Table of Content

Share This Article

- Reading Time: 8 Minutes

- Published: October 9, 2023

- Last Updated: February 7, 2025

In today’s complex and ever-changing financial landscape, achieving and maintaining good financial health is a goal shared by individuals and businesses alike. But how do we measure our financial well-being? How can we gain insights into our financial performance and make informed decisions to achieve growth and stability? Enter financial ratios – the essential tools that provide a comprehensive understanding of your financial health. Whether you are a seasoned investor, a business owner, or simply someone looking to take control of your finances, understanding and ensuring efficient financial ratio analysis is the key to unlocking a world of valuable information. In this blog, we will demystify these powerful metrics, empowering you with the knowledge and tools to assess your financial standing, identify areas for improvement, and ultimately pave the way to a healthier and more prosperous financial future. So, let us embark on this enlightening journey and discover how financial ratios can transform the way you approach your business finances.

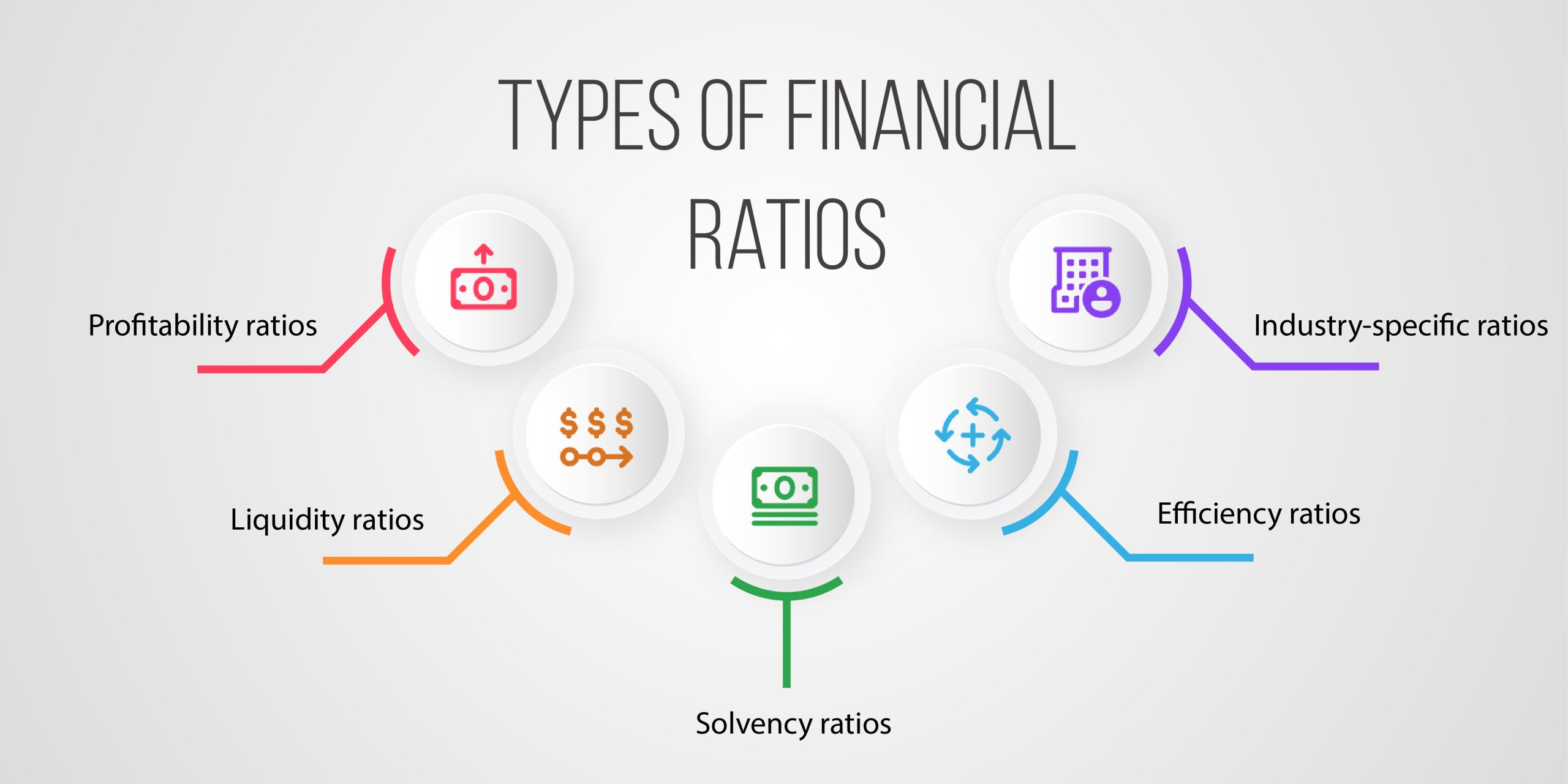

Types Of Financial Ratios

Here are the most important financial ratios for every type of business. Let us unveil their importance in detail:

-

Profitability Ratios

Profitability ratios assess a business’s ability to generate profits relative to its expenses and other costs. Common profitability ratios include:

Gross Profit Margin

This ratio shows the percentage of sales revenue after deducting the cost of goods sold (COGS). It reflects the profitability of the business’s core operations.

Net Profit Margin

This ratio shows the percentage of sales revenue that remains as net profit after deducting all expenses, including operating costs, interest, and taxes. It measures the overall profitability of the business.

Return on Assets (ROA)

ROA is a financial metric that measures a business’s efficiency in generating profits from its assets. It shows the efficiency of utilising assets to generate earnings.

Return on Equity (ROE)

ROE measures the return generated on a shareholder’s equity investment. It indicates how effectively a business is generating profits from the capital invested by its shareholders.

-

Liquidity Ratios

Liquidity ratios assess a business’s ability to meet short-term obligations and its overall cash position. Common liquidity ratios include:

Current Ratio

This ratio compares a business’s current assets to its current liabilities. It measures the business’s ability to cover short-term obligations.

Quick Ratio or Acid-Test Ratio

This ratio is similar to the current ratio but excludes inventory from current assets. It provides a more conservative measure of liquidity, as inventory may not be easily converted to cash in the short term.

Cash Ratio

The cash ratio is a financial metric that assesses a business’s ability to cover its short-term liabilities using only its cash and cash equivalents. It provides insight into a business’s liquidity and its capacity to meet immediate financial obligations without relying on other assets.

-

Solvency Ratios

Solvency ratios assess a business’s long-term financial stability and its ability to meet long-term obligations. Common solvency ratios include:

Debt-to-Equity Ratio

This ratio compares a business’s total debt to its shareholders’ equity. It indicates the proportion of financing provided by debt versus equity.

Interest Coverage Ratio

This ratio measures a business’s ability to cover its interest payments with its operating income. It helps assess whether a business has sufficient earnings to meet its interest obligations.

Debt-to-Assets Ratio

This ratio calculates the proportion of a business’s assets financed by debt. It indicates the level of financial risk associated with a business’s capital structure.

-

Efficiency Ratios

Efficiency ratios assess a business’s operational efficiency in utilising its assets, managing inventory, and collecting receivables. Common efficiency ratios include:

Inventory Turnover Ratio

This ratio measures how quickly a business sells its inventory. It reflects the efficiency of managing and selling inventory, with a higher ratio indicating more efficient inventory management.

Accounts Receivable Turnover Ratio

This ratio assesses how efficiently a business collects its receivables from customers. It indicates the efficiency of the business’s credit and collection policies.

Asset Turnover Ratio

This ratio measures a business’s efficiency in utilising its assets to generate sales revenue. It measures how effectively a business utilises its assets to generate sales.

-

Industry-Specific Ratios

Industry-specific ratios are ratios that are tailored to specific industries or sectors. These ratios help assess a business’s performance relative to its industry peers and consider industry-specific factors. Common industry-specific ratios include:

Revenue per Available Room (RevPAR)

This ratio is commonly used in the hotel industry to measure the average revenue generated per available room.

Customer Acquisition Cost (CAC) to Lifetime Value (LTV) Ratio

This ratio is often used in the software-as-a-service (SaaS) industry to assess the cost of acquiring customers relative to the expected lifetime value of those customers.

Price-to-Earnings (P/E) Ratio

This ratio is commonly used in the stock market to compare a company’s market price per share to its earnings per share. The interpretation of the P/E ratio can vary across industries.

Key Challenges in Interpreting and Analysing Financial Ratios

The practice of financial ratio analysis enables businesses to gain a thorough grasp of their financial standing and take proactive steps to ensure growth and prosperity. Nonetheless, it remains crucial to ensure the proficient interpretation and analysis of the financial ratios to sidestep potential challenges in the process. Here are a few challenges that businesses may face during this process:

-

Industry Comparisons

Comparing financial ratios across industries can be challenging because different industries have varying business models, cost structures, and operating dynamics. Ratios that are considered favourable in one industry may not be appropriate for another. Therefore, it is essential to understand the industry norms and benchmarks when performing the interpretation of financial ratios.

-

Lack of Historical Data

Financial ratios are more meaningful when analysed over time. However, businesses may face challenges if they lack sufficient historical data to establish trends and make meaningful comparisons. Limited historical data can limit the ability to identify patterns and accurately assess the business’s performance.

-

Limited Context

Ratios provide numerical values but may lack the necessary context to fully understand their implications. Businesses need to consider the underlying factors and circumstances that influence the ratios. For instance, a decline in profitability ratios may be a cause for concern, but it could result from temporary factors such as one-time expenses or industry-wide downturns.

-

Complex Business Structures

Financial ratios may become less informative and challenging to interpret in the presence of complex business structures, such as conglomerates with multiple subsidiaries or businesses with diverse product lines. Aggregating financial data across different business segments can distort the ratios and make their interpretation more complex. In such scenarios, seeking assistance from professionals like outsourced accounting and bookkeeping services providers is advisable. With their team of accounting experts, these providers help ensure a robust financial system by effectively interpreting and analysing financial ratios. Their expertise ensures accurate insights and allows businesses to make informed decisions based on reliable financial information.

-

Accounting Methods and Manipulation

Differences in accounting methods and practices can impact the calculation of financial ratios. Ensuring that the financial data used for ratio analysis is consistent and comparable is important. Additionally, businesses need to be cautious of potential financial manipulation or creative accounting practices that can distort the ratios and mislead the analysis.

Strategies for Addressing Challenges in Interpreting Financial Ratios

-

Industry-Specific Knowledge

Develop a deep understanding of the industry in which your business operates. Stay updated on industry trends, benchmarks, and key performance indicators. This knowledge will help in setting appropriate benchmarks and contextualising the financial ratios.

-

Historical Data Analysis

Gather and analyse historical financial data to identify trends and patterns. The availability of longer-term data will provide a more comprehensive view of your business’s financial performance and help make meaningful comparisons over time.

-

Consistent Accounting Practices

Ensure consistency in accounting practices and reporting standards across your business. This will enhance the comparability of financial data and ratios over time. Be cautious of any potential accounting manipulation or irregularities that could distort the ratios.

-

Benchmarking

Benchmark the financial ratios against industry peers or competitors. This will provide insights into how your business is performing relative to others in the same industry.

-

Professional Expertise

Seek assistance from financial experts, like outsourced accounting and bookkeeping services providers, who bring years of experience and expertise in financial analysis to the table. They can offer valuable insights, ensure accurate ratio interpretation, and assist in navigating any obstacles encountered during the analysis.

Closing remarks

In conclusion, financial ratios serve as essential tools for evaluating and improving a business’s financial health. Businesses can gain valuable insights into their profitability, liquidity, solvency, efficiency, and industry position by analysing these ratios. However, navigating the challenges of interpreting and analysing the financial ratios requires industry-specific knowledge, historical data analysis, contextual understanding, integration of non-financial information, and consistent accounting practices.

Moreover, businesses can streamline financial ratio analysis by outsourcing financial management tasks to experienced providers, reaping benefits such as specialised expertise, cost-efficiency, and enhanced effectiveness. An experienced outsourcing partner can contribute extensive knowledge, ensuring precise ratio interpretation and analysis.

When contemplating the selection of a service provider, it is vital to assess their qualifications, track record, and industry expertise. It is prudent to seek out firms with a well-established track record in this domain, specialised market insights, and a deep understanding of any unique requirements your business may entail. Whiz Consulting can be counted on for all these attributes; our specialised team of accounting experts will guarantee an effective ratio analysis and help optimise your entire financial system. Get in touch with us today to elevate your financial performance and reach improved financial well-being.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.