-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

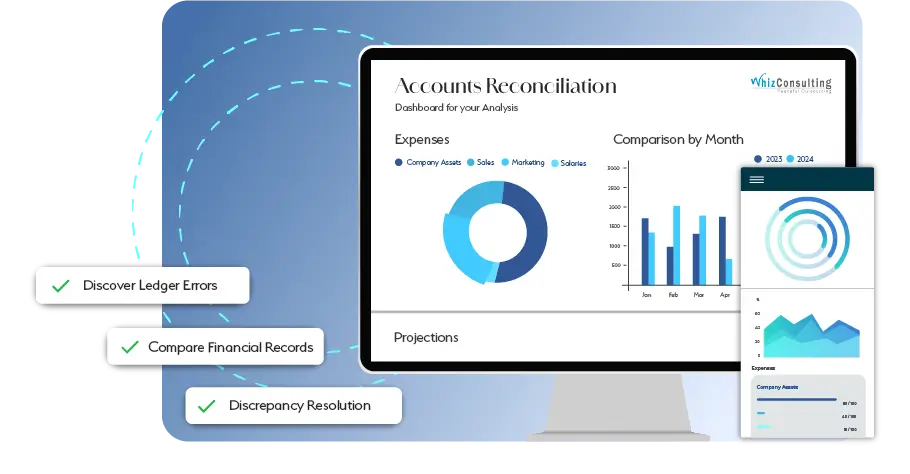

Your Trustable Partner for Best Accounts Reconciliation Services

It is crucial to keep your financial records up-to-date and organized to achieve financial organization and confidently make decisions in a better, informed way. At Whiz Consulting, we not only help you get financially better but also keep your accounts in sync to identify any discrepancies as soon as possible. With our expert account reconciliation services, you can get a clear picture of your finances whenever you want.

Accounts Reconciliation Outsourcing Services We Offer

- Partial or full account reconciliation

- Bank statement and record alignment

- Credit card and bank statement matching

- Invoice-to-ledger verification

- Check sequencing and tracking

Challenges We Address for You

Taking Care of Large Volumes of Transactions

It can seem a bit daunting to reconcile numerous transactions across multiple accounts. However, it doesn’t need to be. At Whiz Consulting, we simplify the process and make sure every detail is aligned to keep your finances accurate and up to date.

Identification of Discrepancies ASAP

We offer unmatched services that promise no errors or delays will cause any confusion. Our perfect approach detects and resolves any and all discrepancies at the earliest, to keep your financial reports error-free.

Maintaining Reconciliation On-Time

To fall behind on reconciliation can have serious consequences. It can disrupt financial planning and compliance. Thus, we make sure your accounts are reconciled properly and frequently to give you peace of mind as well as freedom to form a clear financial plan.

Make Confident Decisions with Accurate Accounts

To manage your account balance correctly, you must have precision, expertise, as well as efficient tools. Our accounts reconciliation services take on the toughest of challenges to ensure each transaction is aligned and discrepancies are resolved on time. With the help of advanced techniques and state-of-the-art tools, we keep your records updated, avoid delays, and enhance financial clarity.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch Now

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

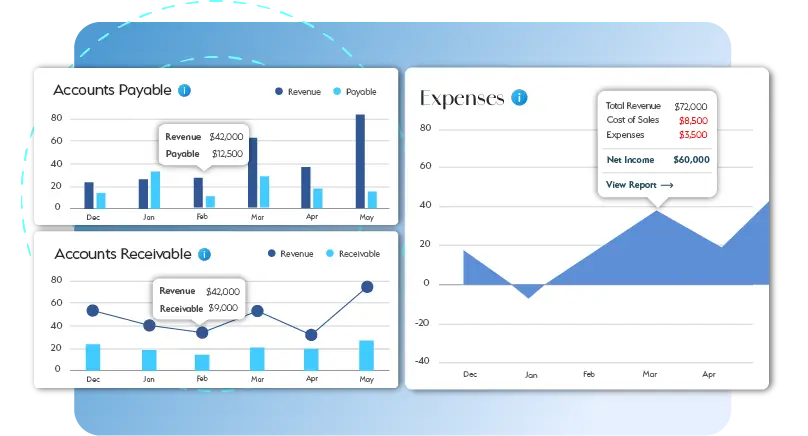

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Accounts reconciliation refers to the comparison of financial records with external statements to make sure there’s accuracy. This helps in identifying discrepancies, prevention of fraud, and maintenance of financial integrity.

Yes, they can! Bookkeepers can perform bank reconciliation as well. They compare a business’ financial records with bank statements to make sure all transactions are correctly recorded. They take care of the discrepancies as well to keep the financial data maintained.

The role of an accounts reconciliation specialist is to review and reconcile financial records, identify and resolve discrepancies, ensure compliance with accounting standards, as well as support accurate financial reporting.

Regular financial reconciliation makes sure there are accurate records, fraud is prevented, and errors are identified. They also help businesses to maintain compliance with regulations and manage cash flow efficiently.

Outsourcing bookkeeping benefits from expert knowledge and state-of-the-art tools. They help in lowering errors, saving time, and enabling organizations so you can focus on growing your business.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Reconciliation Services: Accurate Financial Records with Us

It is essential to maintain accurate financial records for any business, regardless of size. Reconciling accounts can easily be a time-consuming and overwhelming task. This process requires precision and a keen eye, which can easily distract business owners from their main tasks. Outsourcing accounts reconciliation services lend a hand here. By outsourcing these services, you can trust experts to handle it all and verify your financial data. This means you not only get to make sure there’s accuracy but the finances are managed properly as well. Learn more the benefits of accounts reconciliation services below:

Get a CallAccount reconciliation means cross-checking financial records against bank statements, credit card transactions, and any other external documents. Mismatching leads to discrepancies which impact financial decision-making. However, outsourced reconciliation professionals can easily identify and rectify errors. They ensure accuracy and trustable financial data.

Reconciling accounts in-house requires significant time, expertise, as well as effort. Just for this task, hiring more people and then training them seems like a cost-consuming task. By outsourcing, you not only save time but also save on valuable resources. You get access to expert services and professionals who handle the process effortlessly.

Accounts reconciliation services help you to make use of state-of-the-art software to automate and streamline the reconciliation process. These tools are accurate, reduce manual errors, as well as offer a clearer view of your financial health. With cloud-based technology, you get access to real-time insights and reports anytime, anywhere.

Financial regulations and accounting standards change often. Hence, staying compliant with updated regulations becomes a necessity to avoid penalties. Outsourcing experts remain caught up with up-to-date regulations and ensure your business does too. They adhere to all the legal requirements for the same. Further, they minimize risks which are related to fraud and financial management.

By identifying and addressing any discrepancies at the earliest, accounts reconciliation services help you to manage cash flow properly. You get to receive accurate and real-time insights according to available funds, outstanding payments, and other financial metrics. This assists you to plan budgets, forecast expenses, and make better investment decisions.

As your business expands so do your transactions. They become more complex with time. Outsourced reconciliation services are highly flexible and scalable, and they allow you to adapt to the services based on your requirements. This means you only pay for what you require and nothing more.

Accurate financial records are the pillars of informed decision-making. Outsourcing accounts reconciliation services allows you to entrust your financial data to a reliable professional. This means you get more time to yourself and to come up with better long-term goals.

Outsourcing accounts reconciliation services is one of the best ways to maintain financial accuracy, make sure there’s law compliance, and enhance operational efficiency. They simplify your processes, improve cash flow management, and lead your business to grow sustainably.