Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: February 22, 2024

- Last Updated: January 16, 2025

Accounting & Bookkeeping has become important for maintaining financial accuracy and integrity, involving rigorous documentation and reconciliation of financial transactions. A lapse in these practices can not only cause financial disarray but also pose significant legal risks, particularly with agencies like the IRS. Recognizing and addressing discrepancies promptly is vital. In this context, it’s imperative that either an in-house bookkeeper or outsourced bookkeeping service is helpful in spotting these irregularities early on. This blog post will guide you about the indicators of bookkeeping discrepancies and accounting errors, offering insights into their detection and the potential ways to remove their occurrence.

Key Indicators of Accounting Errors

Accounting errors can be subtle yet impactful, leading to serious financial and legal consequences. Here are some key indicators that can signal discrepancies in accounting & bookkeeping:

1. Mismatched Balances:

One of the most straightforward signs of a discrepancy is when the balance in your accounting software does not match the balance in your bank statements. This could be due to unrecorded transactions or errors in entry.

2. Unexplained Losses or Profits:

Sudden, unexplained changes in profit or loss figures without a corresponding business activity can be a red flag. These fluctuations may indicate accounting errors in recording sales or expenses.

3. Inconsistent Transaction Dates:

Discrepancies can occur if the dates of transactions in your books don’t match the actual dates when these transactions took place. This mismatch can lead to inaccurate financial reporting.

4. Duplicate Entries:

Sometimes transactions can be accidentally recorded more than once. This can inflate your revenue or expenses and give an incorrect picture of your financial health.

5. Missing Documents:

Invoices, receipts, or other financial documents that are unaccounted for can lead to gaps in your financial records. It’s important to have a complete record of all transactions.

6. Discrepancies in Inventory Records:

For businesses with physical inventory, a mismatch between the recorded inventory and the actual stock can indicate problems in bookkeeping.

7. Unreconciled Accounts:

Regular reconciliation of all accounts is key. Any long-standing unreconciled item can point to discrepancies.

8. Inconsistent Application of Accounting Principles:

Consistency in applying accounting principles is essential. Inconsistencies can result in errors and misrepresentations in financial statements.

Addressing these key indicators promptly can save businesses from potential financial mismanagement and legal issues.

Types of Errors in Accounting & Bookkeeping

Understanding the common types of accounting errors can help in identifying and correcting them efficiently. Here’s a simple overview of the various errors that can occur:

1. Error of Original Entry:

This is one of the most common accounting errors that happens when the amount entered for a transaction is incorrect. Though the mistake carries through all related accounts, keeping them in balance, the figures are wrong. For example, if you meant to post $100 but instead posted $10, this error would affect all accounts involved in the transaction with the incorrect amount.

2. Error of Duplication:

This occurs when a transaction is recorded more than once. Imagine you accidentally record the payment for office supplies twice. This means the expense is overstated, and your accounts do not reflect the true financial position.

3. Error of Omission:

Sometimes, a transaction might not be recorded at all. This could happen for various reasons, such as overlooking an invoice among a pile of documents. Missing out on recording a purchase or a sale can lead to discrepancies in accounts payable or receivable, affecting the overall financial statements.

4. Error of Entry Reversal:

This type of error is when entries are made in the opposite direction than they should be. For instance, if you debit an account that should have been credited or vice versa, it can lead to significant confusion and inaccuracies in your financial records.

5. Error of Principle:

This error occurs when a transaction is recorded against the principles of accounting. An example would be treating a capital expense, like purchasing new equipment, as an operating expense. Such accounting errors can mislead the financial analysis of a company’s operations and capital investments.

6. Error of Commission:

This happens when the entry is made to the correct type of account but the wrong sub-account. If you credit a payment received to the wrong customer’s account in accounts receivable, it could lead to misunderstandings and issues with client accounts.

7. Compensating Error:

Interestingly, sometimes an error can be nullified by another error made in the opposite direction. For example, if an incorrect amount is debited in one account but the same incorrect amount is credited in another, the financial statements might still balance out, hiding the inaccuracies.

How to Prevent Errors in Accounting & Bookkeeping

By understanding common accounting errors and indicators of discrepancies, businesses can implement strategies to avoid these pitfalls. We will provide insight into how partnering with a reputable company that provides online bookkeeping service can be a strategic move in this direction. Here are some practical steps based on the key indicators and types of errors discussed above:

1. Implement Regular Reconciliation Practices:

Regularly compare your accounting records with bank statements to ensure they match. This practice can catch and correct accounting errors such as unrecorded transactions or entry mistakes early on.

2. Monitor for Unexplained Financial Fluctuations:

Keep an eye on your profit and loss statements. Any sudden, unexplained changes should be investigated immediately to uncover potential recording accounting errors or omissions.

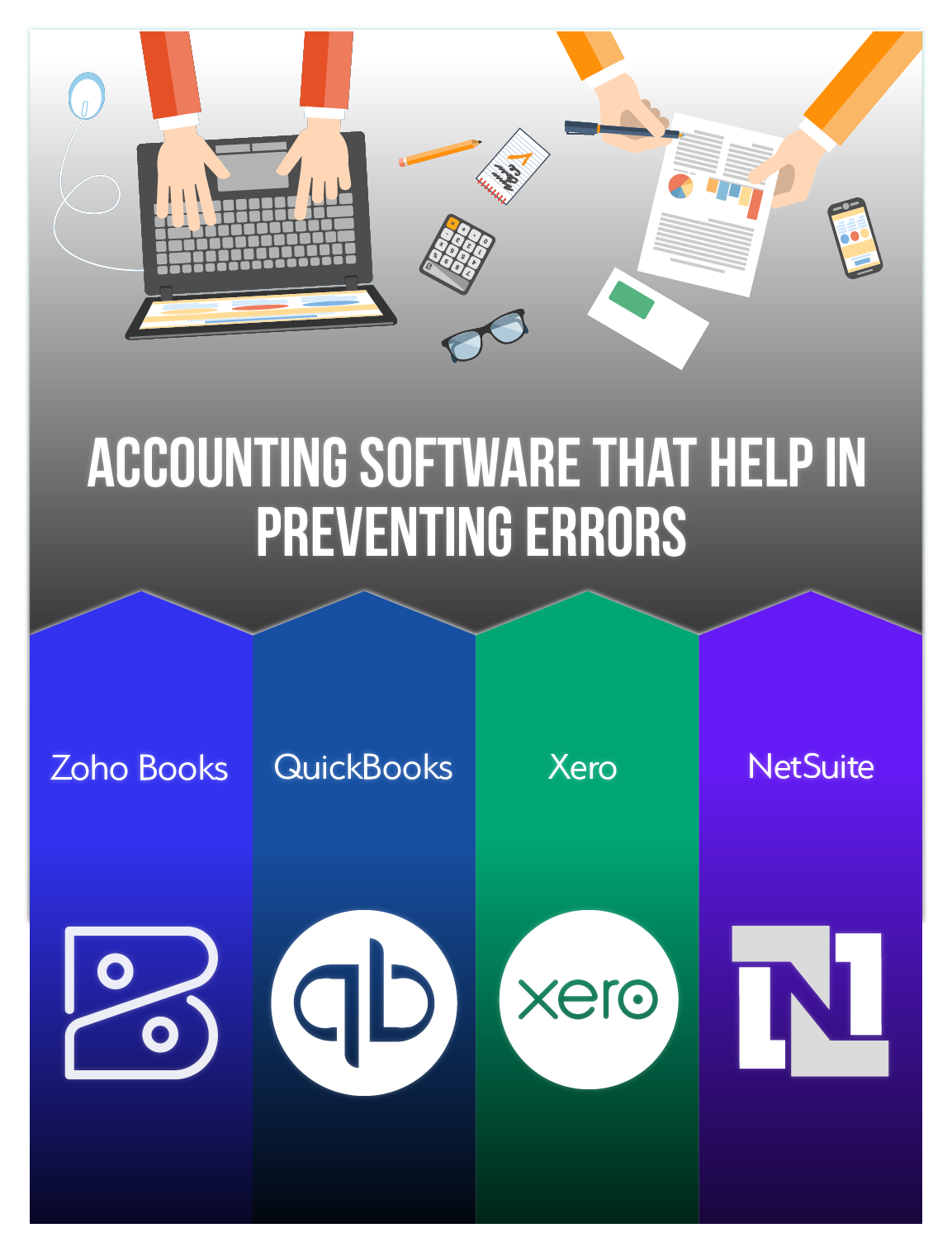

3. Use Accounting Software Wisely:

To mitigate accounting errors, it’s essential to leverage reliable software designed to automate accounting processes. Automating accounting using QuickBooks or any other accounting software allows the automation of critical checks and balances, with features such as duplicate detection, automatic reconciliation, and alerts for unusual transactions. By implementing such a tool, businesses can significantly enhance the accuracy of their financial records, reducing the likelihood of errors.

4. Ensure Accurate Transaction Dating:

Make sure the dates of transactions recorded in your books accurately reflect the actual dates those transactions occurred. This helps maintain consistency and accuracy in financial reporting.

5. Double-Check for Duplicate Entries:

Before finalizing entries, review them to ensure transactions are not recorded more than once. Using accounting software with built-in checks can help prevent duplication.

6. Maintain Complete Documentation:

Keep a comprehensive record of all financial documents, including invoices and receipts. This helps prevent omissions and provides a reference for verifying recorded transactions.

7. Regularly Audit Inventory Records:

For businesses with physical inventory, periodically comparing recorded inventory levels with actual stock can help identify discrepancies early and correct them.

8. Consistently Apply Accounting Principles:

Apply accounting principles uniformly across all your financial reporting. Inconsistencies can lead to accounting errors and misinterpretation of financial data.

9. Educate and Train Your Team:

Ensure that anyone involved in bookkeeping and accounting is properly trained and aware of common accounting errors to watch out for. Continuous education on best practices can significantly reduce the risk of errors.

10. Seek Professional Advice:

When in doubt, consult with a professional accountant or bookkeeper. Their expertise can help identify and correct complex issues before they become significant problems.

11. Consider Outsourcing Accounting Functions:

For many businesses, especially small to medium-sized enterprises, managing all accounting and bookkeeping in-house can be overwhelming. Accounting outsourcing companies or specialized service providers can offer several benefits. It not only ensures that your financial records are managed by experts familiar with the latest accounting standards and practices, but it also allows your team to focus on core business operations.

Final Words

In conclusion, understanding and preventing accounting errors is critical for maintaining the financial health and legal compliance of any business. This blog has highlighted the importance of vigilant bookkeeping, identified key indicators of discrepancies, and outlined the common types of accounting errors that can occur in accounting. By adopting regular reconciliation practices, monitoring financial activities closely, ensuring accurate documentation, and considering the outsourcing of accounting functions, businesses can mitigate the risks associated with bookkeeping errors. Ultimately, the goal is to foster an environment of financial accuracy and integrity, safeguarding against potential legal issues and ensuring the smooth operation of business finances.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.