Table of Content

Share This Article

- Reading Time: 6 Minutes

- Published: November 27, 2023

- Last Updated: March 5, 2025

In the realm of modern business operations, efficiency is paramount, and nowhere is this more evident than in the critical task of handling vendor invoices within accounts payable (AP). For far too long, businesses have grappled with the inefficiencies and pitfalls of manually processing vendor invoices. The time-consuming processes, the risk of human error, and the exorbitant time and resources required have left many businesses yearning for a better way to manage these crucial financial documents. Enter accounts payable automation, a technological marvel that promises to revolutionise the way businesses handle their vendor invoices within the accounts payable process. It is the beacon of hope that can rescue businesses from the clutches of labour-intensive tasks, liberating resources and driving unmatched accuracy. Join us as we navigate this transformative shift, unlocking the secrets of automation and discovering how it can empower your business to thrive when it comes to processing vendor invoices within the accounts payable department.

What is Automated Invoice Processing?

Automated invoice processing in accounts payable is a technology-driven solution that streamlines and accelerates the handling of vendor invoices. It replaces manual, time-consuming tasks with software and artificial intelligence, enabling invoices to be captured, verified, and approved with unprecedented efficiency and accuracy. This innovation revolutionises the way businesses manage their financial transactions, saving time and resources while reducing the risk of errors.

Costs Involved: Manual VS Automated

When transitioning from manual to automated invoice processing, it is essential to compare the cost dynamics of both options. As per the sources, the costs of manual invoice processing can range from £4 to £25 per invoice—a noteworthy financial burden. However, the intriguing aspect lies in the advent of automation, where costs can be as low as £1 per invoice. This way, accounts payable automation makes a substantial difference by slashing labour expenses while enhancing precision and operational efficiency. Nevertheless, numerous businesses have yet to realise these advantages. If your business is among them, let us delve into the specifics of how automation of vendor invoices actually works.

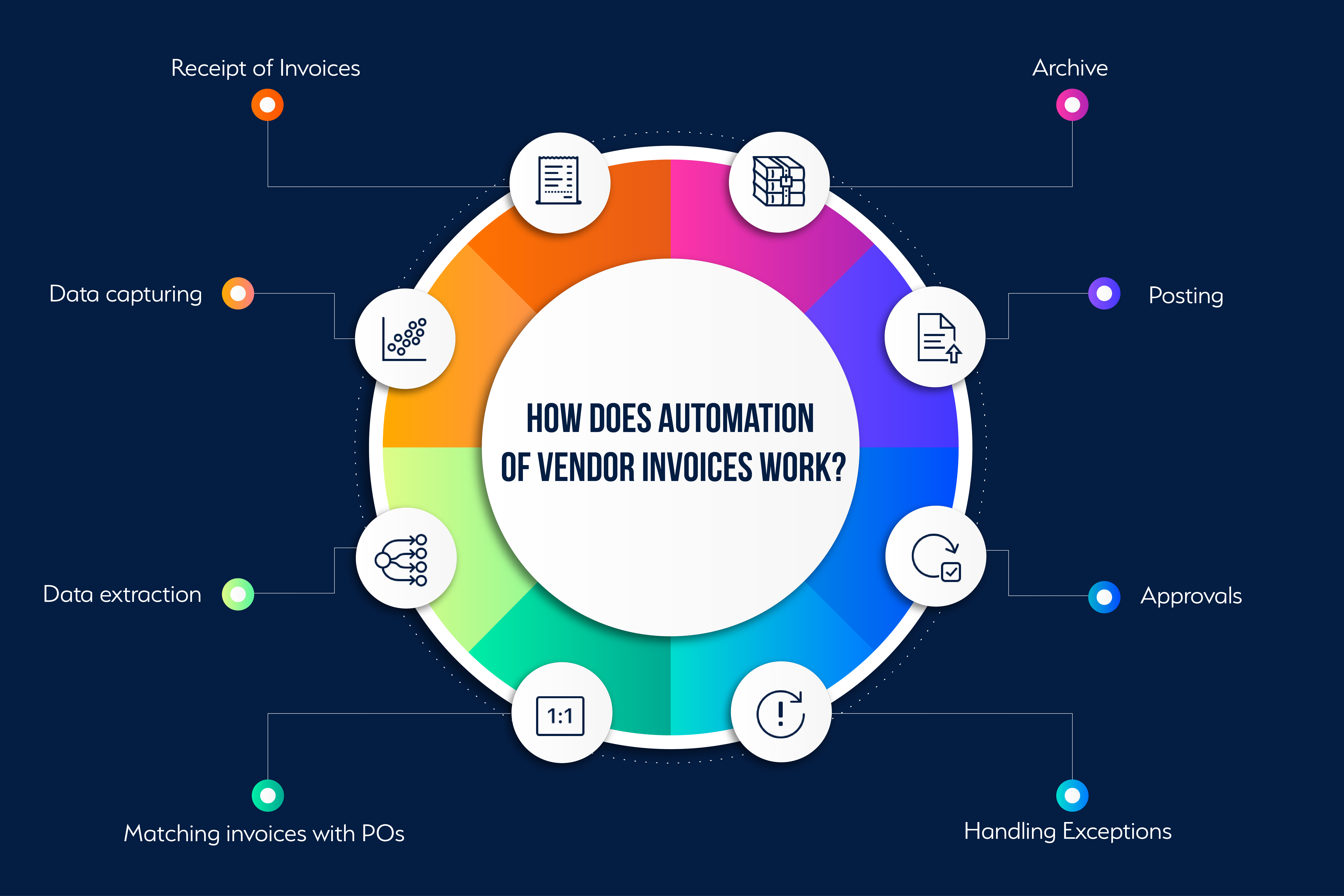

How Does Automation of Vendor Invoices Work?

-

Receipt of Invoices:

Invoices arrive through various means, including email, fax, or electronic data interchange (EDI). In this initial process, the emphasis is placed on digitising invoices for streamlined processing.

-

Data Capture:

Invoices, whether paper or digital, are captured electronically, often through scanning or direct upload. Advanced technologies like Optical Character Recognition (OCR) are employed to extract essential textual and numerical information from invoices.

-

Data Extraction:

The extracted data encompasses critical invoice details such as the invoice number, date, vendor information, line items, and amounts. This data undergoes validation against predefined templates or rules to ensure its accuracy.

-

Matching:

In the next step, the invoices are rigorously compared to associated purchase orders (POs) and receiving reports. The aim is to confirm that the invoiced items and quantities align precisely with what was initially ordered and received.

-

Exceptions Handling:

Inevitably, discrepancies may arise, such as pricing discrepancies or missing documentation. An automated accounts payable system helps to route these exceptions to designated personnel for prompt resolution. Invoices with issues may be sent back to vendors, along with explanations for rejection.

-

Approvals:

Once invoices successfully navigate matching and exception handling, they enter an automated approval workflow. After that, the authorised personnel review these invoices electronically, granting approvals or rejections based on predefined criteria.

-

Posting:

Approved invoices move seamlessly into the accounting software used by businesses. Accounting software helps update financial records, accounts payable ledgers, and general ledgers, ensuring accurate and up-to-date financial data.

-

Archive:

The automation system digitally archives invoices along with the associated documentation and audit trails. This serves both compliance and record-keeping purposes, making it easy to retrieve invoices for audits or historical reference, all while reducing the reliance on paper records.

Benefits Of Automating Vendor Invoices

-

Reduces Invoice Processing Times:

Automation helps streamline the entire invoicing process, significantly reducing the time it takes to handle invoices. This leads to faster approval payment and helps maintain a positive cash flow balance in your business.

-

Reduces Invoice Processing Errors:

Automation minimises manual errors in data entry and calculations. With automated invoice processing, businesses can validate data, reducing the risk of errors in invoices and financial records.

-

Increases Control and Transparency:

Automation provides real-time visibility into the invoice lifecycle. Businesses can track invoices, approvals, and payment status easily, enhancing control and transparency in financial operations.

-

Ensures Compliance:

Staying compliant with the relevant regulations is one of the major accounts payable challenges businesses face. Automated systems help resolve this issue by ensuring compliance with internal policies and external regulations. This reduces the risk of non-compliance issues, penalties, and legal disputes.

-

Improves Employee Productivity:

By automating repetitive tasks like data entry and invoice routing, employees can focus on more strategic activities. This helps boost their overall productivity and allows them to contribute more value to the business.

Challenges Encountered by Businesses in Automating Vendor Invoices

-

Data Extraction and Accuracy:

Automated systems rely on accurate data extraction from invoices, which can be challenging due to varying formats and layouts. Ensuring the accuracy of extracted data is crucial to avoid errors in processing and payment. Achieving this involves consulting knowledgeable professionals proficient in automated tools. For this, businesses often turn to experts like outsourced accounting and bookkeeping services providers. These professionals help you navigate through the complexities of the accounts payable process, thereby ensuring accuracy and precision in your records.

-

Invoice Variability and Complexity:

Invoices can come in diverse formats, making it necessary for automated systems to handle different structures and layouts. Dealing with complex invoices, such as those with multiple line items or discounts, requires sophisticated software capabilities.

-

Invoice Exceptions and Discrepancies:

Automated systems may encounter exceptions or discrepancies in invoices that require the manual intervention of experts. Handling these exceptions with the assistance of experts like accounting and bookkeeping services provider help ensure a smooth invoice processing workflow.

-

Security and Data Privacy:

The implementation of automated vendor invoices involves handling sensitive financial information. Maintaining robust security measures to protect data from unauthorised access or breaches is vital to safeguard business and supplier information. Trustworthy professionals, particularly outsourced experts equipped with advanced security measures, can reliably protect your confidential financial information.

Closing Remarks

In conclusion, the transition from manual to automated vendor invoices presents a transformative shift in streamlining and optimising financial processes. The implementation of automation not only reduces human errors and inefficiencies but also enhances accuracy, speed, and cost-effectiveness. By embracing automation in accounts payable, businesses can unlock new levels of productivity, efficiency, and, ultimately, success in managing their vendor invoices. With automation leading the way, businesses can now focus on higher-value tasks, foster better vendor relationships, and secure a more sustainable future for their financial operations.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.