Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: August 24, 2023

- Last Updated: February 12, 2025

The word accounts payable (AP) plays a pivotal role in the financial management of any business. Whether a newbie or a well-established entrepreneur, every business owner faces some sort of difficulty with their AP function. This complex process includes multiple steps that are intertwined with one another, making a full-fledged AP function. Our blog dives deep into the AP process, highlighting challenges, best practices, the transformative potential of automation and the strategic advantages of outsourcing accounts payable.. So, join us as we uncover the keys to refining AP operations and driving financial success in your business.

Accounts Payable VS Accounts Receivable: What’s the Difference?

The best way to differentiate between the two lies in finding similarities between these processes. So, the point where they intersect is “money”. Accounts payable pertains to money going out, whereas accounts receivable (AR) focuses on money coming into the business. To clarify further, AP emphasises the timely settlement of financial obligations, ensuring prompt payments. Conversely, a strategic approach toward AR management aids in handling invoicing and ensuring systematic collection of receivables. In this manner, these two processes are diametrically opposed to each other. Clearly, both processes have immense significance for business owners. However, sticking to a traditional approach might pose problems. Let us uncover these problems in a more detailed manner.

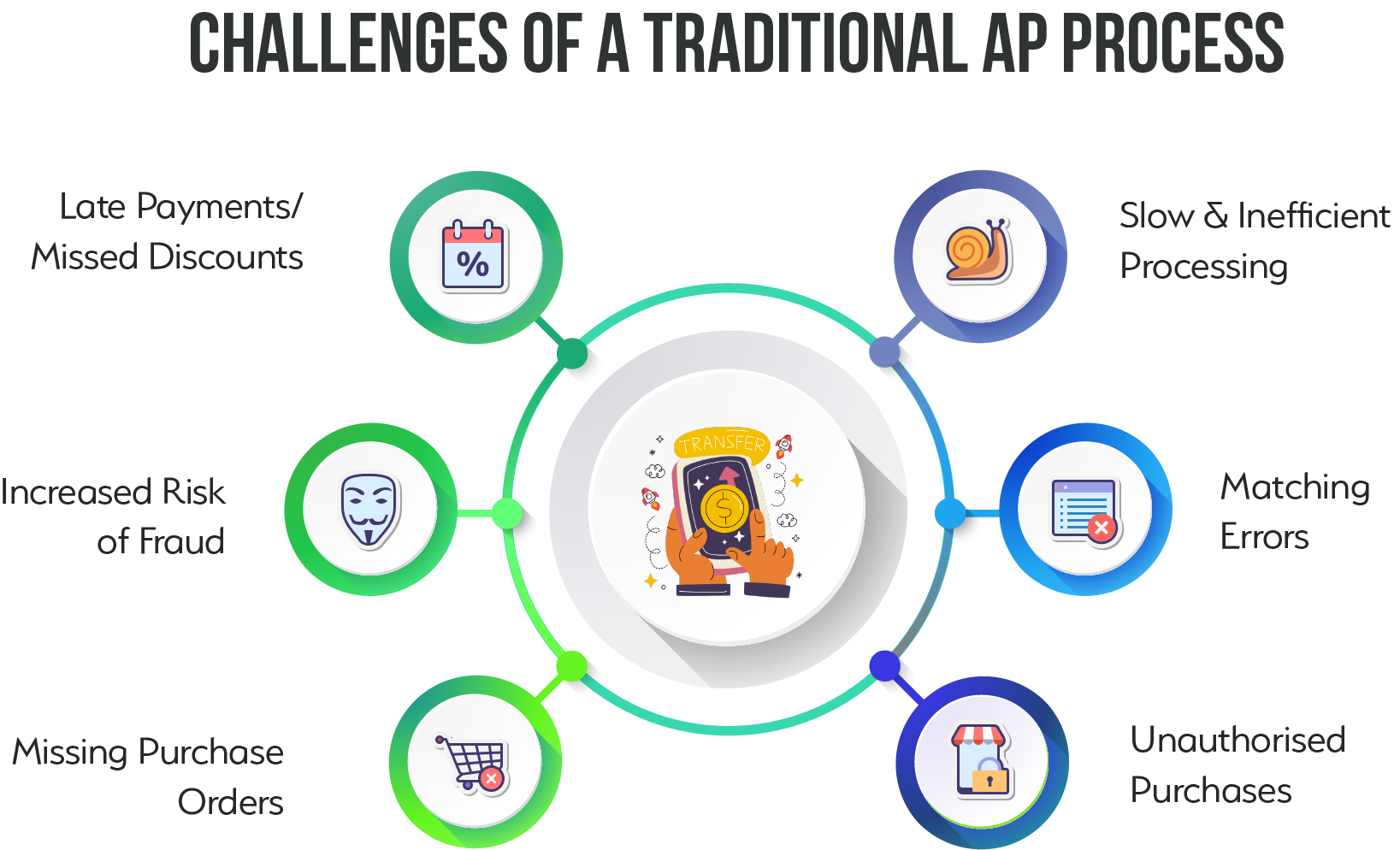

Challenges of a Traditional AP Process

1. Slow & Inefficient Processing:

Traditional AP processes often rely heavily on manual data entry and paper-based systems. This can lead to slower processing times as physical documents must be handled, filed, and retrieved manually. The lack of automation in these systems creates bottlenecks that delay the entire payment cycle, affecting cash flow management and operational efficiency.

2. Matching Errors:

Another challenge associated with traditional AP processes is unwanted matching errors. This usually occurs when there is a discrepancy between the invoices, purchase orders (PO) and receipt reports. In traditional settings, everything is done manually, which makes the process more labour-intensive. This increases the chances of human error since it requires careful scrutiny of details. One small error can lead to big consequences for the entire AP staff. Adopting an automated approach and implying a 3-way matching system can help eliminate such errors.

3. Unauthorised Purchases:

Manual approvals are time-consuming and depend heavily on paper trails that can be misplaced, overlooked, or bypassed. This invites unauthorised purchases to slip through the cracks of a traditional AP process, leading to potential budget overruns and financial discrepancies. Adopting automated workflows or digital approval systems can greatly help in such situations.

4. Missing Purchase Orders:

Generating a purchase order is crucial because it helps avoid duplicate payments and unauthorized purchases. In a paper-based AP system, purchase orders can be easily lost or misplaced. Hence, posing a question on the legitimacy of the financial transaction occurred. This further leads to unnecessary delays and additional administrative work from the AP staff.

5. Increased Risk of Fraud:

The accounts payable process is highly prone to fraud and anomalies. Traditional AP systems lack the stringent controls offered by digital solutions like automatic alerts for duplicate payments or fraud detection algorithms. As a result, fraudulent activities may go unnoticed, especially when relying too much on human oversight.

6. Late/Double Payments and Missed Discounts:

Considering the time it takes to process each transaction, businesses may fall behind in executing timely payments. Also, the lack of a systematic system can lead to double payments, which may add to the administrative work. Finally, businesses may miss out on early payment discounts offered by vendors as they may be unable to flag these opportunities on time. All of this can be avoided by adopting a more modern approach instead of relying on the traditional AP techniques.

Steps to Ensure an Effective AP Process

1. Set up AP Process SOPs:

When implementing an AP system, documenting the AP process flow is crucial. This includes outlining purchase structure, authorisations, vendor identification, payment execution responsibilities, approval processes, checkpoints, managing overspending, etc. Furthermore, businesses must pay equal attention to the following:

- Purchase orders:

These include item details like type, quantity, rate, accounting code, department, payment terms, validity period, and vendor notes. - Invoicing:

This encompasses vendor invoice details such as vendor name, invoiced goods quantity, bill rate, invoice date, due date, invoice amount, and invoice number. - Goods received note entry:

This document the receipt of goods or services from a vendor and serves as proof of delivery. - Approval:

This involves reviewing and authorising invoices before payment to ensure accuracy, legitimacy, and compliance with business policies. - Payment:

This entails issuing funds to vendors for their provided goods or services, crucial for maintaining positive vendor relations.

2. Set up Workflow Approval:

Setting up workflow approvals is a vital step in effective AP processes. It automates reviews, ensures compliance, reduces errors, and enhances efficiency, all while providing clear accountability and transparency, making the AP system more effective and secure.

3. Set up Vendor Master List:

Accurate vendor data is vital for smooth AP operations. When setting up vendors, attention to detail—address, pay rates, payment terms, currency, tax, codes, cost allocation, and bank info—is key. This precision not only ensures clear communication and accurate payments to vendors but also facilitates a smooth transition into automating vendor invoices, enhancing efficiency and reducing manual errors.

4. Set up Vendor Reconciliation:

Regular vendor reconciliation involves comparing vendor accounts with records. Requesting account statements and reconciling them with your system balances helps detect discrepancies and prevent financial inaccuracies. By addressing discrepancies promptly, this process maintains financial record integrity and ensures accuracy in vendor transactions.

5. Set up Accounts Payable Reports:

Effective AP reports are critical for an efficient AP process. Examples include ageing, vendor analysis, invoice discrepancy, and payment analysis reports. They provide insights into financial health, aiding decision-making and cash flow control.

6. Set up Periodic Audits:

Periodic transaction audits act as a crucial checkpoint within the AP system. These audits impartially assess the AP process, identifying control vulnerabilities and ensuring adherence to business policies.

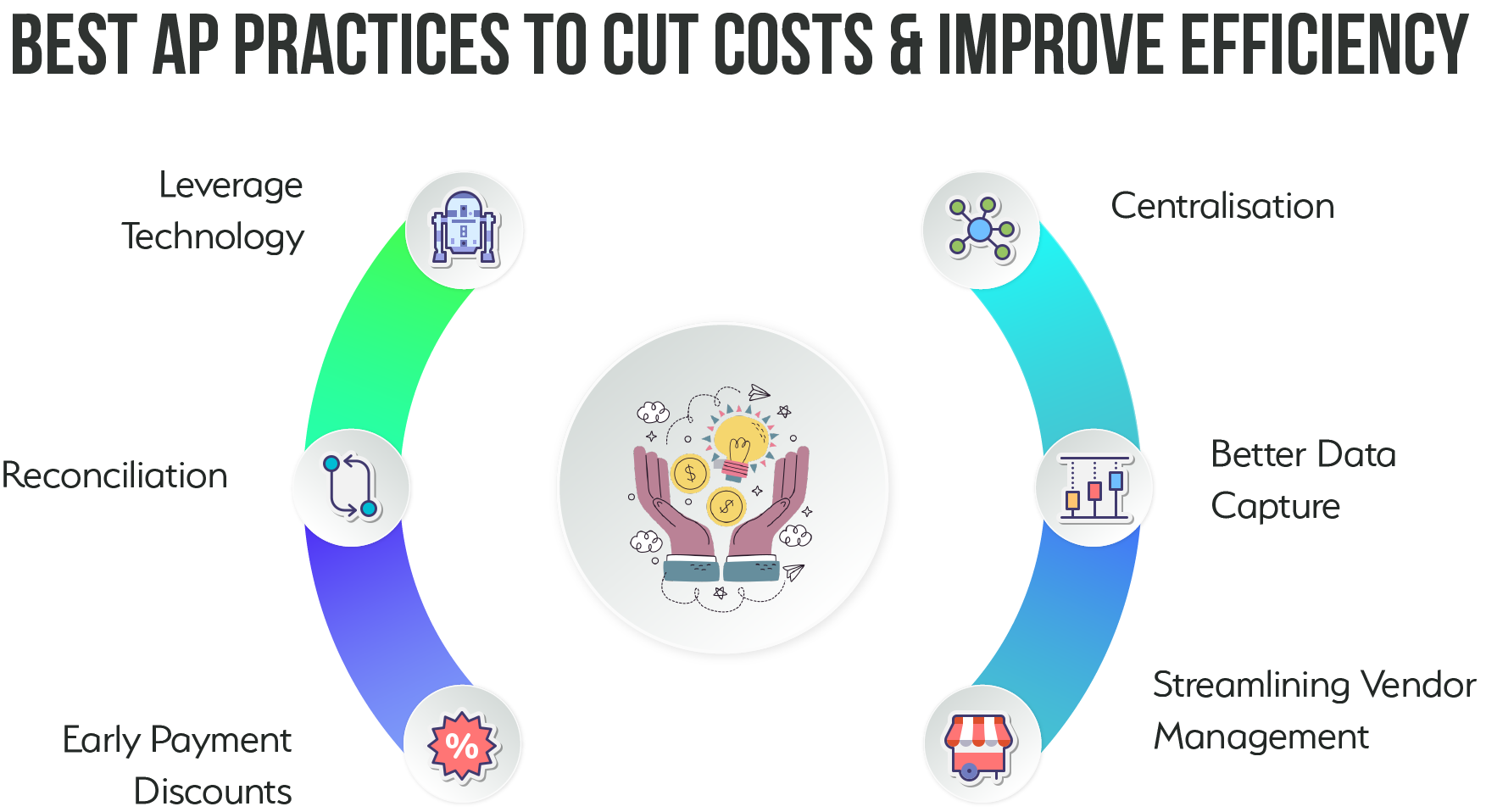

Best Practices for Effective AP Process

The pressure to do more with less is leading businesses to search for new ways to streamline their AP processes. To help you start your journey, we highlighted some crucial steps to ensure effective AP processes; now, let us move on to some of the best AP practices that can be implemented.

1. Centralisation

The consolidation of all the AP functions into a single department or system can improve control and efficiency. This means having a dedicated team or individual responsible for managing your AP function. As a result, streamlining workflows, enhancing oversight and reducing unnecessary administrative work.

2. Better Data capture

Data is the lifeblood of a systematised AP process. Make sure you have a robust system in place for capturing invoices and other key data points. Such technologies include optical character recognition (OCR) and automated data entry systems. As a result, businesses can minimise errors and speed up processing times.

3. Streamline Vendor Management

Having an efficient vendor management process is essential for your AP process. Make sure that you have a centralised system to keep track of vendors, their contact information, payment terms, and payment history. This will make it easier to stay on top of due dates and ensure that payments are made on time.

4. Take Advantage of Early Payment Discounts

Many suppliers offer early payment discounts as an incentive for businesses to pay their invoices promptly. When possible, take advantage of these discounts by paying invoices early. This will help you reduce your overall costs and maintain a positive cash flow.

5. Reconciliation

Regular reconciliation of the accounts payable ledger with vendor statements and bank records is critical to ensuring accuracy in financial reporting. When you reconcile your accounts, you essentially ensure that all your expenses are accurate and up to date. Overall, this gives you a clear picture of identifying discrepancies early, preventing fraud, and maintaining accurate cash flow projections.

6. Leverage Technology

Automation serves as a fundamental practice to reduce errors and increase efficiency. While automation through in-house systems sets the foundation, the full potential is achieved when combined with outsourcing. Outsourcing accounts payable process to experienced service providers helps manage the tools your business already employs. As a result, enabling your team to focus on strategic business objectives while the outsourced experts handle the intricate details of AP management.

How to Automate Your AP Process?

1. Adopt Cloud-Based Accounting Software:

Begin by integrating cloud-based accounting software into your AP processes. Cloud solutions offer real-time data access, scalability, and secure storage. These solutions facilitate easier invoice management and can automatically update records, ensuring that all data is current and easily accessible from anywhere. To find out some of the popular choices, you can check our blog “Top 7 Cloud-based Accounting Software for Small Business”.

2. E-Invoicing:

Transition to electronic invoicing if you have not already done so. This eliminates physical paper trails and enables faster, more accurate invoice processing. E-invoices can be automatically uploaded into the cloud-based system, ensuring they are immediately available for processing.

3. Streamline the Invoice Approval Workflow:

Utilise automation tools within your cloud-based software to set up customised workflows for invoice approval. These tools can automatically route invoices based on pre-defined rules, such as invoice value, vendor, or department, speeding up approvals and minimising manual intervention.

4. Data Validation with Automation:

Implement automated data validation to check for accuracy in invoices. Automation can verify details like vendor information, match invoice amounts with purchase orders, and confirm receipt of billed goods or services, significantly reducing the likelihood of errors.

5. Vendor Portals within Cloud Systems:

Encourage vendors to use online portals that integrate with your cloud-based accounting software. These portals allow vendors to submit invoices directly into your system and track the status of their payments, improving transparency and reducing administrative tasks.

6. Automate Matching and Verification Processes:

Use cloud-based software that includes automation capabilities for 3-way matching (purchase orders, receipts, and invoices). This ensures payments are made only for verified, received goods or services, enhancing financial security and compliance.

7. Analytics and Continuous Improvement:

Leverage the analytical capabilities of your cloud-based accounting software to monitor and analyse AP processes. Use insights from data to identify areas for improvement, adjust automation rules, and optimise the overall accounting and bookkeeping system.

As you begin following these processes, an essential tool for enhancing visibility and control over your accounts payable operations is the development of an AP reporting dashboard. This tool consolidates all critical AP data into a single, accessible interface, allowing for real-time monitoring and decision-making. Here is how you can set up an AP reporting dashboard.

How to Set Up an AP Reporting Dashboard?

1. Define Objectives and Key Metrics:

Clearly outline what you aim to achieve with your accounts payable reporting dashboard. Identify critical KPIs like processing times, cost per invoice, and discount capture rates. This step lays the foundation for what your dashboard will track and monitor.

2. Select AP Automation Software:

Choose software that integrates with your financial systems and supports the automation of vendor invoice processing, payment execution, and real-time data analysis. Ensure it offers customisable reporting features to track your chosen KPIs effectively.

3. Integrate and Customise:

Ensure your accounts payable automation tool can consolidate data from various sources, such as procurement and contract management systems, for a comprehensive view of your operations. Customise your dashboard to highlight essential metrics using visualisation tools for easier analysis and decision-making.

4. Implement Real-Time Reporting and Alerts:

Utilise the software’s real-time reporting capabilities to stay updated on AP metrics. Set up alerts for critical events like due invoices or payment anomalies to maintain control and efficiency in your AP processes.

5. Train and Review:

Educate your team on utilising the accounts payable automation system and interpreting dashboard data to make informed decisions. Regularly review dashboard performance and adjust your setup to adapt to changing business needs or to incorporate new insights for continuous improvement.

Future of Accounts Payable

1. Automation:

The future of accounts payable will see a seamless convergence of automation, cloud-based solutions, and ERP integration. Robotic process automation (RPA) and AI-driven tools will streamline processes, while cloud-based AP solutions will integrate seamlessly with ERP systems. This synergy will deliver real-time data synchronisation, enhanced visibility, and efficient operations, ultimately optimising AP processes and data accuracy.

2. Real-time Payments:

Real-time payments will become the norm, enabling businesses to settle invoices instantly. This shift accelerates payment processing and reduces the need for traditional checks and lengthy approval cycles.

3. Supplier Self-Service Portals:

Self-service portals will empower suppliers to manage their invoices, reducing inquiries and enhancing collaboration. This self-service approach improves efficiency in communication and transaction handling.

4. Cybersecurity and Fraud Prevention:

The focus on cybersecurity and fraud prevention will intensify as cyber threats evolve. Advanced security measures and AI-driven fraud detection tools will safeguard sensitive financial data, protecting businesses from malicious attacks and financial fraud schemes.

5. Outsourcing:

Businesses will increasingly partner with specialised professionals like outsourced accounting and bookkeeping services providers. These experts, going beyond basic services, will become integral in optimising AP processes with advanced technologies. This strategic collaboration will enable businesses to concentrate on core activities while outsourced experts efficiently handle the AP function.

Final Words

From dissecting the intricacies of AP versus accounts receivable to overcoming the challenges of traditional methods and harnessing the power of automation, we have covered a broad spectrum of critical elements. To truly enhance your financial operations and safeguard against inefficiencies and fraud, it is crucial to act on these insights. Implement the advanced strategies discussed, such as setting up effective AP systems, engaging with cloud-based solutions, and considering outsourced accounting and bookkeeping services. As you fine-tune your AP process, you can put your trust in Whiz Consulting. With our team of well-trained accounting professionals boasting years of expertise in different industries, you will have access to quality accounts payable, accounts receivable, payroll, and overall accounting and bookkeeping services. Do not wait any longer to start seeing the results of a more efficient financial system. Contact us today and get on the path to success!

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.