-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Your Path to Streamlined Financial Accounting Services

Every successful business starts with accurate financial data. Our financial accounting services do more than just balance the books—they transform your numbers into actionable insights. From crystal-clear cash flow tracking to detailed, organised reports, we ensure your finances are always in check. Make strong decisions with confidence, backed by precision and compliance. Partner with us to unlock smarter growth and turn financial management into your competitive edge!

End-to-End Outsourced Financial Accounting Services

- Budget Monitoring

- Audit Readiness

- Debtor & Creditor Analysis

- Balance Sheet

- Income Statement

- Cash Flow Statement

- General Ledger

- Trial Balance

- Statement of Changes in Equity

Challenges We Help You Overcome

Streamline your financial processes with our professional financial accounting services. From efficient cash flow tracking to accurate budget planning, we provide valuable insights that enable you to make informed decisions effortlessly and with confidence.

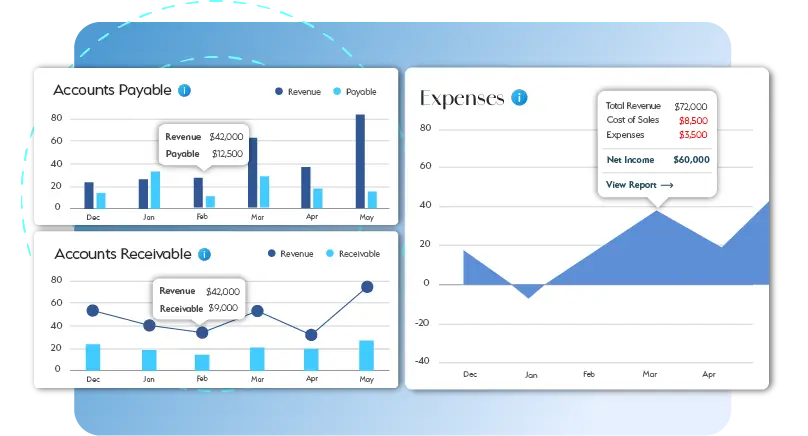

Accurate and Timely Financial Reports

Delays in financial reporting can hinder crucial business decisions. Our team delivers precise and prompt financial reports, including balance sheets and cash flow statements, ensuring you have the data you need to strategise effectively and stay on track.

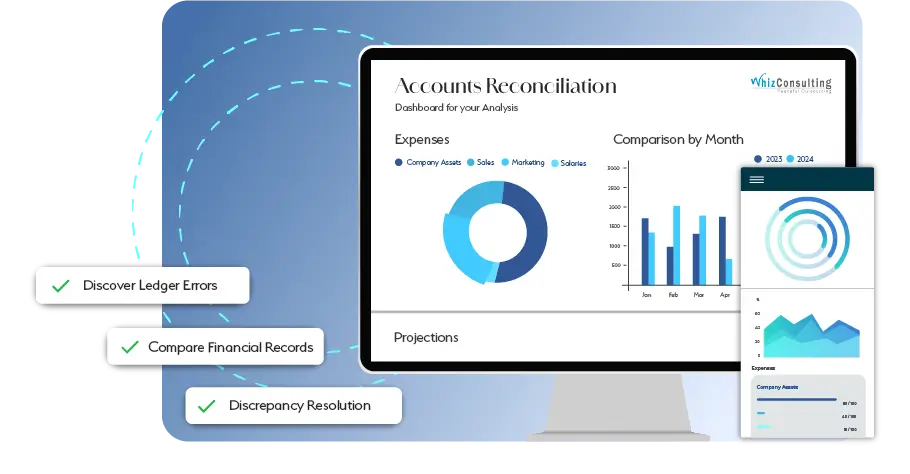

Resolving Financial Discrepancies with Ease

Inconsistent financial records can create confusion and disrupt operations. Our experts meticulously reconcile your accounts, aligning every detail to eliminate discrepancies and maintain the trust of your stakeholders.

Hassle-Free Audit Preparation

Audits do not have to be stressful. We keep your financial records well-organised, compliant, and accurate, ensuring you are always ready for a seamless and worry-free audit experience.

Turning Ambitions into Achievements

Strong financial management is the backbone of business success. Our services go beyond balancing the books—we provide clarity, accuracy, and actionable insights to drive growth and innovation. With streamlined processes and a focus on precision, we help you make bold decisions, outpace competitors, and achieve long-term success.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch Now

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Financial accounting is the process of recording, summarising, and reporting a business’s financial transactions. It helps stakeholders understand the financial performance and position of the organisation through financial statements such as income statements, balance sheets, and cash flow statements.

Outsourced financial accounting services involve hiring external professionals to manage your business’s accounting tasks, such as bookkeeping, tax preparation, financial reporting, and payroll management. This allows businesses to focus on core activities while ensuring their finances are handled accurately and efficiently.

Financial accounting focuses on preparing reports for external stakeholders, such as investors, creditors, and regulators. Managerial accounting, on the other hand, is designed for internal use to help management make strategic decisions.

Popular software includes accounting software such as QuickBooks, Zoho Books, FreshBooks, and Microsoft Dynamics 365 Business Central, which help streamline financial processes and ensure accuracy.

Absolutely. Small businesses can benefit greatly from financial accounting services by maintaining organised records, improving cash flow management, and ensuring compliance without the need for a full-time in-house accountant.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

The Benefits of Outsourced Financial Accounting Services

Effective financial management is essential for any business aiming for growth and stability. However, managing financial accounting internally can be resource-intensive and time-consuming. This is where financial accounting outsourcing becomes a game-changer, providing businesses with expert support and streamlined processes while allowing them to focus on core activities.

Get a CallFinancial accounting services involve recording, summarising, and reporting financial transactions to provide a clear picture of a business’s financial health. These services include bookkeeping, financial statement preparation, compliance management, and reporting. By outsourcing these tasks, businesses can ensure accuracy and efficiency while reducing overhead costs.

Outsourcing financial accounting allows businesses to access professional expertise without the expense of maintaining an in-house team. Providers of financial accounting advisory services bring industry knowledge and advanced tools to the table, ensuring compliance with regulations and optimising financial processes.

- Cost Efficiency: Save on salaries, training, and infrastructure while gaining access to skilled professionals.

- Expertise: Tap into a team of experts who specialise in accounting and financial services and stay updated on the latest regulations.

- Time Savings: Focus on strategic growth while outsourcing routine financial tasks.

- Scalability: Adjust services as your business grows, ensuring your financial systems can handle increasing demands.

Outsourcing providers ensure that your financial records are accurate, organised, and compliant. Through advanced financial accounting advisory services, they can offer insights into budgeting, forecasting, and financial strategy. This enables businesses to make informed decisions and maintain a competitive edge.

By leveraging financial accounting outsourcing, businesses also gain access to modern accounting software and technology, streamlining processes and enhancing efficiency.

Outsourced financial accounting services is a smart move for businesses looking to optimise financial processes, reduce costs, and gain valuable insights. Whether you’re a small startup or a growing enterprise, outsourcing ensures that your accounting and financial services are handled by professionals, giving you the confidence to focus on expanding your business.

Partnering with a trusted outsourcing provider can transform your financial management, paving the way for long-term success.