Table of Content

Share This Article

- Reading Time: 17 Minutes

- Published: April 4, 2024

- Last Updated: February 7, 2025

Starting an online business was once a dreadful task for business owners, but now it is no more. With the increasing developments in the technological arena, business owners who once wondered about starting their own ecommerce business are now operating their online stores with ease. However, this dream come true can quickly become a nightmare if they find their financials in a bad position. No matter the type of business, an effective accounting system is crucial to forming a solid financial base. Especially for online stores, ecommerce accounting is a critical task that should not be overlooked. This guide is the perfect starting point to avoid all the common pitfalls related to e-commerce accounting. Let us dig deeper to discover more that can help master your ecommerce business accounting.

What is Ecommerce Accounting?

Ecommerce accounting is the systematic process of recording, organising, interpreting and communicating the financial transactions that occur in an ecommerce business. This involves recording sales, expenses, inventory, taxes and other crucial data specific to the ecommerce business. The main objective of e-commerce accounting is to provide an accurate and clear picture of your business’s financial health, enabling informed decision-making and compliance with the relevant tax regulations. However, even after holding such immense importance, business owners often forget to pay extra attention towards their ecommerce accounting. This results in increased financial discrepancies, poor cash flow management, incorrect tax filings and many more issues that could jeopardise the financial health and sustainability of their business.

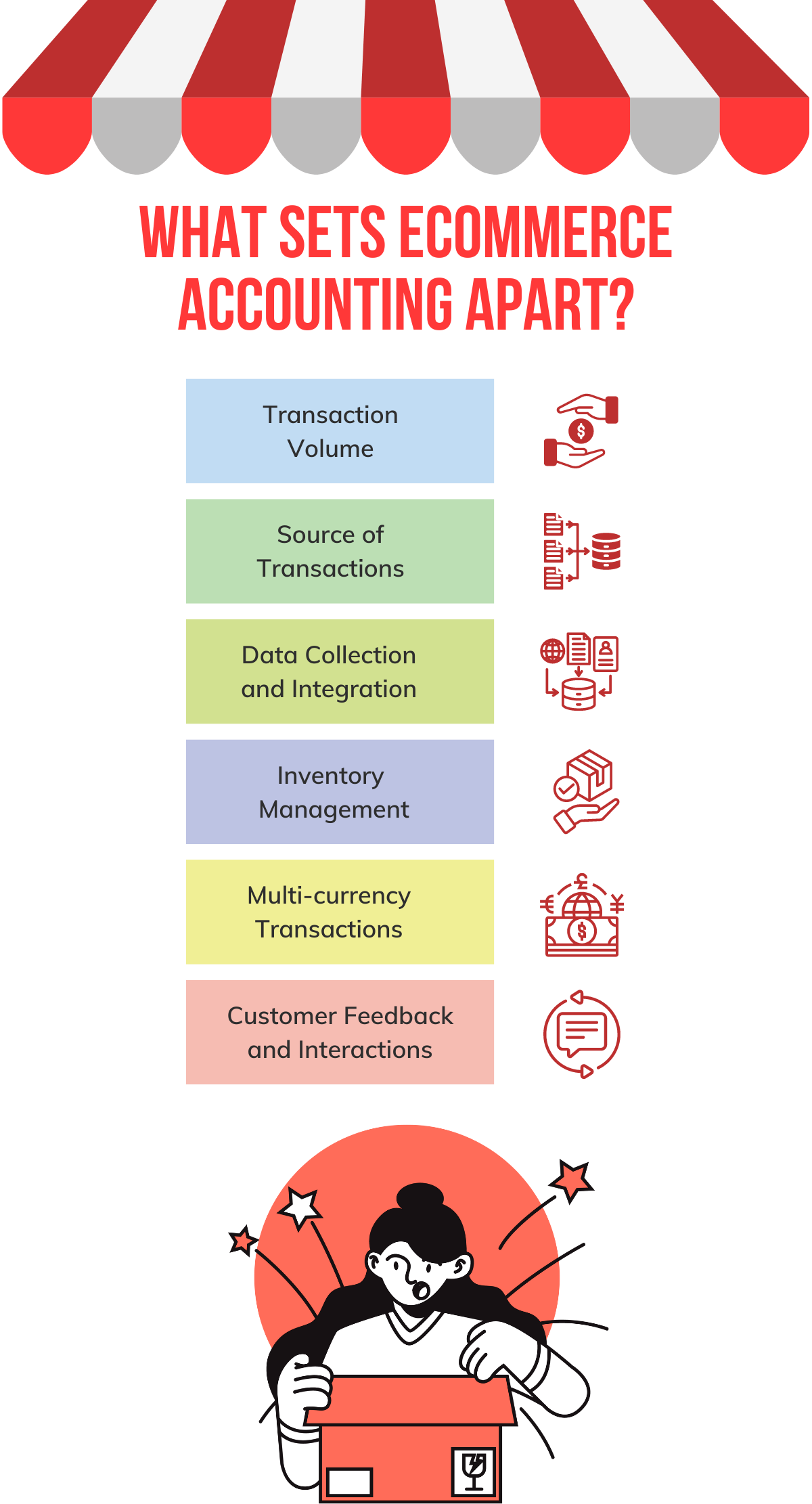

What Sets Ecommerce Accounting Apart?

Normal business accounting is one thing, but e-commerce business accounting is slightly different. Though the fundamentals remain the same, there are certain differences that every e-commerce business owner should be aware of. Here are the top four distinctions that set ecommerce accounting apart.

-

Transaction Volume:

Ecommerce businesses typically encounter a greater volume of transactions compared to traditional brick-and-mortar stores. This high frequency requires robust ecommerce accounting systems to track sales, refunds, and other financial activities accurately.

-

Source of Transactions:

In ecommerce, transactions can originate from multiple channels, such as online marketplaces, social media platforms, and the business’s own website. This diversity requires a more complex accounting approach to consolidate and reconcile transactions from various sources.

-

Data Collection and Integration:

Ecommerce businesses rely heavily on digital tools and platforms for operations. Integrating data from different sources (e.g., payment gateways, shopping carts, and accounting software) is crucial for accurate financial reporting and analysis.

-

Inventory Management:

Ecommerce inventory management involves tracking stock levels, sales, and order fulfilment across multiple channels and warehouses. This requires sophisticated inventory accounting systems to ensure accurate cost of goods sold (COGS) and profit margins in e-commerce accounting.

-

Multi-currency Transactions:

Many ecommerce businesses operate globally, dealing with transactions in multiple currencies. Accounting for these transactions requires conversion to the business’s base currency and managing exchange rate fluctuations.

-

Customer Feedback and Interactions:

Ecommerce businesses often gather customer feedback and interact with customers through digital channels. While not directly related to ecommerce accounting, this feedback can impact financial decisions, such as product pricing and marketing expenses.

Ecommerce Accounting Vs. Ecommerce Bookkeeping

Business owners often get confused between these two terms: “ecommerce bookkeeping and ecommerce accounting”. The main difference between the two lies in their usage. An ecommerce bookkeeper records the financial transactions of a business, whereas an ecommerce accountant does the job of analysing and interpreting that data to ensure accurate reconciliation and precise record-keeping.

Methods of Doing E-commerce Accounting

-

Cash Basis Accounting:

This method is straightforward and records transactions only when cash is received or paid. It is suitable for small ecommerce businesses with straightforward transactions. A professional like an ecommerce accountant or bookkeeper using this method recognises income when received and expenses when paid.

-

Accrual Basis Accounting:

This method records transactions when they are incurred, regardless of when cash is exchanged. It provides a more accurate picture of an ecommerce business’s financial performance and position, making it suitable for larger e-commerce businesses with more complex transactions. In Accrual basis ecommerce accounting, income is recognised when earned, and expenses are recognised when incurred.

-

Hybrid Accounting:

This method combines elements of both cash and accrual accounting. It allows ecommerce businesses to use accrual accounting for long-term items and cash accounting for short-term items. For example, an ecommerce business might use accrual accounting for inventory and long-term liabilities but use cash accounting for day-to-day expenses and revenue. The hybrid ecommerce business accounting method provides flexibility and can be tailored to meet the specific needs of the business.

How to Get Started with E-commerce Accounting?

-

Establish a Streamlined Accounting Workflow:

Begin by creating a systematic workflow for your ecommerce accounting process. This should include automating data entry, setting up regular review processes, and defining the procedures for recording and reconciling transactions. An efficient workflow is essential for maintaining accurate financial records and saving time.

-

Choose the Right Accounting Method:

Decide between the cash basis and accrual basis accounting methods. Cash basis accounting records transactions when money changes hands, while accrual basis accounting records transactions when they occur, regardless of when payment is received or made. To choose the right accounting method for your business, consult professionals like ecommerce accountants and bookkeepers.

-

Open a Separate Business Bank Account:

Keep your personal and business finances separate by opening a dedicated bank account for your ecommerce business. This simplifies tracking income and expenses and ensures accurate financial reporting.

-

Select Appropriate Accounting Software:

Opt for accounting software that seamlessly integrates with your ecommerce platform and payment processors. This enables automatic recording of sales, expenses, and inventory transactions. Popular choices in the UK include QuickBooks, Xero, and Sage. Consulting with an experienced ecommerce accountant can help you choose the right accounting software tailored to your business needs and budget.

-

Record Your Income and Expenses:

Meticulously track all business transactions, categorising each one accurately to streamline tax filing and financial analysis.

-

Manage Your Inventory:

Maintain accurate inventory management records, including the cost of goods sold (COGS), to gauge your business’s gross profit and financial health.

-

Understand VAT Obligations:

Determine your responsibilities regarding Value Added Tax (VAT) based on your sales volume and where you sell and store products. Ensure your ecommerce platform is set up to collect the correct VAT amounts and that you regularly remit these taxes to HM Revenue and Customs (HMRC).

-

Regularly Reconcile Your Accounts:

Consistently compare your ecommerce accounting records with bank and credit card statements to ensure accuracy and identify any discrepancies.

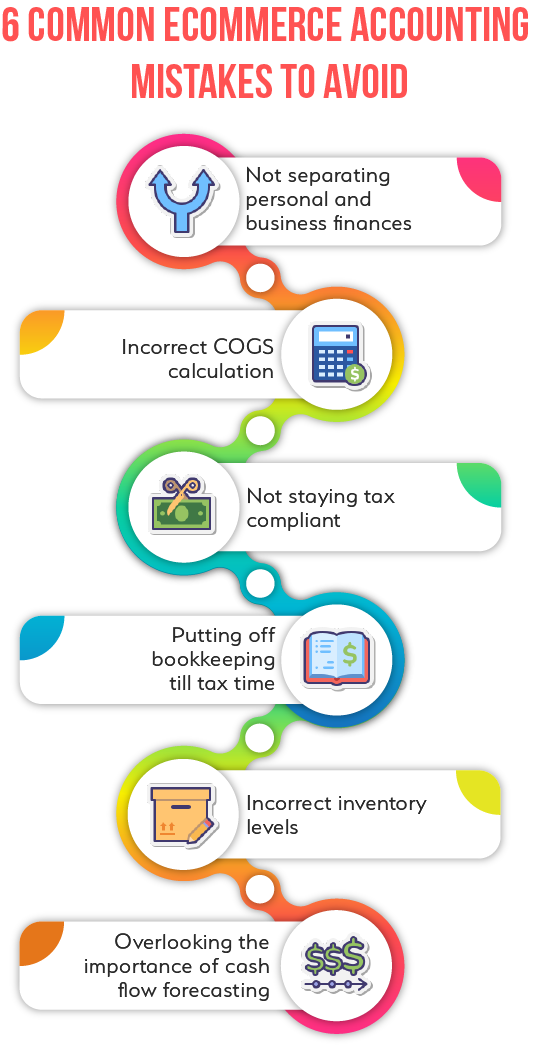

6 Common Ecommerce Accounting Mistakes to Avoid

-

Not Separating Personal and Business Finances:

Mixing personal and business finances can create a tangled mess that is hard to unravel come tax time. Additionally, it can lead to inaccurate financial reporting and difficulties in tracking business performance.

-

Incorrect Calculation of Cost of Goods Sold (COGS):

COGS is a critical metric for ecommerce businesses as it directly impacts gross profit. An incorrect calculation can result from failing to include all direct costs associated with the production or acquisition of the goods sold, leading to inaccurate profit margins.

-

Not Staying Tax-Compliant:

Ecommerce businesses often have to deal with complex tax regulations, including tax collection and remittance across different jurisdictions. Failing to stay on top of these obligations can lead to penalties and legal issues.

-

Putting Off Bookkeeping Until Tax Time:

Procrastinating on bookkeeping can result in a rushed and often inaccurate financial picture at the end of the fiscal year. Regular and accurate bookkeeping ensures that financial records are up-to-date, aiding in better decision-making.

-

Incorrect Inventory Levels:

For ecommerce businesses, managing inventory levels is crucial. Overestimating can lead to excess stock and increased holding costs, while underestimating can result in stockouts and lost sales. Accurate inventory tracking by an ecommerce accountant helps maintain optimal stock levels.

-

Overlooking the Importance of Cash Flow Forecasting:

Cash flow forecasting is vital in ecommerce business accounting to ensure they you have enough liquidity to meet your obligations. It involves predicting future cash inflows and outflows to avoid potential cash shortages. Effective cash flow management by an ecommerce accountant can help businesses plan for growth, manage expenses, and navigate through periods of uncertainty.

Why is Cash Flow Forecasting Important for Ecommerce Businesses?

-

Navigating Volatility:

Ecommerce markets can be highly volatile, with rapid changes in consumer demand and competition. A cash flow forecast helps ecommerce businesses anticipate fluctuations and adjust their strategies accordingly.

-

Inventory Management:

Efficient inventory management is crucial for ecommerce businesses. Effective cash flow forecasting aids in planning for inventory purchases, avoiding stockouts or excess inventory, and optimising storage costs, all integral parts of the ecommerce accounting process.

-

Marketing Budgeting:

A cash flow forecast allows ecommerce businesses to allocate funds effectively for marketing campaigns, ensuring that they can maintain visibility and attract customers without jeopardising their financial stability.

-

Operational Planning:

Cash flow forecasting aids in planning day-to-day operations, such as staffing, logistics, and customer service. It ensures that the business has the necessary funds to operate smoothly and efficiently, highlighting the importance of a well-managed ecommerce accounting process.

How to Create a Cash Flow Forecast?

-

Decide How Far You Want to Plan Out:

Determine the time frame for your cash flow forecast. Depending on your e-commerce business needs and the level of detail you require, it could be monthly, quarterly, or annually.

-

List Your Expected Income:

Include all sources of income, such as sales revenue, returns on investments, and any other income streams. Be realistic and consider seasonal variations and market trends.

-

List Your Expected Outgoings:

Detail all expected expenses, including the cost of goods sold, marketing expenses, operational costs, salaries, and any other outgoings. Do not forget to account for variable costs that may fluctuate with sales volume.

-

Work Out Your Running Cash Flow:

Calculate your running cash flow by subtracting your total expected outgoings from your total expected income. This will give you an estimate of your net cash flow for each period in your forecast. To maintain its accuracy and relevance, regularly update your forecast based on actual performance and market changes.

Financial Reports that Every Ecommerce Business Should Track

-

Income Statement (Profit and Loss Statement):

The income statement summarises revenue, expenses, and net profit over a specific period. It highlights the business’s profitability and operational efficiency, aiding in decisions about pricing, budgeting, and strategic planning.

-

Balance Sheet:

The balance sheet provides a snapshot of the ecommerce business’s financial position, detailing assets, liabilities, and shareholders’ equity. It is crucial for assessing financial stability, liquidity, and solvency and informs investment, financing, and risk management decisions.

-

Cash Flow Statement:

This statement tracks cash inflows and outflows, divided into operating, investing, and financing activities. It is essential for managing liquidity, planning future cash needs, and making informed decisions about investing and financing.

-

Accounts Receivable Ageing Report:

This report categorises outstanding customer payments by age, helping e-commerce businesses prioritise collections, improve cash flow, and manage credit risk.

-

Inventory Turnover Report:

The inventory turnover report measures how often inventory is sold and replaced. It is key for managing stock levels, reducing holding costs, and ensuring timely product availability.

Top Strategies for Efficient Ecommerce Accounting

Ecommerce businesses operate in a dynamic and fast-paced environment, making efficient accounting practices essential for their success. Here are some top strategies for efficient ecommerce accounting:

-

Utilise Cloud-Based Accounting Software:

Choose a reputable cloud-based accounting software that integrates seamlessly with your ecommerce platform. This ensures real-time financial data syncing and accessibility from anywhere. Furthermore, it enhances your ecommerce accounting process by ensuring accurate and up-to-date financial information.

-

Automate Where Possible:

Streamline your ecommerce accounting process by automating repetitive tasks such as invoicing, expense tracking, and bank reconciliations. Automation reduces manual errors and frees up time for more strategic financial analysis.

-

Implement a Robust Inventory Management System:

Accurate inventory tracking is crucial for ecommerce businesses. Use a system that integrates with your accounting software to monitor stock levels, costs, and sales in real time.

-

Regularly Reconcile Accounts:

Regularly reconcile your bank accounts, credit cards, and payment gateways to ensure all transactions are accurately recorded and any discrepancies are quickly addressed.

-

Monitor Cash Flow Closely:

E-commerce businesses often experience fluctuating cash flow. Implement cash flow forecasting and regularly review your cash position to make informed decisions.

-

Stay on Top of Tax Compliance:

Ecommerce taxes can be complex due to different state and local tax laws. Consulting experienced professionals such as ecommerce accountants can help ensure compliance in this regard.

-

Use Analytics and KPIs:

Leverage analytics tools to track ecommerce KPIs such as gross margin, customer acquisition cost, and inventory turnover. These metrics provide insights into your financial health and areas for improvement.

-

Monitor Customer Returns and Chargebacks:

Customer returns and chargebacks can impact an ecommerce business’s revenue and profitability. Therefore, it is important to monitor these closely, analyse the reasons behind them, and implement strategies to reduce their occurrence.

-

Determine Break-Even Sales Figures:

The break-even point is the level of sales at which total revenues equal total expenses, resulting in neither profit nor loss. Ecommerce business owners should calculate their break-even point to understand how much they need to sell to cover their costs and to set sales targets.

-

Outsource Accounting Tasks:

Consider outsourcing certain ecommerce accounting functions to specialised firms or professionals. This can provide access to expert knowledge and allow you to focus on core business activities.

4 Best Accounting Software for E-commerce Businesses

-

QuickBooks Online:

QuickBooks is one of the best accounting software for ecommerce businesses in the UK due to its comprehensive features and integrations. It offers inventory management, sales tracking, and integrations with popular ecommerce platforms like Shopify, WooCommerce, and Amazon. QuickBooks Online also provides robust reporting and analytics tools to help track your financial performance.

-

Xero:

Xero is another excellent option for ecommerce businesses in the UK, known for its user-friendly interface and powerful features. It integrates with various ecommerce platforms and payment gateways, allowing for seamless transaction recording. Xero also offers inventory management, multi-currency support, and detailed financial reporting.

-

Zoho Books:

Zoho Books is another best accounting software for ecommerce businesses in the UK. It offers inventory management, automated workflows, and integration with popular ecommerce platforms. Zoho Books also provides advanced analytics and customisable reports to help you understand your e-commerce business’s financial health.

-

Sage Business Cloud Accounting:

Sage Business Cloud Accounting, previously known as Sage One, is a web-based accounting solution tailored for ecommerce businesses. It provides on-the-go access to crucial functions such as cash flow management and the ability to send and monitor invoices, all accessible via the cloud or a mobile app. This software is designed to streamline financial operations for online retailers, ensuring efficient management of their business essentials.

Top 5 E-commerce KPIs to Track

-

Gross Profit Margin:

This e-commerce KPI serves as a crucial indicator of a company’s financial health, reflecting the percentage of revenue that remains after the cost of goods sold (COGS) is subtracted. It provides valuable insights into the profitability of sales, guiding decisions related to pricing, product development, and cost management strategies.

-

Net Profit Margin:

This KPI offers a comprehensive view of a company’s profitability by showing the percentage of revenue that remains after all operating expenses, taxes, and interest payments have been deducted. It is instrumental in strategic planning, helping businesses identify areas for cost reduction and potential for increasing profitability.

-

Average Order Value (AOV):

This particular KPI helps track the average British pound amount spent each time a customer places an order over a defined period. By increasing the average order value, businesses can boost revenue without proportionately increasing marketing and acquisition costs.

-

Customer Lifetime Value (CLV):

This ecommerce KPI forecasts the total value generated by a customer over the entire duration of their relationship with a company. Businesses aiming to maximise CLV focus on enhancing customer experiences, improving product quality, and implementing loyalty programs to encourage repeat purchases.

-

Customer Acquisition Cost (CAC):

This KPI measures the total cost required to acquire a new customer, encompassing all marketing and sales expenses. Keeping CAC in balance with CLV is vital; the goal is to maximise the difference between the two to ensure sustainable growth. Businesses monitor CAC closely to optimise marketing spend and target the most effective channels for customer acquisition.

What is an Ecommerce Dashboard?

An ecommerce dashboard is a visual representation of key performance indicators (KPIs) and metrics that are crucial for tracking the health and success of an ecommerce business. It provides a centralised view of data related to sales, customer behaviour, inventory levels, website traffic, and other important aspects of the ecommerce operation. The main purpose of an ecommerce dashboard is to help business owners and managers make informed decisions by providing real-time insights into their online store’s performance. A well-designed ecommerce dashboard can highlight trends, identify areas for improvement, and enable quick responses to changes in the market or consumer behaviour.

How to Set up an Ecommerce Dashboard?

-

Identify Key Metrics:

Choose the most important ecommerce KPIs for your business, such as conversion rate, customer lifetime value and average order value.

-

Select a Dashboard Tool:

Choose a tool that integrates with your ecommerce platform and analytics tools.

-

Connect Data Sources:

Integrate your e-commerce dashboard with your ecommerce platform and analytics tools to pull in real-time data.

-

Design the Dashboard:

Organise your ecommerce dashboard with clear visualisations, grouping related metrics together for easy interpretation.

-

Set Up Alerts:

Configure alerts to notify you of significant changes in your key metrics.

-

Test and Refine:

Test your ecommerce dashboard for accuracy and refine it based on user feedback and your evolving business needs.

Role of an Ecommerce Accountant or Bookkeeper

In ecommerce, the role of an ecommerce accountant or bookkeeper is crucial for ensuring the financial health and compliance of the business. These professionals are responsible for maintaining accurate and up-to-date financial records and reconciling bank statements and payment gateways. Furthermore, they help handle inventory accounting, prepare financial reports, assist in budgeting and forecasting, and manage cash flow.

Moreover, ecommerce accountants and bookkeepers ensure tax compliance and provide strategic advice on financial management, cost reduction, and revenue optimisation. Their expertise is also vital in integrating platforms with the best accounting software for ecommerce sellers, thereby supporting the growth and profitability of the ecommerce business.

Is Outsourcing Your Ecommerce Accounting a Good Idea?

Outsourcing ecommerce accounting offers several advantages. It gives you access to specialised expertise and can be more economical than investing in a full-time in-house accounting team. It also allows business owners to devote more time to essential activities and growth strategies. Moreover, outsourcing firms can adjust their services to match your business’s growth and provide knowledge in advanced accounting software and technologies. Furthermore, outsourced e-commerce accountants and bookkeepers also play a vital role in ensuring compliance with tax laws and financial regulations.

How to Select the Right Outsourced Accounting Firm for Your Ecommerce Business?

Specialisation:

Look for accounting and bookkeeping services providers that specialise in ecommerce accounting, as they will understand the unique challenges and requirements of the industry.

-

Experience:

Check their experience with businesses similar in size and complexity to yours. Ask for references or case studies.

-

Technology:

Ensure that the potential ecommerce accounting firms use modern accounting software that can integrate with your ecommerce platform and other business tools.

-

Communication:

Good communication is crucial. Make sure that the outsourced accounting firm is responsive and can explain financial concepts clearly.

-

Security:

Inquire about their data security measures to safeguard your sensitive financial information.

-

Scalability:

Choose an outsourced accounting firm that can scale its services as your business grows.

-

Pricing:

Understand their fee structure and ensure it fits your budget. Be wary of hidden costs.

Wrapping Up

In conclusion, excelling in ecommerce accounting is not merely a requirement but also a strategic asset for any online business. By understanding the complexities of financial transactions, inventory management, and tax obligations, ecommerce entrepreneurs can make informed decisions that drive profitability and growth. Whether you choose to manage your finances in-house or outsource to a professional, the key is to stay organised, use the right software, and keep abreast of changing regulations. Remember, a solid accounting foundation is the bedrock of a successful ecommerce venture. Embrace the right accounting principles, and you will be well on your way to financial mastery in the digital marketplace.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.