Table of Content

Share This Article

- Reading Time: 12 Minutes

- Published: June 10, 2022

- Last Updated: January 16, 2025

Payroll management is the most expensive but one of the most critical accounting activities. It involves calculating employee earnings, withholding taxes, and distributing payments, all while maintaining compliance with federal and state regulations. Proper payroll management is vital for maintaining employee satisfaction, avoiding legal issues, and ensuring smooth business operations. Errors in payroll can lead to fines, penalties, and decreased employee morale. Businesses can use payroll outsourcing services to avoid such situations and reduce the in-house team’s workload. However, before making any decisions about managing the payroll, it is necessary to know the critical factors of payroll processing. Let us learn what payroll is and what factors affect its processing and management.

What is Payroll?

Payroll refers to the process of compensating employees for their work. It encompasses all aspects of paying employees, including the calculation of wages, deductions, and the distribution of payments. The payroll processing can be done manually, via accounting software, or with the help of payroll outsourcing services. Regular and accurate payroll management is compulsory to keep the employees motivated and business financials in sync. Payroll processing is done by following the laws and regulations set out by FSLA (the Fair Labor Standards Act).

Payroll impacts various aspects of a business, including cash flow management, maintaining employee satisfaction, and legal compliance. It is a core function that supports a company’s financial health and stability.

How Does Payroll Work in the USA?

In the United States, payroll calculations for salaried employees are generally straightforward. According to the Department of Labor (DOL), these employees receive a fixed amount each pay period. Typically, salaried employees are not eligible for overtime pay; however, specific overtime rules apply, and it’s essential to verify with your state labor board to determine who is exempt from overtime protection. If a salaried employee is not exempt, they must be compensated for any additional hours worked.

The Key Stakeholders

- Employers: Responsible for ensuring accurate and timely payroll.

- Employees: Provide the necessary information and expect to be paid correctly.

- Government Agencies: Enforce compliance with payroll-related regulations and tax laws.

Payroll Contributions and Cycle

Payroll contributions include Medicare and Social Security taxes, which are part of FICA taxes. Half of these taxes are deducted from employee paychecks, and the other half is paid by employers. Additionally, self-employed individuals must pay self-employment tax in place of FICA. Businesses in the USA typically follow one of several payroll cycles:

- Weekly: Employees are paid every week.

- Bi-weekly: Payments are made every two weeks.

- Semi-Monthly: Employees are paid twice a month, often on the 15th and last day of the month.

- Monthly: Payments are made once a month.

Key Elements of Salary Structure in the USA

Understanding the components of a salary structure is fundamental to the payroll process in the USA. Some essential elements include:

-

Employee Information

Before payroll processing can begin, employees must complete a W-4 form, which provides their federal income tax withholding details and personal information such as their name, address, and Social Security number.

-

Hours Worked

For hourly employees, tracking hours is vital to ensure accurate and timely payment. Even for salaried employees, tracking hours is important to confirm that the correct hours are being reported.

-

Salaries and Wages

Salaries are fixed amounts paid to employees, typically divided into pay periods throughout the year. For example, an employee with a yearly salary of $28,600, paid weekly, would receive $550 before deductions. Wages, on the other hand, are calculated based on the number of hours worked multiplied by the employee’s hourly rate.

-

Overtime Pay

Non-exempt employees who work more than 40 hours a week are entitled to overtime pay. The overtime rate is calculated by multiplying the regular pay rate by 1.5.

-

Fringe Benefits

Fringe benefits, such as health insurance, retirement plans, and other perks, are also part of the payroll process. Some benefits are taxable and must be included in the payroll calculations.

-

Other Pay

Secondary income sources like tips or commissions must also be reported and are subject to payroll taxes. These earnings are included in the payroll process alongside regular wages.

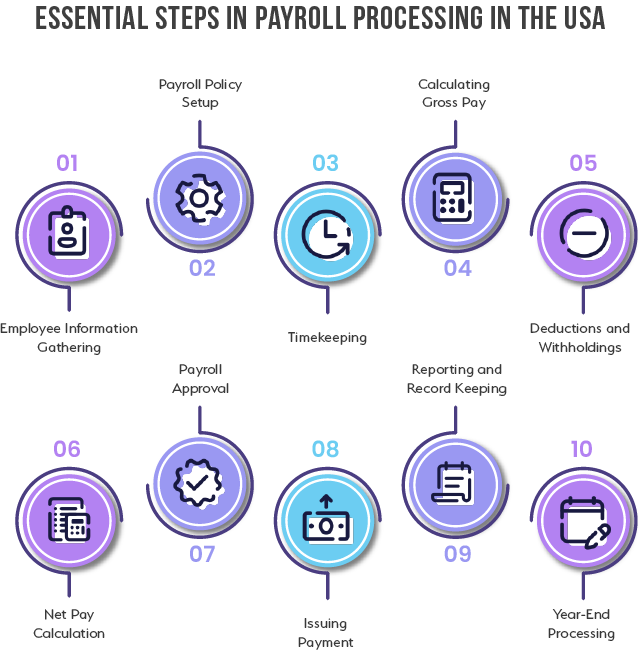

Essential Steps in Payroll Processing

› Step 1: Employee Information Gathering

- Forms Required: Employees must complete a W-4 form to determine their tax withholding and provide personal details such as their Social Security number and address.

- Employee Information Accuracy: Accurate employee information is essential for correct payroll calculations and tax compliance.

› Step 2: Calculating Gross Pay

- Hourly Employees: Multiply the total hours worked by the hourly rate.

- Salaried Employees: Divide the annual salary by the number of pay periods in the year.

- Inclusions: Gross pay may include overtime, bonuses, commissions, tips, and paid time off.

› Step 3: Payroll Deductions

- Statutory Deductions: Federal income tax, Social Security tax, Medicare tax, and state/local taxes, where applicable.

- Voluntary Deductions: Employee contributions to health insurance, retirement plans, and other benefits.

- Garnishments: Court-ordered deductions for debts like unpaid taxes or child support.

› Step 4: Distributing Payments

- Methods: Payments can be made via direct deposit, physical checks, or payroll cards.

- Timing: Payments must be distributed according to the company’s payroll cycle to ensure employees are paid on time.

› Step 5: Payroll Tax Filing and Deposits

- IRS Requirements: Employers must file payroll taxes with the IRS, including federal income tax, Social Security, and Medicare taxes.

- State and Local Tax Filing: Depending on the location, businesses may also need to file state and local taxes.

- Deadlines: Payroll tax deposits are typically due semi-weekly or monthly, depending on the size of the payroll.

› Step 6: Record Keeping and Compliance

- Accurate Records: Employers are required to keep accurate payroll records, including employee information, pay rates, and tax filings.

- Compliance: Maintaining records ensures compliance with federal and state laws, which is critical during audits or legal disputes.

- W-2 and 1099 Processing: Handling the timely preparation, distribution, and storage of W-2s and 1099s, keeping all documentation in compliance.

Key Payroll Challenges for Businesses in the USA

› Compliance with Regulations

- Federal, State, and Local Laws: The United States has a multi-layered legal framework for payroll that encompasses federal, state, and local regulations. Each level of government may impose different requirements for minimum wage, overtime pay, payroll taxes, and employee classification. This complexity makes it challenging for businesses to ensure full compliance across all jurisdictions.

- Constantly Changing Laws: Payroll regulations are frequently updated, with changes to tax rates, reporting requirements, and labor laws occurring at various times throughout the year. Staying up to date with these changes is essential but time-consuming and requires ongoing attention.

- Penalties for Non-Compliance: Failure to comply with payroll regulations can result in severe penalties, including fines, interest on unpaid taxes, and legal action. Businesses may also face audits from the IRS or the Department of Labor, leading to further complications and potential liabilities.

› Tax Errors

- Complex Tax Calculations: Payroll tax calculations involve multiple components, including federal income tax, Social Security, Medicare, and state and local taxes, where applicable. Each employee’s tax liability may differ based on their earnings, filing status, and deductions claimed, making tax calculations prone to errors.

- Incorrect Withholding: Miscalculations in tax withholding can lead to underpayment or overpayment of taxes. Underpayment can result in penalties and interest charges from tax authorities, while overpayment can cause cash flow issues for the business.

- Filing Errors: Filing payroll taxes involves adhering to strict deadlines and accurate reporting. Filing errors, such as incorrect information or late submissions, can lead to penalties and fines.

› Employee Misclassification

- Exempt vs. Non-Exempt Employees: Misclassifying employees as exempt (salaried and not eligible for overtime) or non-exempt (hourly and eligible for overtime) is a common payroll mistake.

- Independent Contractors vs. Employees: Another common misclassification issue involves distinguishing between employees and independent contractors. Misclassifying an employee as a contractor can lead to liability for back taxes, penalties, and unprovided benefits.

› Payroll Errors

- Calculation Mistakes: Payroll mistakes or errors can occur in various forms, such as incorrect calculations of wages, overtime, or benefits. These mistakes can lead to underpayment or overpayment of employees, both of which can cause dissatisfaction, reduced morale, and potential legal action.

- Incorrect Deductions: Errors in applying deductions, such as taxes, retirement contributions, or garnishments, can disrupt employees’ financial planning and lead to legal disputes.

- Financial Losses and Disruptions: Payroll errors can disrupt business operations by causing financial discrepancies, complicating accounting processes, and leading to unnecessary legal costs.

Payroll Software and Benefits

- QuickBooks Payroll, ADP, Gusto, Paychex, and others are commonly used in the USA. Software like Gusto has many advantages, including automated payroll calculations, tax filing, and direct deposits. It also offers compliance tools to help businesses stay up to date with laws and regulations.

- Payroll processing software reduces the time spent on payroll processing, minimizes errors, and helps ensure adherence to federal and state payroll laws.

- These software are suitable for businesses of all sizes, from small startups to large enterprises.

Compliance with US Payroll Regulations

The legal aspects of payroll processing are managed by the IRS (Internal Revenue Services) and DOL (Department of Labor). Every business must comply with the laws and regulations set up by these regulatory authorities to ensure accounting accuracy and avoid penalties. Some of the important payroll regulations are:

-

FLSA

The Fair Labor Standards Act (FLSA) entitles a nonexempt employee to a minimum wage of $7.25 per hour and overtime pay of 1.5 times the regular pay for work done after 40 hours a week. It also requires the businesses to maintain a record of every nonexempt employee. Keeping track of every employee and recording their details requires time and resources. To calculate accurate pay and overtime, a business needs to diligently track the attendance and time spent by every employee on the work. Businesses can use payroll outsourcing services for this activity and reduce the burden on the full-time business employee to increase their productivity.

-

FICA

The Federal Insurance Contributions Act (FICA) manages the two deductions made from an employee’s paycheck, i.e., social security tax and Medicare tax. The total FICA tax should be 15.3%, a combination of social security tax and Medicare.

-

FUTA

The Federal Unemployment Tax Act (FUTA) requires employers to contribute to state and federal unemployment programs to compensate employees who have lost their jobs. The tax paid under FUTA is not a deduction from employees’ paychecks; the employer directly pays it. However, if the employer has agricultural or household workers, the FUTA tax is an exemption.

-

Affordable Care Act (ACA)

Requires employers to provide health insurance to full-time employees.

-

IRS Payroll Requirements

Includes payroll tax filing and deposit schedules.

-

State Payroll Laws

Each state has its own payroll laws, which may include additional taxes, wage laws, and garnishment rules.

Outsourcing Payroll Processing: Pros

-

Expertise

Access to payroll specialists who understand the latest regulations, ensuring compliance with federal, state, and local laws.

-

Time-Saving

Frees up time for business owners and HR teams to focus on core operations and strategic initiatives.

-

Accuracy

Reduces the risk of errors in payroll calculations and tax filings through professional handling and advanced payroll technology.

-

Cost-Effectiveness

Lowers operational costs by eliminating the need for in-house payroll software, hardware, and additional staff.

-

Enhanced Security

Provides robust data protection and security measures to safeguard sensitive payroll information from unauthorized access.

-

Access to Advanced Tools and Analytics

It offers real-time reporting and analytics, allowing businesses to monitor payroll expenses and employee compensation trends effectively.

-

Improved Employee Experience

Enhances the management of employee benefits and ensures timely, accurate payroll delivery, leading to higher employee satisfaction.

-

Flexibility and Scalability

Adapts easily to changes in business size and structure, providing scalable solutions without the need for significant internal adjustments.

The Future of Payroll Processing in the USA

-

Automation and AI

Automation significantly reduces the time spent on manual calculations and data entry, minimizing human errors and enhancing overall accuracy. AI-driven systems can predict and adapt to changes in payroll regulations, automatically updating calculations to comply with new tax laws or benefits entitlements.

-

Remote Payroll Management

As remote work becomes more prevalent, the need for tools and services that facilitate remote payroll management grows increasingly important. Cloud-based payroll solutions allow HR personnel and payroll specialists to manage payroll operations from any location without compromising on functionality or security. These platforms enable real-time data access, ensuring that employee records are up-to-date and that payroll processing is timely.

-

Compliance and Security

Enhanced security protocols, including multi-factor authentication, encryption, and secure cloud storage, are being implemented to protect sensitive payroll data. Regulatory compliance is also a top priority, with systems designed to ensure adherence to the latest payroll-related laws and guidelines automatically. By keeping up with the constantly evolving landscape of payroll regulations, these systems help businesses avoid costly penalties and legal issues.

-

Preparing for Future Changes

To remain competitive and compliant, businesses must stay informed about technological advancements and regulatory changes affecting payroll processing. Regular training sessions for payroll staff, subscribing to industry publications, and attending relevant webinars and conferences are effective strategies for keeping up with trends. Additionally, partnering with technology providers who commit to updating their systems in line with new regulations can safeguard businesses against the pitfalls of non-compliance.

Final Words

Effective payroll processing is not just a back-office function; it is a cornerstone of business success. Mistakes in payroll processing can lead to significant financial penalties, legal challenges, and damage to employee trust and morale. For businesses aiming to minimize risks and maximize efficiency, professional payroll services provided by an accounting firm offer a robust solution. With their expertise, accounting firms can handle complex payroll tasks with precision, ensuring that all calculations are accurate, deductions are properly applied, and compliance requirements are met.

Moreover, partnering with an accounting service provider for payroll processing provides access to advanced tools, real-time analytics, and the latest payroll technology, which can significantly enhance decision-making and operational efficiency. The scalability of outsourced payroll services means they can easily adapt to changes in business size, workforce composition, or geographic expansion, making them an ideal choice for businesses of all sizes and industries.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

The payroll process includes gathering employee information, calculating gross pay, deducting taxes, distributing payments, and filing payroll taxes.

Payroll works by following a series of steps to ensure employees are compensated correctly, and payroll taxes are filed on time.

Key steps include calculating gross pay, applying deductions, distributing payments, and maintaining compliance with tax laws.

Compliance with payroll regulations is crucial to avoid penalties, fines, and legal issues.

Outsourcing payroll to an accounting firm can provide expertise, accuracy, and time savings, making it a good option for many businesses.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.