-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Gain Clarity with Expert Ratio Analysis

Confused by complex financial data? Let us make it simple. Our ratio analysis services uncover the story behind your numbers, providing actionable insights to drive your business forward. We analyze key metrics like profitability, liquidity, and efficiency to highlight strengths and pinpoint challenges. With our expert support, you’ll make informed decisions, improve performance, and unlock new opportunities for growth. Make your numbers work harder for your business!

Ratio Analysis Services We Offer

- Profitability Ratios

- Liquidity Ratios

- Efficiency Ratios

- Solvency Ratios

- Market Ratios

- Turnover Ratios

- Earnings Ratios

Challenges in Ratio Analysis and How We Solve Them

At Whiz Consulting, we address the key hurdles businesses face with ratio analysis to deliver clear and actionable insights.

Complex Data Interpretation:

Understanding what ratios reveal about business performance can be challenging. We simplify the data, providing clear explanations to ensure stakeholders grasp the financial implications.

Inaccurate Calculations:

Errors in financial data can lead to misleading ratios. Our team ensures data accuracy through rigorous validation processes, delivering reliable results every time.

Limited Benchmarking Opportunities:

Without proper benchmarks, it’s hard to evaluate performance. We offer comprehensive industry comparisons, helping you assess where your business stands and identify areas for improvement.

Decode Your Business Performance with Ease

Understanding your financial health doesn’t have to be complicated. With our expert ratio analysis services, we turn complex numbers into clear, actionable insights. From profitability to liquidity and beyond, we provide a detailed roadmap to guide your decisions, minimize risks, and uncover opportunities. Let us handle the heavy lifting while you focus on scaling your business with confidence and precision.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

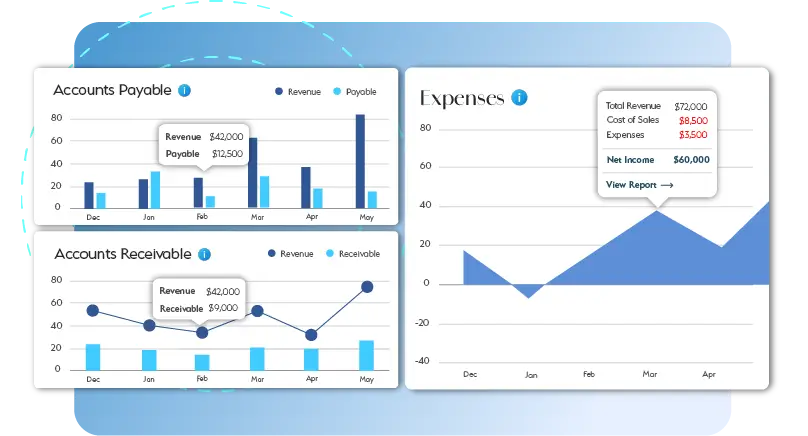

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Financial ratio analysis helps businesses evaluate their financial health by providing insights into profitability, liquidity, efficiency, and solvency. It simplifies complex financial data to support better decision-making and strategic planning.

Industries such as manufacturing, retail, technology, and healthcare benefit from debt to asset ratio analysis. It helps businesses assess their leverage and financial stability within their sector.

Businesses should perform an analysis of the debt to equity ratio quarterly or annually, depending on their financial structure. Regular analysis ensures timely identification of financial risks and opportunities.

Yes, financial ratio analysis enables businesses to compare their metrics, such as equity to debt ratio analysis, with industry benchmarks. This helps identify strengths, weaknesses, and growth opportunities.

Outsourcing interpretation services ensures accurate calculations, expert insights, and time efficiency. Professionals provide detailed reports on metrics like debt to total assets ratio analysis, freeing up internal resources for other priorities.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Unlock the Potential of Your Business with Ratio Analysis Services

Understanding financial performance is critical for any business aiming for sustainable growth. Ratio analysis simplifies complex financial data into key insights, enabling stakeholders to make informed decisions. By evaluating profitability, liquidity, efficiency, and solvency, businesses can identify areas of improvement and opportunities for growth with precision.

Get a CallRatio analysis is the process of comparing financial data from a company’s statements to assess its operational efficiency, financial stability, and overall health. It provides an accurate snapshot of a business’s performance, helping stakeholders understand and address key challenges.

Financial ratio analysis involves various categories of ratios, each serving a specific purpose:

- Profitability Ratios: These measure a company’s ability to generate income relative to revenue, expenses, and other costs.

- Liquidity Ratios: These assess whether a business can meet its short-term financial obligations.

- Efficiency Ratios: These evaluate how well a company uses its resources to generate income.

- Solvency Ratios: These determine a company’s capacity to meet long-term liabilities, such as through debt to total assets ratio analysis and debt to asset ratio analysis.

- Market Ratios: These ratios assess the value of a company’s stock in the market.

Among these, analysis of debt-to-equity ratio, debt to total assets ratio analysis, and equity to debt ratio analysis are vital for evaluating a business’s financial leverage and stability.

Ratio analysis is essential for understanding the financial health of a business. It transforms raw data from financial statements into insights that are easy to comprehend. This helps business owners, managers, and investors make informed decisions.

- Simplifies Complex Numbers: Financial data is often overwhelming. Ratio analysis provides simplified metrics that reveal a company’s strengths and weaknesses.

- Improves Decision-Making: Ratios like debt to asset ratio and equity to debt ratio help businesses identify risks and opportunities for growth.

- Tracks Trends Over Time: Regular analysis reveals patterns, helping businesses monitor performance and predict future outcomes.

- Supports Benchmarking: Ratio analysis allows businesses to compare their performance with industry standards and competitors.

While ratio analysis simplifies financial data, interpreting these ratios requires expertise. Interpretation services help businesses understand the implications of these ratios and translate them into actionable strategies. For instance, a high debt to equity ratio might indicate over-leverage, prompting the need for a more balanced financial approach.

- Enhances Financial Clarity: Businesses can identify inefficiencies, track profitability, and monitor liquidity with ease.

- Informs Strategic Planning: By understanding financial metrics, businesses can align their strategies with long-term goals.

- Mitigates Risks: Ratios like debt to total assets help identify financial risks, allowing businesses to take proactive measures.

Financial ratio analysis is a vital tool for businesses seeking to optimize performance and achieve sustainable growth. By focusing on key metrics like profitability, solvency, and efficiency, ratio analysis provides the clarity needed to make informed decisions. Whether you are tracking trends, benchmarking against competitors, or addressing financial challenges, ratio analysis ensures your business is equipped with the insights to thrive in a competitive market.