-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Take Control of Your Numbers with Expert Financial Ratio Analysis

Tap into the true potential of your financial data with our expert ratio analysis services. We break down intricate metrics into straightforward insights, focusing on profitability, liquidity, and efficiency to support your business goals. Whether you are seizing new opportunities or navigating challenges, our analysis provides the clarity you need to make informed, strategic decisions. Let your financial data work for you and propel your business forward!

Ratio Analysis Services We Offer

- Profitability Ratios

- Liquidity Ratios

- Efficiency Ratios

- Solvency Ratios

- Market Ratios

- Turnover Ratios

- Earnings Ratios

Challenges We Tackle for You

At Whiz Consulting, we address the common challenges businesses face in ratio analysis, delivering accurate and actionable insights designed to meet your unique needs.

Simplifying Financial Complexity

Understanding what financial ratios mean for your business can be overwhelming. We break down the numbers into simple, practical insights, making them accessible for informed decision-making.

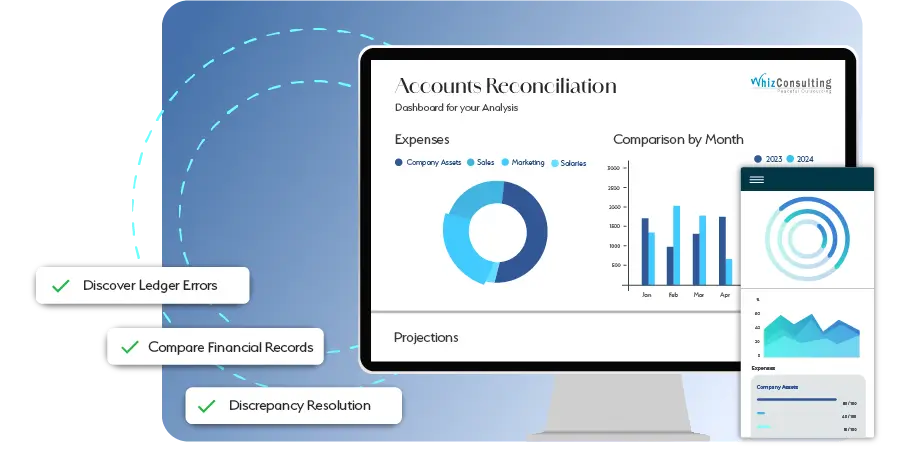

Ensuring Reliable Data

Errors in calculations can distort outcomes and lead to misguided choices. Our team employs meticulous validation techniques to ensure your financial data is accurate and trustworthy.

Strengthening Comparative Insights

Without clear benchmarks, evaluating performance can be difficult. We provide detailed industry comparisons, offering valuable context to measure your business’s performance and uncover growth opportunities.

Empowering Your Journey to Financial Clarity

Simplifying the management of your business’s financial health has never been easier. Our professional ratio analysis services convert intricate financial data into clear, actionable insights. By evaluating key areas like profitability and liquidity, while uncovering potential growth opportunities, we provide a concise framework for strategic decision-making. Let us handle the complexities so you can stay focused on steering your business toward success with confidence and precision.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Financial ratio analysis helps businesses assess their financial health by evaluating key indicators such as profitability, liquidity, and solvency. It translates complex financial data into actionable insights, making strategic decision-making and growth planning more straightforward.

Industries like retail, manufacturing, healthcare, and technology find debt-to-asset ratio analysis especially valuable. It helps these sectors assess financial leverage and stability, providing insights that guide effective financial management.

Businesses should review their debt-to-equity ratios quarterly or annually to monitor financial health and mitigate risks. Regular analysis helps companies adapt to market changes and make informed financial decisions.

Yes, ratio analysis is a powerful tool for comparing performance with competitors. Metrics like equity-to-debt ratios allow businesses to benchmark against industry standards, identify competitive advantages, and pinpoint areas for improvement.

Outsourcing ratio analysis ensures accurate calculations and professional interpretation of metrics such as the debt-to-total-assets ratio. By working with experts, businesses save time, gain deeper insights, and focus on their core operations while making informed decisions based on reliable data.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Unlock Financial Insights with Outsourced Ratio Analysis Services

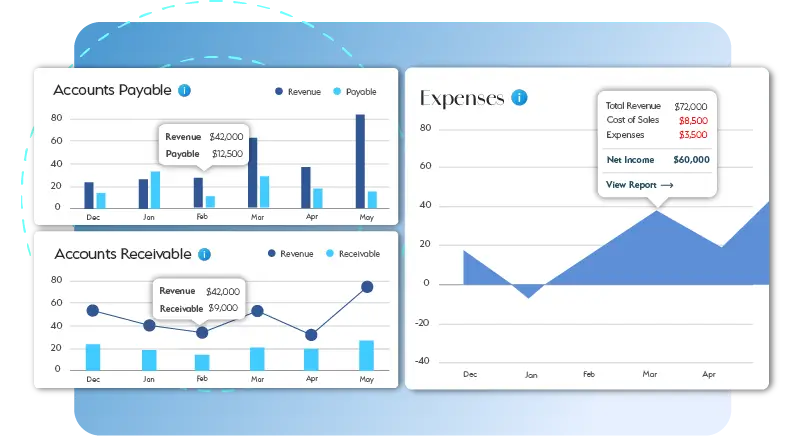

Understanding your company’s financial health is essential for making informed decisions and driving growth. Ratio analysis is a powerful tool that evaluates key financial metrics, such as profitability, liquidity, and leverage, to provide a clear picture of a business’s performance. Outsourcing financial ratio analysis offers businesses the expertise and precision needed to gain actionable insights without overburdening internal teams.

Get a CallOutsourcing ensures that your financial ratio analysis is conducted by professionals who understand the intricacies of evaluating financial metrics. Their expertise guarantees accurate and reliable insights.

Maintaining an in-house team for ratio analysis can be costly. Outsourced services offer a more economical option without compromising on quality.

Outsourced providers leverage sophisticated tools for calculating and interpreting metrics like the debt to total assets ratio and debt to equity ratio, ensuring precise results.

Outsourced ratio analysis services are a smart move for businesses seeking expert insights and precise evaluations. From the analysis of debt-to-equity ratio to customised interpretation services, these solutions empower businesses to make confident decisions and achieve sustainable growth. Partner with a trusted provider to unlock the full potential of your financial data.