Table of Content

Share This Article

- Reading Time: 8 Minutes

- Published: April 14, 2025

- Last Updated: April 14, 2025

Key Takeaways

- Hiring a part-time remote bookkeeper significantly reduces overhead costs compared to a full-time employee, eliminating expenses related to salary, benefits, and office space.

- Part-time remote bookkeeping allows businesses to adjust service levels based on fluctuating needs, scaling services up or down as required.

- Remote bookkeepers are proficient in cloud-based accounting software, automating tasks and streamlining financial processes, leading to increased efficiency and reduced errors.

- Remote bookkeepers provide regular financial reports and analysis, offering valuable insights into the business's financial health and performance.

- Effective communication through various digital tools (Slack, Zoom, etc.) ensures seamless collaboration and timely updates, despite the remote setup.

- Hiring a part-time remote bookkeeper is an effective move towards smarter financial management, providing expert support without the commitment of a full-time hire.

Managing finances doesn’t have to mean hiring full-time staff or stretching your resources thin. A part-time remote bookkeeper delivers expert support on your terms; when and where you need it. Ideal for growing businesses and lean teams, this flexible model helps maintain accurate records, streamline cash flow, and reduce overhead. Moreover, with cloud-based tools and real-time collaboration, you gain the control and clarity to make smarter decisions, without the commitment of a full-time hire.

How Does a Part-Time Remote Bookkeeper Works?

Managing finances is non-negotiable, but hiring a full-time bookkeeper isn’t always practical, especially for small businesses and startups. That’s where part-time remote bookkeepers come in. They plug into your systems from anywhere, handle the numbers behind the scenes, and keep your books clean without draining your budget or office space.

Onboarding and Software Setup

The first step is the process of onboarding and set-up. The bookkeeper gathers key details about your business, income sources, expense types, and existing bookkeeping systems. Moreover, they help you choose or integrate cloud-based accounting software like QuickBooks, Xero, or NetSuite, ensuring remote access and real-time syncing. They will also need proper credentials, permission settings, and workflow preferences to establish a secure and streamlined collaboration.

Organizing Financial Data

Before diving into daily tasks, your part-time remote bookkeeper will organize your existing financial data. This includes importing historical transactions, cleaning up inconsistencies, and structuring your chart of accounts. If your records are scattered across spreadsheets, emails, or paper receipts, the professional consolidates everything into one digital system for consistency and clarity.

Recording and Categorizing Transactions

One of the primary functions of a part-time remote bookkeeper is to record business transactions accurately and timely. Categorize each transaction to reflect your business activity and tax requirements. They also attach supporting documents like receipts or contracts to ensure everything is audit ready.

Bank and Account Reconciliation

To ensure your books reflect accuracy, the bookkeeper reconciles your bank accounts, credit cards, and other payment platforms. They match transactions in the software with actual bank statements, flag discrepancies, and correct errors. This keeps your financial reports reliable and helps detect issues like double entries or fraud.

Accounts Payable and Receivable Management

They also help manage cash flow by tracking the inflow and outflow of money. On the receivables side, they issue and follow up on invoices, record payments, and alert you to overdue accounts. By entering bills in a timely manner, setting payment reminders, and ensuring you’re not missing due dates or overpaying vendors; they are also responsible for accounts payable management.

Generating Reports and Insights

Your part-time professional generates financial reports such as profit and loss statements, balance sheets, and cash flow summaries. Moreover, their financial reporting services offer insights to offer insights into your business’s financial health, performance trends, and opportunities for cost-saving or growth.

Tax Season Support and Compliance

Throughout the year, your bookkeeper keeps detailed, categorized records to make tax season smooth. When it’s time to file, they prepare clean, organized financials for your CPA or tax advisor. Along with ensuring HRMC compliance, they handle VAT, payroll taxes, and Companies House filings

Ongoing Communication and Flexibility

Even though they work remotely, they must maintain consistent communication. Most part-time remote bookkeepers check in through scheduled calls, emails, or shared dashboards. They use popular tools such as Slack, MS Teams, Google Meets and Zoom to stay connected with your business. They adapt their hours and workload to match your business cycle, offering flexibility without sacrificing accuracy or dependability.

Hiring the Right Remote Bookkeeper

Choosing the right part-time remote bookkeeper is a big deal for your business. Getting it right means your finances are in safe hands. They’ll keep your records spot-on, help you understand where your money’s going, and free you to focus on your vision for your business.

Define Your Bookkeeping Needs

Let’s start by outlining what kind of services you require. Are you looking for someone to handle daily transactions, payroll processing, or reconcile accounts monthly? A clear scope helps you filter candidates who truly fit, especially if you need industry-specific experience like ecommerce accounting, real estate accounting, or healthcare accounting.

Choose the Right Hiring Platform

When hiring a part-time remote bookkeeper, your choice of platform matters. While sites like Upwork and LinkedIn offer freelancers, partnering with firms that specialise in outsourced accounting services brings more reliability. With the growing momentum of the offshoring trend, remote bookkeeping has become more cost-effective and scalable. Many businesses now go with accounting outsourcing to India, Mexico, or Vietnam to tap into experienced professionals at reduced costs.

Evaluate Technical and Software Skills

Your bookkeeper should be well-versed in the cloud-based accounting software your business relies on whether that’s QuickBooks, Xero, Zoho Books, or NetSuite. Don’t just ask if they know the platform; ask for specific examples of how they’ve used it to solve real client challenges, streamline processes, or automate complex workflows to save time and reduce errors.

Test for Accuracy and Communication

A part-time remote bookkeeper must demonstrate clear communication, reliability, and the ability to meet deadlines consistently. Before committing, consider evaluating their attention to detail, responsiveness, turnaround time, and how well they follow instructions; this hands-on test can reveal far more than a resume ever could.

Benefits of Hiring a Remote Bookkeeper for Your Business

Considering how crucial sound financial management is for any thriving business, let’s explore the significant advantages like reduced salary, no office space, saving time, increasing efficiency, and access to specialised expertise. Here is how these key benefits that make engaging a flexible, remote financial expert a smart move for your enterprise:

Lower Overhead, Higher Value

A part-time remote bookkeeper gives you professional support without the cost of a full-time hire. There is no need to invest in salaries, benefits, office space, or equipment to maintain. For example, instead of paying a substantial amount for a full-time bookkeeper, you can hire a part-time bookkeeper at a fraction of the cost without compromising quality.

Flexibility That Fits Your Business

Your financial needs change due to many reasons such as seasonal spikes, new projects, or slower months. A part-time remote setup lets you scale services up or down without disrupting your operations. If you only need help accounts reconciliation twice a month or managing invoicing weekly, you get exactly that with no wasted hours or budget.

Access to Skilled Talent Without Geographic Limits

Do you need someone who understands your industry-specific accounting like real estate commissions, subscription revenue, or Amazon seller fees? A remote hire allows you to expand your verticals easily. You can work with a part-time expert who’s handled your exact scenario before, even if they’re across the country.

Strong ROI Through Tech-Driven Efficiency

Skilled part-time remote bookkeepers are pros at using tools like QuickBooks Online, Xero, or Zoho Books. They’ll automate recurring tasks like invoice reminders or payroll journal entries. This way you get streamlined financial reports and reduced manual errors; saving you both time and money.

Enhanced Focus on Core Business Activities

Ultimately, hiring a remote bookkeeper allows you and your team to concentrate on the strategic aspects of your business; driving sales, innovation, and customer relationships. Knowing your financial records are in capable hands provides peace of mind and allows you to dedicate your energy to growth and success in the competitive market.

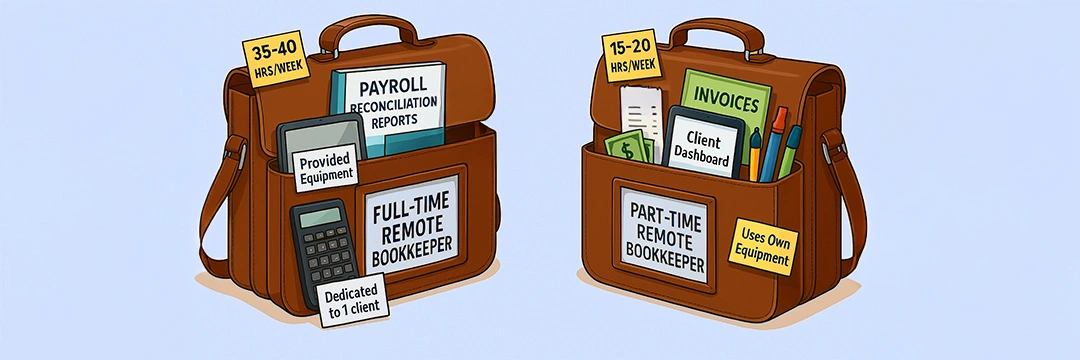

Full Time vs. Part-Time Remote Bookkeeper: What’s Better?

Choosing between a full-time and part-time remote bookkeeper depends on your business’s size, complexity, and budget. While both models have their strengths, many businesses find part-time remote support to be more efficient and cost-effective; especially in early growth stages. To help you decide what suits your needs best, here’s a side-by-side comparison of their key differences:

| Features | Full-time Remote Bookkeeper | Part-time Remote Bookkeeper |

|---|---|---|

| Working Hours | Typically standard full-time hours (e.g., 35-40 hours/week). | Works a specific, limited number of hours per week or month, offering flexibility. |

| Cost (Salary & Benefits) | Higher overall cost due to full-time salary, benefits, etc. | More cost-effective as you pay only for the hours worked; fewer or no benefits to cover. |

| Scope of Responsibility | Can handle a wide range of tasks and potentially more complex financial operations due to dedicated hours. | Typically focuses on core bookkeeping tasks; may handle a narrower scope depending on agreed hours. |

| Availability & Dedication | Generally higher availability during standard business hours; fully dedicated to one employer. | Availability is limited to agreed-upon hours; may work with multiple clients concurrently, requiring efficient time management. |

| Office Space/Equipment | No direct office space cost, but company might provide equipment. | No office space or equipment costs for the hiring company; bookkeeper uses their own setup. |

| Flexibility & Stability | Less flexible in terms of adjusting workload and costs in the short term. | Highly flexible; workload and costs can be adjusted more easily based on fluctuating needs. |

| Focus & Expertise | May develop deep, company-specific knowledge over time. | Often brings a broader range of experience from working with various clients and industries. |

Conclusion

For growing businesses, a part-time remote bookkeeper isn’t just a cost-saving option; it’s a strategic move toward smarter financial management. This is where Whiz Consulting steps in as a trusted partner. With over 10 years of industry experience and a team of 100+ qualified accountants, we provide comprehensive remote bookkeeping services tailored to your business needs. From initial account setup to daily entries and month-end reporting, we ensure precision, compliance, and peace of mind.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Part-time remote bookkeeping services offer flexibility to adapt to your changing business demands. We can readily adjust your service level, increasing or decreasing support as needed, ensuring cost-effectiveness and optimal assistance during any business cycle.

We prioritise your data security through advanced encryption methods and secure communication channels for all remote operations. Our team adheres to stringent confidentiality agreements and follows rigorous protocols to protect your sensitive financial information with utmost care.

Yes, our experienced part-time bookkeepers are well-equipped to assist with tax season and audit preparations. They can organise your financial data, prepare necessary reports, and ensure a smooth and efficient process for both tax filings and potential audits.

We understand the need for timely support. Following a brief consultation to understand your specific bookkeeping needs, we can typically connect you with a qualified remote bookkeeper and commence services within a few business days, ensuring a swift start.

The cost of our remote bookkeeping services is customisable to meet your unique business requirements, and the scope of work involved. We will provide a detailed pricing structure after discussing your specific needs and the services you choose, ensuring a tailored and transparent solution.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.