Table of Content

Share This Article

- Reading Time: 11 Minutes

- Published: April 18, 2023

- Last Updated: February 3, 2025

Bookkeeping is the backbone of any successful business, yet many small business owners struggle to keep their finances in order or believe they can cut costs by handling it in-house. While the in-house approach might seem tempting, it often leads to higher expenses and accounting complexities down the line. Enter outsourced bookkeeping services – a game-changer for small businesses. Despite the clear benefits, many small business owners remain wary of entrusting their financials to an outsourced bookkeeping service provider due to widespread misconceptions. Are you one of those cautious small business owners? Concerned that outsourcing might not be the right fit for your company?

Worry no more! This blog will debunk all the myths and cover topics like the benefits of outsourcing, how to choose the right bookkeeping services provider and the latest technologies they use. So, let us set the record straight and explore how bookkeeping outsourcing can bring clarity, efficiency, and peace of mind to your business. Say goodbye to confusion and hello to streamlined bookkeeping!

»What Exactly is Outsourcing Bookkeeping?

Outsourced bookkeeping means hiring a third-party service provider to handle your company’s financial record-keeping. This service includes recording financial transactions, maintaining ledgers, reconciling bank statements, and preparing financial reports. Instead of managing these tasks in-house, you delegate them to professionals who specialise in bookkeeping. Outsourced bookkeeping services can be tailored to meet the specific needs of your small business, whether you require basic bookkeeping, payroll management, tax preparation, or advanced financial analysis.

»Benefits of Outsourced Bookkeeping Services

-

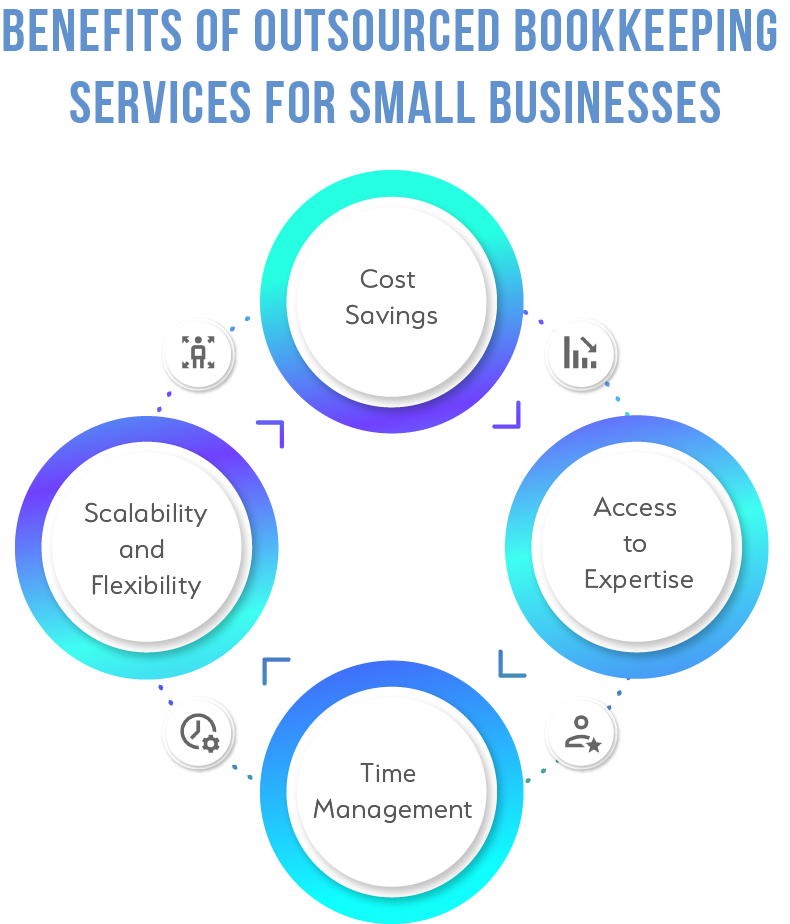

Cost Savings

Hiring a full-time, in-house bookkeeper can be expensive, especially for small businesses. Outsourcing your bookkeeping allows you to access professional expertise at a fraction of the cost. You pay only for the services you need, which can significantly minimise overhead expenses.

-

Expertise and Accuracy

Professional bookkeeping service providers possess the expertise and experience to manage your financial records accurately. They stay updated with the latest accounting standards, regulations, and software, ensuring your books are always compliant.

-

Time Efficiency

Managing bookkeeping in-house can be time-consuming, taking valuable time away from primary business activities. Bookkeeping outsourcing frees up your time, enabling you to focus on expanding your business and serving your customers.

-

Scalability

As your small business grows, your bookkeeping needs will evolve. Outsourced bookkeeping services are scalable, meaning you can easily adjust the level of service to match your changing requirements without the hassle of hiring and training new staff.

-

Access to Technology

Outsourced bookkeeping service providers use advanced tools and technology to streamline financial processes. This ensures accuracy, enhances data security, and provides real-time access to financial information.

Despite these clear benefits, many small business owners remain hesitant due to prevalent misconceptions surrounding outsourced bookkeeping services. Here are some of the common myths associated with bookkeeping outsourcing.

»8 Common Myths About Outsourced Bookkeeping Services

Myth 1: You Will Have to Pay More

The term “expensive” is often associated with outsourcing, leading many small businesses to believe it will increase their costs. However, outsourcing can be a very cost-effective way. There are multiple reasons to support the fact that outsourcing is not overpriced. First, you can tap into a global talent pool when you outsource. This means you can find the best person for the job at an affordable price. Additionally, when you outsource, you only pay for the work that is done. You do not have to worry about overhead expenses associated with hiring an in-house employee. Finally, when you outsource, you can get the work done faster and more efficiently than if you were to do it yourself. The reason is that an outsourced bookkeeping service provider comprises professionals who possess years of experience and extensive knowledge about bookkeeping and accounting.

Myth 2: You Will Lose Control of Your Finances

The second myth that we need to dispel is that outsourced bookkeeping services lead to a loss of control over business finances. This myth stems from the misconception that handing over bookkeeping tasks to an external provider will leave them in the dark about their own business finances. However, the truth is quite the opposite. With an experienced bookkeeping service provider, you retain full control and oversight. Professional bookkeeping service providers offer transparent processes, regular updates, and real-time access to your financial data through advanced platforms. This ensures that you are always informed and can make timely, well-informed financial decisions.

Myth 3: You Will Not Have Access to Real-time Data

Another myth surrounding outsourced bookkeeping services is that you will not have real-time access to your financial data. However, it is untrue. With advanced accounting software and outsourced experts handling your finances, you have complete access to your financial data. These professionals use cutting-edge technology that allows you to view your financial information in real time, ensuring transparency and control. Moreover, it must be known that bookkeeping is an important part of any business and outsourcing it in no way means sacrificing control or access to real-time financial data. Far from being a barrier, outsourcing provides a robust platform for maintaining and even enhancing your financial oversight.

Myth 4: You Will be Exposed to Greater Risk

The next myth that exists among small business owners is that bookkeeping outsourcing is riskier than an in-house team. But is it the truth? The answer is no. Moreover, outsourcing your bookkeeping and accounting function helps eliminate the risk of accounting and bookkeeping errors as you gain access to more specialised and experienced professionals. In addition, reputable outsourced bookkeeping services providers take extra measures to ensure a high level of security of your financial data and records.

Myth 5: You Will Not Have Quality Records

Contrary to popular belief, you can still have quality records when outsourcing your bookkeeping tasks. The reason is that when you outsource your bookkeeping, you are hiring a team of experienced professionals who know how to maintain records properly. They help ensure accuracy in your financial records and can prevent costly mistakes or fraud. Additionally, they help ensure quality control by enabling you to review reports and detect discrepancies quickly and easily.

Myth 6: You Will Have to Struggle to Find a Good Bookkeeper

Another common myth around outsourced bookkeeping services is that you will have to struggle to find a good bookkeeping services provider. This is not true! There are many great providers out there who offer quality services and fulfil the role of a bookkeeper and accountant more efficiently than an in-house team. However, when looking for an outsourced bookkeeping service provider, be sure to do your research and ask around for recommendations. Once you find a few service providers that meet your business needs, be sure to get in touch with them and ask questions about their services. This will help you narrow down your choices and find the best provider for your small business.

Myth 7: Your Small Business Does Not Need Bookkeeping Services

Many small business owners believe they do not need outsourced bookkeeping services from a third party because they are not large enough. This is a myth that needs to be dismissed. An experienced team of high-skilled accounting and bookkeeping experts can often do the work more quickly and efficiently than an in-house team, be it a small or big business. Additionally, by outsourcing bookkeeping needs, small business owners can avoid the need to hire and train new staff members. Moreover, bookkeeping outsourcing can free up valuable time and resources, enabling small business owners to focus on core operations and strategic growth initiatives. In essence, outsourcing bookkeeping is not just for large companies; it is a smart move for businesses of all sizes looking to optimise their financial management.

Myth 8: You Need to Be Tech-savvy

Are you a small business owner who feels you need to be tech-savvy to outsource your bookkeeping function? If so, you are not alone. This is another common myth that we hear all the time. The reality is that while some financial literacy is beneficial, being tech-savvy is not a requirement for outsourcing your bookkeeping tasks. In fact, many small business owners who outsource their bookkeeping find that technical expertise is one less thing they must worry about. When you hire an experienced bookkeeping services provider, you can focus on running your business and leave the bookkeeping in the hands of experts. As a result, you can save a lot of time and minimise your stress levels.

Outsourcing bookkeeping can transform small businesses by providing expert financial management and saving valuable time. However, navigating this realm can be daunting due to prevalent misconceptions. Having debunked common myths, let us now explore how to select the best bookkeeping services provider to enhance your small business’s financial health.

»How to Choose the Right Bookkeeping Services Provider?

-

Experience and Expertise

Look for bookkeeping services providers with a proven track record and experience in your industry. They should have a team of certified professionals who are knowledgeable about the latest accounting practices and regulations.

-

Services Offered

Ensure the bookkeeping and accounting services provider offers a comprehensive range of services that meet your small business needs. This might include payroll processing, tax preparation, financial reporting, and more.

-

Tools and Technology

Ensure the service provider uses top cloud-based accounting software. This not only guarantees efficiency and accuracy in managing your financial records but also enhances security.

-

Customisation and Flexibility

The bookkeeping and accounting services provider should be able to tailor their services to fit your specific requirements. Flexibility in service offerings is essential as your small business needs may change over time.

-

Reputation and Reviews

Research the service provider’s reputation by reading reviews and testimonials from other clients. Positive feedback and recommendations are indicators of reliable and high-quality service.

-

Communication and Support

Effective communication is key to a successful outsourcing relationship. Ensure the provider offers responsive customer support and regular updates on your financial status.

-

Cost and Value

When evaluating bookkeeping and accounting services, compare pricing structures and ensure transparency in billing. Rather than focusing solely on cost, consider the overall value they provide, as high-quality services can result in long-term savings and better financial management for your small business.

»Technologies Used by Bookkeeping Service Providers

Outsourced bookkeeping services providers leverage various advanced technologies to enhance their services and ensure accuracy and efficiency in managing financial records. Some of the key technologies include:

-

Cloud-Based Accounting Software

Platforms like QuickBooks, Xero, and Sage offer cloud-based solutions that allow for real-time access to financial data, seamless collaboration, and automatic updates. These tools enable small businesses to stay connected with their financials from anywhere, ensuring timely and informed decision-making.

-

Automated Data Entry Tools

Tools such as Hubdoc automate the data entry process by capturing and categorising receipts, invoices, and other financial documents. This automation reduces manual effort, minimises errors, and speeds up the bookkeeping process.

-

Bank Reconciliation Software

Automated bank reconciliation tools like AutoEntry and Expensify streamline the reconciliation process by automatically matching transactions in your bank statements with those in your accounting records. This ensures that your financial records are always accurate and up-to-date.

-

Secure Data Storage and Backup

Bookkeeping and accounting services providers use secure cloud storage solutions such as Dropbox Business and Google Drive to protect your financial data and ensure it is backed up regularly. These platforms offer robust security features, including encryption and access controls, to safeguard sensitive information.

By incorporating these technologies, outsourced bookkeeping services providers can deliver high-quality, efficient, and reliable financial management services to small businesses. These tools not only enhance the accuracy and timeliness of financial data but also provide valuable insights that help small businesses make strategic decisions and achieve their financial goals.

»Final Thoughts

Outsourced bookkeeping services offer substantial advantages for small businesses, yet many owners remain cautious due to prevalent myths. By dispelling these myths, it becomes evident that outsourcing bookkeeping can be cost-effective, enhance accuracy, and improve efficiency and compliance.

Whiz Consulting, a renowned name in accounting and bookkeeping services, exemplifies these advantages. Their expertise has helped numerous small businesses achieve seamless financial management and robust growth. Don’t wait—contact us and take the first step towards transforming your small business’s financial future! Partnering with industry leaders like Whiz Consulting paves the way for improved financial health and sustained business success, making it an invaluable choice for forward-thinking businesses.

»FAQs related to bookkeeping services

Q1. What is bookkeeping outsourcing?

Bookkeeping outsourcing involves hiring external professionals or firms to handle your business’s financial record-keeping. This allows businesses to leverage expert services without maintaining an in-house team.

Q2. When should you outsource bookkeeping?

You should consider outsourcing bookkeeping when managing your financial records becomes too time-consuming or complex or when you need expert financial insights without the overhead of an in-house team.

Q3. What is virtual bookkeeping?

“Virtual bookkeeping” refers to online bookkeeping services that perform these tasks remotely. Although the term usually refers to external companies or freelancers hired for your bookkeeping needs, virtual bookkeeper jobs can also include internal bookkeepers who work remotely.

Q4. Why hire a virtual accountant?

You can save overhead by hiring a virtual accounting service. These businesses work on a contract basis, eliminating the need to hire an employee and pay vacation time, benefits, payroll taxes, additional office space, etc.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.