Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: August 13, 2024

- Last Updated: January 18, 2025

Efficient management of the accounts receivable process is important in preserving a stable cash flow and guaranteeing the economic resilience of a company. The accounts receivable denotes the sum owed to a company for goods or services provided on credit and requires careful attention to various essential actions, including setting credit terms and ensuring prompt payment collection. In this guide, we will conduct a comprehensive examination of the complete accounts receivable process, along with best practices to underscore the significance of effective accounts receivable management.

What is Accounts Receivable?

Accounts receivable (AR) refers to the money a business is owed for goods or services it has provided but has not yet received payment for. When a company sells products or services on credit, the amount customers owe is recorded as accounts receivable. This money is expected to be paid within a short period, usually within a year, making AR a current asset on the company’s balance sheet. In simple terms, accounts receivable is the total amount customers owe a business for purchases made on credit. It is crucial for managing cash flow and ensuring the company has enough funds to operate smoothly.

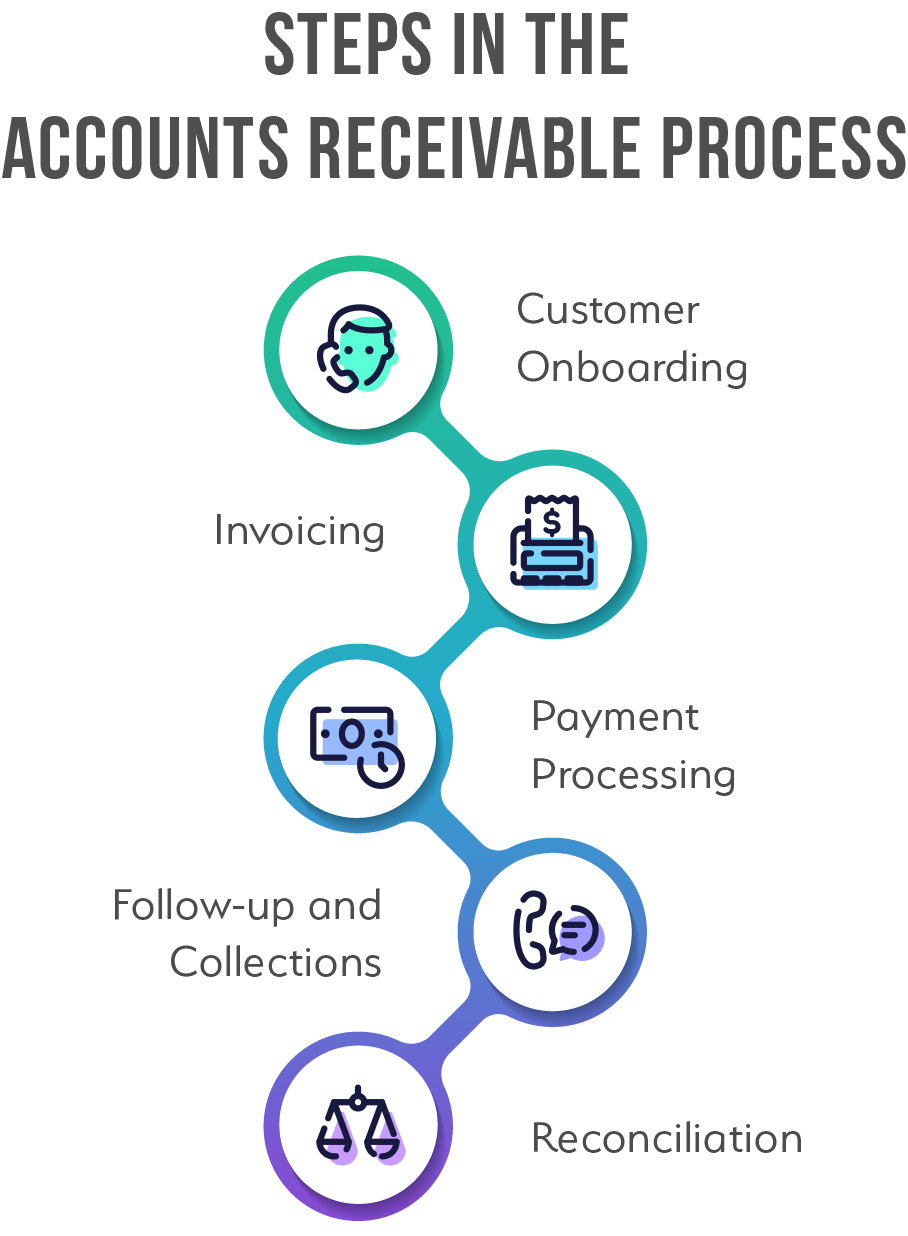

Process of Accounts Receivable: Step-By-Step

The accounts receivable process is essential for maintaining a healthy cash flow, supporting business growth, and ensuring profitability. Here’s a straightforward AR beginner’s guide to help you understand and implement an effective accounts receivable process.

-

Establish a Credit Application Process

Before extending credit, it’s crucial to determine how and to whom you will offer it. Implement a credit application process to gather necessary information for evaluating a customer’s creditworthiness. This process might include:

– Contact Information: Name, address, phone number.

– Credit History: Credit checks and references.

– Employment Information: For individual customers.

– Business Information: For companies, including accounts payable contact details.

– A well-structured credit application ensures that you make informed decisions about extending credit. -

Develop a Collection Plan

Creating a collection plan involves agreeing on payment terms with your customers. This includes:

– Payment Frequency: Monthly or weekly billing, depending on customer preference.

– Terms and Conditions: Clear documentation of payment due dates, late fees, and interest rates.

– Business Agreement: This formal document outlines the responsibilities of both parties, including payment timelines and consequences for late payments.

– A detailed collection plan helps maintain consistent cash flow and reduce the risk of late payments. -

Ensure Compliance with Consumer Credit Laws

Compliance with consumer credit laws is mandatory. The Federal Trade Commission (FTC) enforces regulations to protect consumers. Key compliance points include:

– Interest Rate Disclosure: Clearly communicate any interest rates applied.

– Billing Disputes: Respond to billing errors promptly.

– Debt Collection Practices: Follow legal guidelines for debt collection.

– FTC Regulation Practices: Staying updated with FTC regulations ensures your accounts receivable process is legally sound. -

Send Out Invoices

Invoices are a critical part of the accounts receivable process. Each invoice should include:

– Invoice Number: Unique identifier.Date: Clearly displayed.Business Details: Names and addresses of both parties.

– Description: Detailed account of goods or services provided.

– Amount Due and Due Date: Total payment required and the deadline. Digital invoicing can streamline this process, making it more efficient and reducing the risk of errors. -

Implement an Accounts Receivable Management System

Adopting an accounts receivable management system is beneficial, especially for larger businesses. This system:

– Tracks Invoices and Payments: Keeps records of all transactions.

– Generates Reports: Provides insights into outstanding invoices and cash flow.

– Automates Tasks: Sends automatic reminders for due payments. An automated system enhances efficiency and accuracy in managing accounts receivable. -

Monitor the Collection Process

Regularly tracking the collection process is vital. Conduct an invoice aging analysis to categorize invoices by their overdue period (e.g., 0-30 days, 31-60 days). This helps in:

– Identifying Overdue Invoices: Focus on collecting older debts.Estimating

– Bad Debt: Anticipate potential losses.

– Taking Action: Follow a structured policy for pursuing late payments, including the possible involvement of collection agencies. -

Real-Time Logging of Charges and Expenses

Log all charges and expenses in real-time. Use accounts receivable software to:

– Scan and Upload Documents: Attach receipts and orders directly to the corresponding invoices.

– Update Records Instantly: Ensure all transactions are recorded promptly. Real-time logging improves transparency and accuracy in financial records. -

Offer Early Payment Discounts

Offering discounts can encourage customers to pay early. This can be stated on the invoice or included in the business agreement. Early payment discounts also improve cash flow.

-

Maintain Strong Customer Relationships

Building and maintaining good relationships with customers can enhance the accounts receivable process. Regular, friendly communication helps ensure that customers are more likely to pay on time. Customer satisfaction should always be a priority.

-

Plan for Escalation

Despite best efforts, some customers may not pay. Have a plan for escalation:

– Follow-Up: Reach out multiple times via different communication channels.

– Demand Letter: Send a formal notice if necessary.

– Collections Agency: Consider involving a collections agency for unpaid debts.

– Payment History: Decide whether to continue business with delinquent customers based on their payment history.

» Why Does Efficient Accounts Receivable Management Matter?

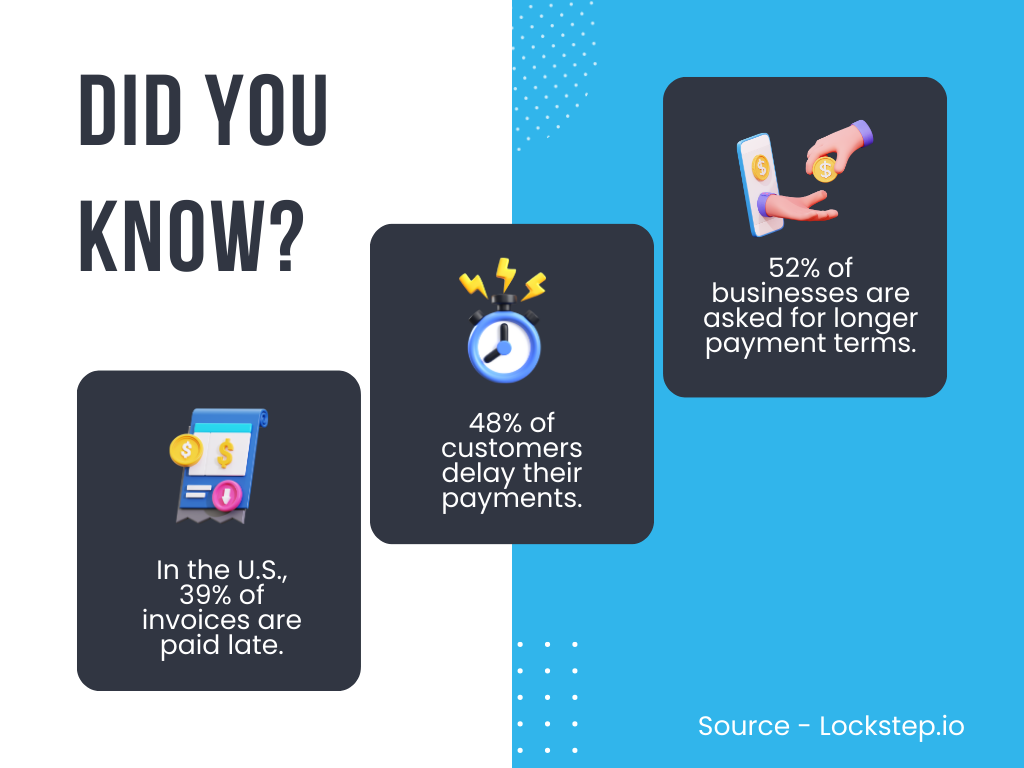

Efficient management of accounts receivable is crucial for any business. The accounts receivable process involves extending credit, invoicing customers, and collecting payments. Effective management ensures a steady cash flow, which is essential for maintaining a business’s financial health.

Here’s why efficient accounts receivable management matters:

-

Improved Cash Flow

Cash flow is the lifeblood of any business. Efficient AR accounting ensures that cash comes in regularly, allowing the business to pay its own bills, invest in growth, and handle unexpected expenses. Delays in the accounts receivable process can lead to cash shortages, affecting the company’s ability to operate smoothly.

-

Reduced Bad Debt

Bad debt occurs when customers fail to pay their invoices. By having a structured accounts receivable process, businesses can minimize the risk of bad debt. This includes evaluating a customer’s creditworthiness before extending credit and following up promptly on overdue invoices.

-

Better Customer Relationships

Efficient AR management helps maintain good customer relationships. Clear communication about payment terms and prompt invoicing show professionalism and reliability. When customers understand the AR meaning and accounts receivable process, they are more likely to pay on time, fostering trust and long-term business relationships.

-

Enhanced Financial Planning

Knowing when payments are due helps businesses plan their finances better. With a predictable inflow of cash, companies can make informed decisions about expenditures, investments, and budgeting. This predictability is a key benefit of an organized accounts receivable process.

-

Increased Operational Efficiency

Automating parts of the accounts receivable process, such as sending invoices and tracking payments, can save time and reduce errors. This allows the accounting team to focus on more strategic tasks, improving overall operational efficiency.

What is Accounts Receivable Automation?

Automation and technology have revolutionized AR management, making the accounts receivable process more efficient and accurate. By automating repetitive tasks, businesses can streamline operations, reduce errors, and enhance cash flow.

-

Automation in AR Management

AR management involves tracking, following up on, and recording payments owed to a business. Automating this process applies digital technology to manage these tasks efficiently. This means that businesses can use sophisticated software platforms to improve their accounts receivable process and free up staff for higher-level tasks.

-

Reduction of Manual Data Entry

One key advantage of automation in AR management is the reduction of manual data entry. Traditional accounting systems require significant manual input, which is time-consuming and prone to errors. Automation minimizes this by capturing and entering data automatically into the AR ledger, reconciling discrepancies, updating records, and producing reports. This not only saves time but also significantly reduces the risk of errors, making the accounts receivable process more reliable.

-

Use of AI and RPA

Modern AR management platforms leverage artificial intelligence (AI) and robotic process automation (RPA) to streamline various functions. AI can evaluate customer creditworthiness, generate and distribute invoices, and monitor outstanding payments. RPA can automate routine tasks such as data entry and reconciliation. By utilizing these technologies, businesses can ensure timely invoicing, reduce overdue payments, and improve overall cash flow.

-

Integration with Financial Systems

Another significant benefit of automation in AR management is the seamless integration with other financial systems. This ensures real-time updates and consistency across platforms. When a payment is received, it is automatically recorded and updated in the accounts receivable process, eliminating the need for manual updates and reducing the risk of discrepancies.

-

Maintenance of Master Data

Automation also aids in maintaining master data, which includes static information about customers, such as business names, addresses, and bank accounts. Automated systems can recognize and standardize this data from various sources, ensuring it is centralized, accessible, and secure. This helps businesses maintain accurate and up-to-date records, further enhancing the accounts receivable process.

-

Benefits of AR Automation

Automating the accounts receivable process has manifold benefits. It reduces processing time, improves efficiency, increases security and compliance, and nearly eliminates human errors. Automated systems can extract information from different platforms to generate and send invoices digitally, monitor aging invoices, and send follow-up notices according to predefined schedules. This ensures timely collections and improves customer relationships.

-

Reconciliation Process

Automation simplifies the reconciliation process by capturing and recognizing data from various documents, such as receipts, invoices, and expense reports, and inputting it automatically into a central system. This eliminates the need for manual entry, reducing the risk of errors and making the reconciliation process more efficient.

-

Outsourcing and Automation

Combining outsourcing with automation can further optimize AR management. By outsourcing AR functions to specialized providers and leveraging automation, businesses can ensure efficient and effective management of their accounts receivable process while focusing on core activities.

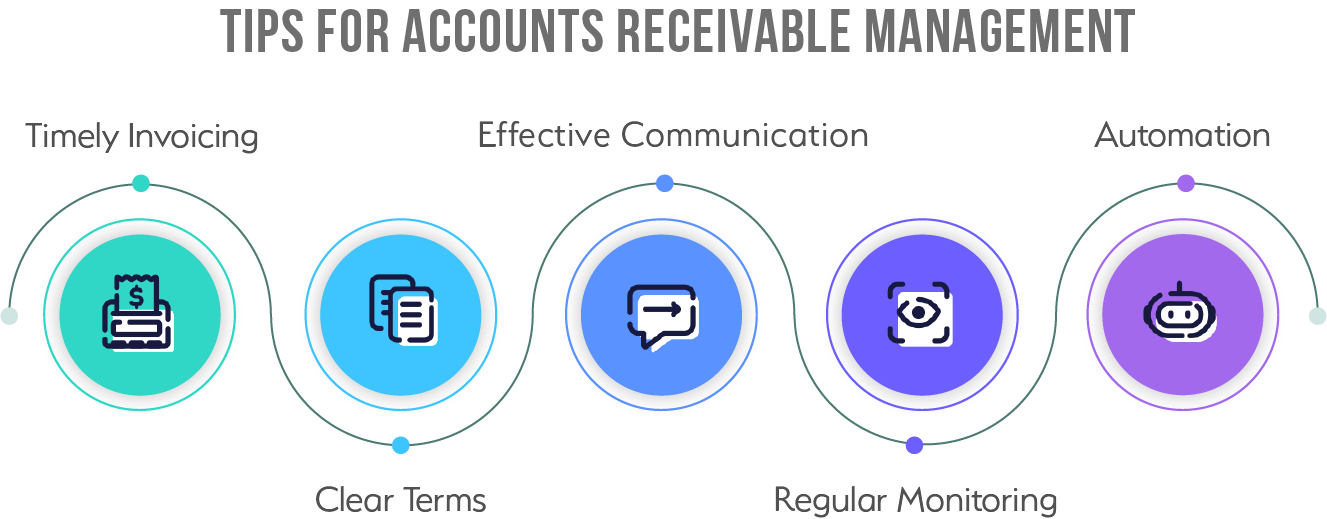

6 Best Practices for Accounts Receivable Process

Here are the best practices for optimizing your Accounts Receivable process:

-

Utilize Accounts Receivable Management

Software Managing accounts receivable involves handling numerous transactions and numbers, which can lead to errors if done manually. AR management software reduces human error, enhances efficiency, and ensures accurate financial records throughout the accounts receivable process. It also allows customization of workflows tailored to your business needs. Consider outsourcing AR functions to an AR management company to streamline processes further.

-

Regular Evaluation and Metrics Tracking

Continuous monitoring of business KPIs like Days Sales Outstanding (DSO) and Collection Effectiveness Index (CEI) is crucial. These metrics provide insights into AR performance and help devise effective collection strategies. Regular evaluation ensures proactive management and timely adjustments to improve cash flow and enhance accounts receivable services.

-

Clear and Detailed Credit and Collection Policies

Establish clear credit terms and collection policies that are communicated to customers upfront. This transparency reduces misunderstandings and disputes, fostering positive customer relationships. Regular updates to policies ensure they remain relevant and aligned with business goals and accounts receivable meaning.

-

Prompt Invoicing

Timely invoicing significantly impacts payment timelines in the accounts receivable process. Send invoices promptly upon delivering goods or completing services to minimize payment delays and disputes. Automation can streamline this process, ensuring invoices are accurate and promptly issued, enhancing cash flow, and supporting accounts receivable outsourcing services.

-

Maintain Comprehensive Records

Detailed record-keeping is essential for effective AR management. Accurate records track outstanding invoices, support auditing processes, and facilitate timely dispute resolution. Maintaining updated records ensures transparency and compliance with financial reporting requirements.

-

Outsourcing AR Functions

As mentioned above, in AR automation, outsourcing AR management to an AR management company can provide expertise, access to advanced technologies, and scalability, allowing your team to focus on core business activities. It also ensures consistent and efficient AR operations, enhancing overall financial performance and accounts receivable services.

Implementing these best practices ensures streamlined Accounts Receivable processes, improves cash flow, and strengthens customer relationships. By leveraging technology and strategic policies, businesses can optimize AR management and achieve sustainable growth in the accounts receivable process.

What are Outsourced Accounts Receivable Services?

Outsourced accounts receivable services involve hiring third-party experts to manage a business’s accounts receivable process. These accounting outsourcing services encompass a range of activities designed to streamline AR accounting, enhance efficiency, and ensure timely collections. By outsourcing, businesses can leverage specialized expertise and advanced technologies to optimize their accounts receivable management.

7 Services Offered in Outsourced Accounts Receivable

-

Credit Management

Outsourcing firms assess the creditworthiness of customers to determine appropriate credit limits and terms. This service helps minimize the risk of bad debt and ensures that credit is extended to reliable customers.

-

Invoice Generation and Distribution

Outsourcing providers create and send invoices to customers promptly and accurately. This includes electronic invoicing, which speeds up the billing process and reduces accounting errors.

-

Payment Processing

These accounts receivable services include efficiently handling incoming payments and ensuring they are recorded accurately in the AR ledger. This reduces the chances of discrepancies and improves cash flow management.

-

Collections Management

Outsourcing firms implement systematic follow-ups on overdue accounts. They use a combination of automated reminders and direct contact to encourage timely payments and reduce the number of outstanding invoices.

-

Dispute Resolution

Professionals handle any disputes that arise from billing issues. They work to resolve these disputes quickly, ensuring that payments are not delayed due to misunderstandings or errors. When you outsource accounts receivable, these experts can efficiently manage and resolve disputes, further ensuring timely collections.

-

Reporting and Analysis

Accounts receivable outsourcing companies provide detailed reports and analysis on the accounts receivable process. These reports help businesses understand their cash flow status, identify trends, and make informed financial decisions.

-

Reconciliation

Regular reconciliation of accounts ensures that the records in the accounts receivable ledger match the actual payments received. This process is crucial for maintaining accurate financial records.

6 Benefits of Outsourcing Accounts Receivable

-

Improved Cash Flow

Outsourcing the accounts receivable process ensures that invoices are sent promptly and follow-ups on overdue accounts are handled efficiently. This leads to quicker payments and a more consistent cash flow.

-

Cost Savings

By outsourcing, businesses can reduce the costs associated with hiring and training in-house staff for AR accounting. Outsourcing firms provide skilled professionals who can more effectively manage the accounts receivable process.

-

Enhanced Efficiency

Outsourcing firms use advanced technologies and best practices to manage the AR process. This results in fewer errors, faster processing times, and improved overall efficiency.

-

Focus on Core Activities

When businesses outsource accounts receivable, they can focus more on their core activities, such as product development and customer service. This allows for better resource allocation and enhances overall business performance.

-

Access to Expertise

Outsourcing providers are experts in AR management. They bring a wealth of experience and knowledge to the table, ensuring that the accounts receivable process is handled professionally and in compliance with relevant regulations.

-

Scalability

As businesses grow, their accounts receivable needs may change. Outsourcing firms can easily scale their services to match these changing needs, providing flexible and adaptable solutions.

10 Key Terms in Accounts Receivable Process

Understanding the key terms in the accounts receivable process is crucial for managing your business finances effectively. Here are some important terms of AR accounting explained in simple words:

-

Accounts Receivable Turnover Ratio

This ratio measures how efficiently a company collects its receivables. It is calculated by dividing the net credit sales by the average accounts receivable during a period. A higher ratio indicates an efficient collection of receivables.

-

Invoice

An invoice is a document sent to customers to request payment for goods or services provided. It includes details such as the amount due, due date, and a description of what was sold.

-

Credit Terms

These are the conditions under which credit is extended to customers. It includes the payment due date and any discounts offered for early payment.

-

Days Sales Outstanding (DSO)

This metric shows the average number of days it takes to collect payment after a sale. A lower DSO indicates a faster collection of receivables.

-

Aging Report

An aging report categorizes outstanding invoices by the length of time they have been overdue. It helps businesses identify which invoices need immediate attention.

-

Bad Debt

Bad debt refers to amounts that are unlikely to be collected from customers. These are often written off as a loss.

-

Collections

This is the process of pursuing payment from customers who owe money. It includes sending reminders, making phone calls, and possibly involving a collections agency.

-

Credit Memo

A credit memo is issued to a customer to reduce the amount they owe. It is often used to correct an overcharge or return of goods.

-

Reconciliation

This is the process of ensuring that the amounts recorded in the accounts receivable ledger match the actual payments received.

-

Write-off

A write-off is the accounting action taken when it is determined that a receivable will not be collected. It is removed from the accounts receivable balance.

Conclusion

In summary, it is crucial for any business seeking to uphold strong cash flow and financial well-being to master the accounts receivable process. By utilizing successful AR tactics like automated invoicing, consistent supervision, and hiring accounts receivable outsourcing companies, businesses can guarantee prompt payments and reduce unpaid debts. Adept AR administration not only boosts operational steadiness but also cultivates improved customer connections and facilitates more precise financial foresight. Using technology and top-notch approaches in the accounts receivable process can revolutionize how businesses manage their receivables, resulting in enhanced efficacy, reduced expenses, and enduring expansion.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

. Standard Operating Procedures (SOPs) for the accounts receivable process ensure consistency, accuracy, and efficiency in managing receivables. Key SOPs include:

- Customer Credit Evaluation: Assess customer creditworthiness before extending credit.

- Invoice Generation: Create accurate and timely invoices based on sales and service records.

- Payment Processing: Record payments promptly and accurately, updating customer accounts.

- Collections Management: Implement procedures for timely follow-up on overdue accounts, including automated reminders and escalation protocols.

- Reconciliation: Regularly reconcile accounts receivable records with the general ledger to ensure accuracy.

- Reporting: Generate regular reports to monitor the accounts receivable process, track outstanding invoices, and assess cash flow.

The accounts receivable balance sheet is a financial statement that includes accounts receivable as a current asset, reflecting the money owed to a business by its customers. It provides a snapshot of the business’s financial position at a specific point in time. Accounts receivable means all the outstanding invoices that are yet to be paid by customers for goods or services delivered. This balance sheet entry helps businesses track their receivables, manage cash flow, and assess financial health. Proper management of this asset is crucial for ensuring liquidity and operational stability.

Accounts receivable outsourcing involves hiring third-party providers to manage the accounts receivable process. This can include tasks such as invoice generation, payment processing, collections, and reporting. The aim is to improve efficiency, reduce errors, and ensure timely collections. Accounts receivable services allow businesses to focus on their core activities while leveraging the expertise of specialized providers to handle their receivables. Understanding what is accounts receivable and effectively outsourcing its management can lead to improved cash flow, reduced operational costs, and enhanced financial stability for businesses.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.