Table of Content

Share This Article

- Reading Time: 11 Minutes

- Published: November 7, 2024

- Last Updated: February 6, 2025

Remote work culture has become more apparent, particularly for critical activities like accountancy. Frequently seen as a crucial chore, bookkeeping and accounting are essential to financial operations and planning. It functions similarly to a GPS, guiding one toward achievement and progress. Hiring remote bookkeepers is less expensive than hiring a whole staff and can assist businesses in managing their money from any place. Remote bookkeeping management helps businesses reduce expenses and decentralise operations and expansion. If you’re considering employing a remote bookkeeper, we’ll provide all the information you need in this article.

What is Remote Bookkeeping

The practice of using cloud-based accounting software to manage financial records and transactions for firms from a distance is known as remote bookkeeping. Data entry, invoice processing, and financial report preparation are among the duties performed by a professional who works as a remote bookkeeper. This makes it possible for businesses without a bookkeeper to easily access quality financial services.

Since the bookkeeper’s location is irrelevant and there is no need for rent or utilities, making online bookkeeping services practical and affordable. While the remote bookkeeper takes care of their financial records, businesses and organisations may focus on the important parts of running their operations. Small to medium-sized firms that need expert bookkeeping services but might not want to recruit full-time, internal staff will find it more valuable. Employing remote accounting services can help businesses acquire precise and current financial data, which can help them optimise their business solutions.

How does Remote Bookkeeping Work: Process

-

Provide Access

The first step is to provide the person handling your remote bookkeeping services with access to your data. Secure cloud-based accounting programs that give both parties an up-to-date picture can frequently accomplish this.

-

Data Analysis

After gaining approval, the remote bookkeeper examines the company’s historical records to ascertain the current state of the accounts and looks for any gaps or issues.

-

Understanding Requirements

Bookkeeping is a vast phenomenon, and a virtual accountant must have a thorough understanding of key concepts to provide reliable services. Once all the data is collected and analysed, the following step is to understand the requirement and build a plan accordingly.

-

Data Processing

The remote bookkeeper accurately records all business transactions by analysing financial data and producing an analysis and action plan. Accurate reporting by bookkeeper helps clients make strategic business decisions.

-

Delivering Reports

The last task is the preparation of detailed financial reports, together with specific recommendations regarding the state’s financial situation. These reports are delivered to the client at the scheduled time and used as the basis of the decision-making process.

Tasks Handled by a Remote Bookkeeper

-

Preparing Financial Statements

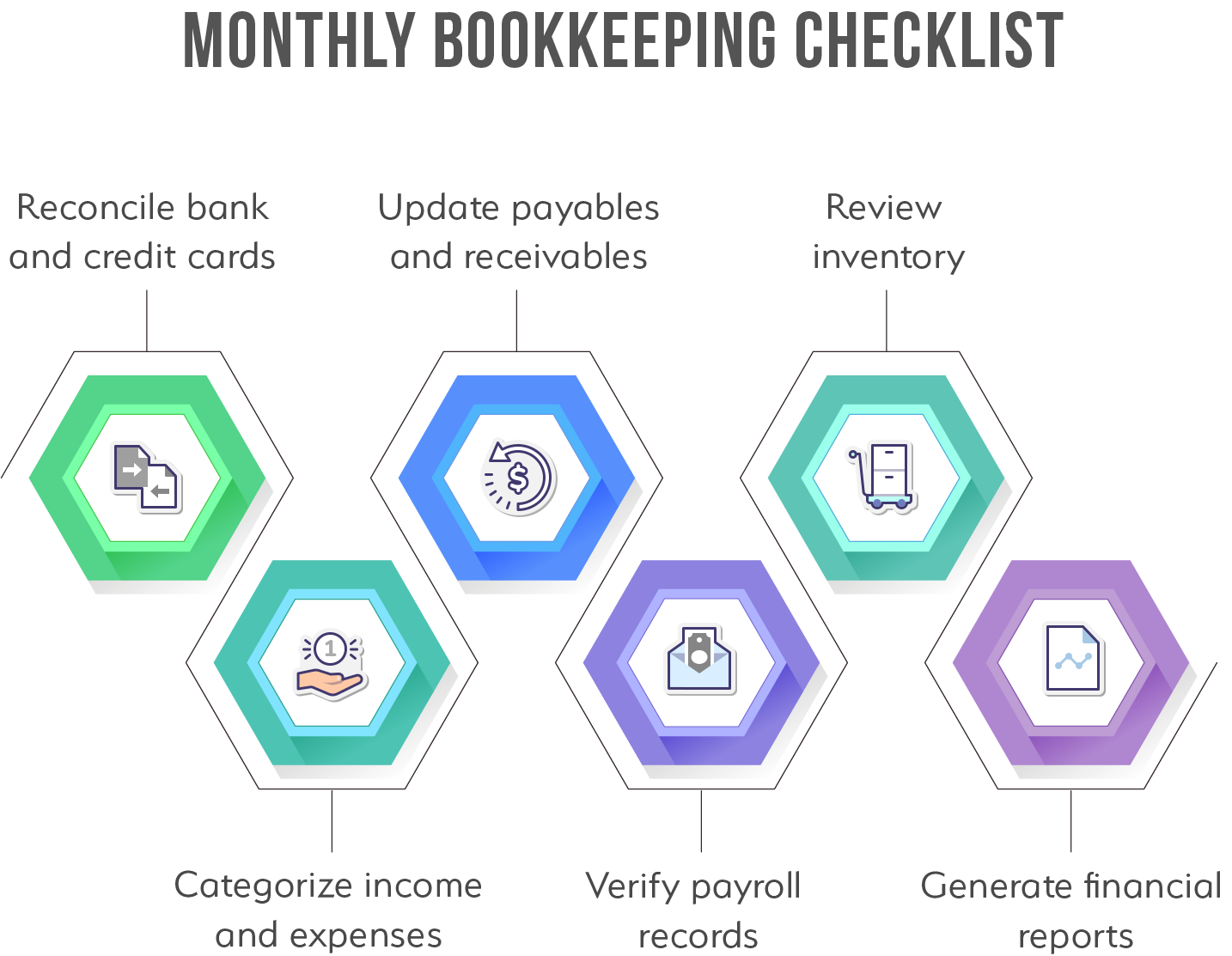

A remote bookkeeper generates financial statements, including cash flow, balance sheet, and income statement, and accurately records and updates revenue and expense accounts.

-

Reconciling Statements

A remote bookkeeper ensures that all accounting records correspond with the most recent bank statements and any other papers that could be seen as evidence of the outcome.

-

Invoice Processing

The complete invoice process is controlled by a virtual bookkeeper, who creates purchase orders for vendors and processes their bills, ensuring both are done correctly.

-

Accounts Payable Management

Bookkeeping services, managed by a remote bookkeeper, oversee vendor payments, balance accounts, and handle disputes. This ensures timely payments, accurate records, and smooth vendor relationships.

-

Creating Invoices

A remote bookkeeper creates and sends accurate invoices for completed work or sold goods/services. This ensures timely billing and reduces errors, keeping cash flow consistent for the business.

-

Accounts Receivable

Remote bookkeepers handle invoice processing, track payments, and follow up on overdue invoices. These services maintain open communication with clients, ensuring timely collections and smooth cash flow.

-

Bank Reconciliation

A virtual bookkeeper ensures all company transactions align with bank records. Online bookkeeping services help identify discrepancies and maintain accurate financial records, ensuring proper financial management.

-

Payroll Processing

A remote bookkeeper ensures employees are paid accurately and on time. They handle payroll taxes, deductions, and other related tasks, keeping payroll organized and compliant with regulations.

-

Financial Record-keeping

Remote bookkeeping services maintain organized, up-to-date financial records. A remote bookkeeper ensures all transactions are recorded accurately, helping with compliance and financial decision-making.

-

Balance Sheet Maintenance

A remote bookkeeper ensures balance sheets accurately reflect your company’s assets, liabilities, and equity. These services provide a clear snapshot of your financial standing.

-

Profit & Loss Reporting

Remote bookkeepers provide detailed profit and loss statements, tracking your company’s financial performance. This helps businesses identify trends and make informed decisions to improve profitability.

-

Cash Flow Management

A remote bookkeeper manages cash inflows and outflows, ensuring your business maintains a healthy cash flow. Reliable bookkeeping services help avoid cash shortages and support financial stability.

Software Used by Remote Bookkeepers

Online bookkeepers employ various cloud accounting bookkeeping software programs since their job necessitates thinking of the best way to carry out their responsibilities. Some of the most widely utilised tools by online bookkeeping services are as follows:

-

Xero

Xero accounting software is easy and efficient for small and medium-sized businesses. With its emphasis on cloud-based accounting solutions, Xero helps remote bookkeepers with basic invoicing and bank feeds.

-

QuickBooks

Because QuickBooks is easy to use and appropriate for small businesses and anyone whose books are managed remotely for payroll and other costs, most outsourced accounting and bookkeeping firms are familiar with it.

-

Zoho Books

Zoho Books is ideal for online bookkeepers and is best suited for small and mid-sized enterprises. It makes tracking expenses and creating invoices easier.

-

FreshBooks

For independent contractors and small business owners, FreshBooks is an excellent tool for project management and invoicing.

-

NetSuite

A remote bookkeeper may easily handle complex accounting chores like inventory management and financial planning when he uses NetSuite for larger businesses.

Challenges Faced in Setting Up Remote Bookkeeping

It can be advantageous to switch outsource bookkeeping and accounting functions to an online bookkeeper. Still, there are several issues to be aware of, just like with any shift in work procedures:

-

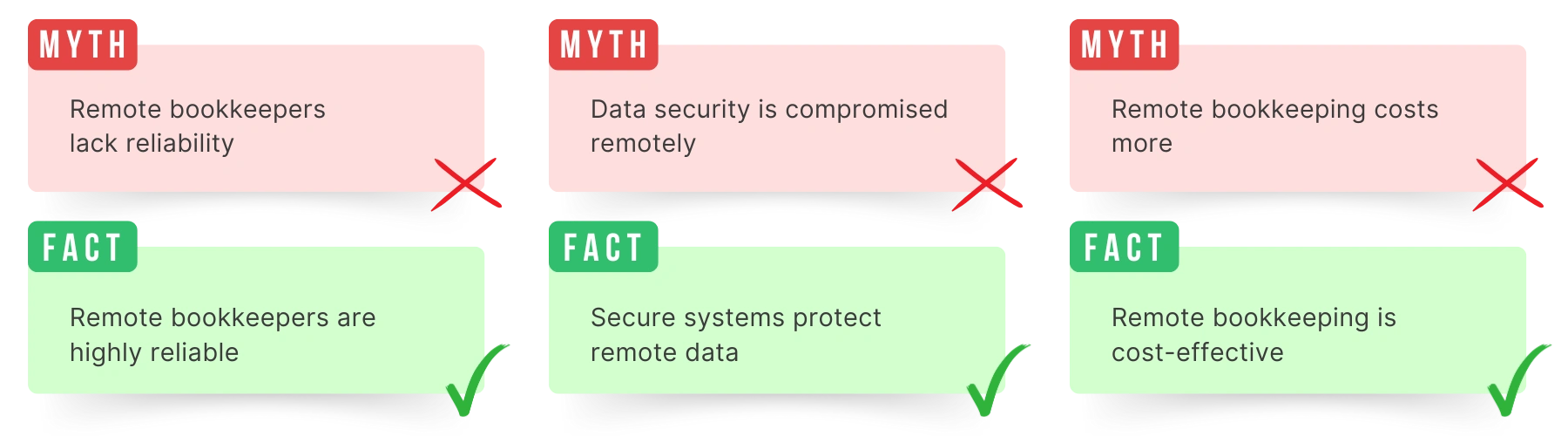

Data Security Issues:

Because of cyber threats, protecting sensitive financial data when accessed remotely can be challenging without proper security measures.

-

Communication Barriers:

Work from staff might not be able to communicate effectively or accurately, which could lead to misunderstandings or a long processing time for financial chores.

-

Technology Access:

The day-to-day operation of an online bookkeeper depends on technology. If they are not equipped with the right software and hardware, it could impact on the quality of services.

-

Time Zone Differences:

If your remote bookkeeper is in a different time zone, it can become difficult to organise shifts and deadlines.

-

Training & Onboarding:

Providing a virtual bookkeeper with adequate training in your company’s operations might Be time-consuming.

-

Monitoring Productivity:

It can be challenging to determine whether remote bookkeepers, are operating effectively without performance monitoring tools or prompt follow-ups.

-

Compliance Issues:

Managing local tax laws and regulations remotely can be complex when operating in multiple regions across the UK and requires high expertise and attention. To ensure compliance, businesses must stay updated with evolving tax regulations, such as VAT rules, which can differ across sectors and regions within the UK.

Steps to Set Up Remote Bookkeeping for Your Business

Here are the proper steps to follow to hire a bookkeeper and accountant for your business:

1. Evaluate Your Company’s Needs:

To begin with, ascertain the precise bookkeeping services your company requires. Do you need regular payroll and invoices, or are you seeking extra services like balance sheet and tax preparation? Understanding requirements will let you decide which particular responsibilities to provide the remote bookkeeper.

2. Selecting the Best Accounting Software:

Pick accounting software that is easy for you and the online bookkeeper. Xero, QuickBooks, Zoho Books, and NetSuite are some of the most used cloud accounting programs utilised by the best online bookkeeping services. These programs may provide you with up-to-date information about your financial situation.

3. Employ a Remote Bookkeeper:

Are you searching for a trustworthy company specialising in your industry to handle your bookkeeping needs? A respectable company will assign you a dedicated remote bookkeeper even with fewer transactions. They ought to have handled similar business requirements and worked on your preferred software in the past.

4. Establish a Secure Data Exchange:

Ensuring secure data sharing procedure is crucial. When sharing data with clients and teams, use encrypted services like Dropbox, Google Drive, or the built-in features of accounting software to safely share data with clients and teams.

5. Establish Communication Protocols:

Using Zoom, Microsoft Team, or email, decide on suitable check-in times, status and progress updates, and reporting frequency. This aids in keeping your remote bookkeeper abreast of your financial goals.

6. Monitor and Review Frequently:

Make sure your bookkeeping department is well-organised by regularly reviewing your financial records. Regular reporting of cash flow, financial reports, costs, and other crucial business data is required of your outsourced accounting company.

Best Practices for a Remote Accounting and Bookkeeping Firm

Here are some of the best practices to follow:

-

Using Proper Accounting Software:

The proper tools are necessary for a remote bookkeeper to do their financial duties effectively. Reports, expense tracking, and record creation are made possible by software like Xero, QuickBooks, Zoho, and others. Additionally, these systems provide remote access, which helps the virtual bookkeeper.

-

Establish a Clear Workflow:

The clients outline the tasks related to accounting and bookkeeping that must be completed and the deliverables they anticipate from the bookkeeper. This includes handling invoices, payments, payroll, reconciliations, reporting, and taxes correctly for a remote bookkeeper.

-

Secure Communication:

By keeping the team and clients updated on developments, Slack or MS Teams facilitate communication. When working on a project, communication is crucial, especially in the case of remote bookkeeping.

-

Regular Data Backup:

Online accounting firms offering remote bookkeeping services must prioritize data protection by regularly backing up all critical files. This keeps data and information from being lost and permits businesses to continue even during other technological issues.

Benefits of Hiring a Remote Bookkeeper

-

Enhanced Security:

One benefit of working with an experienced remote bookkeeper is that your financial information will be handled safely. Some online bookkeeping services use modern technologies that have improved cloud services with better encryption and data privacy features. Compared to traditional in-house data processing for bookkeeping, this is far less hacker-friendly and far more secure.

-

Making Well-Informed Business Decisions:

You get regular and timely financial reports when you use remote accounting services, and your bookkeeper makes data-driven decisions. With this strategy, you may concentrate on other crucial facets of your company without worrying about money management.

-

Stress Reduction:

Managing your company’s finances can be less stressful by hiring a remote bookkeeper and operating your bookkeeping independently. The online bookkeeper handles most daily transactions, freeing the business owners to focus on other critical areas and expansion. Frontline communication may also be facilitated via the team chat app.

-

Access to Expertise:

Hiring seasoned bookkeepers with experience in implementing effective accounting procedures is made easier by remote bookkeeping service providers. One appealing feature is obtaining high-quality professional financial services without investing in internal staffing or training.

-

Flexibility and Scalability:

Businesses may effectively manage their financial records and bookkeeping budgets using outsourced bookkeeping. Remote bookkeeping services are a great option for companies of all sizes since they are flexible enough to accommodate full-time, part-time, or project-based requirements.

-

Cost and Time Savings:

Hiring online bookkeepers offers organisations several advantages, chief among them being time and cost savings. Online bookkeeping services protect the company’s assets from direct costs and internal staff costs such as property rent, taxes, and insurance.

-

Employee Turnover:

Hiring a remote bookkeeper eliminates the challenges of employee turnover faced with in-house staff. This ensures an uninterrupted, reliable bookkeeping process without the added costs of training or onboarding new employees.

Conclusion

Employing remote bookkeeping services offers firms several advantages, including significant cost savings, enhanced data protection, and collaboration with experts. A remote bookkeeper may ensure that financial operations are carried out efficiently using cloud technology, freeing time for business operations and development.

Remote accountant wanted? Our remote bookkeeping services provide accuracy, efficiency, and cost savings. Contact us today to find out how we can help you simplify your financial management!

Extra Advice for Remote Bookkeeping

1. Hire an Indian bookkeeping company:

Selecting an Indian accounting and bookkeeping company has several advantages; it offers highly qualified experts at affordable prices, and it becomes a financially viable choice for companies looking for remote bookkeeping services because of favourable exchange rates.

2. Hire a company rather than an individual:

A company offers a staff with a range of specialisations and guarantees ongoing assistance, lowering the possibility of delays brought on by individual availability.

3. Examine client evaluations and feedback:

Evaluating can help you make an appropriate decision for your company by giving you a clear picture of the firm’s performance, dependability, and customer service.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Remote bookkeeping uses cloud-based accounting software such as Xero, QuickBooks, or Zoho to handle financial data and transactions electronically. Bookkeepers use remote data access to guarantee precise documentation, prompt reporting, and real-time financial monitoring for companies.

Secure access methods, two-factor authentication, and encrypted cloud-based software are used by remote bookkeepers to protect financial data, guaranteeing confidentiality and adherence to industry security standards.

Using cloud-based software, a remote bookkeeper, also known as a virtual bookkeeper, maintains financial records, processes invoice, reconciles accounts, handles payroll, and creates reports. Working remotely, they manage payroll, guarantee proper financial tracking, and offer cash flow insights.

Remote bookkeeping refers to services provided by a bookkeeper working from a different location, while virtual bookkeeping primarily involves using cloud-based software to manage financial records.

Yes, with digital tools and software, bookkeeping can be accomplished remotely. Remote bookkeepers oversee financial duties from any place, guaranteeing firms’ timely and accurate record-keeping.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.