-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Unlock Consistent Cash Flow with Strategic Accounts Receivable

Chasing late payments and managing unpaid invoices can be a burden. Whiz Consulting offers comprehensive outsourced accounts receivable services to streamline your billing and secure consistent cash flow. With our dedicated team managing your accounts, you can be confident in prompt payments and accurate financial reporting.

Outsourced Accounts Receivable Management Services We Offer

- Invoice Generation & Distribution

- Payment Collection & Follow-up

- Account Reconciliation & Aging Reports

- Cash Flow Forecasting & Management

- Credit Control & Risk Assessment

Challenges We Solve for You

We streamline internal processes, reduce the incidence of late payments, optimize workflow efficiency, and facilitate cost reduction.

Late or Unpaid Invoices

Frustrated with pursuing payments? Our outsourced accounts receivable services provide consistent follow-up and timely collections, decreasing overdue invoices and minimizing uncollected debts.

Inaccurate or Disorganized Invoicing

Our team guarantees accurate, prompt invoicing, handling every detail precisely. Through our comprehensive accounts receivable services, we simplify your billing process, reducing errors, and ensuring accurate accounting for every charge.

Cash Flow Issues from Slow Payments

Experiencing difficulties due to delayed payments? Our accounts receivable outsourcing solutions accelerate collections and manage schedules to bridge cash flow gaps. With optimized receivables, your business maintains the resources necessary for growth and success.

Streamlining Accounts Receivable for Enhanced Cash Flow

Our experts turn your accounts receivables process into an efficient system. We leverage our expertise, advanced technology and bespoke solutions, to reduce collection time, enhance cash flow and improve financial operations. Whether it is invoice management or customer relationship management, our team takes care of it all.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

The primary objective of accounts receivable services is to ensure prompt collection of customer payments, maintain precise financial records, and enhance cash flow management. This includes efficient invoicing, payment follow-up, account reconciliation, and dispute resolution.

A high accounts receivable turnover ratio signifies that your organization is effectively collecting payments, resulting in improved cash flow and fewer bad debts. Monitoring this ratio helps you assess your collections process and identify areas for improvement.

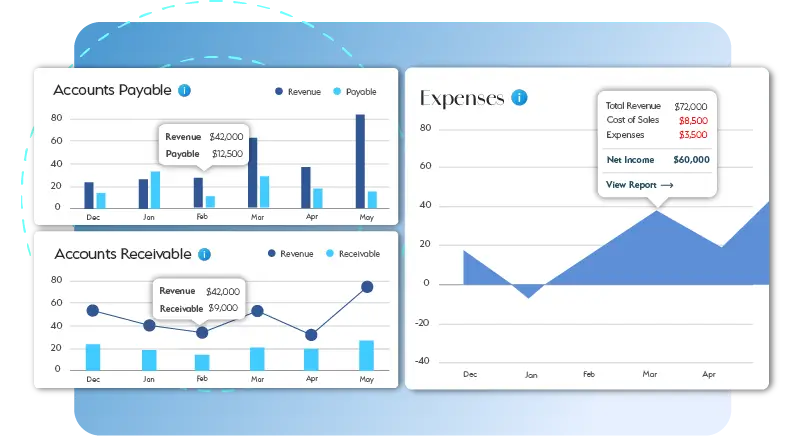

Accounts payable represents the funds a business owes to its suppliers, whereas accounts receivable represents the funds owed to the business by its clients. Both are crucial for managing cash flow and maintaining sound financial health.

Automation streamlines the accounts receivable process by minimizing manual tasks such as data input, invoice creation, and payment tracking. It enhances operational efficiency, reduces errors, and enables organizations to concentrate on optimizing their accounts receivable management strategy.

Yes, organizations can utilize specialized software to automate key aspects of the accounts receivable process, including generating invoices, sending payment reminders, and reconciling accounts. This increases efficiency and facilitates smoother cash flow management.

Accounts receivable outsourcing services offer expert assistance to manage billing, collections, and client follow-up, ensuring timely payments and fewer outstanding debts. Outsourcing enables organizations to focus on expansion while experts manage the complexities of their accounts receivable.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Receivable Services: Optimizing Cash Flow and Strengthening Financial Stability

Effective cash flow management is essential for maintaining robust financial health. A key aspect of this is accounts receivable, which represents outstanding payments owed to a business by its clients. Efficient accounts receivable management ensures consistent cash flow, supports business expansion, and reduces the risk of late payments and bad debts.

Get a CallAccounts receivable represents the funds owed to a company by its clients for delivered goods or services that have not yet been paid. It is classified as a current asset on the balance sheet. A large volume of accounts receivable often indicates that a business is extending credit to clients, which can stimulate sales but also increases the risk of payment delays or defaults.

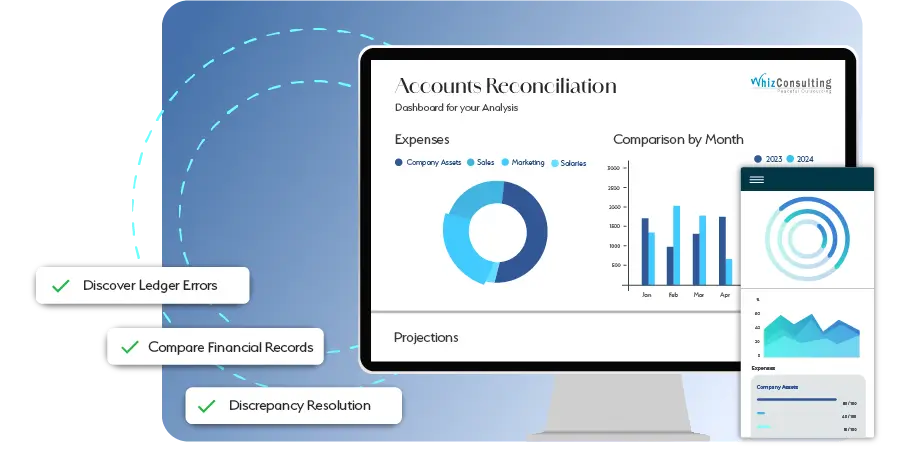

Managing accounts receivable involves more than just sending invoices. It requires a structured approach to ensure prompt payments, accurate financial records, and positive client relationships. Professional accounts receivable services streamline this process, minimizing human error and enhancing cash flow management. These services typically encompass:

- Invoice Creation and Distribution

- Payment Collection and Follow-up

- Account Reconciliation

- Preparation of Aged Debt Reports

- Dispute Resolution

Delegating these tasks to a reliable provider through accounts receivable outsourcing services can further optimize your workflow and free up resources for core business functions.

A key performance indicator in accounts receivable management is the accounts receivable turnover ratio, which measures how effectively a business collects its receivables within a specific period, generally one year. A high turnover ratio indicates efficient collection procedures, while a low ratio may indicate relaxed credit policies or collection difficulties.

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A higher ratio signifies quicker collection of payments, leading to improved cash flow and increased availability of funds for operational requirements or reinvestment.

Choosing accounts receivable outsourcing services enables businesses to entrust the complexities of the accounts receivable process to specialists. This method improves efficiency, lowers expenses, and ensures uninterrupted cash flow, allowing your organization to focus on growth and strategic goals.