Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: February 10, 2023

- Last Updated: February 12, 2025

Accounts receivable (AR) are payments owed to a company by its customers, which are recorded assets on the balance sheet and represent lines of credit for previous purchases. Customers must pay their balance within a year or less because accounts receivable is both a legal obligation and a current asset. In the accounts receivable process, when you send an invoice (or bill), it is added to your accounts receivable section in the balance sheet until it is paid. It refers to both the money owed and the process of collecting it. So, the accounts receivable process entails sending invoices, checking to see if they have been paid, pursuing payment, and matching payments to invoices (also known as invoice reconciliation). Accounts receivable is also known as bills receivable. Since accounts receivable is a vital part of bookkeeping and accounting, paying extra attention to these two functions is essential. If you want to know gain knowledge regarding accounts receivable, then this blog is a great way to start. So, let us delve deeper into the details.

Importance of Accounts Receivable

Accounts receivable is defined as the lifeblood of cash flow management in organisations. It enables business owners to manage their cash flow by highlighting which clients owe you and how much. A strong accounts receivable process helps you in reflecting a true view of your business’s financial position. In addition, it is critical for calculating profitability and providing the most accurate indicator of a company’s income. This is the reason why it is classified as an asset because it represents money entering the company.

Therefore, effective accounts receivable management is important because it assists in increasing sales and, thus, profits. This is because providing credit to customers usually entices them to use a company’s services and contributes to the development of a positive customer-business relationship. However, the significance of receivables management extends beyond sales and cash flow. Here is a detailed description of why you should ensure effective AR management. So, let us dig deeper.

Why to Ensure Effective Accounts Receivable Management?

It is known that a company’s cash flow and many other aspects are affected by effective accounts receivable management. As a result, it should always receive the attention it deserves. If your company is not effectively managing its collections and there is a widespread and persistent problem of payments in arrears, you risk not having enough cash on hand to pay for critical operations such as salaries, purchases, and dividends. Furthermore, strong accounts receivable management helps strengthen customer relationships and boosts the company’s reputation. Contrary to this, poor relations with your customers could impact your organisation’s client retention and ability to grab good deals in the foreseeable future.

Finally, managing your accounts receivables in an effective manner impacts your investor relations and your ability to grow. It helps attract investors because it allows them to easily see how adept your company is at the collection and assess the company’s credit record. As an indicator of healthy balance sheets, investors and lenders will look to see if your company has an efficient AR process and a good track record of collecting payments. Thus, considering its importance, you should invest in corrective measures to maximise AR effectiveness.

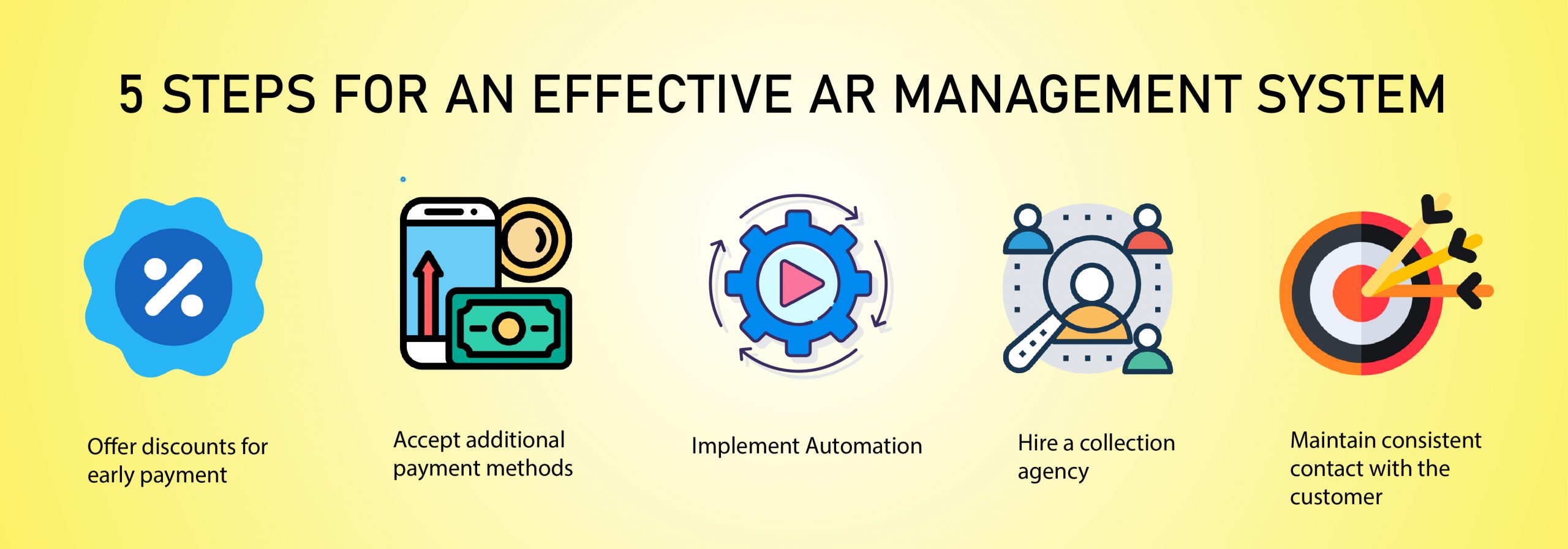

So, let us highlight 5 steps to ensure an effective AR management system.

- Offer discounts for early payment- If you want to improve your accounts receivable process and ensure effective AR management, one of the easiest things you can do is offer discounts for early payment. This will give customers an incentive to pay their invoices quickly and help you keep more cash on hand. You can offer a small discount, like 2% or 5%, or you can offer a larger discount for payments made within a certain period of time, like 10%, for payments made within 10 days.

- Accept additional payment methods- Business owners are constantly adopting new methods of receiving payments from their customers. The availability of different payment methods offers a range of flexibility and facilitates faster payments from customers. Thus, the more payment methods you accept (via transfer, credit card, traditional check, PayPal, etc.), the better will be your accounts receivable process. However, the time it takes to receive payment and its fees can differ depending on the payment method.

- Automation- Apart from putting an end to the constant delays and costs related to traditional methods, the benefits of utilising automation are widespread. The automation features aids in reducing the amount of time spent manually contacting delinquent accounts. When you automate your accounts receivable process with a digital solution, you can eliminate potential manual errors, bill your customers instantly, and track your incoming payments to gain visibility into your cash flow—all while providing your customers with a transparent process.

- Hire a collection agency- Using a collection agency to manage late or unpaid receivables helps ensure effective AR management by making sure that you receive payments promptly. In addition, using a collections agency can help reduce the bad debt you have on your books. However, when choosing a collections agency, it is important to choose one that is reputable and has a good track record. Or, you can opt for outsourced accounting companies that provide accounts receivable services comprising skilled professionals and accounting experts to streamline your AR process.

- Maintain consistent contact with the customer- Even if you make payments as simply as possible, some customers will still fail to pay. So, in order to tackle such issues, you can begin following up with the customer on the exact day the invoice becomes past due. In addition, you can remind them of the late payment so they understand how serious you are about getting them to pay. Customers will usually promise to send the payment as soon as possible or to forward the payment details if payment has already been made. But consistent follow-ups give you an early indication of the status of your receivables, such as whether a customer is about to default or is simply experiencing a temporary financial snag.

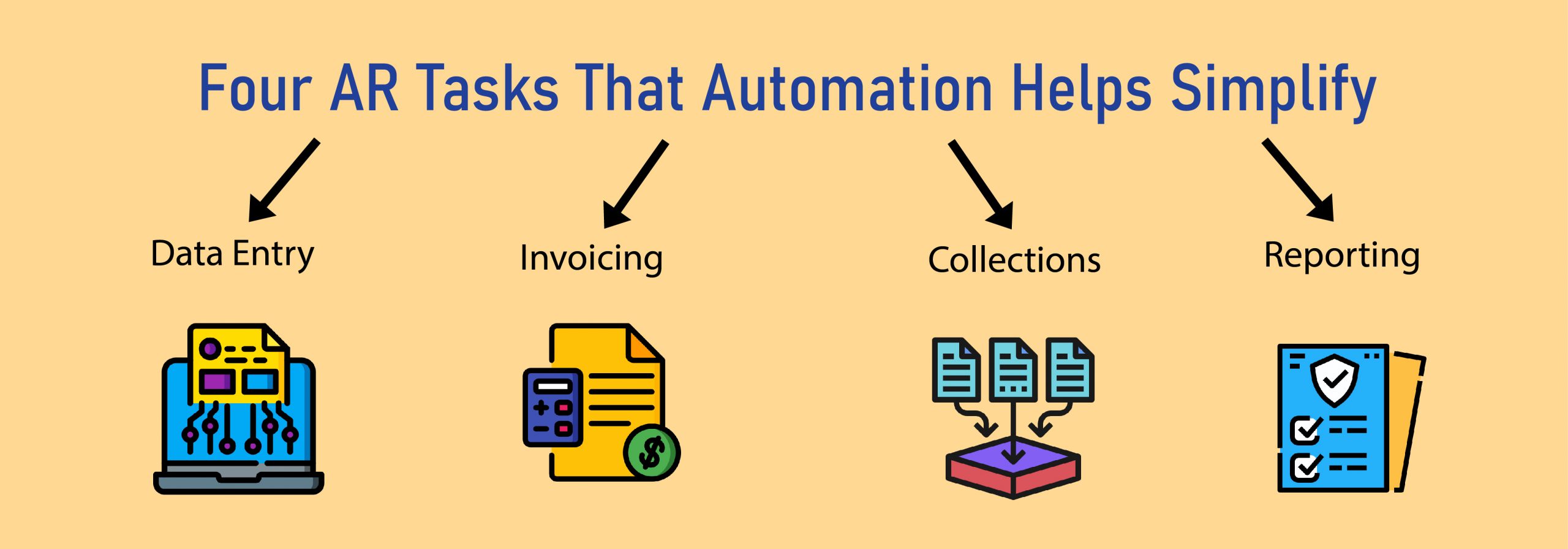

So far, we have learned that accounts receivable management is an integral part of any business’s financial health. It ensures that cash is coming in on time and in the right amounts. However, it can be tedious for accounts receivable staff, who manually monitor customers’ payments and credit limits. But it does not have to be so hard. As mentioned above, automation can help streamline the process by automatically tracking customer payments and sending out reminders when necessary. From reducing manual work to improving accuracy and more, keep reading to learn about how automation can simplify your AR process!

- Automation can help with data entry- If you are still stuck under manual processes for collecting payments, you are wasting valuable time that could be used to grow your business. You can make use of cloud-based software like FreshBooks, QuickBooks, Sage, etc., to ease your data entry process by quick integration with your existing system. This not only saves you time but also reduces the chance of human error. However, you can also opt for outsourced accounting services to streamline your AR process and reap maximum benefit from cloud-based technology.

- Automation can help with invoicing- By automating the process of creating invoices, businesses can save time and improve efficiency. Invoices generated by the software are often more accurate than those created manually. This is because the software can check for errors and omissions before generating the invoice. With the help of automated invoicing, you can ensure that all relevant information is included on the invoice, like discounts and promotional codes.

- Automation can help with collections- In the accounts receivable process, you can take the hassle out of collections by automating the associated processes and tasks. This can include automating reminders, follow-ups, and even payments. The concept of automation can also help you keep track of who has been contacted and when, so you can follow up accordingly.

- Automation can help with reporting- Reporting is an important part of the accounts receivable process, as it allows you to keep track of what is going on with your customers’ invoices. With automation, you can set up reports that will be generated automatically on a specified schedule. This can save you a lot of time and effort, as you will not have to generate reports manually.

Conclusion

As you can see, accounts receivables are a very important part of bookkeeping and accounting. It helps businesses keep the cash flow steady and timely so that they can continue to operate successfully. By keeping track of all the funds owed to them from their customers and vendors, businesses are able to maintain a healthy balance sheet. Although this process may seem daunting initially, having a proper understanding of what accounts receivables entails will help you manage it efficiently and effectively in the long run.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.