-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

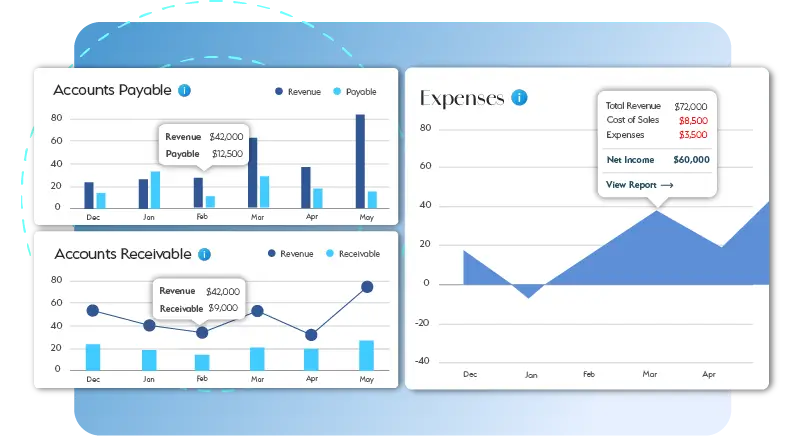

Effortless Accounts Payable Services for Optimal Cash Flow

From tracking due dates to capturing all invoice details, managing accounts payable can be a significant challenge. We offer comprehensive outsourced solutions to streamline your accounting processes. With our expert team at your service, you can be confident that your bills are paid promptly, ensuring smooth cash flow.

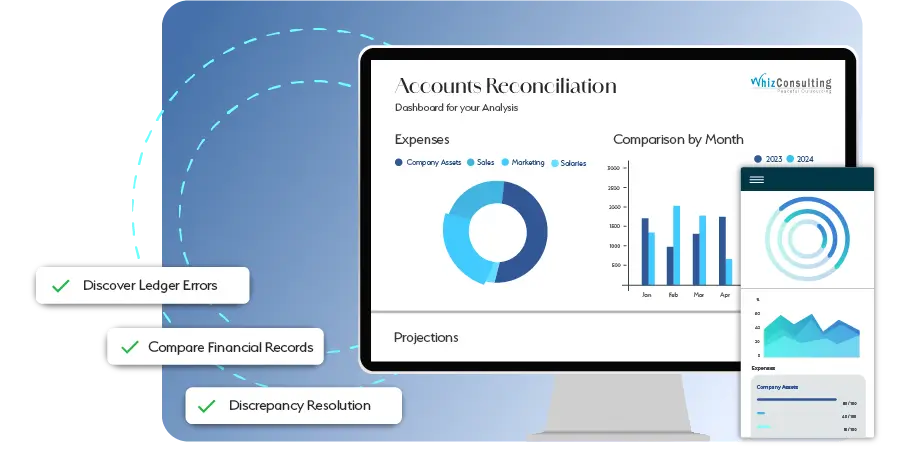

Outsourced Accounts Payable Services We Offer

- Invoice Processing & Management

- Vendor Management & Reconciliation

- Payment Scheduling & Processing

- Expense Tracking & Reporting

- Compliance & Regulatory Adherence

Challenges We Tackle for You

Managing accounts payable can present significant challenges. Our skilled accountants empower you to overcome these obstacles and streamline your financial operations.

Late or Missed Payments:

Our outsourced accounts payable services guarantee timely payment processing, mitigating the risk of overdue bills and associated penalties. Farewell to missed deadlines and embrace the tranquility of knowing your payments are always punctual.

Inaccurate or Misplaced Invoices:

Leveraging advanced accounts payable automation, we capture every detail, from payment terms to line-item specifics, ensuring payment accuracy. We eliminate the burden of sifting through paper mountains by digitizing and organizing invoices for swift retrieval.

Difficulty Managing Cash Flow:

We optimize your payment schedules to maintain a healthy cash flow and prevent operational disruptions. By strategically timing payments and identifying early payment discount opportunities, we assist you in managing outflows more effectively.

Effortless Accounts Payable Management Made Simple!

At Whiz Consulting, we transform your accounts payable function from a challenge into a seamless experience. By partnering with us, you gain access to expert professionals, cutting-edge technology, and proven methodologies that mitigate risks, reduce costs, and enhance efficiency. From managing vendor relationships to ensuring strict adherence to payment regulations, we deliver a bespoke solution tailored to your specific needs.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Outsourcing AP reduces processing costs, improves accuracy by minimizing errors, and frees up your staff to focus on more strategic, revenue-generating activities within the business.

Look for a provider with proven experience, robust technology, strong security measures, transparent pricing, and positive client testimonials. Ensure they fit your business needs.

Reputable providers use advanced encryption, secure data centers, and comply with industry regulations to protect your financial data from unauthorized access and breaches.

Most providers offer seamless integration with popular accounting systems via APIs or secure file transfers, ensuring a smooth data flow and minimizing disruption to your current workflows.

Outsourcing providers offer online portals and reporting tools that give you real-time access to invoice status, payment information, and key performance indicators, ensuring full transparency.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Accounts Payable Services

Accounts payable is a critical function for businesses, ensuring timely payments to vendors and suppliers for goods and services received. It encompasses managing short-term liabilities, cultivating strong creditor relationships, and optimizing financial workflows. Efficient accounts payable services can significantly streamline operations, minimize errors, and enhance cash flow management.

Get a CallAccounts payable represents the amount a company owes suppliers or vendors for products or services delivered but not yet settled. The accounts payable process constitutes a part of a company’s broader financial framework, including receiving, reviewing, and paying invoices within agreed terms. This process is fundamental for managing cash flow, ensuring on-time payments, and fostering healthy supplier relationships. A key metric in evaluating efficiency is the accounts payable turnover ratio, which measures the speed at which a business settles its payables.

An accounts payable specialist is responsible for managing and overseeing the AP process. Their duties encompass verifying invoices, reconciling them with purchase orders, coding expenses to the appropriate accounts, and processing payments. In larger organizations, they may also handle account reconciliations, resolve payment disputes, and ensure compliance with company policies and financial regulations.

Accounts payable automation involves utilizing advanced technology to optimize and simplify the AP process. By replacing manual tasks such as data entry, invoice verification, and payment processing, businesses can achieve substantial time and cost savings.

Faster Processing: Automating the AP workflow accelerates invoice processing, enabling timely payments and strengthening vendor relationships.

Reduced Errors: Automation minimizes human errors such as incorrect data entry or missed payments.

Improved Cash Flow: By automating payment schedules, companies can leverage early payment discounts and avoid late fees, enhancing cash flow management.

Cost Savings: Automation reduces reliance on manual labor and paperwork, leading to significant savings.

Greater Transparency: Automated systems provide real-time insights into the accounts payable process, enabling businesses to track invoices, monitor cash flow, and generate accurate financial reports.