-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Reliable Financial Accounting Services, Always On

Accurate financial data drives great decisions. Our financial accounting advisory services keep your records organised, compliant, and up to date. With detailed reporting and smooth cash flow management, we deliver insights for smarter planning. Partner with us and gain the confidence to grow!

Outsourced Financial Accounting Services We Offer

- Budget Monitoring

- Audit Readiness

- Debtor & Creditor Analysis

- Balance Sheet

- Income Statement

- Cash Flow Statement

- General Ledger

- Trial Balance

- Statement of Changes in Equity

Financial Challenges We Tackle for You

Managing financial accounting doesn’t have to be overwhelming. Our financial accounting advisory services streamline the entire process, from cash flow management to crafting precise budgets, giving you the clarity and confidence to make informed decisions with ease.

Timely Financial Reporting

Delayed reports can disrupt crucial decisions. Our expertise ensures the timely delivery of accurate financial statements, keeping you informed and in control. With our financial accounting services, you’ll always stay ahead.

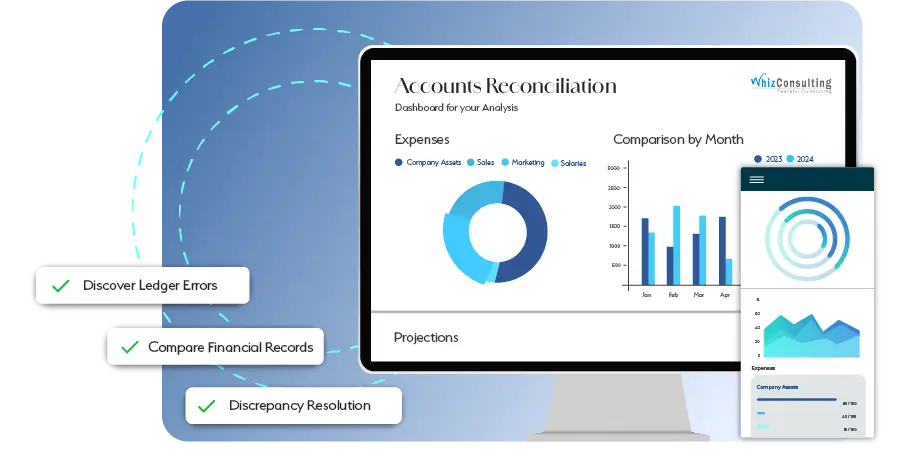

Resolving Discrepancies

Struggling with mismatched records? We handle account reconciliations with precision, eliminating errors, improving accuracy, and building trust with stakeholders and investors. Through financial accounting outsourcing, we provide a reliable solution to ensure your records are always accurate.

Audit-Ready Records

Facing an audit? No stress. We help you to organise and maintain your financial records to ensure compliance and accuracy, making audits seamless and hassle-free. Our accounting and financial services keep you prepared for any financial scrutiny.

Building Your Future Together

At its core, financial accounting isn’t just about numbers—it’s about understanding your business’s journey and unlocking its potential. We provide more than just data; we deliver clarity, precision, and the tools to drive success. With our support, you can overcome challenges, seize new opportunities, and focus on what truly matters. Together, we will lay the foundation for a future filled with growth, innovation, and achievement.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We utilise cutting-edge technology and proven best practices to design streamlined workflows that guarantee accuracy, efficiency, and the timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you to ensure effective communication and a thorough understanding of your bookkeeping needs. Whether it’s a quick update or a strategic discussion, we’re always just a call away.

-

Decade of Experience

With over 10 years of industry expertise, we have a proven history of helping businesses across various sectors stay organised and financially sound.

-

Dedicated Experts

Our team comprises highly skilled and certified professionals, dedicated to supporting your business. From accountants to financial analysts, we have the expertise to tackle your unique challenges.

-

Real-Time Insights

Enjoy a clear, up-to-date view of your financial health at any time. Our real-time reporting and dashboards provide actionable insights to help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us reduces overhead costs. Our scalable services are tailored to your needs, saving you the expense of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Outsourced financial accounting services involve hiring external professionals to manage tasks like bookkeeping, financial reporting, and tax preparation. These services ensure your financial records are accurate, compliant, and efficiently handled.

Financial accounting outsourcing provides cost-effective access to experts, timely financial reporting, and the ability to focus on core activities. It improves efficiency while ensuring compliance with regulations and delivering reliable financial insights.

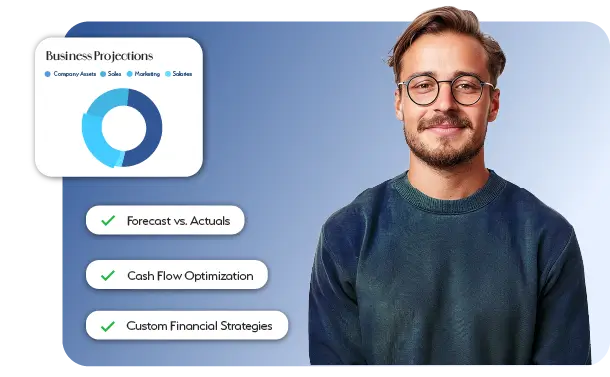

Financial accounting advisory services offer more than basic bookkeeping. They provide tailored strategies, cash flow optimisation, expense management, and data-driven insights to help businesses make informed decisions and achieve long-term goals.

Yes, outsourcing eliminates the need for in-house recruitment, training, and salaries. With accounting and financial services, you pay for only what you need, making it a highly cost-efficient solution.

Not at all. Financial accounting outsourcing ensures your records are handled by skilled professionals with expertise in compliance and reporting standards. This guarantees accuracy and timely delivery of financial reports.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Financial Accounting Services

Managing financial accounting operations of every kind of business can be both demanding and time-consuming. For companies seeking precision and efficiency, financial accounting outsourcing offers a practical solution. By entrusting these tasks to experienced professionals, businesses can focus on innovation and growth while maintaining accurate and compliant financial records.

Get a CallOutsourced financial accounting services involve hiring external experts to handle tasks such as bookkeeping, financial reporting, and tax compliance. These services cover everything from maintaining daily transaction records to preparing comprehensive financial statements. With skilled professionals managing your finances, your business operations can run smoothly and effectively.

Outsourcing connects businesses with professionals who specialise in financial accounting advisory services. With years of experience and a thorough understanding of regulations, these experts ensure accuracy and compliance in all financial processes.

Building and maintaining an in-house accounting team can be costly. Outsourcing accounting and financial services eliminates the expenses of recruitment, training, and salaries, offering a budget-friendly alternative for businesses of any size.

Outsourcing guarantees precise and prompt financial reporting, including income statements, balance sheets, and cash flow analyses. These critical insights empower businesses to make informed decisions and meet regulatory standards effortlessly.

Delegating financial tasks allows businesses to prioritise core operations and strategic growth initiatives. This shift enhances productivity and paves the way for long-term success.

Expert financial accounting advisory services go far beyond traditional bookkeeping. They deliver tailored strategies and actionable insights to help businesses optimise cash flow, control expenses, and plan for sustainable growth. By leveraging advisory expertise, companies can make data-driven decisions that align perfectly with their objectives, driving both stability and success.