Table of Content

Share This Article

- Reading Time: 8 Minutes

- Published: March 23, 2023

- Last Updated: March 5, 2025

Globalisation has undoubtedly made an impact on various aspects of the business world, and with it comes a need to find more efficient and cost-effective ways to get things done. With increasing labour costs and rising inflation rates, it is becoming increasingly difficult for businesses to keep their functions and employees’ salaries competitive. An increasingly popular strategy to combat inflation and labour shortages and also remain competitive in today’s global market is offshoring.

Generally, businesses outsource a variety of functions to offshore countries to gain access to high-skilled professionals. But one of the most commonly offshored functions is accounting and bookkeeping. Hiring an outside firm to handle your accounting can save time and provide access to experts at much lower costs. But how does offshoring works, and what are the benefits? All your questions will be answered in this blog. In this blog, we will explore how offshoring your accounting process or hiring outsourced accounting services from offshore countries can help tackle inflation and labour shortages. From reducing costs to providing access to new markets, offshoring can be a ground-breaking solution to your inflation and labour shortages concerns. Before diving into how offshoring helps combat inflation and labour shortages, let us know a bit about “inflation” and “labour shortage”.

Inflation and Labour Shortage

Inflation is the sustained increase in the price of goods and services. It occurs when the demand for goods and services exceeds the supply. This can lead to decreased purchasing power, as people cannot afford to buy as much with their money. Generally speaking, a little bit of inflation is considered good for an economy – it encourages spending and keeps things moving forward. Too much inflation, however, can be problematic as it can erode purchasing power and lead to rapid price increases. As of February 2023, the UK inflation rate is 10.40%, which is much higher than the average of 2.73%.

On the other hand, labour shortage refers to a situation where there is an insufficient number of workers available to meet the demand for labour. This can arise for various reasons, including skilled workers retiring or leaving the workforce, changes in technology or production methods that require different skills, or an increase in demand for labour that exceeds the supply of workers.

The terms “inflation” and “labour shortage” are closely related because whenever there is inflation, business owners raise prices to cover their higher costs. This, in turn, leads to higher wages as workers demand more money to cover their own rising costs. Eventually, this can lead to a labour shortage, as businesses find it difficult to afford the high wages. Let us explore how offshoring can help tackle inflation and labour shortages that most businesses face in the current economy.

Offshoring Strategies: Building Resilience Amidst Inflation and Labour Shortage Challenges

With the globalisation of the economy and increased financial literacy among business owners, offshoring has become increasingly popular in recent years to save money. Offshoring has especially become a popular solution for businesses looking to reduce costs and overcome the challenges of inflation and labour shortages. Offshoring is the practice of contracting with a company outside of one’s own country to provide goods or services. Typically, businesses offshore their operations to take advantage of lower labour costs and/or to access a market they would otherwise be unable to enter. By outsourcing non-core activities to countries with lower wage rates, businesses can achieve significant cost savings.

Though business owners can opt for offshoring for different functions, outsourced accounting services are one type of service that has become increasingly popular in recent years. By working with an accounting firm based in a developing country, businesses can save money on their accounting needs. Though initially, they might face problems, like cultural differences and language barriers, these can be mitigated by careful planning and research. Overall, offshoring can be a very effective way to reduce costs and remain competitive in today’s economy.

How Does it Help Fight Inflation?

So far, we have learned that offshoring is widely seen as a way to cut costs, but it can also help fight inflation. Offshoring accounting processes can help combat inflation in several ways. By choosing outsourced accounting services from countries with lower labour costs, businesses can keep their costs down and avoid passing on price increases to consumers. This can help keep inflation in check, as businesses can maintain their profit margins even if prices rise. Moreover, by hiring offshore accounting services, they can quickly and easily adjust pricing according to market conditions. This flexibility can be crucial in today’s ever-changing global economy and help them stay one step ahead of the competition.

Additionally, offshoring can help to increase efficiency and productivity by allowing businesses to focus on their core competencies and outsource non-essential tasks, which can further combat inflationary pressures.

Finally, offshoring can provide a hedge against inflation by diversifying a business’s operations across different countries. By hiring offshore accounting services, businesses can reduce their overall costs, increase efficiency, and protect themselves from the effects of inflation.

How Does Offshoring Combat Labour Shortages?

By hiring outsourced accounting services from another country, businesses can take advantage of lower wage rates and a larger pool of potential workers, which helps reduce labour costs and improve efficiency. This can be particularly useful in industries with high demand but a limited supply of skilled workers locally. Offshoring can also help businesses to access skilled workers who might otherwise be unavailable. As a result, businesses can tap into a global talent pool and find the right workers for the job, even if they are located in another country.

Finally, offshoring can help businesses to improve their flexibility and responsiveness. By choosing to offshore the accounting processes, businesses can scale up or down as needed without making long-term commitments or investing in expensive infrastructure. This can help them to be more agile and adaptable in the face of changing market conditions. At last, offshoring can help improve productivity. This is because businesses can make use of better infrastructure and technology in other countries. If you are thinking of offshoring your accounting, make sure you take the time to do your research and learn effective practices. This will help you make the best decision for your company. But how can you ensure maximum benefit and avoid pitfalls? Here are some effective strategies that will help reap the maximum out of offshoring. So, let us get started.

Best Practices for Effective Offshoring

Undoubtedly offshoring has become a popular strategy for businesses looking to reduce costs and tap into new markets. However, doing your homework and developing an effective strategy to multiply the benefits and minimise pitfalls is important. Here are some of the best practices for effective offshoring:

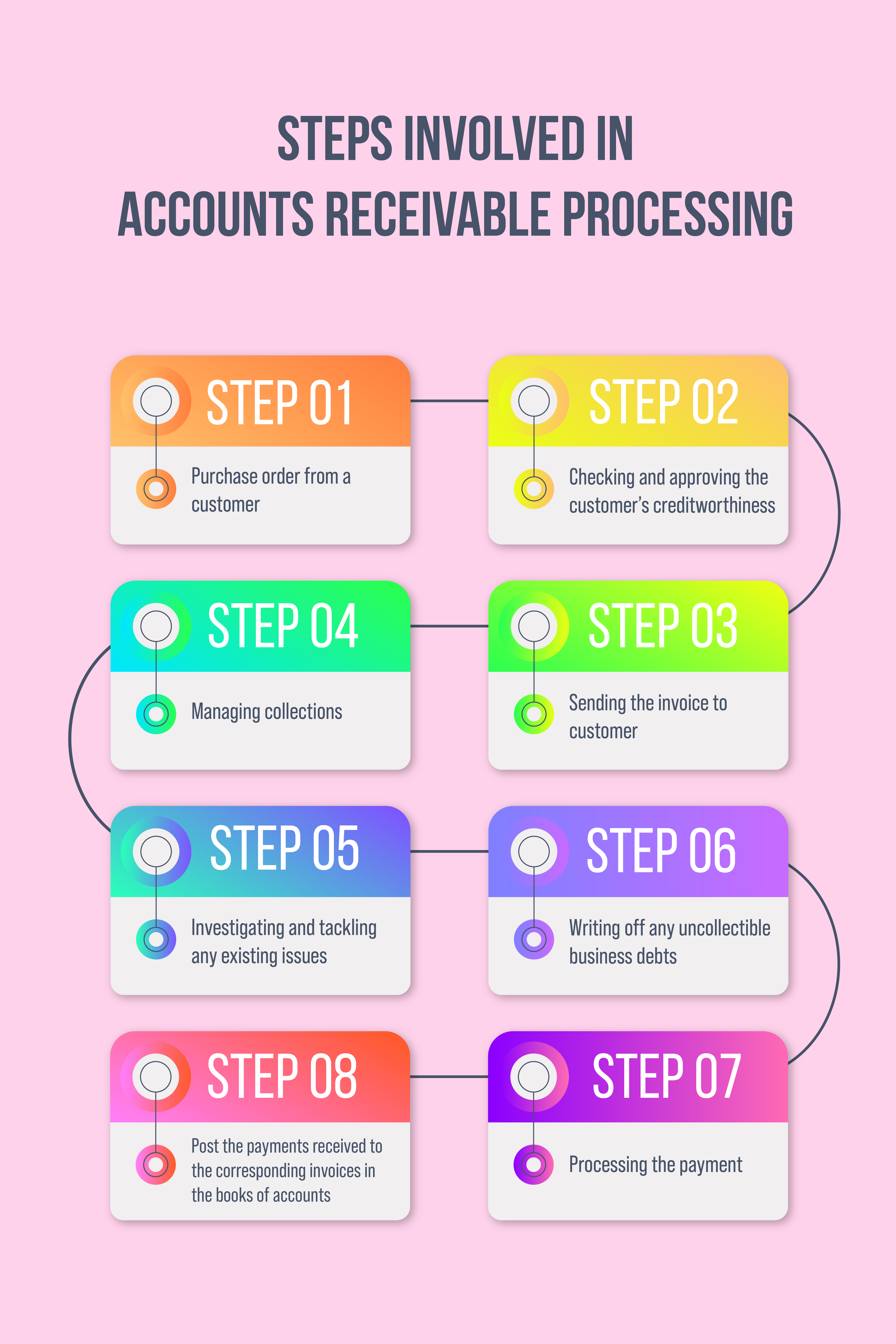

- Define your goals and objectives- Before developing an effective offshoring strategy, you must first identify your goals and objectives. Which process do you want to outsource? What are you hoping to achieve by offshoring? Once you have a clear understanding of your goals, you can then determine which functions or processes could be relocated without compromising your business process’s quality. Whether you are thinking of outsourcing accounts payable or accounts receivable or any other process, it is essential to understand your business goals clearly.

- Do your research- Not all countries are created equal when it comes to offshoring. As a business owner, you should consider factors such as labour costs, infrastructure, political stability, proximity to target markets, and tax implications when choosing a location for your offshore operations. For instance, your country might follow VAT rates and schemes, but other countries might not. Depending on the country you choose to offshore to, there can be different rules and regulations surrounding taxation. However, if you select a service provider who has experience providing service for businesses in the UK, then you can avoid such complications in the future. Also, it is always a plus point if they have experience in providing services for your industry.

- Conduct a cost-benefit analysis- Offshoring is often motivated by the desire to reduce costs. However, it is important to remember that there are other factors to consider, such as quality and compliance. A cost-benefit analysis will help you compare the potential costs and benefits of various offshoring scenarios so that you can make an informed decision about whether or not it makes sense for your company.

- Develop a communication plan- Once you have decided the location of offshoring your accounting process, whether it is about outsourcing accounts payable, accounts receivable, or any other function, it is important to develop an effective communication strategy for keeping in touch with the new team. This includes developing appropriate channels for addressing questions or concerns, holding regular meetings, etc.

- Manage expectations- As a business owner, you should be realistic about what can be achieved through offshoring and manage expectations accordingly among all stakeholders (e.g., shareholders, employees, customers). In addition, it is very important to communicate openly and regularly about progress (or lack thereof) toward goals to keep everyone on the same page.

- Monitor performance regularly- Finally, it is essential to monitor the performance of your offshored team on a regular basis. This will help you ensure that targets are being met and any issues are addressed on time.

Conclusion

Whether you have just started from scratch or running a well-established business, offshoring is a brilliant way to manage rising prices and a lack of personnel. It gives companies access to wide international markets, decreasing production expenses and ensuring they have sufficient expertise. Furthermore, outsourcing accounting operations to qualified professionals in other countries can boost organisations’ efficiency and ensure their market competitiveness. It also helps reduce costs and enables them to stay ahead of their competitors in a constantly changing environment. The bottom line is that offshoring, when done right, can help companies move forward and create an affordable yet effective manner of working.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.