-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

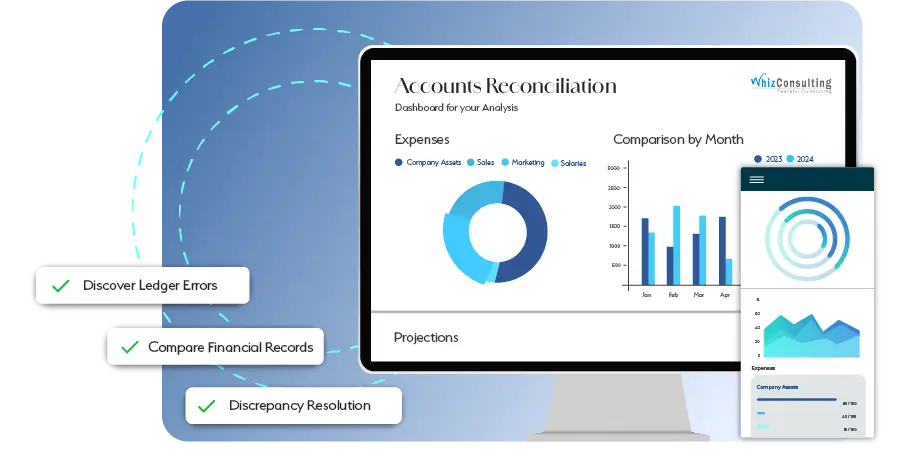

Whiz Consulting: Your Trusted Partner for Accounts Reconciliation

Keeping your financial records accurate and up-to-date is vital for informed decision-making in business. At Whiz Consulting, we specialise in account reconciliation services, ensuring your accounts are always in sync. We promptly detect discrepancies before they escalate into costly errors. With our expertise in accounts reconciliation, you’ll always have a clear picture of your financial health. Allow us to handle the details, so you can focus on managing your business efficiently.

Accounts Reconciliation Outsourcing Services We Offer

- Partial or full reconciliation of accounts

- Bank statement and financial record alignment

- Credit card and bank statement matching

- Invoice-to-ledger verification

- Check sequencing and tracking

Challenges We Address For You

Our accounts reconciliation services are designed to tackle the key pain points businesses face.

Massive Volumes of Transactions

Reconciling a high quantity of transactions across various accounts can be challenging. We streamline the process by efficiently handling workload and ensuring all details in your books are accurate and aligned.

Addressing Discrepancies Timely

Errors or omissions in your records can impact your decision-making abilities. Our detailed approach detects and resolves discrepancies timely so that your financial reports are reliable and precise.

On-Time Reconciliation

Gone are the days when you struggle with delayed financial planning. We ensure your accounts are timely reconciled to provide a clear financial picture and peace of mind.

Precision That Powers Decisions

Accurate account management requires a blend of expertise, precision, and advanced tools. Our reconciliation services tackle the complexities of financial management, ensuring every transaction aligns perfectly. With swift error resolution and up-to-date records, we provide the clarity and confidence you need to focus on growing your business.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We utilise cutting-edge technology and proven best practices to design streamlined workflows that guarantee accuracy, efficiency, and the timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you to ensure effective communication and a thorough understanding of your bookkeeping needs. Whether it’s a quick update or a strategic discussion, we’re always just a call away.

-

Decade of Experience

With over 10 years of industry expertise, we have a proven history of helping businesses across various sectors stay organised and financially sound.

-

Dedicated Experts

Our team comprises highly skilled and certified professionals, dedicated to supporting your business. From accountants to financial analysts, we have the expertise to tackle your unique challenges.

-

Real-Time Insights

Enjoy a clear, up-to-date view of your financial health at any time. Our real-time reporting and dashboards provide actionable insights to help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us reduces overhead costs. Our scalable services are tailored to your needs, saving you the expense of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Accounts reconciliation involves comparing financial records with external documents like bank statements to ensure they match. It helps identify discrepancies, reduce fraud risks, and maintain financial accuracy.

Yes, bookkeepers can manage bank reconciliation services by cross-checking financial records with bank statements to resolve discrepancies and ensure accurate data.

A specialist handles account reconciliation services, identifies errors, ensures compliance with accounting standards, and maintains accurate financial reports for strategic decision-making.

Regular reconciliation of accounts ensures accuracy, prevents errors, identifies fraud, and supports sound financial decisions. It also helps maintain compliance and effective cash flow management.

Outsourcing streamlines processes by using expert knowledge and advanced tools like bank reconciliation software. It reduces errors, saves time, and allows businesses to focus on growth while ensuring accurate records.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Reconciliation Services: Ensuring Accuracy in Financial Records

Maintaining precise financial records is crucial for any business. However, the reconciliation of accounts can often be a time-intensive and daunting task. This meticulous process is essential for detecting discrepancies but can divert focus from core business activities. Outsourcing accounts reconciliation services is an effective way to entrust experts with the job, ensuring accuracy and better financial management.

Get a CallAccounts reconciliation involves cross-verifying financial records against bank statements, credit card transactions, and other documents. Any mismatches can lead to significant discrepancies, impacting decision-making. Professional reconciliation services help identify and rectify these errors, ensuring your records remain accurate and reliable.

Reconciliation tasks, including accounts payable reconciliation and accounts receivable reconciliation, require a significant investment of time and expertise. Outsourcing allows you to free up internal resources while benefiting from efficient and cost-effective processes.

Our services incorporate leading account reconciliation software to automate and streamline the reconciliation process. These tools enhance precision, reduce manual errors, and provide a transparent view of your financial health, accessible via real-time updates.

Staying compliant with evolving regulations is essential for any business. Our experts keep your records aligned with standards, minimising risks of fraud and errors. We also specialise in bank reconciliation services to maintain the integrity of your financial data.

By addressing discrepancies promptly, reconciliation services help in effective cash flow management. You gain clear insights into available funds, pending payments, and other financial metrics, enabling better budget planning and investment strategies.

As businesses grow, transaction volumes and complexities increase. Our accounts reconciliation services are scalable, allowing you to adjust the level of support as required, ensuring cost-efficiency.

Accurate records form the backbone of sound decisions. By outsourcing accounting reconciliation, you can focus on driving business growth while we ensure your financial data is dependable.