-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Making Financial Reporting Easier for Your Business

At Whiz Consulting, we go above and beyond to deliver clear, accurate financial reports so you can understand the areas of improvement even more precisely. From making sure numbers are accurate to comprehending important insights, we handle it all. We offer you the time and freedom to grow your business. With us, financial clarity is just a step away.

Financial Reporting Services We Offer

- General ledger reports

- Trial balance preparation

- Fixed asset and depreciation calculation

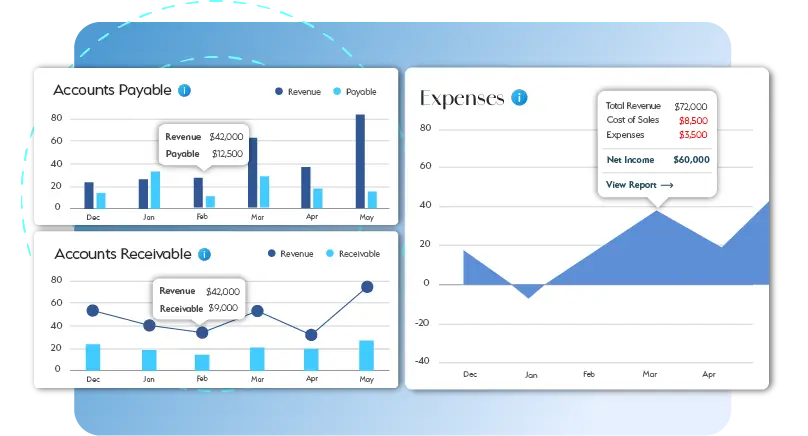

- Accounts payable reports

- Accounts receivables reports

- Financial Statement Analysis

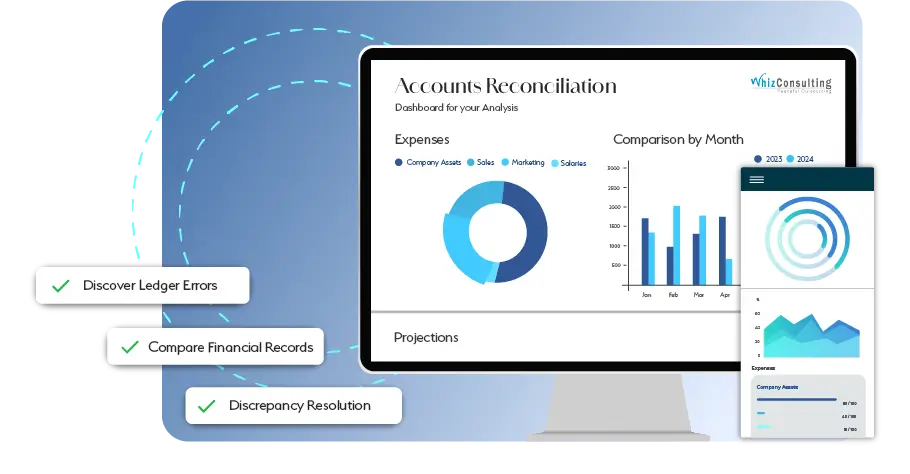

- Bank reconciliation reports

- Inventory reports

Challenges We Tackle For You

We provide financial reporting services, fully addressing the major challenges that businesses face in managing their finances.

Organizing Financial Data

Financial records which are not well organized or kept consistently may complicate the decision-making process. We make sure that all of your data is reliable, consistent, and easy to read, and serve as a solid basis for strategic planning.

Converting Data into Actionable Insights

The raw financial data is overwhelming and difficult to interpret. We summarize your numbers into insights, so that you have the information needed to make data-driven business decisions with confidence.

Bringing Consistency in Accounting Practices

Establishing consistent accounting practices ensures reliable financial reporting. We set-up standardized procedures to maintain accuracy and long-term financial stability.

Our Priority is Your Financial Clarity

At Whiz Consulting, we transform complex financial data into clear, actionable insights. Our expert-driven financial reporting services makes sure there’s accuracy, compliance, and timely deliveries are made to empower your business to achieve its goals. With modern tools and personalized solutions, we help avoid errors, understand insights, and make better business-related decisions.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch Now

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Yes, we prioritize data security with advanced encryption, strict confidentiality agreements, and industry-standard protocols.

Absolutely, small businesses take advantage of outsourcing by benefiting from cost-effective access to professional expertise. It also streamlines processes and offers more time for tasks.

Timelines are personalized according to your requirements. Standard reports meet the agreed deadlines, all the while aligning with custom requests, which may take some time.

Yes, you will. We maintain transparent processes and regular updates ensure you have overall insight as well as full oversight while we manage the details.

Outsourcing saves time, reduces costs, as well as enhances accuracy. You gain access to experts, advanced tools, and insights that improve compliance and decision-making.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Financial Reporting Services: Making Your Financial Management Easier

Managing financial reporting in-house exhaust valuable resources heavily. It requires precision, compliance, and the capability of interpreting complex data. By outsourcing financial reporting to experts, your business can gain access to accurate, strategic, as well as actionable insights.

Understand how outsourcing financial reporting can help your business:

Get a CallOutsourced services make sure experts handle your data, delivering personalized and precise reports in a timely manner. You can save on in-house hiring and infrastructure expenses all the while enjoying expert-driven accuracy.

Take advantage of state-of-the-art tools such as automated reconciliation and cloud-based dashboards. These technologies help enhance data accuracy and offer real-time insights. They allow safe and secure access to financial health reports from anywhere, as they are virtual.

Outsourced professionals stay updated with ever-changing regulations. This makes sure your financial reports comply with the latest accounting standards. They reduce the risk of penalties as well as ensure audit readiness.

Transform raw financial data into actionable insights to effectively manage your finances. Detailed analysis and visualizations help identify trends, take a hold of opportunities, and address challenges. This offers confident decision-making for the business.

Outsourcing offers flexibility to adapt services to your business needs. Scale up or down as needed, to make sure you only pay for what you use.

Regular and accurate updates improve cash flow management. You can gain a better and deeper understanding of your financial position. You can make better budgeting and investment decisions with us.

Free your internal resources from intricate financial tasks and redirect efforts toward growth, innovation, and customer satisfaction.

Outsourcing partners stay informed about new industry standards. They ensure the financial reports remain up-to-date, accurate, as well as reliable.

Outsourcing financial reporting is a smart, cost-effective strategy. It streamlines operations, minimizes risks, and offers expert guidance. By partnering with a reliable provider, you get all the time to focus on growing your business while leaving the financial complexities to the experts.