-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Effortless Accounts Receivable for Smooth Cash Flow

Chasing down overdue payments and managing outstanding invoices can be a constant headache. At Whiz Consulting, we provide end-to-end outsourced Accounts Receivable solutions designed to streamline your billing process and keep your cash flowing smoothly. With our expert team on your side, you can trust that your invoices are getting paid on time and that your financials are in check.

Outsourced Accounts Receivable Services We Offer

- Invoice Generation & Distribution

- Payment Collection & Follow-up

- Account Reconciliation & Aging Reports

- Cash Flow Forecasting & Management

- Credit Control & Risk Assessment

Challenges We Tackle for You

Managing accounts receivable can be a significant challenge for businesses, but at Whiz Consulting, we not only streamline the process to address common pain points but also help you save on costs, optimize workflows and reduce overdue payments.

Late or Unpaid Invoices

We ensure consistent follow-up and timely collection, reducing overdue payments and minimizing the risk of uncollected debt. Say goodbye to the stress of chasing customers and enjoy peace of mind knowing your receivables are on track.

Disorganized Billing & Invoicing Errors

Our team handles all aspects of invoicing, ensuring every detail is accurate and sent promptly. We streamline your invoicing process, reducing errors and ensuring that all charges are correctly billed and accounted for.

Cash Flow Gaps Due to Slow Payments

By managing payment schedules and follow-ups, we help accelerate collections and bridge gaps in your cash flow. We optimize your receivables process to ensure your business always has the funds it needs to thrive.

Optimizing Accounts Receivable for Better Cash Flow

At Whiz Consulting, we specialize in turning your accounts receivable process into a streamlined, efficient system. With our experienced professionals, advanced technology, and tailored solutions, we help reduce your collection time, improve cash flow, and enhance your financial operations. From invoice management to customer relationship management, we handle it all, so you can focus on what really matters: growing your business.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

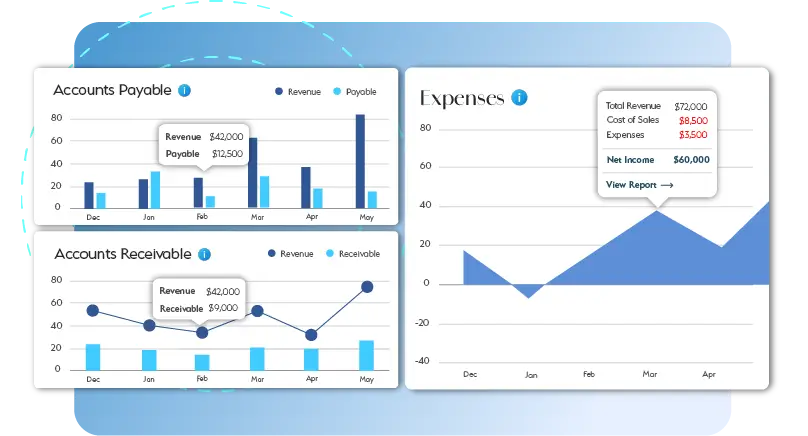

The primary goal of accounts receivable services is to ensure timely payment collection from customers, maintain accurate financial records, and improve cash flow management. This is achieved through effective invoicing, payment follow-up, account reconciliation, and dispute resolution.

A high accounts receivable turnover ratio indicates that your business is collecting payments quickly, which improves cash flow and reduces the risk of bad debt. Monitoring this ratio helps businesses assess the efficiency of their collections process and identify areas for improvement.

Accounts payable refer to the money a business owes to vendors or suppliers, while accounts receivable refer to the money owed to the business by customers. Both processes are crucial for managing cash flow and maintaining financial health.

Accounts payable automation reduces the time spent on manual data entry, tracking, and payment processing. This allows businesses to focus on optimizing their AR process and ensures a more holistic approach to managing cash flow.

Yes, there are various software solutions available that allow businesses to automate aspects of their accounts receivable process, such as invoice generation, payment reminders, and reconciliation. Automation can increase efficiency and reduce human errors.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Receivable Services: Streamlining Cash Flow and Improving Financial Health

Effective management of cash flow is crucial for maintaining a healthy financial position. One of the most vital components of cash flow management is accounts receivable, which refers to the outstanding invoices or payments a business is owed by its customers. Managing accounts receivable efficiently ensures a steady cash flow, supports business growth, and reduces the risks of overdue payments and bad debt.

Get a CallAccounts receivable refers to the amount of money that a company is owed by its customers for goods or services delivered but not yet paid for. It’s essentially a short-term asset for the business. If a company has a high volume of accounts receivable, it indicates that the business is selling on credit, which can boost sales but also creates the risk of non-payment if customers delay or default on their payments.

Managing accounts receivable is more than just sending invoices. It involves a series of well-coordinated tasks aimed at ensuring timely payments, maintaining accurate financial records, and fostering healthy relationships with customers. Accounts receivable services are designed to streamline this process, reducing the risk of human error and improving overall cash flow management. These services include:

- Invoice Generation and Distribution

- Payment Collection and Follow-up

- Account Reconciliation

- Aging Reports

- Dispute Management

One of the key performance indicators (KPIs) to measure the efficiency of your accounts receivable process is the accounts receivable turnover ratio. This metric indicates how often your business collects its average accounts receivable balance within a given period, typically a year. A high turnover ratio suggests that your company is collecting payments efficiently, whereas a low ratio could indicate collection issues, or that you are too lenient with credit terms.

The formula for the accounts receivable turnover ratio is:

Accounts Receivable Turnover Ratio= Average Accounts Receivable Net Credit Sales

A high ratio means quicker collection of outstanding payments, which in turn leads to improved cash flow and more funds available for reinvestment or covering operational costs.