Table of Content

Share This Article

- Reading Time: 12 Minutes

- Published: August 22, 2024

- Last Updated: February 13, 2025

In the ever-evolving world of business, maintaining accurate and efficient financial records is not just a necessity; it is the backbone of your enterprise. Imagine steering your business ship through turbulent waters without a reliable compass – that is what operating without a robust bookkeeping process feels like. Whether you are a burgeoning startup finding its footing or a seasoned entrepreneur scaling new heights, a solid bookkeeping system is your secret weapon for success. Here, we will uncover the secrets to build an efficient bookkeeping process, diving deep into the meaning of bookkeeping, types of bookkeeping, the importance of bookkeeping, the steps involved, the duties of bookkeeper, and many more. We will also explore the pivotal role that professional bookkeeping services play in this equation.

Get ready to embark on a transformative journey that will completely change the way you manage your bookkeeping!

What is Bookkeeping?

Bookkeeping, often facilitated through professional bookkeeping services, is the systematic recording, organising, and tracking of financial transactions in a business. It is the bedrock of your business’s accounting process, providing the crucial data needed to create financial statements, manage cash flow, and formulate informed business decisions.

Types of Bookkeeping

The two types of bookkeeping systems are single-entry and double-entry bookkeeping. Understanding these systems will help you choose the one that best suits your business needs, whether you opt for in-house solutions or outsourced bookkeeping services.

Single Entry

Single-entry bookkeeping is a straightforward method suitable for small businesses with simple financial transactions. In this system, each transaction is recorded only once, either as income or expense, in a single ledger. This method resembles a chequebook register where you list receipts and expenditures as they occur. While single-entry bookkeeping is easier to maintain and requires less technical expertise, it offers limited insight into your financial position, making it less ideal for businesses with more complex financial activities.

Double Entry

Double-entry bookkeeping is a more sophisticated and accurate method of recording financial transactions. In this system, every transaction affects at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced. This dual recording provides a complete picture of your financial health and helps in detecting errors and fraud. Double-entry bookkeeping is essential for businesses that need comprehensive financial reports and are looking to scale their operations. Leveraging robust bookkeeping and accounting services can streamline this process, providing expert oversight and ensuring compliance with financial regulations.

Why Does Bookkeeping Matter?

-

Clear Insight into Financial Health

Bookkeeping offers a transparent view of your financial health by tracking the sources of your income and how your money is being spent. This insight is crucial for formulating informed business decisions, managing cash flow, and identifying areas for cost savings. Effective bookkeeping and accounting practices help you stay on top of your finances and ensure long-term business success.

-

Essential for Accurate Tax Filing

Accurate bookkeeping is crucial when it comes to filing your taxes. By maintaining organised financial records, you ensure that all income, expenses, and deductions are accurately reported. This not only helps you comply with tax laws but also prevents you from facing penalties or audits. Leveraging bookkeeping services from experienced service providers can make tax preparation more straightforward and less stressful.

-

Crucial for Securing Loans

When seeking a loan or investment, lenders and investors will require detailed financial records to assess your business’s viability and creditworthiness. Well-maintained books demonstrate your business’s financial stability and can enhance your chances of securing the funds you need for growth.

-

Detecting and Correcting Errors

Consistent bookkeeping and accounting allow you to catch and correct errors promptly, preventing small mistakes from becoming major issues. By keeping a close eye on your financial transactions, you can identify discrepancies, prevent fraud, and ensure the accuracy of your financial statements.

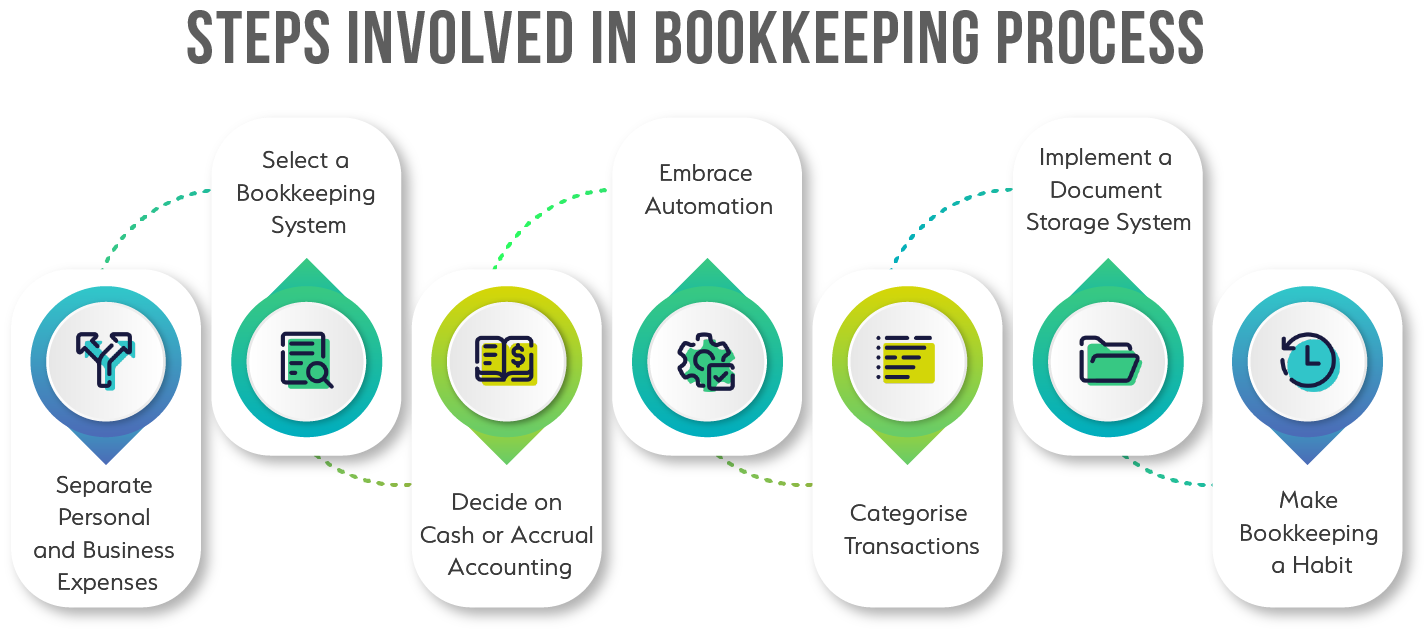

Steps Involved in the Bookkeeping Process

-

Separate Personal and Business Expenses

One of the foundational steps in business bookkeeping is to separate personal and business expenses. This separation ensures that your financial records are clear and that you can accurately track your business’s financial performance.

-

Select a Bookkeeping System

Selecting the appropriate bookkeeping system is vital for your business. Whether you choose a single-entry or double-entry system depends on the complexity of your transactions. To enhance accuracy and efficiency, many businesses turn to professional bookkeeping services, which can provide expert guidance and management tailored to your specific needs.

-

Decide on Cash or Accrual Accounting

Choose between cash and accrual accounting methods. Cash accounting records transactions at the moment cash is exchanged, whereas accrual accounting tracks income and expenses as they are earned or incurred. This decision will influence how you perceive your business’s financial health and overall performance.

-

Embrace Automation

In today’s digital landscape, businesses are increasingly leveraging automation to optimise their accounting and bookkeeping tasks. Choosing the right tools and software is essential to streamline your bookkeeping process. From advanced accounting software to automated systems, these solutions can significantly reduce manual work, save time, and minimise errors, allowing for more efficient and accurate financial management.

-

Categorise Transactions

Properly categorising transactions is essential for accurate financial reporting. Create categories that reflect your business’s unique expenses and income sources, which will help in generating meaningful financial reports and insights.

-

Implement a Document Storage System

Implement a document storage system to organise and store your financial documents, such as receipts, invoices, and bank statements. This system will make it easier to retrieve necessary documents for audits, tax filings, and financial reviews.

-

Make Bookkeeping a Habit

Maintaining consistency is crucial in bookkeeping. Dedicate regular time—whether daily, weekly, or monthly—to keep your books updated. By making bookkeeping a habit, you ensure that financial records remain accurate and up-to-date, which minimises the risk of falling behind. A diligent bookkeeper plays an essential role in this process, ensuring that your financial records are consistently maintained and error-free.

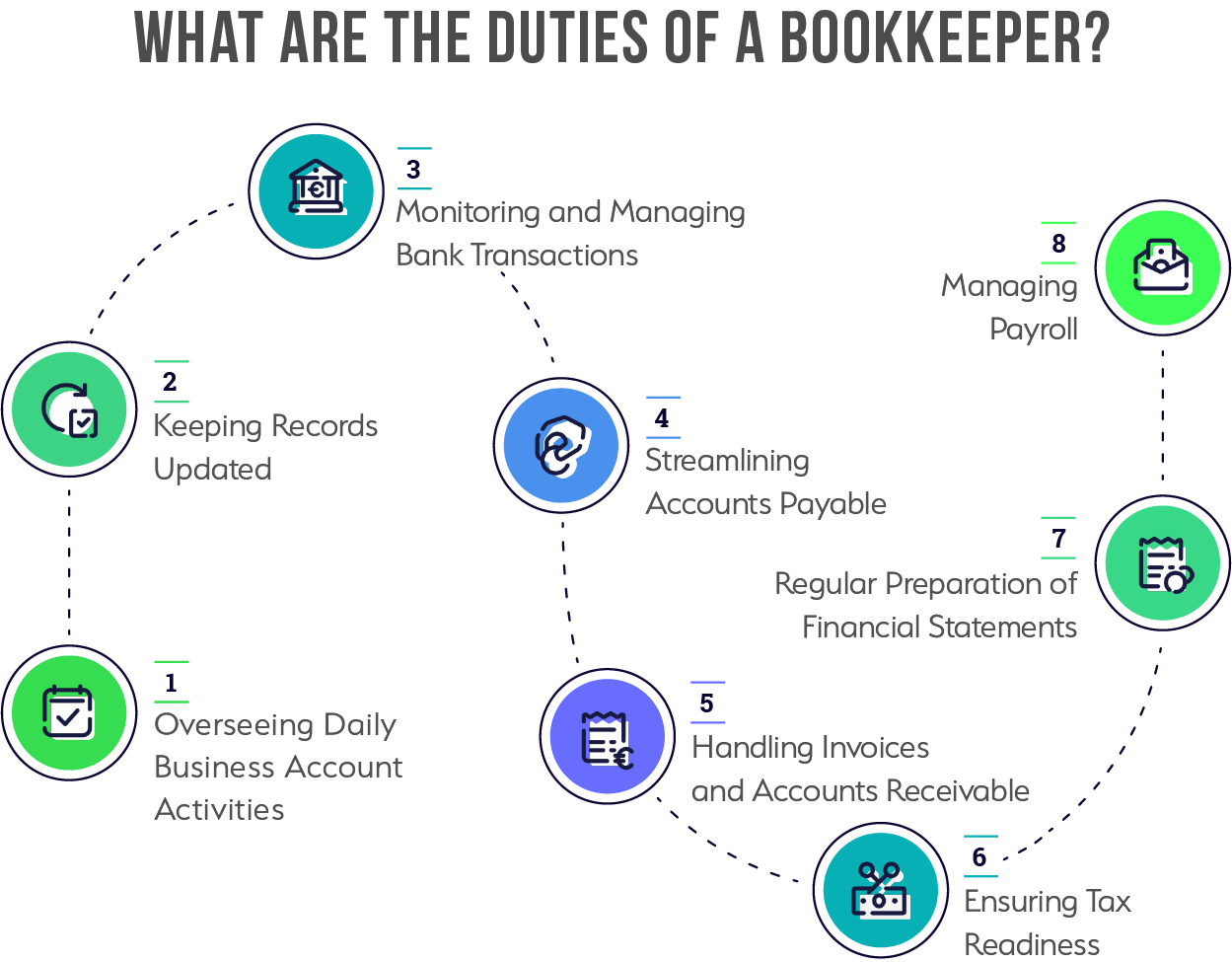

What Are the Duties of a Bookkeeper?

-

Overseeing Daily Business Account Activities

A bookkeeper is responsible for managing a business’s daily financial transactions, such as recording sales, purchases, receipts, and payments, while ensuring that all entries are accurate. By incorporating the expertise provided through bookkeeping services, businesses can enhance the efficiency and precision of these daily operations.

-

Keeping Records Updated

Another core duty of a bookkeeper is to ensure that financial records are consistently updated and accurate. This is particularly important in small business bookkeeping, where timely and precise record-keeping is essential for maintaining a clear financial picture and formulating better business decisions.

-

Monitoring and Managing Bank Transactions

Bookkeepers monitor and reconcile bank transactions regularly to ensure that the company’s financial records match bank statements. This helps in identifying discrepancies and ensuring accurate cash flow management. By utilising professional bookkeeping services providers, businesses can add an extra layer of expertise and precision to this task, ensuring that all financial activities are thoroughly reviewed and that potential issues are addressed proactively.

-

Streamlining Accounts Payable

Managing accounts payable involves carefully tracking all outgoing payments ensuring that bills and invoices are paid on time. Effective streamlining of this process is essential for avoiding late fees and maintaining your business’s credit standing. For a deeper dive into optimising this crucial function, “A Comprehensive Guide to Accounts Payable Management” offers valuable insights.

-

Handling Invoices and Accounts Receivable

Bookkeepers manage invoices and monitor accounts receivable, ensuring that customers are accurately billed and payments are collected promptly. In small business bookkeeping, this task is particularly vital for maintaining a healthy cash flow, as timely collections directly impact the financial stability of the business.

-

Ensuring Tax Readiness

Preparing for tax season is a significant duty of a bookkeeper. This involves organising and maintaining financial records throughout the year to ensure that the business is ready for tax filings, maximising deductions, and ensuring compliance. Relying on experienced bookkeeping services providers can make tax preparation more straightforward and less stressful.

-

Regular Preparation of Financial Statements

Bookkeepers help prepare regular financial statements, such as income statements and balance sheets, which provide a snapshot of the business’s financial health. These reports are essential for internal review and external reporting.

-

Managing Payroll

Managing payroll includes calculating employee wages, withholding taxes, and ensuring that all payments are made accurately and on time. This task requires attention to detail and knowledge of payroll laws. Businesses can collaborate with reputable bookkeeping services providers to simplify payroll management, ensuring compliance and accuracy.

Challenges Involved in Bookkeeping

-

Time Management and Efficiency

Bookkeeping can be time-consuming and requires meticulous attention to detail. Efficient time management is crucial to handling the volume of transactions and maintaining accurate records without falling behind. By engaging professionals through outsourced bookkeeping services, businesses can relieve this burden and concentrate on growth.

-

Accuracy and Data Entry Errors

Maintaining accuracy in bookkeeping is crucial, as even small errors in data entry can result in significant financial discrepancies. Diligent and thorough bookkeeping practices are essential to avoid mistakes that might impact financial reporting. Many businesses find that leveraging external expertise, such as that offered by outsourced bookkeeping services providers, can enhance accuracy and ensure that records are meticulously maintained.

-

Keeping Up with Technology Changes

The bookkeeping field is constantly evolving with new software and technologies. Businesses need to stay updated with these changes to utilise the best tools for efficiency and accuracy. Hiring experts like bookkeeping services providers helps businesses gain exposure to the latest technology and ensure optimal performance.

-

Managing Cash Flow

Effective cash flow management is critical for business sustainability. Bookkeepers need to monitor cash flow closely to ensure that the business has enough liquidity to meet its obligations and invest in growth opportunities.

-

Security and Confidentiality Concerns

No matter the size, every business deals with sensitive financial information that must be kept secure and confidential. Ensuring the protection of this data from breaches and unauthorised access is a vital aspect. Outsourced bookkeeping services providers stand out in this aspect. These professionals employ robust security measures to protect your financial data. By addressing these security concerns, they offer peace of mind for your business. Curious about the other benefits they provide? Let us explore further.

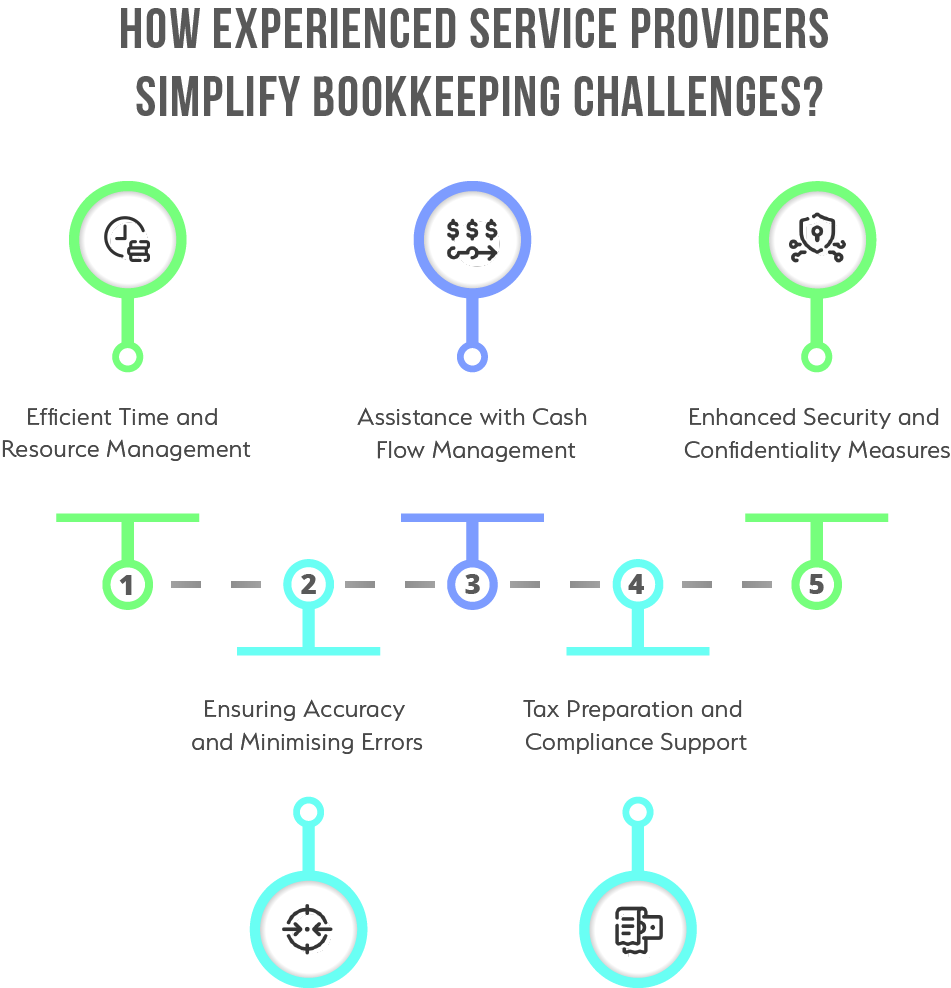

How do Experienced Service Providers Simplify Bookkeeping Challenges?

-

Efficient Time and Resource Management

Bookkeeping services providers help businesses save time and resources by handling routine bookkeeping tasks. This enables businesses to focus on primary activities, thereby enhancing productivity and operational efficiency.

-

Ensuring Accuracy and Minimising Errors

Outsourced bookkeepers and accountants are trained to maintain high accuracy levels in financial records. They utilise advanced accounting software and thorough review processes to minimise errors, ensuring that the financial data is reliable and accurate.

-

Assistance with Cash Flow Management

Outsourced experts assist in managing cash flow by monitoring incoming and outgoing funds, ensuring that the business maintains a healthy cash flow. They also provide insights and strategies to manage finances better, which is crucial for the business’s sustainability.

-

Tax Preparation and Compliance Support

Another significant advantage of using bookkeeping services providers is their expertise in tax preparation and compliance. They help ensure that all tax filings are accurate and timely, helping businesses avoid penalties and stay compliant with the latest tax regulations.

-

Enhanced Security and Confidentiality Measures

Bookkeeping services providers implement robust security measures to protect sensitive financial data. They ensure confidentiality and prevent unauthorised access to financial information, providing business owners with peace of mind.

Streamline Bookkeeping: Quick Tips

-

Implement Cloud-Based Accounting Software

Using cloud-based accounting software can greatly streamline bookkeeping tasks. It allows for real-time data access, automatic updates, and secure storage, making the bookkeeping process more efficient and less prone to errors.

-

Regularly Reconcile Bank Statements

Regular bank statement reconciliation helps identify and correct discrepancies between the business’s records and the bank’s records. This practice ensures accuracy in financial reporting and prevents potential issues.

-

Maintain Detailed and Organised Records

Keeping detailed and well-organised financial records is essential for efficient bookkeeping. It facilitates easy transaction tracking, simplifies audits, and helps in the quick retrieval of information when needed.

-

Set Clear Financial Goals and Budgets

Establishing clear financial goals and budgets helps in guiding the business’s financial planning and decision-making. It ensures that the business stays on track to meet its financial objectives and manage resources effectively.

-

Monitor Cash Flow Regularly

Regular monitoring of cash flow is crucial for maintaining the financial health of the business. It helps in identifying potential cash shortages, planning for expenses, and making informed financial decisions.

-

Keep Personal and Business Finances Separate

Separating personal and business finances is vital for clear financial tracking and reporting. It prevents confusion, ensures accuracy in bookkeeping, and simplifies tax preparation.

-

Conduct Periodic Financial Reviews

Periodic financial reviews help assess the business’s financial performance and identify areas for improvement. They provide insights into the business’s financial health and support strategic planning.

End Note

In the dynamic world of business, maintaining accurate financial records is not just a task—it’s the foundation of your success. As we have explored throughout this guide, a robust bookkeeping process is vital, whether you are a startup navigating your first challenges or an established business aiming for new heights. From understanding the basics of bookkeeping to leveraging advanced tools and professional services, the importance of precision, consistency, and efficiency cannot be overstated.

Outsourced bookkeeping services can bring additional expertise, help manage your cash flow more effectively, and ensure compliance with ever-changing regulations. By embracing these practices, you not only safeguard your business’s financial health but also set the stage for sustainable growth and success. Remember, the right bookkeeping approach tailored to your business’s needs can transform your financial management, providing the clarity and confidence needed to formulate informed decisions. Now, with these insights at your disposal, you are better equipped to handle the financial intricacies of your business and steer it toward a prosperous future.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.