-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Stay Ahead with Proactive Virtual CFO Services

We bring clarity and control to your business finances with our Virtual CFO services. By optimising budgets, streamlining cost management, and maximizing resource efficiency, we simplify financial complexities. Our expert guidance allows you to focus on achieving your business goals while we handle the financial details, empowering you to lead with confidence and drive success.

Outsourced Virtual CFO Services We Offer

- Accounting & Bookkeeping

- Financial Analysis

- Tax Planning

- Business Valuation

- Funding Evaluation

- Business Acquisition & Mergers

Challenges We Tackle for You

At Whiz Consulting, we recognise the critical need for precise financial oversight and strategic planning. Our Virtual CFO services are designed to address and resolve these common challenges effectively:

Lack of Strategic Financial Direction:

Focusing only on historical data limits your ability to make proactive decisions. Our Virtual CFOs provide forward-looking strategies, forecasting, and detailed financial models to help you stay ahead of market changes and position your business for growth.

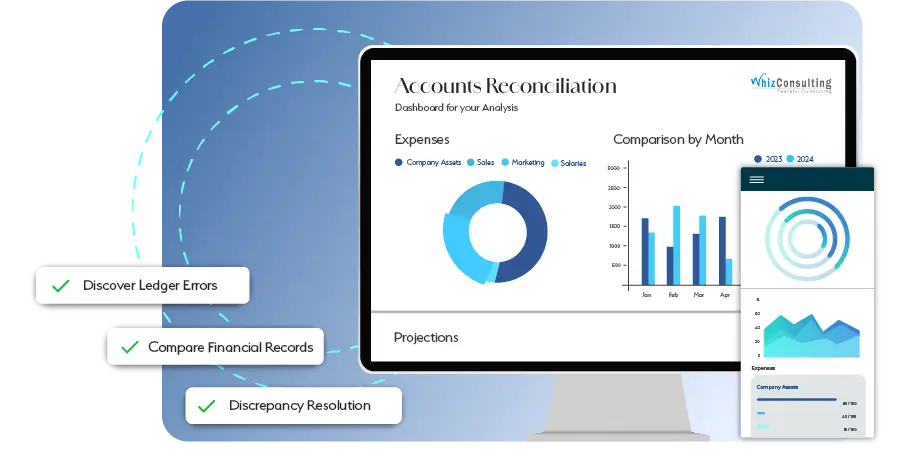

Unreliable Financial Reporting:

Delayed or inaccurate reports can create roadblocks in decision-making and compliance. We streamline your financial systems, delivering timely and accurate reporting to ensure you always have the insights needed to make critical decisions.

Challenges in Managing Cash Flow and Budgets:

Poor cash flow management and ineffective budgeting can disrupt operations and growth plans. Our Virtual CFOs create customized cash flow strategies, comprehensive budgets, and actionable financial plans, giving you the control needed to achieve financial stability.

Strategic Growth with Virtual CFO Services

Eliminate financial uncertainty with our expert Virtual CFO solutions. We transform complex financial data into actionable insights through advanced analysis, accurate forecasting, and strategic planning. Acting as your dedicated financial partner, we enhance profitability, mitigate risks, and align your financial processes with your goals, enabling confident decision-making and long-term success.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We utilise cutting-edge technology and proven best practices to design streamlined workflows that guarantee accuracy, efficiency, and the timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you to ensure effective communication and a thorough understanding of your bookkeeping needs. Whether it’s a quick update or a strategic discussion, we’re always just a call away.

-

Decade of Experience

With over 10 years of industry expertise, we have a proven history of helping businesses across various sectors stay organised and financially sound.

-

Dedicated Experts

Our team comprises highly skilled and certified professionals, dedicated to supporting your business. From accountants to financial analysts, we have the expertise to tackle your unique challenges.

-

Real-Time Insights

Enjoy a clear, up-to-date view of your financial health at any time. Our real-time reporting and dashboards provide actionable insights to help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us reduces overhead costs. Our scalable services are tailored to your needs, saving you the expense of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Virtual CFO services encompass financial planning and analysis, creating budgets and forecasts, managing cash flow, and preparing detailed financial reports. These services often include risk assessment, strategic financial guidance, and support with fundraising and investor relations.

The cost of a virtual CFO depends on factors like the range of services provided, the size of your business, and its financial complexity. Pricing is typically structured as a fixed monthly fee or hourly rate, often more cost-effective than employing a full-time CFO.

A virtual CFO serves as an outsourced financial strategist, providing expert guidance to help businesses achieve their financial objectives. They deliver actionable insights, oversee financial operations, and offer strategic advice, all without being part of your in-house team.

While accountants primarily focus on tracking and reporting past financial transactions, virtual CFOs look forward, focusing on strategy, forecasting, and driving growth. A virtual CFO provides high-level guidance and actionable strategies, beyond record-keeping and compliance.

To find the best virtual CFO, prioritize candidates with industry-relevant experience, excellent communication abilities, and a proven record of delivering results. Ensure they understand your business needs and objectives, and check references to verify their expertise and compatibility.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Unlock Strategic Financial Growth with Virtual CFO Services

Managing the financial health of a business is a critical task that requires expertise, strategy, and precision. For companies that do not have the capacity to hire a full-time CFO, virtual CFO services offer an ideal solution. These services provide high-level financial oversight and guidance without the cost and commitment of an in-house executive.

Get a CallA virtual CFO service involves outsourcing the financial leadership of a company to experienced professionals. These services go beyond bookkeeping and accounting to offer strategic financial planning, risk management, cash flow analysis, and compliance oversight. Whether you are a startup or a growing enterprise, virtual CFO solutions can adapt to your business needs.

Choosing to hire a virtual CFO is a smart move for businesses aiming to gain professional financial expertise without the overhead of a full-time hire. Virtual CFO companies provide access to industry experts who craft strategies tailored to your business goals, ensuring long-term growth and stability.

- Cost-Effective Expertise:Hiring a virtual CFO is significantly less expensive than employing a full-time CFO, while still delivering expert-level guidance.

- Scalable Solutions:Virtual CFOs provide flexibility, allowing businesses to scale services up or down as needed, ensuring cost-effectiveness.

- Strategic Financial Planning:With detailed budgeting, forecasting, and financial reporting, virtual CFO solutions help businesses stay on track and make data-driven decisions.

- Risk Management:A virtual CFO identifies potential financial risks and offers proactive strategies to mitigate them.

- Investor Relations:Virtual CFOs assist in fundraising, preparing pitch decks, and maintaining transparent financial communications with investors.

When searching for the best virtual CFO services, consider a provider’s track record, industry expertise, and ability to deliver customised solutions. Ensure they understand your business’s unique needs and goals to maximise the benefits.

The financial landscape of a business is constantly evolving, and having the right guidance can make all the difference. By partnering with virtual CFO companies, you gain access to expert financial leadership that drives success. Whether you need strategic planning, risk management, or financial insights, hiring a virtual CFO is a game-changer for businesses aiming for sustainable growth. Make the smart choice today and unlock the full potential of your financial operations.