Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: June 30, 2023

- Last Updated: March 5, 2025

Accounts payable, the backbone of any business, is often seen as an enigma. It can be confusing and overwhelming for many people who are new to accounting or finance. However, understanding accounts payable is crucial because it affects a company’s financial stability and reputation. Properly managing the process is also essential, be it with the help of expert in-house accountants or by choosing a good accounts payable outsourcing firm. But before planning on how to manage the process, let us first understand what accounts payable is, how it works, and everything else that can make managing it easier for you. From understanding payment terms to managing invoices, we will guide you through everything step-by-step so that you can gain valuable insights into the process. So, let us dive right in!

What is Accounts Payable?

Accounts payable refers to the money a company owes to its vendors for goods or services received on credit. Accounts payables are considered a current liability, which means they are typically due within one year.

Companies use accounts payable to manage their short-term debts and ensure they have the funds available to pay their vendors on time. Companies often use accounting software like QuickBooks or Xero to keep track of their accounts payable.

When it comes time to pay the vendor, the company will either write a cheque or make an electronic payment. Most companies choose to set up automatic payments for their recurring debts, such as rent or utilities, vendor payments, etc., to ensure they are never late on a payment.

How Do Accounts Payable Work?

The accounts payable process refers to the set of activities that a company undertakes to manage its outstanding bills and invoices. This process involves several steps, including receiving invoices from vendors, verifying the accuracy of the invoices, recording the invoices in the company’s accounting system, and paying the invoices on time.

- The first step involved in the accounts payable process is receiving invoices from vendors. Vendors may send invoices by mail, email, or through an online portal. Once the invoices are received, they are reviewed to ensure they are accurate and match the received goods or services.

- The next step in the process is to record the invoices in the company’s accounting system. It involves entering the invoice details into the accounting software, such as the vendor’s name, invoice number, and amount. The invoices are then categorised based on the type of expense, such as office supplies or rent.

- Once the invoices are recorded, they are routed to the accounts payable department for approval.

- After the invoices are approved, the company will typically have a set period of time to pay the bills. It is known as the payment term and is usually specified on the invoice. The company will need to ensure that it pays the invoices on time to avoid late fees or damage to its credit rating.

- In some cases, the company may need to dispute an invoice if there are errors or discrepancies. This may involve contacting the vendor to resolve the issue or requesting additional documentation to support the invoice.

Overall, the accounts payable process is an important part of a company’s financial management. By effectively managing its outstanding bills and invoices, a company can maintain good relationships with its vendors, avoid late fees and penalties, and ensure that its financial records are accurate and up-to-date.

Completing all these tasks in-house takes too much time and effort, increasing the accounting department’s workload. So, delegating the accounts payable process to third-party experts is a good idea. You can hire a virtual accountant with relevant experience and specialising in efficiently handling the process.

Why is Efficient Accounts Payable Management Important?

Efficient accounts payable management is integral to the success of any business. It involves a series of processes that ensure timely payment of invoices, accurate tracking of expenses, and effective communication between vendors and internal teams.

- Better cash flow: One key benefit of efficient accounts payable management is improved cash flow. By tracking invoices and paying them on time, businesses can avoid costly penalties and maintain good relationships with suppliers. It helps to secure discounts for early payments and build trust with vendors. All of this combined leads to better cash flow management.

- Cost-savings: Effective accounts payable management also helps companies identify opportunities for cost savings. Through analysis of spending patterns and vendor negotiations, businesses can reduce costs associated with procurement while maintaining high-quality goods or services.

- Enhanced transparency in financial reporting: In addition, streamlined accounts payable processes increase transparency in financial reporting, enabling companies to make informed decisions based on real-time data. It leads to better budgeting, forecasting, and risk management strategies that support long-term growth.

Ultimately, investing in efficient accounts payable management allows businesses to remain competitive in today’s dynamic marketplace by improving cash flow visibility while reducing costs over time.

Best Practices for Managing Accounts Payable

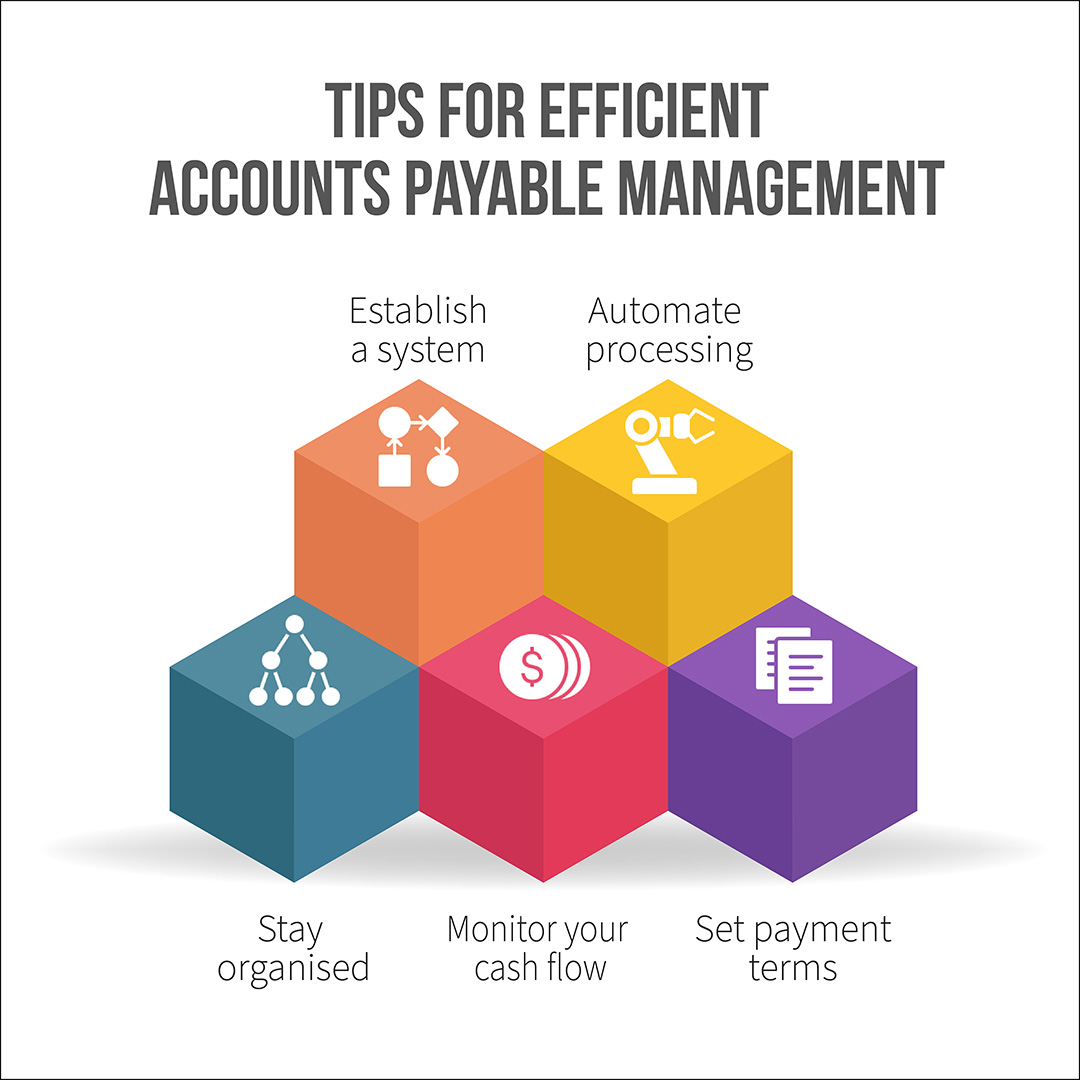

Whether your accounts payable process is being managed in-house or with the help of a virtual accountant offering outsourcing services, efficiently managing the accounts payable process is critical for any business to maintain strong financial health. Here are some tips to help you manage your accounts payable process efficiently:

- Establish a system: Establishing a process for accounts payable can help you stay on top of payments and prevent late fees. Ensure you have a clear process for receiving, approving, and paying invoices.

- Automate processing: Automating the accounts payable process can help reduce errors and save time. Use accounting software that can automate invoice processing, payment processing, and vendor communication.

- Monitor cash flow: Regularly monitor your cash flow to ensure you have adequate funds to pay your bills. It can help you avoid late payments or missed payments.

- Set payment terms: Set clear payment terms with your vendors. It can help you avoid late fees and build strong relationships with your vendors.

- Stay organised: Keep all accounts payable documentation organised and easily accessible. It can help you quickly resolve any disputes or questions.

How Can Outsourcing Help with Efficient Accounts Payable Management?

Outsourcing is the process of trusting a third-party service provider to help manage your processes. Accounts payable outsourcing can help with efficient accounts payable management in several ways.

Firstly, it enables organisations to streamline their processes by delegating time-consuming tasks to specialised service providers. As a result, it allows businesses to focus on their core competencies and devote more time to activities that generate revenue.

Moreover, outsourcing can help in reducing operational costs as service providers are often located in countries with lower labour costs. It makes it more affordable for businesses to access skilled personnel without incurring high overheads.

Accounts payable services providers also have the expertise and technology to manage accounts payable functions efficiently. They can automate routine tasks such as data entry, invoice processing, and payment schedules using advanced software and tools. It eliminates errors and speeds up the entire process, resulting in faster payments and improved cash flow.

Overall, accounts payable outsourcing services can provide businesses with significant benefits, including cost savings, increased efficiency, and improved accuracy. It can help organisations stay competitive in today’s rapidly changing business environment and enable them to focus on their core objectives.

How to Find the Best Accounts Payable Services for Your Business?

In today’s competitive market, more and more businesses have started delegating their accounts payable functions to outsourced service providers. However, with numerous accounts payable outsourcing companies in the market, choosing the right one for your business is difficult. Finding the best accounts payable services for your business requires careful consideration of several factors. Following are some of the important factors you must consider finding the best service provider for your accounts payable process:

- Firstly, you need to determine your specific business needs and look for a service provider that can effectively meet those needs. Additionally, it is important to consider the level of expertise and experience of the service provider in managing accounts payable processes. You can check the provider’s reputation by reading online reviews and asking for references from other businesses they have worked with.

- Another important factor to consider is the cost of the services. While you want to find a provider that offers competitive rates, it is also essential to ensure that the quality of service is not compromised. You can compare quotes from different providers and negotiate to get the best deal.

- Lastly, you must ensure that the accounts payable service provider uses up-to-date technology and software to manage your accounts. It will help streamline processes and reduce errors, increasing efficiency and cost savings in the long run.

Conclusion

Accounts payable is one of the most important accounting processes as it directly affects the business cash flow. With an effective accounts payable system in place coupled with strong internal controls, businesses can ensure that funds are managed responsibly and efficiently, allowing them to focus more on growing their business instead of worrying about potential cash flow problems.

However, accounts payable management is a complex task; thus, it is best to hire help from experts instead of struggling with it on your own. Using accounts payable outsourcing helps streamline the entire process and makes it more efficient and easier to manage. Whiz Consulting is one such outsourcing service provider that helps different businesses with numerous accounting activities like accounts payable, payroll, accounts receivable, and reconciliation. So, contact us today and get your accounting in order.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.