Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: February 15, 2023

- Last Updated: February 12, 2025

In any business, cash is king. Having a positive working capital ensures that a company has the resources it needs to meet its short-term obligations and take advantage of opportunities that may arise. Contrary to this, a company with a negative working capital may face difficulty meeting obligations like outstanding accounts payable and the risk of defaulting on loans or missing out on opportunities. Therefore, it is important to understand and accurately forecast the working capital required to keep operations running smoothly. However, this can be difficult if you do not know all the basics. In this blog, you will learn how to estimate your working capital requirements using different methods and ensure that you have the funds available for business operations. But first, let us learn the importance of working capital and why is working capital estimation necessary.

What is Working Capital?

Working capital is the amount of money a company needs for day-to-day operating expenses, such as raw materials, employee salaries, and rent. It tells you how well a company can pay its short-term obligations. It is the difference between a company’s current assets and current liabilities. If a company does not have enough working capital, it will be unable to pay financial obligations like accounts payable and may have to declare bankruptcy. Thus, ensuring positive working capital in your business is important. However, you can only ensure a positive working capital if you are aware of its elements or components. Here, we have highlighted certain important components of working capital to ensure a positive working capital and improve your financial literacy as a business owner.

Components of Working Capital

As mentioned above, every business must clearly understand its working capital requirements. This can be a complex task, as there are many factors to consider. However, you can better understand what is required by breaking it down into parts.

The first component of working capital is current assets. These are the assets that will be used to pay for the day-to-day operations of the business. They include cash, inventory, accounts receivable, and other short-term assets. Then the second component is the current liabilities. These are the debts and obligations that need to be paid in the short-term. They include things like accounts payable, taxes payable, and wages payable. The third and final component is called the cash conversion cycle. It refers to the time it takes for a business to convert its raw materials into finished products and then sell those products to customers.

By understanding these 3 components of working capital, you can get a better handle on how much cash balance your business needs to maintain smooth operations. So, now that you have gained a decent understanding of working capital and its components, let us delve deeper to explore its importance and why working capital estimation is needed.

Importance of Working Capital

- To ensure timely payment of bills and salaries: One of the most important uses of working capital is to ensure that all bills and salaries are paid on time. This is particularly important in businesses with tight cash flow or irregular income streams. If you are unaware of your working capital requirement, you will probably not have sufficient funds to pay off your short-term obligation. As a business owner, you can ensure timely payment of bills and salaries by investing in outsourced services as well.

- To maintain inventory levels: Another key use of working capital is to finance inventory levels. This is especially important for businesses that operate on just-in-time delivery models where any interruption in supply can lead to significant losses. Hiring outsourced accounting services from experienced service providers can help manage inventory levels more accurately.

- To take advantage of early payment discounts: Many suppliers offer early payment discounts, which can lead to significant savings for businesses. However, these discounts can only be taken advantage of if enough funds are available to make the payments on time. Positive working capital will enable you to take advantage of such discounts.

- To support expansion plans: If a business wants to expand, it will need access to additional funds to finance the growth. Working capital can provide this funding through internal accruals or external financing sources such as loans or equity injections. However, business expansion becomes possible only when you give complete attention to the core activities.

Purposes of Estimation

So far, we learnt that as a business owner, it is crucial to clearly understand your working capital needs to make well-informed financial decisions. Estimating your working capital requirements is a vital step in this process. There are several different purposes for which you may need to estimate your working capital requirements. You may need to estimate your working capital in order to:

- Develop a business plan: A key component of any business plan is a detailed financial analysis. This analysis will include an estimation of your working capital needs.

- Secure financing: If you are seeking financing from investors or lenders, they will likely require an estimation of your working capital needs as part of their due diligence process.

- Monitor cash flow: It is important to monitor your business’s cash flow closely. A part of this process includes estimating your future working capital needs so that you can make adjustments to your operations accordingly.

- Make strategic decisions: Whether you are starting your business from scratch or running an established one, you will need to make several strategic business decisions. Estimating your future working capital needs help in making different strategic decisions.

Not just the points mentioned above, you might encounter a lot of other reasons to estimate working capital. So, let us learn some methods for ensuring an effective working capital estimation.

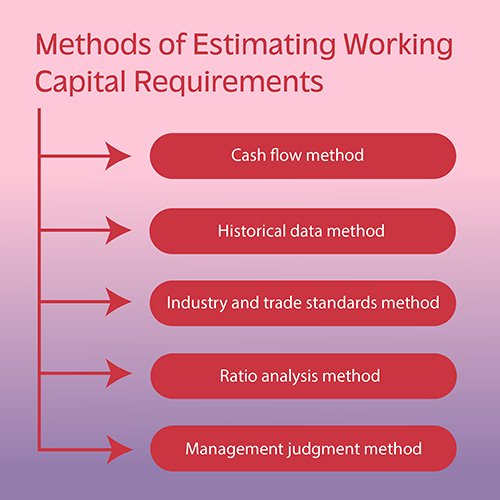

Different Methods of Estimating Working Capital Requirements

There are a number of different methods that can be used to estimate working capital requirements. Let us highlight some of the important ones.

- Cash flow method- The cash flow method is a popular option for estimating working capital requirements. With this method, you forecast your company’s future cash flow and use that information to estimate the amount of working capital you will need. The cash flow method simply projects future cash inflows and outflows to determine how much working capital will be required. This can be done using financial statements, such as income statements and balance sheets. This will give you a good idea of how much working capital you will need in the future.

- Historical data method- As the name suggests, the historical data method uses information from the company’s past to estimate future working capital requirements. This approach is based on the premise that a company’s future working capital needs will be similar to its past needs. To calculate working capital using this method, you first need to determine your company’s average cash conversion cycle (CCC) over time. The CCC is the number of days it takes for a company to convert raw materials into cash. Once you have determined the CCC, you can estimate your company’s future working capital needs by multiplying the CCC by your projected sales.

- Industry and trade standards method- This approach can be used to get a general idea of the minimum amount of working capital required for a specific industry or trade. To use this method, you will need to find industry-specific data on the average level of inventory, accounts receivable, and accounts payable. This information can be found in surveys or reports from trade associations or other similar organisations. Once you have gathered this data, you can estimate your company’s working capital requirements by applying these averages to sales volume. While this approach does not provide a precise estimate, it can help get a general idea of the minimum amount of working capital that may be required for your business.

- Ratio analysis method- With the ratio analysis method, businesses look at their financial statements and calculate some key financial ratios. The ratios used in the ratio analysis method are the current ratio, quick ratio, and inventory turnover. Even if you own a small business, such financial ratios help to give a snapshot of how well the business is doing and how much working capital is needed.

- Management judgment method- This method relies on the knowledge and experience of management to come up with an estimate. To use this method, management first needs to consider the company’s past working capital needs. They will then look at any changes that have happened within the company or industry which could impact future working capital requirements. After considering all this, management will come up with an estimate for the company’s future working capital needs. This method is often used because it is quick and easy and does not require sophisticated financial analysis. However, this method can be less accurate than other methods because it is based on subjective judgement rather than hard data.

Bottom line

So far, we have learnt that working capital describes the funds available to a business to grow, expand, and meet short-term obligations. It is important to maintain a healthy working capital balance to avoid defaulting on accounts payable and other debts. Thus, estimating working capital requirements is an important part of managing a business effectively and profitably. By understanding the various methods available to estimate the necessary funds, you can ensure access to the right amount of funds at all times and make sure your business finances remain healthy. Moreover, keeping on top of estimated costs can help you avoid overpaying for services or materials when too much cash has been set aside. Thus, be sure to use the best method when estimating how much working capital you need to ensure the successful operation of your company.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.