-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Streamline Your Bookkeeping & Elevate Your Business

We don’t just record your numbers; our online bookkeeping solutions offer actionable insights that empower you to make informed decisions. From financial organization to cash flow management and tax preparation, we keep your books in top shape, freeing you to focus on your business’s growth. Partner with us and stay ahead of the curve!

Outsourced Bookkeeping Services We Offer

- AP & AR Management

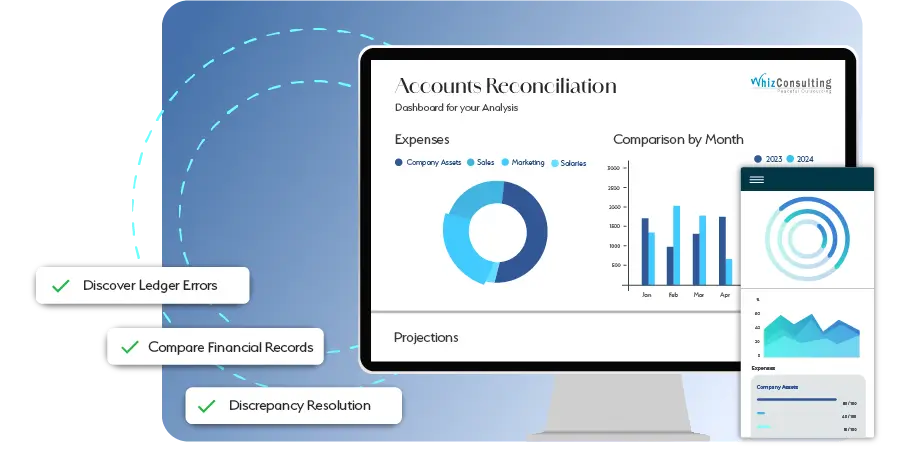

- Bank & Credit Card Reconciliation

- Financial Reporting & Analysis

- Payroll Processing

- Expense Tracking & Management

- Inventory Management Support

- Tax Preparation

Bookkeeping Challenges We Solve for You

Our outsourced bookkeeping services address key business challenges to provide financial peace of mind.

Ensuring Transactional Accuracy:

We meticulously record all financial transactions, from simple daily expenses to intricate multi-step processes. Our precision minimizes errors and provides valuable financial clarity.

Implementing Best Practices:

With over a decade of experience supporting local businesses, we’ve honed our skills to deliver exceptional accounting solutions. Rely on us for impeccably organized finances using best practices tailored to your needs.

Focus on Core Business:

Bookkeeping demands significant time and can distract us from essential business operations. We manage the complexities of financial record-keeping, allowing you to concentrate on growing your business while saving valuable time and resources.

Your Solution: Our Expertise

Managing cash flow, reconciling complex transactions, and generating accurate reports – our expertise meets your demanding bookkeeping needs. We leverage automation and proven strategies to streamline, minimize errors, and provide clear financial insights. Our support helps you meet deadlines, avoid costly mistakes, and make confident decisions.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

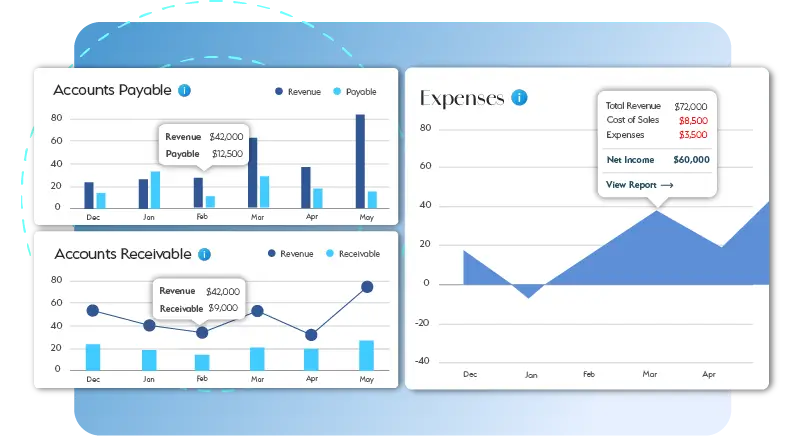

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Our bookkeepers are certified professionals with extensive experience in accounting principles and industry best practices. They stay updated on the latest tax laws and software to ensure accurate and efficient financial record-keeping.

We prioritize data security with robust measures like encryption, access controls, and regular audits. Our systems comply with industry-standard security protocols to safeguard your confidential financial information.

We provide regular updates and reports on your financial health. You’ll have access to online dashboards and can schedule virtual meetings to discuss your financial performance and address any concerns.

We implement rigorous quality control measures, including double-entry bookkeeping, regular reconciliations, and internal audits. We strive for 100% accuracy and provide clear explanations for any discrepancies.

Our services are flexible and scalable. We can easily adjust our services to accommodate your changing business needs, whether you require more or fewer hours or need to add specific services.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Bookkeeping Services: Prioritizing Your Finances

Managing accounting and bookkeeping internally can be costly and time-consuming. Valuable time spent on bookkeeping could be better allocated to core business activities. Outsourced bookkeeping services provide access to skilled professionals to manage your financial records. By ensuring financial order and driving cost efficiency, these services offer significant value. Whether you’re exploring remote or offshore bookkeeping options, these solutions provide flexibility and reliability. Interested in learning more? Let’s explore how outsourcing bookkeeping can benefit your business:

Get a CallEffective bookkeeping management requires specialized expertise to handle complex processes. This expertise comes at a cost: recruiting qualified personnel, maintaining infrastructure, and providing ongoing training and development. These expenses can quickly accumulate – a significant financial burden for many businesses. Outsourcing bookkeeping services allows you to reduce these costs while maintaining efficiency and accuracy.

A key advantage of outsourcing bookkeeping is access to cutting-edge technology. Professional bookkeeping service providers utilize state-of-the-art software to efficiently manage financial tasks, delivering accurate and reliable results. Whether your focus is on remote bookkeeping or comprehensive financial management, the right tools can significantly enhance your operations.

As your business grows, so does the complexity of your financial operations. Outsourced bookkeeping services offer flexibility, enabling you to easily scale your services up or down based on your specific needs. If your business experiences fluctuating demands, these services adapt seamlessly, ensuring you only pay for the services you require. This adaptability ensures you’re well-prepared for growth without incurring unnecessary overhead.

Navigating financial regulations and compliance standards can be challenging. Outsourced bookkeeping professionals ensure your business remains fully compliant with all relevant guidelines and accounting laws. With experts staying informed about evolving regulations, you can trust them to maintain up-to-date and compliant financial practices. Whether you’re considering offshore bookkeeping or partnering with a remote bookkeeping team, compliance remains a top priority.