Table of Content

Share This Article

- Reading Time: 18 Minutes

- Published: October 10, 2023

- Last Updated: January 18, 2025

Get ready to enter the world of accounting automation, a rapidly growing trend in the financial industry. You may have heard about accounting automation, seen some flashy marketing materials, and imagined how it could revolutionize your business. But are you aware of the automation of the accounting process? Before you implement accounting automation in your business, it is important to know all about it to enjoy all its benefits and take your business to new heights of success. Therefore, we have prepared a guide on accounting automation to help you explore and understand its basics and how you can benefit by implementing it in your business. So, let us dive into it.

What is Automation in Accounting?

Accounting automation is the use of technology to automate the tasks involved in the accounting process. It includes bookkeeping, preparing financial statements, and filing taxes. The goal of accounting automation is to make accounting easier and more efficient. It requires businesses to use accounting software like NetSuite, Xero, QuickBooks, etc., to streamline the different accounting and bookkeeping functions.

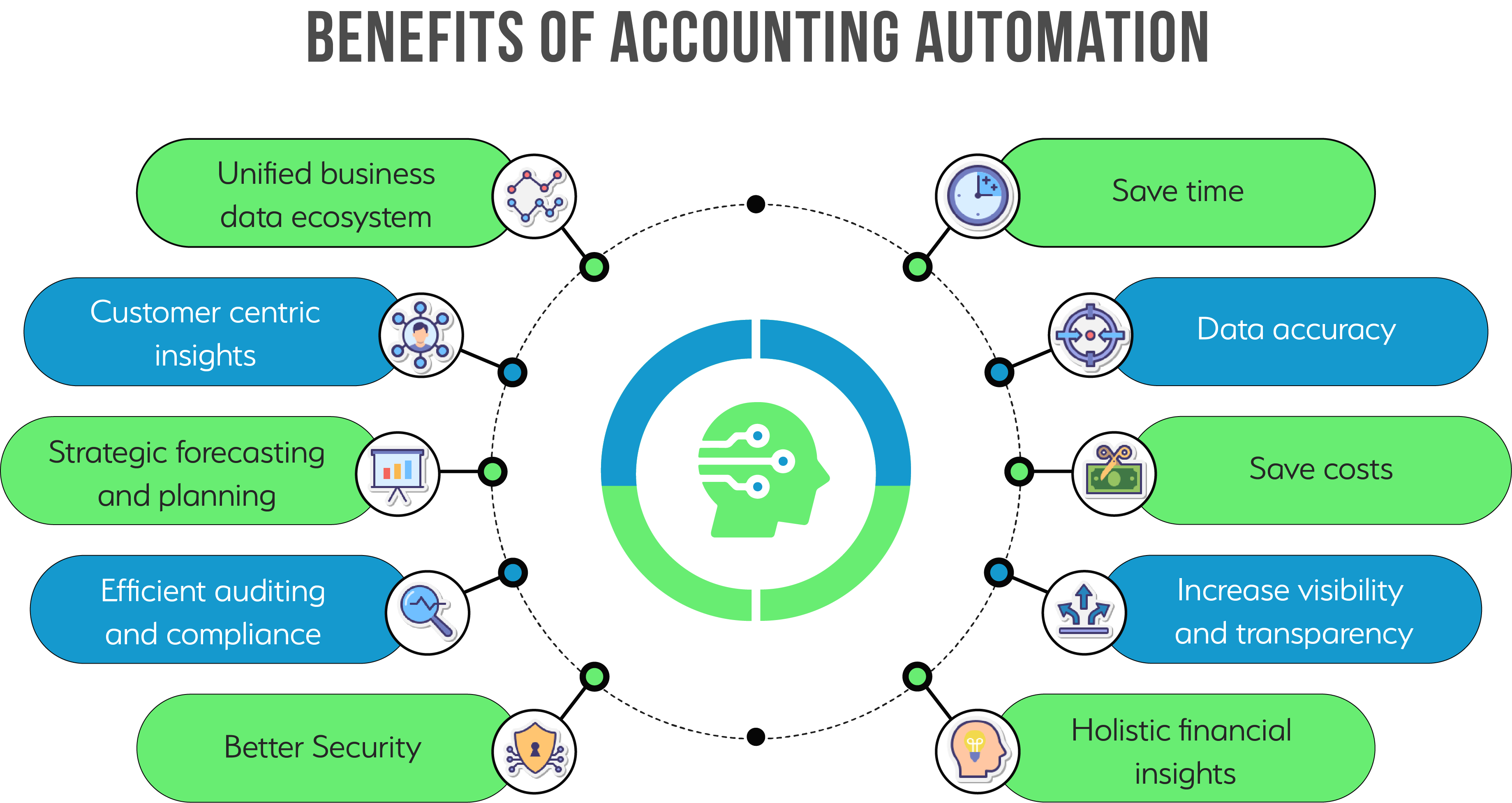

Benefits of Accounting Automation

Technology is changing accounting for the better, and accounting automation has many benefits, but it is important to manage expectations. Depending on the size and structure of your business, some features may not be available or may work differently than expected. However, accounting automation can definitely save you time and money by streamlining key financial processes. Some benefits of automation in accounting include the following:

-

Automated invoice processing:

With accounting automation, businesses can send and receive invoices electronically. Automation helps overcome accounts receivable challenges and speeds up the process by avoiding duplication and inaccuracy at the data entry stage.

-

Improved accuracy:

Automating financial processes can help reduce errors caused by manual data entry. This improved accuracy will save time and money in the long run.

-

Enhanced reporting capabilities:

Many accounting software programs offer built-in reporting features that give you real-time insights into your business finances. These reports can help you make better decisions about where to allocate resources.

-

Increased efficiency:

Automating tasks, such as data entry and invoicing, can free up employees’ time so they can focus on other tasks that add value to the business.

-

Scalability:

As your business grows, accounting automation can help you scale your operations without adding additional headcount.

-

Unified business data ecosystem:

Accounting automation helps to create a unified business data ecosystem by combining several financial operations and data sources on a single platform. This interface enables seamless data flow between departments, guaranteeing all stakeholders have access to consistent and up-to-date financial data. As a result, firms may make more unified and strategic decisions, boosting efficiency and agility.

-

Customer Centric Insights:

Automated accounting systems provide valuable insights into client preferences and spending trends. This extensive financial data enables firms to tailor their offers to better meet client requests, increasing happiness and loyalty. As a result, businesses can increase revenue while also gaining a competitive advantage.

-

Strategic forecasting and planning:

Accounting automation improves strategic forecasting and planning by delivering real-time financial data and analytics. This enables organizations to quickly modify their plans based on realistic financial forecasts and market trends. As a result, organizations can make smarter decisions, allocate resources more efficiently, and plan for upcoming difficulties and possibilities.

-

Efficient auditing and compliance:

Accounting automation improves auditing efficiency and guarantees compliance by keeping correct, up-to-date financial records. This technology reduces human error and gives auditors solid data, making the audit process more rapid and effective. Furthermore, automated solutions can assist firms in remaining compliant with evolving financial regulations by constantly upgrading to reflect new compliance requirements.

-

Better Security:

Automated accounting systems improve security by employing advanced data protection mechanisms and lowering the likelihood of human mistakes. Automated systems protect crucial financial information using encryption and secure access restrictions, preventing unauthorized access and data breaches. This higher level of security is critical to ensuring the authenticity and confidentiality of financial information.

How to Get Started with Accounting Automation?

The stages of automation of the accounting process will differ from one company to another. One simple way to incorporate accounting automation is to opt for cloud accounting software over traditional desktop accounting software. The cloud accounting software lets you plug and play with different apps in real time from anywhere in the world. Find a tool that fits your needs. Many popular accounting tools can only be accessed via the cloud.

If you are considering implementing automation in your accounting process, be sure to do some research to find the best solution for your needs. Here are some tips to help you successfully implement such a solution:

-

Define your business requirements and objectives:

What do you hope to achieve by automating your accounting processes? Be sure to communicate these requirements and objectives to all stakeholders.

-

Do your research:

There are many different accounting automation software on the market. Take the time to find one that meets your specific needs.

-

Make a plan:

Once you have selected the right software solution, develop a plan for how you will implement it within your organization. Be sure to involve all relevant stakeholders in this process.

-

Test, test, test:

Before going live with your new system, be sure to test it thoroughly. This will help ensure a smooth transition and avoid any disruptions to your business operations.

-

Train employees and provide ongoing support:

After implementing the new system, train employees on how to use it effectively. It is also important to have someone available to provide ongoing support as needed.

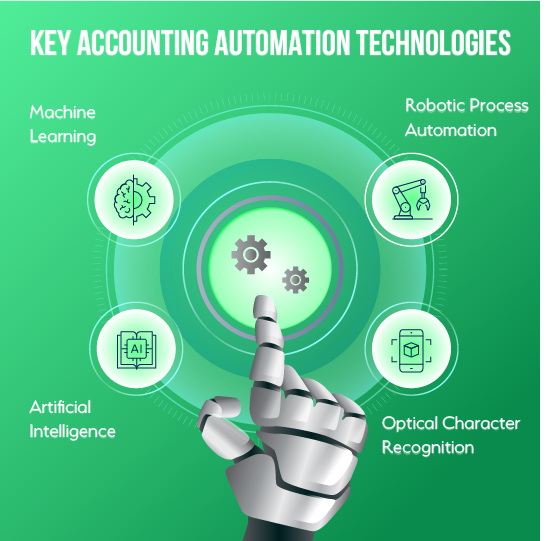

Key Accounting Automation Technologies

Over the past few years, there has been a rise in the use of accounting automation technologies. These technologies aim to make the accounting and bookkeeping process faster and easier by automating various tasks. One of the technological benefits that businesses enjoy from automation is cloud accounting. Along with businesses, cloud accounting is also good for the environment. There are many similar technologies that increase the importance and benefits of accounting automation for businesses.

The following are some important accounting automation technologies that help businesses enhance the efficiency of their processes:

-

RPA (Robotic Process Automation):

One of the most popular accounting automation technologies is robotic process automation (RPA). RPA involves using software bots to automate repetitive tasks. It can be used to automate various accounting tasks such as data entry, invoicing, and report generation. While RPA can significantly speed up the accounting process, it is important to note that it is not a replacement for human accountants. RPA can only automate routine tasks; it cannot provide expert judgment or creative solutions that human accountants can provide.

-

OCR (Optical Character Recognition):

OCR is a powerful tool that can significantly reduce the time and effort required to complete accounting tasks. With OCR technology, accountants no longer need to manually enter data from physical documents into their accounting software. Instead, they can simply scan the document and let the software do the work. Manually entering data from physical documents also introduces an element of human error into the equation, but with OCR, that risk is greatly reduced. In addition to its many practical benefits, OCR also marks a significant step towards achieving fully automated accounting processes.

-

AI (Artificial Intelligence):

Another common accounting automation technology is artificial intelligence (AI). AI involves using algorithms to learn from data and make predictions. It can be used for various tasks, such as fraud detection, financial forecasting, and tax compliance. While AI has great potential for automating many aspects of the accounting process, it is important to remember that it is still in its infancy and has limitations. For example, AI cannot yet replace human judgment when it comes to making complex financial decisions.

-

ML (Machine Learning):

Machine learning is revolutionizing the field of accounting by enabling automation that was previously unimaginable. By analyzing large amounts of data and identifying patterns, machine learning can make accurate predictions about future transactions and identify potential errors or fraud. This technology has already been employed in areas such as expense management, invoice processing, and financial forecasting. Some areas where machine learning can prove beneficial when it comes to accounting include automated audit testing, predictive analytics, etc. Companies use historical financial data along with external factors, such as market trends and economic indicators, to forecast future business performance more accurately than ever before.

When used correctly, these technologies can significantly speed up the accounting process and help accountants identify potential issues more quickly. They can also help reduce errors and improve accuracy. For example, businesses can deal with accounts payable challenges with accounting automation technologies and enhance the efficiency and accuracy of the process. Ultimately, by taking advantage of the advances in accounting automation technologies, accounting firms can more effectively serve their clients and remain competitive in the marketplace.

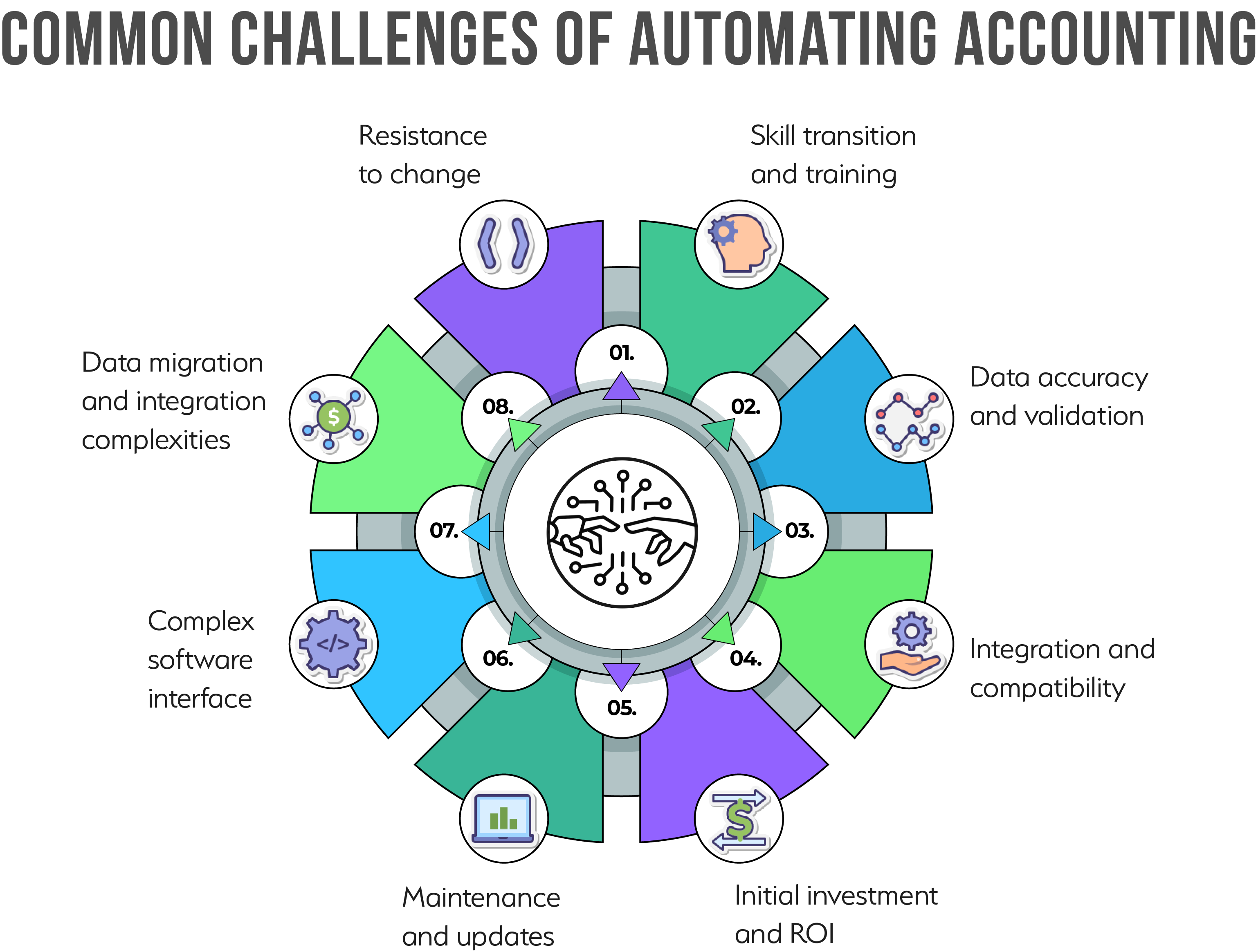

Challenges of Accounting Automation

Automation of the accounting process is a great way to streamline tasks, reduce errors, and save your accountant’s time. However, it also poses some challenges that must be addressed to reap its full benefits.

-

Resistance to change:

Resistance to change is a common issue when introducing accounting automation in an organization. Employees frequently fear that new technology may disturb their routines or jeopardize their roles, which causes concern and reluctance to accept automated systems. This reluctance can greatly impede the changeover process, postponing the benefits of enhanced efficiency and accuracy that automation promises. To address these challenges, management must provide comprehensive training and promote the long-term benefits of automation, emphasizing how it may improve rather than replace human functions.

-

Skill transition and training:

Skill transition and training are essential challenges when introducing accounting automation in an organization. The emergence of new technologies mandates that staff enhance their abilities, with a concentration on data analytics and automated systems instead of traditional bookkeeping. This move may necessitate major expenditure in training programs and may temporarily lower productivity as employees adjust to the new tools. To effectively address these difficulties, firms must plan wisely, provide extensive training opportunities, and establish a supportive culture that encourages continuous learning and skill development.

-

Data accuracy and validation:

When selecting to automate accounting, maintaining data quality along with accurate validation might be difficult. Automation is strongly dependent on the initial correctness of data inputs and the proper configuration of processing algorithms. Any inaccuracies in these areas can cascade across the system, resulting in erroneous financial reports. Therefore, stringent checks and continual monitoring are required to ensure the trustworthiness of financial data.

-

Integration and compatibility:

A notable hurdle in accounting automation is assuring interoperability and compatibility with existing systems. Many firms struggle when their new accounting software does not integrate effectively with other operational tools, disrupting processes and data consistency. To avoid these integration challenges, automation systems must be carefully chosen to be compatible with present technological infrastructures.

-

Initial investment and ROI:

While automation has long-term benefits, the initial expenditure can be prohibitive for some organizations, particularly smaller ones with limited resources. Assessing the Return on Investment (ROI) and demonstrating the prospective cost savings, efficiency improvements, and better accuracy over time is critical in justifying the initial expenditures of automation.

-

Maintenance and updates:

Automated systems need ongoing maintenance and updates to maintain their effectiveness and security. Overlooking regular updates might lead to system vulnerabilities and out-of-date functionality. A comprehensive plan for sustaining and upgrading automated systems is required to keep them working seamlessly and efficiently.

-

Complex software interface:

Adopting new technologies in accounting frequently involves negotiating complex software interfaces. Employees may be presented with complex tools that, while powerful, are not simple to use or intuitive. This level of complexity might result in a high learning curve, decreased productivity, and potential pushback from employees used to simpler systems. To successfully deal with this difficulty, software must strike a balance between complex features and ease of use, as well as substantial training and support to ensure that all users are at ease and proficient with the new tools.

-

Data migration and integration complexities:

When switching to automated accounting systems, firms frequently face data transfer and integration challenges. Integrating historical financial data into new systems can be risky for data loss or inaccuracies, and establishing seamless interaction with existing software platforms can be technically difficult. These intricacies necessitate rigorous planning and, in many cases, the knowledge of IT specialists to assure data integrity and effective communication between systems. The proper execution of the process is critical to avoiding financial reporting delays and maximizing the automation technology’s capabilities.

Addressing these challenges will require careful planning and execution. Still, it ultimately will transform your organization’s efficiency with improved accuracy, productivity gains through task automation, and faster turnaround cycles. Automation of the accounting process will free up valuable resources within each department, giving teams more time for high-level strategic initiatives.

8 Accounting Tasks You Should Automate Immediately

If you are like most business owners, you wear a lot of hats. Not only are you responsible for running your company, but you are also in charge of its finances. It can be a lot to manage, especially if you are not using accounting automation tools.

There are a lot of benefits to automating your accounting and bookkeeping tasks, including reducing errors, saving time, and improving data accuracy. However, many business owners do not realize how much they can actually automate. Here are some accounting tasks that you should automate immediately:

- Purchase Management: Automating purchase management can streamline the procurement process from order to delivery. This includes automatically generating purchase orders based on inventory levels, tracking orders, managing supplier relationships, and reconciling invoices upon receipt of goods. Automation ensures that purchases are made at optimal times and within budgetary constraints.

- Accounts Payable: Automation in accounts payable involves setting up workflows that approve invoices, match them with purchase orders, and process payments without manual intervention. This reduces the likelihood of errors and delays, improves relationships with suppliers through timely payments, and helps manage cash flow more effectively.

- Accounts Receivable: Automating accounts receivable can speed up the billing process and reduce the number of days sales outstanding. This can include sending invoices automatically, tracking invoice status, and reminding customers about due payments. Additionally, it can facilitate faster receipt and reconciliation of payments into the appropriate accounts.

- Payroll: Payroll automation can handle everything from calculating pay based on hours worked, including overtime and bonuses, to making deductions for taxes and other benefits. It ensures compliance with employment and tax laws, minimizes errors, and saves significant administrative effort and time.

- Expense Management: Automating expense management helps track, categorize, and approve expenses without manual data entry. Employees can submit expenses through mobile apps, and managers can approve them with automated workflows. This not only speeds up the reimbursement process but also helps maintain accurate and up-to-date financial records.

- Bank Reconciliation: Automation tools can compare internal financial records against bank statements automatically to spot discrepancies, such as unrecorded transactions or differences in amounts. This process, which can be exceptionally time-consuming if done manually, helps ensure that the financial records are accurate and trustworthy.

- Financial Reporting: Automated financial reporting tools can generate financial statements and reports at regular intervals without manual intervention. These tools can pull data from various sources, ensuring that reports are comprehensive, accurate, and available in real-time. Automation also allows for customized reporting to meet specific managerial or regulatory needs.

- Tax Preparation and Filing: Automation tools can streamline the process of preparing and filing taxes by keeping track of deductible expenses and earnings throughout the year. This minimizes last-minute rushes and helps ensure accuracy in tax filings.

Which Tasks Cannot be Automated?

While many tasks can be automated, a few can only partially be automated, and certain cannot be automated at all. For example, record keeping cannot be fully automated as accounting relies heavily on accurate and up-to-date records. This task must be done manually, as automation cannot guarantee accuracy.

Another task that cannot be automated is analysis and reporting. Accountants must be able to interpret data and figures in order to provide insights and recommendations. This is something that a machine cannot do. Also, automated accounting systems can generate reports. However, these are often basic and lack the detail that is required by clients or management, and accountants are still needed to produce high-quality tailor-made reports manually.

Tips to Transition from Traditional to Automated Accounting Software

Are you considering switching from traditional accounting software to an automated solution? If so, you are not alone. Many businesses are making the transition in an effort to streamline their accounting processes and improve efficiency. However, it is important to remember that using automation software can be somewhat challenging. Let’s learn how to transition from traditional to automated accounting software.

-

Familiarize yourself with the features of your new software:

Before you start using your new software, take some time to explore all its features. It will help you better understand how the automation process works and what functions are available to you.

-

Set up your chart of accounts:

One of the first things you will need to do with your new software is set up your chart of accounts. It will ensure that all your financial data is organized and easy to track.

-

Import your existing data:

If you are switching from another accounting software solution, you will likely want to import your existing data into your new system. Most automation software offers an easy-to-use interface for this process.

-

Train your staff on the new system:

Depending on the size of your business, you may need to train one or more employees on how to use the new system. It is important that everyone who will be using the software has a thorough understanding of how it works.

-

Utilize the support available:

Most automated accounting software companies offer customer support and training resources to help you speed up their system. Take advantage of these offers to ensure your transition is as smooth as possible.

-

Test the system before going live:

Before you start using the new system for all your financial data, make sure to thoroughly test it out first. It will give you an opportunity to get comfortable with the system and ensure that everything is running smoothly before you go live.

How Can You Find the Best Accounting Software Offering the Maximum Benefits of Automation?

When it comes to finding the best accounting software that offers the maximum benefits of automation, it is crucial to do your research and consider several factors. Since numerous options are available on the market, such as NetSuite, QuickBooks, Xero, Zoho Books, etc., you must take all necessary steps to choose the best accounting software for your business. Following are some tips to find the accounting software best suited for your business so that you get the most out of this valuable tool:

- Accounting automation features: Firstly, determine what type of automation features your business requires. These could include automatic invoice generation, bank feed importation, or automated financial report creation.

- Scalability: Secondly, consider the software’s scalability and compatibility with your existing systems. It is important to ensure that the software meets all your current needs while also having room for growth as your company expands in size or complexity over time.

- Customer Service Support: Thirdly, look into customer service support offered by potential vendors. You need a company that is only one call away whenever something goes wrong with their system so you can receive immediate assistance.

- Security Features: Another major consideration should be the security features provided by accounting software, which protect customer data and internal information from cyberattacks.

With thorough analysis along these lines, you can easily pinpoint top-notch accounting tools ideally suited for optimal benefit as well as maximizing efficiency throughout day-to-day operations – enabling full focus towards accelerating overall productivity.

Expectations vs. Reality of Accounting Automation

When it comes to the accounting automation process, there are often a lot of expectations. Many businesses have high hopes for what automation can accomplish, from increased efficiency to cost savings and reduced errors. However, some are finding that the reality of automation is not always as straightforward as anticipated.

- One common expectation is that automation will completely eliminate the need for human intervention in accounting processes. While there certainly are areas where machines can take over repetitive tasks and reduce the risk of error, there will always be a need for human oversight and input when it comes to making decisions or interpreting data. Automated solutions enhance performance and actually require human supervision throughout their implementation phases while embracing teams’ vital insights.

- Many business owners expect that automating their accounting will save them a ton of time and money. However, the reality is that there is often a lot of upfront work that needs to be done to get the automation set up correctly. Additionally, even though automating your accounting and bookkeeping can save you time in the long run, it is important to keep in mind that there will still be some manual work involved. Also, while automation can lead to cost savings through reduced labor costs, additional costs may arise from maintaining software licenses or hiring IT professionals.

- Another expectation is that some firms may expect seamless integration with their existing processes, significant cost savings, and increased efficiency. In actuality, implementing accounting automation is a complex process that requires proper planning, prioritization, team training, and software updates to ensure compatibility. Integrating new technology takes time, resources, and the upskilling or training required by those using it effectively.

- One challenge companies may face when implementing automated systems is ensuring that all data is accurately entered into the system. It includes training employees to use new software as well as reviewing data input by automated processes.

Despite these discrepancies between expectations and realities, automation of the accounting process remains an exciting development within financial administration professions. It helps improve accuracy and productivity while granting employees more opportunities to focus on higher-order tasks, such as analyzing their data critically rather than spending excessive time crunching numbers manually.

Conclusion

Accounting automation has been a hot topic in the accounting world for some time now. By leveraging the latest technologies, such as AI and machine learning algorithms, companies can save hours of manual work while improving accuracy. Automated accounting systems are becoming increasingly popular in the present day due to their numerous benefits; however, it is important to carefully evaluate these systems before implementing them in an organization’s operations. Ultimately, keeping an open mind to technological advances and investing resources where it makes sense will ensure the greatest return on investment in any automated system.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.