Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: October 29, 2024

- Last Updated: February 6, 2025

An accountant plays an important role in maintaining the financial health of your business. Searching for an “accountant near me” means you have easy access to a professional who can provide sound financial advice to meet your business needs. However, finding the right accountant goes beyond proximity; there are tons of other factors. So how do you choose the perfect match for your business? This blog explores 10 key factors to consider when hiring an accountant, helping you make an informed decision that supports your business’s growth and success.

The Importance of Finding a Local Accountant

Do you understand why the keyword “accountant near me” is so popular? While having an in-house accountant can keep your finances organised, it comes with a hefty investment. However, outsourced accounting firms help you leverage the expertise of reliable professionals without incurring high costs. Additionally, finding an accountant locally means they are likely to be more well-versed with local tax regulations and other compliances. They are accessible for in-person appointments, benefiting small or medium business owners who want regular financial consultations.

10 Things to Consider Before Hiring an Accountant

Now that you know why you should consider searching “accountant near me”, let’s look at the 10 things that will help you as a virtual accountant guide in this quest:

1. Qualifications and Certifications

The first thing you should look for when searching “account near me” is the qualification of the professional. You need someone who has the right qualifications to perform accounting services in the UK. Qualification is an important aspect as it shows the professional you are looking for has the right knowledge to deal with the intricacies of the financial domain. Also, consider whether the accountant has an active license to practice accounting in particular locations.

2. Prioritize Data Security

After getting results for “accountant near me,” make sure that the services you choose provide strong data security safeguards in place. Your financial details are extremely sensitive, therefore securing them from breaches or unauthorized access is important. A reputable virtual accountant will use encryption, secure storage, and confidentiality agreements to protect your information. Confidentiality ensures that your financial information remains private, giving you peace of mind. Prioritizing security not only safeguards your assets but also fosters trust in your accounting collaboration.

3. Range of Services Offered

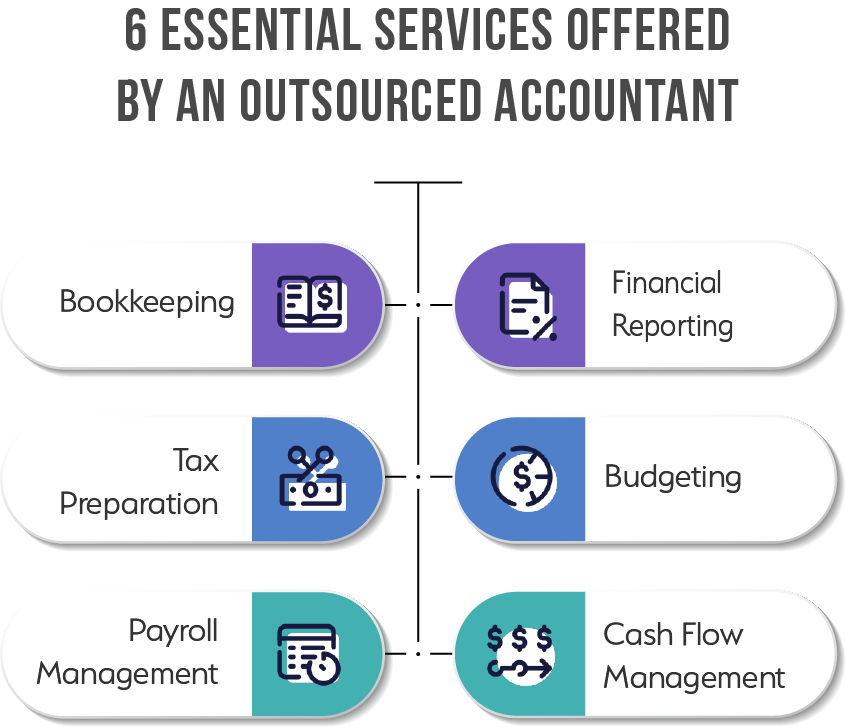

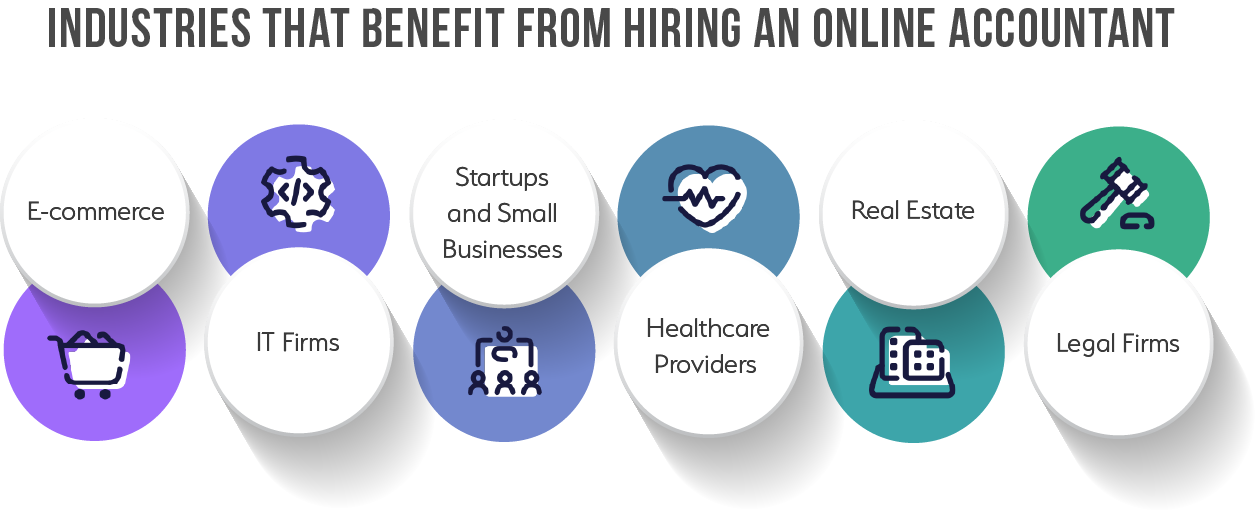

When searching for an “accountant near me,” consider the range of services they provide. Some outsourced virtual accountants only specialise in tax filing, while others provide comprehensive accounting services for small businesses, large and medium ones. These services include payroll management, bookkeeping, and financial forecasting. If you plan to scale your business in the near future, you may want an accountant who can scale your services accordingly. Additionally, with the rise of “offshore accounting,” some firms offer international accounting services, helping businesses manage finances globally.

4. Use of Accounting Technology

Technological development in the field of accounting has been tremendous. Modern accounting software like QuickBooks, Xero, or NetSuite can streamline your business’s finances. When looking for an “accountant near me,” ensure to look for the ones who are well-versed in using these tools. If you manage multiple locations or have remote staff, “offshore accounting” could be a more viable option. With services like real-time tracking and regular monitoring, these services can help in making your business more agile and responsive to changes.

5. Communication and Availability

When you hire an accountant, communication is key. You want someone who is responsive and available when you need them. Searching for “accountants close to me” or “local accountants for small business” ensures that the company has followed effective communication practices. Clear and timely communication ensures that any financial issues can be resolved quickly without impacting your business operations.

6. Fees and Pricing Structure

The cost of hiring an accountant is another important consideration. Fees can vary widely depending on the accountant’s experience, location, and the complexity of the services required. Some accountants charge a flat fee, while others work hourly. It’s essential to have a clear understanding of their pricing structure before you hire an accountant. Make sure you’re getting value for your money without any hidden fees. When you search “accountant near me” you are likely to get numerous results. Compare the prices, services, and value they offer before making the final decision.

7. Understanding of Local Tax Laws

The goal behind finding a reliable accountant near me should be to find someone who has expertise in UK-specific tax laws. You can further narrow your search by searching “accountants London” to find accountants who are more specialised in local tax laws and VAT compliance. An accountant having proper knowledge of taxes will ensure that your business remains compliant. Additionally, this expertise can help you save money through tax deductions and credits you might not be aware of.

8. Offshore Accounting Expertise

With more businesses expanding globally, offshore accounting services have become more popular. Finding an offshore accountant with expertise can be a game-changer if your business operates internationally or plans to do so. Offshore accounting helps you manage finances across different countries, handle foreign currencies, and comply with international tax laws. When searching for an “accountant near me,” it’s worth considering whether they offer offshore services or have partnerships with international firms.

9. Reputation and Reviews

Another important consideration when searching for an accountant near me is reputation. Look for reviews and testimonials of the service provider in your area. Checking online reviews on platforms like Google or Trustpilot can give you a sense of their reliability, professionalism, and client satisfaction. Additionally, word of mouth is powerful—ask other small business owners for recommendations on local accountants for small businesses who have a solid reputation.

10. Flexibility and Adaptability

The financial landscape is always evolving, and your business needs an accountant to adapt. Whether it’s new tax laws, changes in industry standards, or economic shifts, an accountant should proactively adjust your financial strategy. Flexibility is especially important for small businesses, as they often experience rapid growth or change periods. Finding an “accountant for small business near me” who can grow with your company is a significant advantage.

Additional Considerations: Should You Hire Offshore Accounting Services?

In some cases, you may not need a local accountant at all. If your business operates globally, “offshore accounting” might be a more practical option. Offshore accounting allows you to handle international transactions and comply with the tax laws of multiple countries. However, it’s important to weigh the pros and cons of this option carefully. While offshore accounting can sometimes save money, it may also complicate your financial processes. Discuss this option with your accountant and evaluate whether it fits your business needs.

Should You Prioritise Cost or Quality When Hiring an Accountant?

When searching for an accountant near me, one of the biggest deciding factors is the cost consideration. While choosing an accountant based on their fees may be tempting, it’s essential to consider the long-term benefits of hiring a qualified and experienced professional who can deliver quality service.

Low-cost accountants may seem attractive to small businesses operating on tight budgets, but they might not provide your business’s comprehensive services or industry-specific expertise. A cheaper accountant could also lack experience with complex matters accounting or tax strategies related to your sector. This could result in costly mistakes or missed opportunities for financial optimisation.

On the other hand, investing in a high-quality accountant may initially seem expensive, but it often pays off in the long run. Quality accountants can help you save money through effective tax planning, ensure compliance with evolving regulations, and provide insights that foster business growth. They are also more likely to offer personalised services that align with your business goals.

Ultimately, the decision should not just be about finding the cheapest “accountant near me” but striking a balance between affordability and the value of the services offered.

Conclusion

Choosing the right “accountant near me” is a critical decision that can have long-term impacts on one’s business’s success. If you need a bookkeeper and accountant for your business for face-to-face meetings, a specialist in “offshore accounting”, these 10 considerations will help you make the right choice. Remember, the right accountant does more than balance your books—they are a trusted partner in your business’s financial health and growth.

Whiz Consulting’s skilled accountants will help you secure the financial future of your organisation. Whether you’re searching for accountants London or any other area in the United Kingdom, we’ll help you make the best decision. Contact us now to get started!

Get customized plan that supports your growth

Have questions in mind? Find answers here...

When hiring an accountant, consider their qualifications, experience, and the services they offer. Knowing if they specialise in small businesses or specific industries relevant to your business is important. You should also inquire about their fees, billing methods, and how they stay updated on tax laws. Lastly, confirm their approach to communication and how often they will provide updates. This ensures they can meet your needs efficiently.

In addition to tax preparation, accountants can handle bookkeeping, payroll, financial forecasting, and cash flow management. Some accountants also offer strategic business advice, including guidance on tax-saving strategies, expense management, and financial planning for growth. If you operate internationally, you might want to inquire about their proficiency in handling offshore accounting to manage global finances.

The cost of hiring an accountant can vary widely based on their experience, location, and the complexity of the services required. Some charge a flat rate for services like tax filing, while others may bill by the hour or offer a monthly retainer. Discussing and understanding the fee structure upfront is crucial to avoid unexpected charges. Small businesses can often find cost-effective solutions by working with accountants who offer tailored packages for bookkeeping and financial services.

It’s beneficial to hire an accountant at key stages in your business, such as when starting a new business, expanding operations, or dealing with complex tax filings. An accountant can also help when applying for business loans, managing payroll for growing teams, or navigating audits. Their expertise can be invaluable for ensuring compliance with tax regulations and maximising deductions, which is essential for long-term business growth.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.