Table of Content

Share This Article

- Reading Time: 19 Minutes

- Published: January 10, 2024

- Last Updated: February 7, 2025

In the bustling realm of e-commerce, where businesses thrive in the digital hustle, a savvy grasp of accounting and bookkeeping is the secret to sustainable growth. Stepping into the spotlight, Shopify is a leading e-commerce platform that has redefined how entrepreneurs unveil their goods and services in the digital arena. Shopify provides a dynamic stage where businesses do not just survive but thrive in the vibrant, ever-changing landscape of online commerce.

For e-commerce businesses navigating the Shopify landscape, adeptly handling the nuances of Shopify accounting and bookkeeping is not merely a choice—it is an imperative. In this blog, we will unravel the essentials of accounting and bookkeeping specific to Shopify, demystifying the complexities often accompanying online businesses. So, let us embark on this journey that will not only streamline your Shopify accounting and bookkeeping processes but also position your e-commerce venture for long-term success in an ever-evolving digital landscape.

How E-commerce Accounting Sets Itself Apart?

-

Sales Across Platforms:

E-commerce businesses often operate across various online platforms like their own website and third-party marketplaces (Shopify, Amazon). Managing sales data from different platforms and reconciling transactions requires accounting systems that can consolidate information from diverse sources, providing a holistic view of the business’s financial performance.

-

Inventory Management:

Efficient inventory management is critical in e-commerce, requiring real-time tracking across all sales channels to prevent stockouts or excess inventory. Furthermore, accurate valuation and cost of goods sold (COGS) calculations are essential for maintaining profitability.

-

Payment Processing:

E-commerce accounting involves tracking and reconciling digital payment transactions, including credit cards and online wallets. This includes recording payments received, accounting for transaction fees, and addressing issues like chargebacks and refunds.

-

Refunds and Chargebacks:

E-commerce businesses often experience a higher frequency of returns and chargebacks. Managing these issues in the e-commerce accounting system is essential for accurate financial reporting and monitoring of product performance.

-

Shipping and Fulfilment:

Effective shipping and fulfilment operations are vital for e-commerce success. E-commerce accounting must factor in shipping costs, track revenue, and manage fulfilment expenses, considering their impact on overall profitability and customer satisfaction.

-

International Compliance:

E-commerce’s global reach involves complexities related to international regulations and taxes. Navigating tax jurisdictions, customs duties, and compliance requirements is essential to avoid legal complications and financial setbacks.

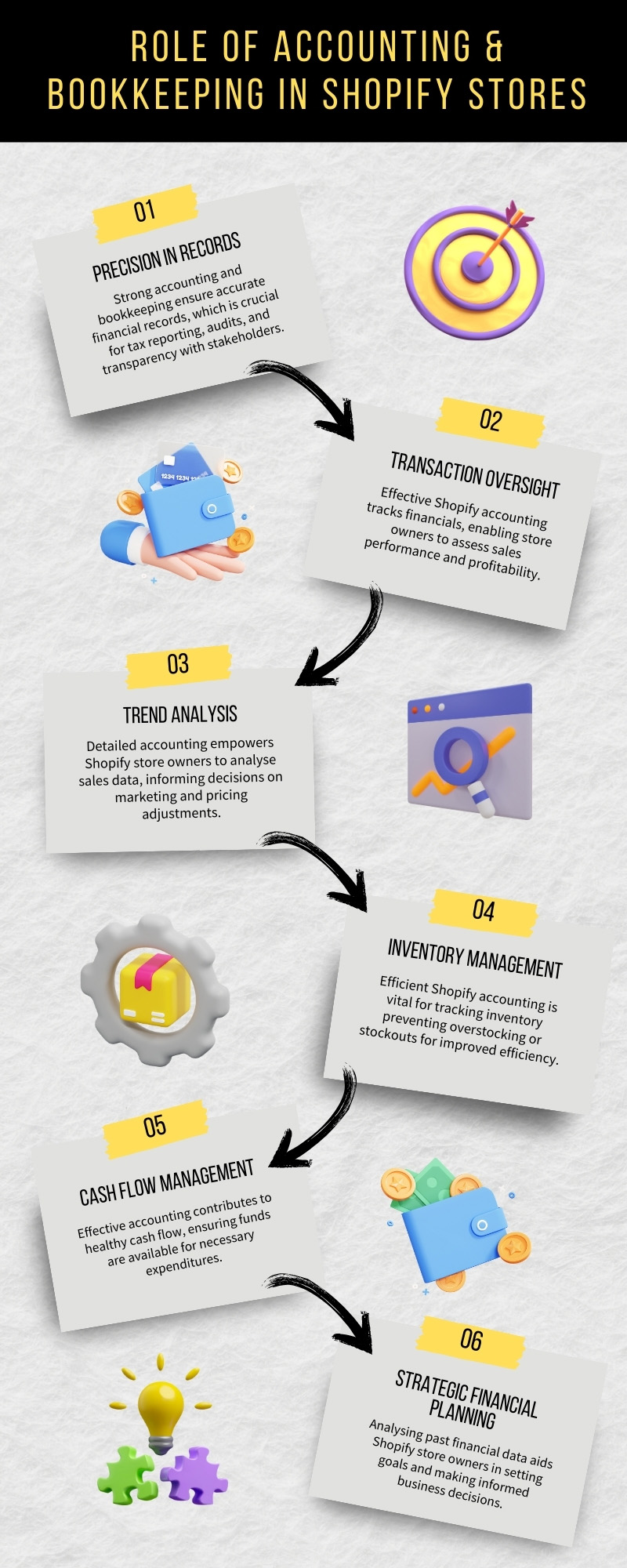

Role of Effective Accounting and Bookkeeping in Shopify Stores

-

Precision in Records:

Sound accounting and bookkeeping practices form the bedrock of precise financial records. This involves meticulously recording every facet of the financial landscape, from income and expenses to refunds. Furthermore, generating comprehensive financial statements, such as balance sheets and profit and loss (P&L), ensures a clear snapshot of the business’s financial health. The precision in financial records is not only critical for tax reporting and audits but also for establishing transparency and trust with stakeholders.

-

Transaction Oversight:

Effective accounting for Shopify stores offers a panoramic view of financial transactions, encompassing sales, expenses, and the cost of goods sold (COGS). Accurate recording and categorisation empower Shopify store owners to delve into their financial data, enabling a granular assessment of sales performance. This, in turn, facilitates the identification of profitable products and an overall evaluation of business profitability.

-

Trend Analysis:

Detailed accounting records serve as a goldmine for Shopify store owners seeking to decipher customer behaviour trends over time. By analysing sales data, businesses can uncover patterns that lead to informed decision-making. This insight is invaluable for crafting targeted marketing strategies, refining product offerings, and making pricing adjustments to stay competitive. In essence, trend analysis transforms raw data into actionable intelligence for sustained business growth.

-

Inventory Management:

In the realm of e-commerce, effective Shopify accounting and bookkeeping are indispensable for managing inventory-related transactions. This involves vigilant monitoring of stock levels, tracking the cost of goods sold, and identifying any slow-moving or obsolete inventory. Accurate inventory management not only prevents overstocking or stockouts but also enhances operational efficiency. It aligns supply with demand, ultimately contributing to a streamlined and responsive business operation.

-

Cash Flow Management:

Accounting and bookkeeping play a pivotal role in the effective management of cash flow, a lifeline for business sustainability. Monitoring the inflow and outflow of cash, which includes sales, inventory purchases, and operating expenses, enables the early identification of potential cash flow issues. This proactive approach helps ensure a healthy cash balance, making funds available for necessary expenditures. In essence, cash flow management safeguards the financial vitality of the Shopify stores.

-

Strategic Financial Planning:

The analysis of past financial data serves as a compass for Shopify store owners navigating the complex landscape of strategic financial planning. Evaluation of revenue and expense patterns facilitates the setting of realistic financial goals. Armed with insights from past data, businesses can craft robust strategies for achievement. Furthermore, financial projections derived from historical data aid in budgeting, resource allocation, and informed investment decisions. This holistic approach to strategic financial planning becomes a catalyst for sustained growth and resilience in the competitive e-commerce arena.

How to Set Up Your Shopify Accounting System?

Setting up your Shopify accounting system includes the following steps:

-

Open a Business Bank Account:

Establishing a clear financial delineation between personal and business matters is paramount for any entrepreneur. Open a dedicated business bank account to create a distinct financial identity for your venture. This separation not only streamlines financial tracking but also fosters organisational efficiency in managing your business transactions. By maintaining this separation, you lay the foundation for accurate accounting records, simplifying both day-to-day financial management and long-term financial analysis.

-

Choose the Right Accounting Software:

Navigating the digital landscape of e-commerce necessitates a judicious choice of accounting software. Opt for a platform that seamlessly integrates with Shopify to harness the full potential of automation and accuracy. Notable options such as QuickBooks, Xero, Sage and Zoho Books come equipped with features tailored for e-commerce businesses. When making your selection, consider factors like ease of use, cost, and functionality. An Accounting software becomes the linchpin for efficient financial management, ensuring that your e-commerce operations run smoothly and your financial records remain precise.

-

Connect Your Shopify Store:

Bridge the gap between your e-commerce hub and financial records by linking your Shopify store to your chosen accounting software. Most modern accounting platforms offer integrations or dedicated apps that facilitate the automatic syncing of crucial data. This includes sales figures, expenses, and other financial metrics directly from your Shopify store. This seamless connection eliminates manual data entry, reducing the likelihood of errors and saving valuable time. By embracing this integration, you create a dynamic financial ecosystem where your business data flows effortlessly, enabling you to make informed decisions and maintain financial clarity.

-

Choose an Accounting Method:

Determine whether you will opt for the cash or accrual method of accounting. Cash accounting registers transactions at the moment funds change hands, while accrual accounting records transactions when they occur, regardless of when actual money is exchanged. It is advisable to seek guidance from professionals such as accounting service providers to identify the most suitable method for your business. To do this, you can explore keywords like “top Shopify accounting service provider in London,” “best Shopify accounting service provider in Birmingham,” or “best Shopify accounting service provider in Manchester.” Depending on your location, you can search and choose a proficient service provider experienced in managing accounting for Shopify stores.

-

Set up Payment Gateways for your Shopify Store:

Setting up your Shopify store to accept payments is crucial for a seamless customer experience. Popular payment gateways like Shopify Payments, PayPal, and Stripe offer diverse options to cater to customer preferences. Configure these gateways within your Shopify admin dashboard, providing customers with trusted and familiar payment choices. To streamline financial processes, connect these gateways to your accounting software, ensuring automated and accurate recording of transactions, including sales, refunds, and fees. This integration not only saves time on manual data entry but also provides a holistic view of your business’s financial health, empowering you to make informed decisions and enhance overall operational efficiency.

While these steps outline the establishment of a Shopify accounting system, there are specific practices that can be adopted to streamline your accounting and bookkeeping processes. Let us unveil 9 best practices that can streamline your Shopify accounting and bookkeeping.

9 Best Practices for Successful Shopify Accounting and Bookkeeping

-

Tracking Daily Sales:

Embark on your Shopify accounting journey by giving paramount importance to the meticulous tracking of daily sales. Cultivate a practice of consistently and accurately monitoring sales activities as they unfold. This proactive approach not only provides a real-time snapshot of your business’s financial performance but also empowers you to make timely and well-informed decisions. The ability to observe sales trends on a daily basis serves as a valuable tool in adapting strategies, optimising inventory and responding promptly to market dynamics. This continuous tracking ensures that your business operates with agility and responsiveness, maximising its potential for growth and success.

-

Revenue Management:

Establish a resilient system for managing your revenue effectively within your Shopify ecosystem. Categorise income sources meticulously, track sales across diverse channels and consistently reconcile transactions. This comprehensive approach ensures a nuanced understanding of your earnings, facilitating strategic financial planning. By dissecting revenue streams and maintaining accurate records, you gain the insights needed to make informed decisions, optimise resource allocation, and drive sustained business growth.

-

Managing Daily Expenses:

Maintain a keen eye on your daily expenses to ensure financial clarity in your Shopify operations. Efficiently categorise and record expenditures promptly, allowing for effective cost control. This practice not only optimises your budget but also contributes significantly to the overall financial stability of your Shopify store. By fostering a disciplined approach to expense management, you create a foundation for transparency, adaptability, and long-term resilience in the face of evolving business landscapes.

-

Controlling Business Costs:

Implement proactive measures to oversee and regulate your business costs by conducting regular reviews of expenses. Engage in negotiations with suppliers, pinpoint areas for implementing cost-cutting strategies, and optimise expenditures to foster overall profitability and ensure the long-term financial sustainability of your business. This strategic approach not only enhances your financial resilience but also positions your Shopify venture for sustained success in a dynamic business environment.

-

Handling Inventory and Calculating Product Costs:

Ensure the ongoing success of your e-commerce venture by prioritising the accuracy of your inventory management processes. Regularly update and reconcile inventory records while meticulously calculating product costs, factoring in all associated expenses. This comprehensive accounting practice not only guarantees profitability by providing insight into the true costs of your products but also prevents potential issues related to stock management, ensuring your business operates with efficiency and adaptability in the dynamic e-commerce landscape.

-

Maintaining a Healthy Cash Flow:

Place a paramount emphasis on the effective management of your cash flow to ensure the long-term sustainability of your business. Vigilantly monitor both incoming and outgoing cash, encompassing sales revenue, expenses, and operational costs. This strategic approach serves not only to identify and address potential cash flow challenges but also to establish and maintain a robust cash balance, bolstering financial stability and resilience for the sustained success of your enterprise.

-

Accurate Financial Reporting:

Commit to the generation of precise and timely financial reports, encompassing crucial documents such as balance sheets and profit and loss statements. Upholding precision in financial reporting is integral not only for tax compliance and audits but also for furnishing stakeholders with transparent insights into your business’s financial performance. This dedication to accuracy not only fosters trust and credibility but also forms the bedrock for building strong and enduring relationships with stakeholders. By providing a clear and accurate representation of your financial standing, you pave the way for informed decision-making and lay a solid foundation for sustained growth and prosperity.

-

Adherence to Regulatory Compliance:

Stay proactive in staying informed about tax regulations and compliance requirements relevant to your business. Regularly update your Shopify accounting and bookkeeping practices to ensure adherence to legal standards, minimising the risk of financial setbacks due to non-compliance.

-

Automation for Efficiency:

Elevate your Shopify accounting and bookkeeping practices by adopting automation tools and selecting the right accounting software. Automate transaction categorisation, invoice generation, and financial reporting to reduce manual errors, save time, and enhance overall efficiency in managing your Shopify accounting processes. Automation not only increases accuracy but also empowers you to focus on strategic decision-making for the growth of your e-commerce venture.

How to Choose the Right Accounting Software?

-

Integration with Shopify:

Ensure that the accounting software seamlessly integrates with your Shopify platform. A cohesive integration facilitates the automatic synchronisation of financial data, reducing manual efforts and potential errors in data entry.

-

User-friendly Interface:

Opt for accounting software with an intuitive and user-friendly interface. A straightforward design enhances usability, making it easier for you and your team to navigate through features, enter data, and generate reports without unnecessary complications.

-

Reporting:

Evaluate the reporting capabilities of the accounting software. Robust reporting tools provide valuable insights into your business’s financial performance. Look for features that allow customisation, ensuring you can generate the specific financial reports you need for informed decision-making.

-

Cost:

Consider the cost of the accounting software and how it fits into your budget. Compare pricing plans, considering features, scalability, and additional fees. Choose a solution that aligns with your business needs without compromising financial sustainability.

-

Scalability:

Ensure the accounting software can scale with your business. As your company grows, you will need software that can handle increased transaction volumes and accommodate additional users. Look for solutions that offer scalable pricing plans or the ability to integrate with other software as needed.

-

Security:

Prioritise the security features of the accounting software. Since financial data is sensitive, robust security measures are crucial. Look for accounting software that employs encryption, secure login processes, and regular updates to safeguard your financial information from potential threats.

Which Accounting Software Works Best with Shopify?

Choosing the right accounting software for your Shopify Store is crucial for seamless financial management. Several options work well with Shopify, each offering unique features. Here are some of the popular ones:

-

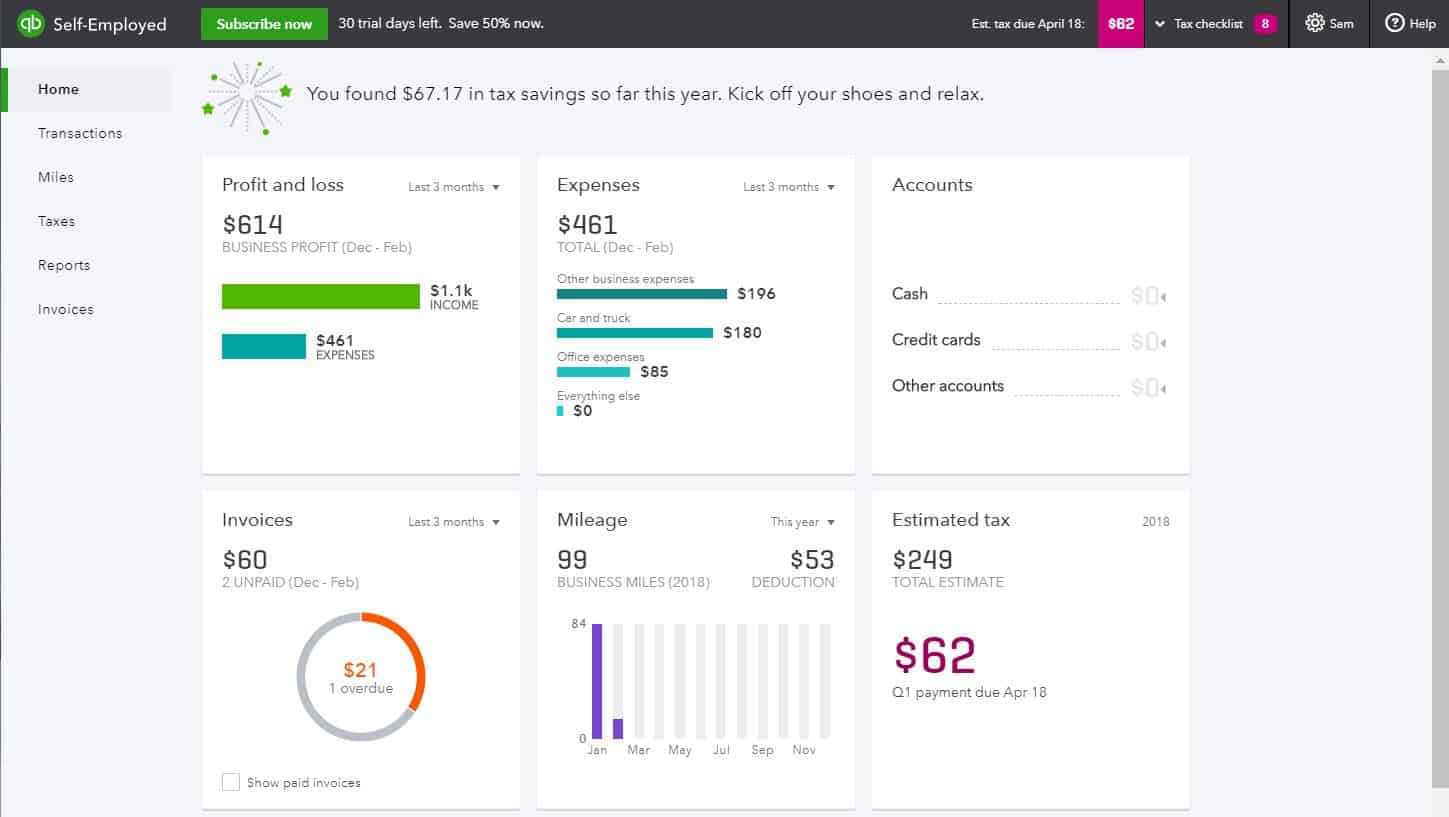

QuickBooks Online:

QuickBooks Online is a favoured option for Shopify accounting and bookkeeping, renowned for its user-friendly interface and effortless navigation. Its visually engaging design, featuring vibrant pie charts and graphs, not only enhances the aesthetic appeal but also simplifies the tracking of accounts. The intuitiveness of QuickBooks Online proves invaluable for users at various levels of financial expertise. Additionally, QuickBooks Online offers seamless integration capabilities, allowing for the automatic syncing of Shopify transaction data. This integration ensures that your financial records are consistently up to date, minimising manual data entry and reducing the risk of errors in your accounting processes.

-

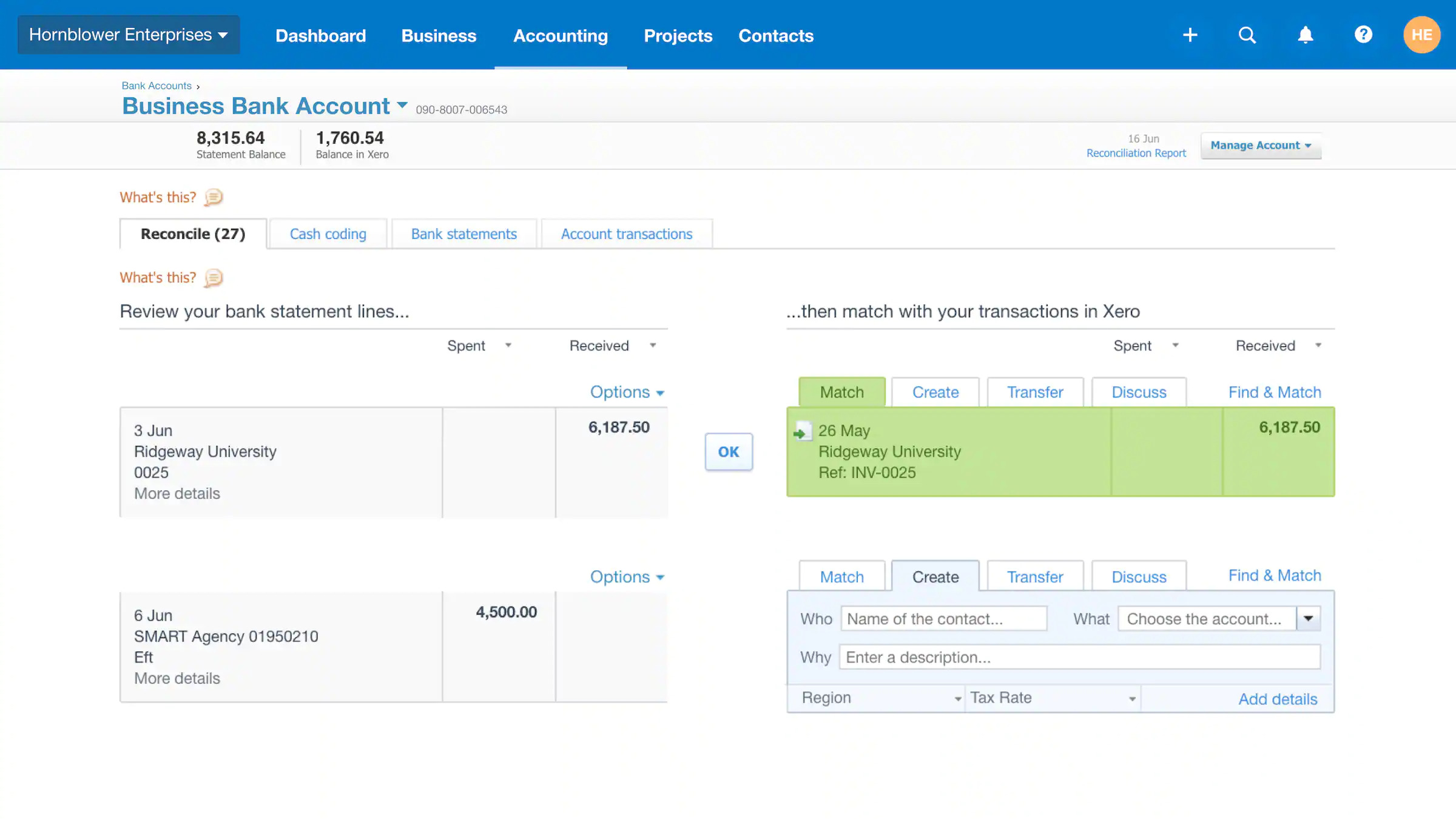

Xero:

Xero stands out as a robust accounting solution for Shopify, offering a comprehensive suite of features that cover everything from efficient data capture to intricate bank reconciliations and multicurrency accounting. Particularly favoured by larger e-commerce merchants, Xero’s versatility extends to its array of apps and integration partners. This feature-rich platform facilitates on-the-go management of Shopify accounting needs. The seamless syncing capabilities enable data flow between Xero and other essential applications, fostering a connected ecosystem. With Xero, managing the financial intricacies of your Shopify store becomes not only efficient but also adaptable to the evolving needs of your business.

-

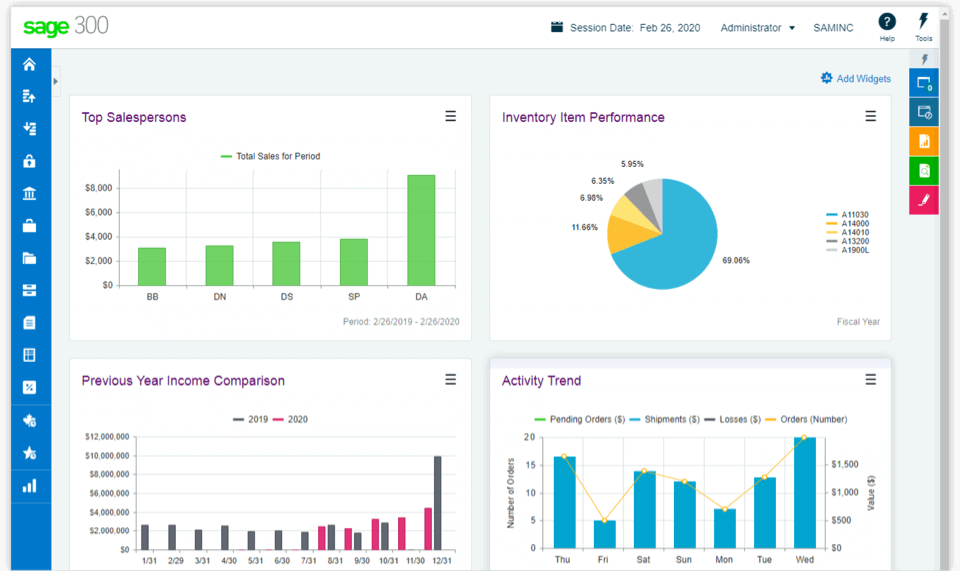

Sage:

Sage accounting software emerges as a formidable contender for Shopify accounting, especially lauded for its instant invoice reporting feature. This functionality enables Shopify store owners to effortlessly follow up on outstanding bills without navigating through extensive accounting records. Tailored for small businesses, Sage combines power with simplicity, making it an ideal choice for Shopify entrepreneurs. Beyond its core accounting functions, Sage also facilitates integration with Shopify, allowing for a seamless flow of transactional data between platforms. This integration ensures that your financial records remain accurate and easily accessible, empowering you to stay on top of your business’s financial health with minimal effort.

-

Zoho Books:

Zoho Books stands out as a versatile accounting solution that can seamlessly integrate with Shopify, offering mobile and iOS-friendly functionality. Catering to both Shopify store owners and accountants, it provides an extensive suite of bookkeeping features and robust customer support options. Beyond efficient financial record tracking, Zoho Books facilitates user-friendly invoice customisation and quick online payments, streamlining billing processes. Notably, its time-saving feature converts professional quotes into invoices with a simple click, enhancing overall efficiency and making it a valuable asset for effective financial management in the dynamic realm of e-commerce.

Challenges of E-commerce Accounting and Bookkeeping

-

Inventory Management:

E-commerce stores need to efficiently manage their inventory levels, track the cost of goods sold (COGS), and handle inventory valuation methods. Without accurate inventory tracking and reconciliation, financial statements and profitability calculations may be skewed.

-

Integration and Synchronisation:

Maintaining accurate and up-to-date financial records requires seamless integration between Shopify and accounting software. Ensuring that all sales, refunds, discounts, and fees are properly recorded in real-time can be challenging, especially if there are connectivity issues.

-

Payment Gateways and Transaction Fees:

E-commerce businesses typically use payment gateways that charge transaction fees. Tracking and reconciling these fees with sales revenue can complicate the financial recording process. Additionally, different payment processors may have varying deposit schedules, requiring careful synchronisation.

-

Reporting and Analytics:

E-commerce businesses rely on various metrics and financial reports to assess performance and make strategic decisions. Generating accurate reports for metrics like customer lifetime value (LTV), customer acquisition cost (CAC), and return on investment (ROI) can be challenging without proper integration between Shopify and accounting software.

-

Currency Conversions and Multicurrency Transactions:

For Shopify stores operating internationally, handling multiple currencies can present accounting challenges. Accurate tracking of exchange rates, managing currency conversions, and reconciling multicurrency transactions require robust accounting systems and expertise. This proficiency can be sought from experienced service providers well-versed in the intricacies of e-commerce businesses. Consider searching for terms like “outsourced Shopify accounting service provider in London”, “top Shopify accounting service provider in Edinburgh”, or “best accounting service provider in Birmingham”, depending on your geographical location. This targeted search approach ensures that you connect with the right service provider equipped to address the specific needs of your Shopify store.

-

Order Fulfilment and Shipping Costs:

E-commerce businesses must properly account for order fulfilment expenses, including shipping costs and return/refund logistics. Tracking these costs accurately and allocating them to the correct orders can be complex, especially when dealing with multiple carriers and shipping methods.

How Can Outsourced Accounting Services Help Overcome These Challenges?

-

Efficient Inventory Management:

Outsourced accounting services can help streamline inventory management processes. These service providers can implement systems and tools that accurately track inventory levels, monitor COGS, and reconcile inventory valuations. This ensures accurate financial reporting and helps you make informed decisions about inventory purchasing and management.

-

Integration and Synchronisation Support:

Accounting service providers can assist in integrating your Shopify store with accounting software and ensure seamless synchronisation of financial data. They can set up automated processes and troubleshoot any connectivity issues, ensuring that all sales, refunds, fees, and discounts are accurately recorded in real-time.

-

Payment Gateway Reconciliation:

Accounting and bookkeeping services can help you track and reconcile transaction fees charged by payment gateways. They can accurately record and allocate these fees to the appropriate sales transactions, allowing for more accurate financial reporting and analysis.

-

Customised Reporting and Analytics:

Accounting service providers can generate customised reports and provide valuable insights into key performance metrics for your Shopify store. They can create financial dashboards that analyse metrics, enabling you to make data-driven decisions and optimise your business strategies.

-

Multicurrency Accounting Expertise:

If your Shopify store deals with multiple currencies, outsourced accounting services can handle the complexities of currency conversions and multicurrency transactions. They can accurately track exchange rates, manage currency conversions, and ensure that appropriate accounting entries are made for each currency transaction.

-

Specialised Knowledge in E-commerce Accounting:

Outsourced accounting and bookkeeping service providers often possess specific expertise in e-commerce accounting. They are familiar with the unique challenges and requirements of online businesses, allowing them to provide tailored solutions and best practices that are specific to the e-commerce industry.

Factors to Evaluate Before Outsourcing E-commerce Accounting

-

Expertise in E-commerce Accounting:

Ensure that the outsourced service provider possesses specialised expertise in e-commerce accounting, particularly with a focus on Shopify. Familiarity with the platform’s intricacies, transactional processes, and e-commerce tax regulations is essential for accurate financial management.

-

Technology Integration:

Verify the service provider’s capability to seamlessly integrate with Shopify’s platform. The ability to synchronise data effortlessly, including sales, expenses, and inventory information, is vital for maintaining accurate and up-to-date financial records.

-

Data Security and Compliance:

Prioritise outsourcing partners that adhere to robust data security measures and compliance standards. Given the sensitive nature of financial data, ensure that the chosen provider complies with industry regulations and employs encryption protocols to safeguard your e-commerce financial information.

-

Scalability:

Consider the scalability of the outsourced service provider. As your Shopify e-commerce business grows, your accounting needs will evolve. Ensure that the outsourcing partner can scale its services to accommodate increasing transaction volumes, diverse product lines, and expanding financial complexities.

-

Cost-Effectiveness:

Evaluate the cost-effectiveness of your outsourcing partner. While cost savings are a significant advantage, ensure that the chosen provider offers a transparent pricing structure with no hidden fees. Assess the overall value proposition, taking into account the quality of service and potential long-term benefits.

Closing Remarks

In the intricate landscape of Shopify accounting and bookkeeping for e-commerce entrepreneurs, the challenges posed by transaction complexities, inventory tracking, and tax compliance demand a comprehensive solution. As this blog concludes, outsourcing emerges as the strategic answer to navigate Shopify’s multifaceted financial landscape. Whiz Consulting, with its specialised expertise in e-commerce accounting and bookkeeping, stands out as the go-to choice for e-commerce businesses. By entrusting accounting and bookkeeping tasks to Whiz Consulting, Shopify store owners can streamline their financial processes, ensuring accuracy, compliance, and transparency. So, contact us and propel your e-commerce business toward long-term prosperity. This strategic approach will not only facilitate efficiency but also empower your business to drive sustained growth in the ever-evolving and dynamic world of e-commerce.

Additional Tips

- Use abandoned cart recovery emails to encourage returning customers.

- Provide excellent customer service to improve customer satisfaction and loyalty.

- Offer free shipping or discounts to incentivise customers to make purchases.

- Monitor and analyse your store’s performance with Shopify’s built-in analytics tools.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.