Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: February 27, 2023

- Last Updated: March 5, 2025

Managing your accounting and bookkeeping can be a daunting task. Several aspects of these tasks are time-consuming and also confusing at times. Every business handles its accounting duties differently, so no standard way will work best for everyone. But with the help of automation, it is possible to streamline your daily accounting tasks in such a way that it becomes simple and easy to manage with little effort on your part. Whether you hire an in-house team or choose an outsourced accounting service, automation helps bypass human error by eliminating repetitive or monotonous activities. Automation can be used for storing, retrieving, and processing data resulting in an organisation saving on costs associated with hiring in-house staff. It can save us time and money and make our jobs easier. But there are a few things to remember when automating our accounting tasks. In this blog, we will highlight 4 ways to automate your recurring accounting tasks. But first, let us understand a little more about accounting automation and its relevance.

What is Meant by Automation?

For the last several years, artificial intelligence has been growing rapidly. This innovation has led to the development of software that can perform repetitive tasks. In most businesses, accounting requirements are usually the same from month to month, and completing these tasks can be time-consuming. However, with the help of technology, it is possible to automate this task to free up time for more important tasks. Automation is a technology that automates a repetitive task or process to save human intervention time. It allows us to automate recurring accounting tasks and business functions that humans previously did. Automating individual processes or business functions can increase efficiency, reduce costs, and improve customer service. Since recurring accounting tasks are one of the important business functions, it is beneficial to automate such tasks. But first, let us understand what exactly is a recurring accounting task.

What Are Recurring Accounting Tasks?

Recurring accounting tasks are the tasks that are needed to be performed on a regular basis. Such tasks are important for keeping your business finances in order. These tasks include bookkeeping, invoicing, reconciliation, preparing financial statements, and more. By staying on top of these tasks, you can ensure that your books are accurate and up-to-date. This will give you a better understanding of your financial situation and help you make better decisions for your business.

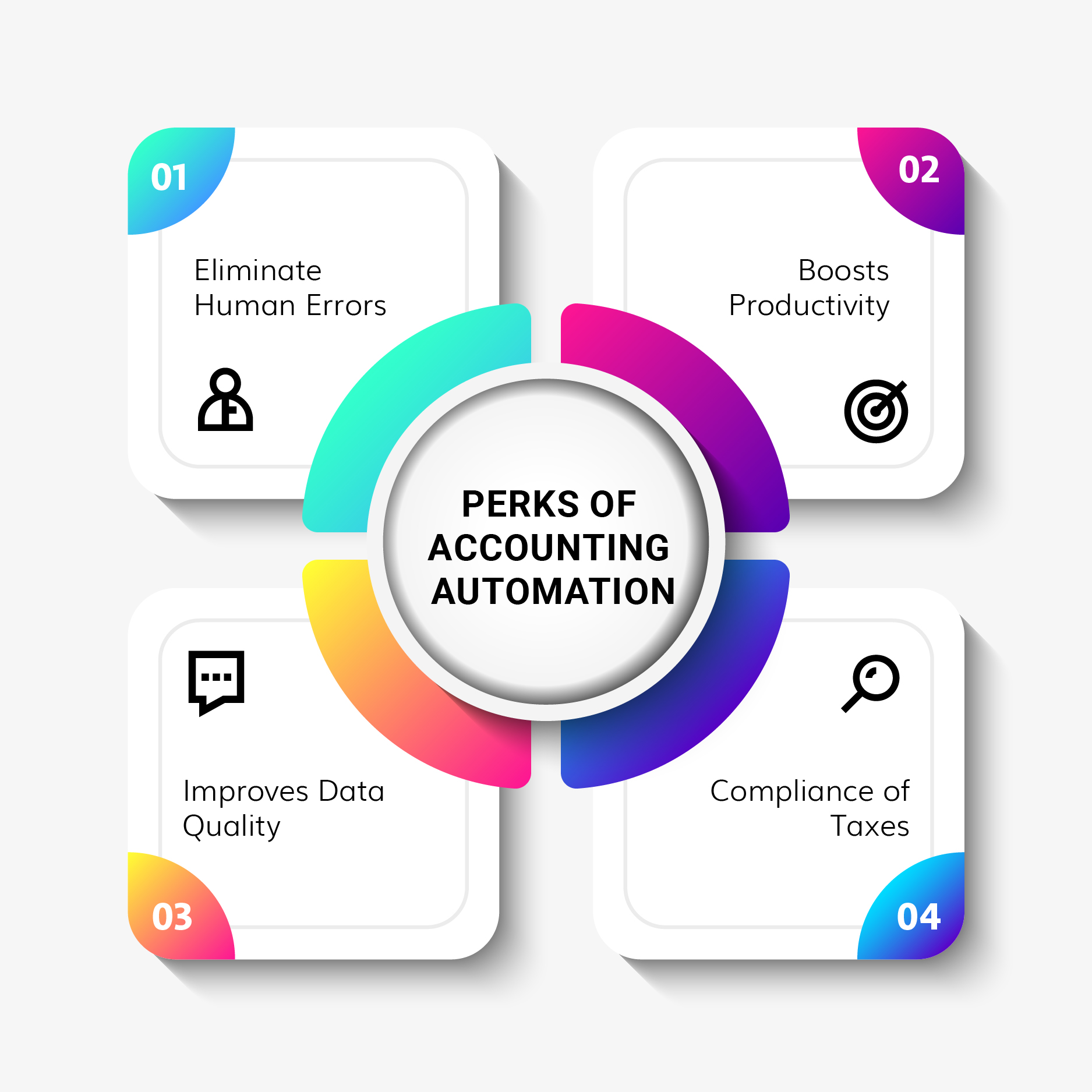

While some of these tasks can be performed manually, using accounting software or online accounting services is often more efficient. This can help to save time, reduce costs, improve consistency, etc. But is it only this much, or does automation provide more? Why has it become the major point of focus for emerging businesses? Well, it is because of its capability to provide impressive advantages. So, let us highlight some of the perks of accounting automation.

- Eliminate human errors- Keeping track of documents, invoices, and other business records is extremely crucial for organisations. Every business needs accurate and reliable data to ensure a streamlined bookkeeping and accounting system. Still, some businesses rely on paper-based records and follow traditional techniques. This leads to more manual mistakes and discrepancies and ultimately affects the organisation. However, choosing automation for such tasks will help to prevent human errors. Since automation does not mess up as easily as humans do, you will have reliable, tested records and efficient workflows as opposed to traditional methods. As a business owner, you can maximise automation’s benefits by hiring outsourced accounting service providers who are experts in implementing accounting automation for businesses.

- Boosts productivity- With the help of automation, you tap into the latest accounting technologies, which helps to enhance your productivity and achieve great returns. Adopting automation speeds up the accounting process, and as a result, business owners get more time and resources to devote to other crucial tasks. Therefore, automation is an essential tool to foster business growth.

- Improves data quality- To understand how accounting automation improves data quality, first, consider how much manual labor is involved in manual bookkeeping and accounting. In-house accounting personnel spends hours each month manually entering data into various systems and matching up transactions made on paper checks compared to electronic ones. The process can be time-consuming and prone to human error, especially when reconciling accounts with bank statements or other third-party vendors. Using automated methods like accounting software assists in eliminating these issues by automating both data entry and reconciliation processes resulting in enhanced data quality. Business owners can also consider outsourcing finance and accounting services to ensure more accuracy and gain access to expertise.

- Compliance of taxes- Tax preparation and filing can be time-consuming, especially for small business owners, but it does not have to be. Accounting software like Xero, QuickBooks, and FreshBooks handle tax preparation for you, including data extraction and return submission. On the other hand, you can also hire an outsourced accounting service to reap the maximum benefit from automation. Keeping all of your financial data in one place makes it much easier to find the information you need for tax filings—plus, you will have the peace of mind that what you are pulling is correct and up to date.

With the above-stated points, it is clear that adopting automation is a great help. Whether you use automation for non-recurring or recurring activities, it shapes your overall business better. Here are 4 tips to bring automation to your recurring accounting activities:

- Fully digital- Going completely digital can help you reap the benefits of automated accounting. Instead of dealing with paper receipts and invoices, try storing them digitally. If you already have them on paper, scan them to access them from your computer or other smart devices (some accounting software will have an in-built function for doing just that). As a result, your accounting software will help to compile and collate all the documents for you and even record them directly on your ledgers.

- Tracking taxes- When accounting systems are inefficient, noncompliance is more likely to occur, leading to fines and penalties, later costing your company money. Business owners can approach automation by tracking taxes and compliance. They can begin by using automated solutions to automatically deduct and calculate VAT with each order or purchase made by their business. The other way is to use automation to keep invoices and documents organised and facilitate the preparation of annual reports and tax returns.

- Systematize your workflows- In order to approach automation, you must establish a standardised workflow for your organisation. It is crucial because it helps you determine which accounting part will require automation and what automation will be needed.

- Leveraging data and reporting- Being a business owner, you might have a lot of data in your accounting process. Such huge amounts of data gathering can become tedious and time-consuming as previous financial transactions are equally relevant to businesses. So, it is better to approach automation tools to gather and analyse the relevant data. The automated solutions help to convert raw data into easy-to-understand reporting formats. As a result, getting insights regarding your business finances becomes quite simple. With the help of automated solutions, you can track your financial data and transform them into information that will be critical for decision-making. In addition, business owners can generate weekly and monthly reports to know about business performance. This way, they get more solid numbers which can become helpful in cash flow optimisation. However, many businesses still feel stuck or confused regarding how much cash balance they should maintain; if you are one of them, you can check out our blog about “Healthy cash balance, which a business should maintain.”

Conclusion

Now that you have figured out how to automate your accounting process, the next step is finding the best software. As a business owner, you should always consider what your company requires rather than what looks good on paper. Accounting software like Xero, QuickBooks, and FreshBooks provides you with the right automation tools you need to run a self-sufficient and efficient accounting process. They also digitise your process, making it more accessible and flexible. However, business owners are often preoccupied with other crucial organisational matters. Due to this, they have less time and energy to devote to finding, comparing, and selecting reliable accounting software. In such cases, they can hire outsourced accounting services from skilled professionals and accounting experts. The reason is that outsourcing companies employ skilled professionals with hands-on experience and knowledge about the latest accounting tools and technologies. In a nutshell, you can save your finance team a lot of time and stress by outsourcing bookkeeping and accounting services like accounts payable, invoicing and accounts receivable, tax compliance, payroll, and expense management. Contributing to the accuracy and consistency of the financial data of your business.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.