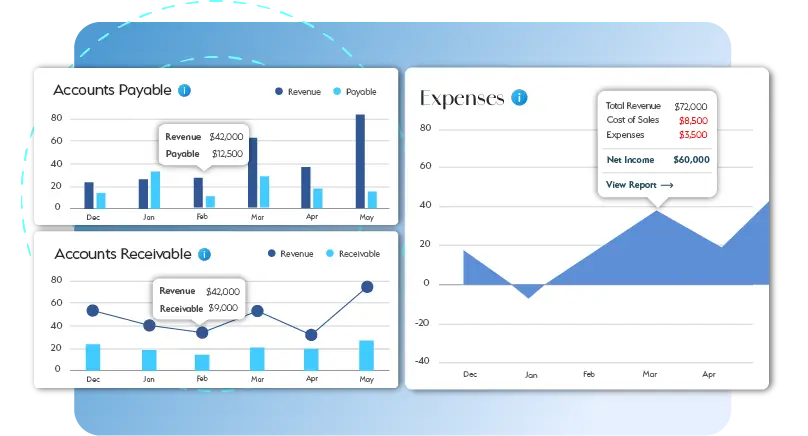

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Virtual CFOs offer a wide range of services, including financial planning, budgeting, and forecasting, cash flow management, and comprehensive financial reporting. They also assist with risk assessment, provide strategic financial advice, and offer support in areas like fundraising and managing relationships with investors.

The cost of hiring a virtual CFO varies depending on the services required, the size of the business, and the complexity of financial operations. Typically, virtual CFOs charge a fixed monthly fee or an hourly rate, making them a more cost-effective option compared to hiring a full-time CFO.

A virtual CFO acts as an outsourced financial expert, guiding businesses toward their financial goals. They provide insights, develop strategies, manage financial operations, and ensure sound financial decision-making, all while working remotely as an external partner.

An accountant primarily focuses on maintaining accurate financial records, ensuring compliance, and preparing reports based on past data. In contrast, a virtual CFO emphasizes forward-looking financial strategies, planning, and analysis aimed at driving business growth and achieving long-term objectives.

Selecting the right virtual CFO involves assessing their industry expertise, communication skills, and track record of success. Ensure they have a deep understanding of your business needs and goals, and do not forget to verify their credentials and references to confirm their suitability for your company.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Transform Your Financial Strategy with Virtual CFO Services

In today’s fast-paced business world, staying on top of your finances is essential for growth and success. However, not every company has the resources to hire a full-time Chief Financial Officer (CFO). That is where virtual CFO services come in, offering the expertise of a seasoned financial professional without the cost of a full-time executive.

Get a CallVirtual CFO services provide businesses with strategic financial leadership on a flexible basis. By partnering with a virtual CFO company, businesses can access expert guidance in financial planning, budgeting, forecasting, and risk management. These services are tailored to meet the unique needs of businesses, ensuring sound financial health and long-term growth.

When you hire a virtual CFO, you gain access to top-tier financial expertise at a fraction of the cost of a full-time CFO. Virtual CFO solutions offer support in areas such as cash flow management, financial reporting, fundraising, and compliance, enabling business owners to focus on core operations while their finances are professionally managed.

- Cost-Effective Expertise: Hiring a virtual CFO is significantly more affordable than employing a full-time CFO while providing the same level of expertise.

- Strategic Planning:Virtual CFOs help businesses develop long-term strategies, ensuring they remain financially resilient and competitive.

- Scalability:The flexibility of virtual CFO services means businesses can scale their financial support as they grow.

- Customised Solutions: The best virtual CFO services are tailored to address specific business challenges, ensuring every financial decision aligns with company goals.

- Data-Driven Insights:Virtual CFOs use advanced tools and analytics to provide actionable insights, helping businesses make informed decisions.

Partnering with the right virtual CFO company is critical. Look for providers with proven experience, strong industry knowledge, and the ability to deliver personalised financial strategies.

Whether you are a startup seeking growth or an established business aiming for sustainability, virtual CFO solutions can provide the financial leadership you need. By leveraging the expertise of the best virtual CFO services, you can streamline operations, enhance profitability, and achieve your business goals. Take the step to hire a virtual CFO today and unlock your company’s full potential.