Table of Content

Share This Article

- Reading Time: 17 Minutes

- Published: December 26, 2023

- Last Updated: March 17, 2025

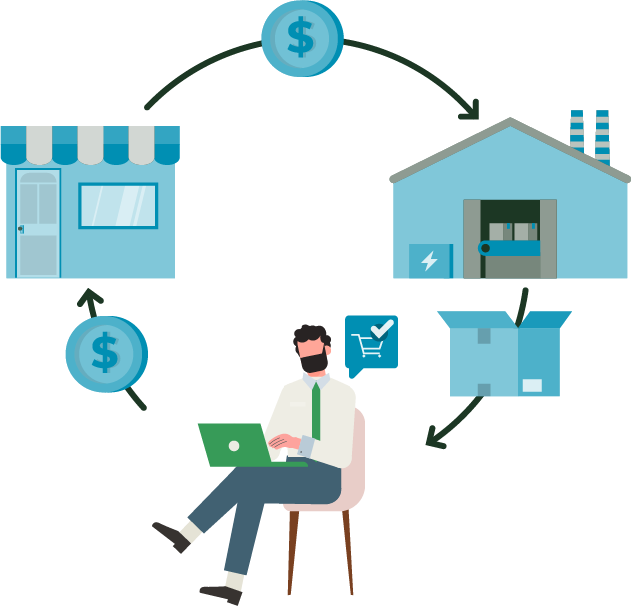

Ready to take control of your Amazon business finances? Whether you’re just starting out or looking to streamline your operations, mastering Amazon accounting is the key to unlocking growth and success. From navigating complex fees to staying compliant with tax regulations, understanding the ins and outs of Amazon’s financial ecosystem can make all the difference. In this comprehensive Amazon accounting guide, we’ll break down everything you need to know to manage your profits, track expenses, and keep your business running smoothly so you can grow your business without any hassle. Let’s dive in!

What is Amazon Seller Accounting? What Does it Include?

Amazon seller accounting focuses on the specific financial aspects unique to running an Amazon business. Amazon seller accounting involves managing the unique financial aspects of operating an Amazon business. This includes tracking sales, fees, and expenses; managing inventory and cost of goods sold (COGS); ensuring sales tax compliance; and generating financial reports. Accurate accounting enables sellers to understand profitability, maintain tax compliance, and make informed business decisions.

How is Ecommerce Accounting Different from Other Industries?

Several unique elements, each essential to the financial management of online enterprises, make ecommerce accounting different from standard accounting. Here are few of the key differentiating factors:

High Transaction Volume

To begin with, the ecommerce industry deals with a substantial number of transactions daily. Because of this substantial volume, accounting must be done carefully to guarantee accurate and well-organized financial records. Because of the enormous volume of transactions, traditional accounting techniques may not be as suitable for the speed of ecommerce.

Sales in Several Marketplaces

Another feature that distinguishes e-commerce accounting is sales across several marketplaces. Companies frequently offer their goods on various internet marketplaces, each with its guidelines and procedures. Maintaining correct financial records and adhering to various rules necessitates a systematic approach to managing sales data from various marketplaces.

Monitoring COGS and Stock

The focus on stock and Cost of Goods Sold (COGS) tracking is another unique aspect. Because ecommerce depends so heavily on inventory, keeping a close eye on the cost of items sold is essential. This careful monitoring supports well-informed pricing and stock level decisions, enhancing the company’s overall financial stability.

Global Transactions and Tax Management

E-commerce companies with global operations must deal with the complexities of tax management across borders. This requires the accountants to be well-versed in internal tax laws. Non-adherence to tax laws can result in legal complications and hinder the business’s financial stability.

Digital Payments and Complicated Data

Digital payments and sophisticated data processing further distinguish e-commerce accounting. Since most online transactions are conducted digitally, a robust and secure payment processing system is non-negotiable. E-commerce is mostly technology-driven, managing and analyzing complicated data is crucial for making well-informed decisions.

Management of Inventory

Whether you have an internal accounting team or have chosen to outsource your ecommerce accounting services, inventory management is an essential component. Financial health depends on effectively controlling stock levels, monitoring sales, and tracking product levels. This feature illustrates the particular difficulties of handling tangible products in an online setting.

Omnichannel, Returns, and Refunds

Additional difficulties in e-commerce accounting arise when managing returns, refunds, and omnichannel operations. To preserve customer experience and financial stability, businesses must effectively manage returns and refunds and negotiate a variety of sales channels.

Reporting in a Complex Financial Matrix

Managing a sophisticated financial matrix and reporting system is a part of ecommerce accounting. Companies must produce reports addressing various financial topics to support thorough analysis and strategic planning. This emphasis on reporting shows the necessity for firms to switch to a more modern way of things.

Steps to Setting Up Your Amazon Seller Accounting

Effective accounting and bookkeeping are fundamental to ensuring long-term success. Here’s a step-by-step guide to help you establish a solid financial foundation for your Amazon business:

Step 1: Set Up a Tax Entity

The first step in organizing your Amazon business finances is setting up a tax entity. You can choose from options like an LLC, S Corp, C Corp, or Partnership, depending on your business needs. Selecting the right structure is crucial for compliance, tax efficiency, and building a strong foundation for your Amazon business finances.

Step 2: Set Up Your Amazon Seller Account

Creating an Amazon Seller account is essential for gaining access to the platform and effectively managing your sales data. By linking your Seller account to your business bank account, you can track payments, fees, and refunds, providing the backbone for your financial management system.

Step 3: Invest in the Right Accounting Software

Select accounting software that integrates seamlessly with Amazon Seller Central. Look for solutions that support double-entry accounting, which provides a clear picture of your income statement, balance sheet, and cash flow. Software like QuickBooks, Xero, or NetSuite can help automate key processes and ensure accuracy.

Step 4: Leverage Add-Ons and Automation Tools

Enhance your accounting system with add-ons and automation. Many accounting tools offer integrations specifically designed for Amazon sellers, helping automate tasks like tracking settlements and importing financial data. These integrations save time and reduce the chance of errors.

Step 5: Establish Financial Reporting Framework

Define key financial metrics and establish a robust reporting system. Regularly tracking KPIs, such as profit margins, revenue growth, and expenses, will help you make data-driven decisions and optimize business performance.

Step 6: Implement Inventory Management

Efficient inventory management is essential for e-commerce businesses. Set up a system that tracks stock levels, associated costs, and profit margins. Most accounting software integrates inventory management tools, ensuring accurate financial reporting on your products.

Step 7: Monitor Sales and Revenue

Regularly track your sales and revenue to spot trends, assess profitability, and understand your cash flow. Stay proactive in reviewing your financial data so you can make timely adjustments to your pricing strategy or inventory management.

Accounting Software that Works Best for Amazon Sellers

When choosing accounting software for Amazon sellers, there are several options tailored to manage inventory, track sales, and ensure accurate financial reporting. Here’s a breakdown of the best accounting software for Amazon sellers:

QuickBooks

QuickBooks is one of the most popular choices for small and medium-sized Amazon sellers. It offers seamless integration with Amazon, helping to track income, expenses, and inventory. With its easy-to-use interface and powerful reporting tools, QuickBooks is ideal for managing finances and tax calculations.

Key features include:

- Invoicing and Billing

- Expense Tracking

- Financial Reporting

- Purchase Order Management

- Inventory Management

- COGS Tracking

- Running Payroll

- Tax Preparation

- Bank Reconciliation

- Mobile App

- Integration with Amazon

- Time Tracking

- Customizable Dashboard

- Multi-User Access

Xero

Xero is a cloud-based accounting solution known for its simplicity and ease of use. It integrates well with Amazon and provides automatic bank feeds, invoice creation, and financial reporting. Xero is perfect for businesses looking for a balance between functionality and ease of use.

Key Features:

- Invoicing and Billing

- Expense Tracking

- Financial Reporting

- Inventory Management

- Payroll Processing

- Tax Compliance

- Bank Reconciliation

- Mobile App

- Integration with Amazon

- Time Tracking

- Project Tracking

- Multi-User Access

NetSuite

NetSuite is an enterprise-level solution perfect for large-scale Amazon sellers. It offers advanced features like real-time financial visibility, integrated inventory management, and multi-channel sales tracking. It’s highly customizable and can support complex business operations.

Key Features:

- Invoicing and Billing

- Expense Tracking

- Financial Reporting

- Purchase Order Management

- Inventory Management

- Tracking Landed Cost of Product

- Multiple Warehouse Tracking

- COGS Tracking

- Order Management

- Multi-Entity Management

- Payroll Processing

- Tax Compliance

- Bank Reconciliation

- KPIs Tracking

- Customizable Dashboards

- Integration with Amazon

Zoho Books

Zoho Books is an affordable option with robust features for Amazon sellers, including inventory tracking, order management, and tax calculation. Its user-friendly interface and integration with various eCommerce platforms make it ideal for small businesses.

Key Features:

- Invoicing and Billing

- Expense Tracking

- Financial Reporting

- Purchase Order Management

- Inventory Management

- Multiple Warehouse Tracking

- Tracking Landed Cost of Product

- COGS Tracking

- Project Management

- Tax Compliance

- Bank Reconciliation

- Mobile App

- Integration with Amazon

- Multi-User Access

Tackling the Common Challenges in Amazon Seller Accounting

Amazon seller accounting involves managing a complex range of transactions and data. Several common challenges and mistakes can arise, but by avoiding these, you can significantly improve the financial management of your business. Here are some key points to consider in managing Amazon seller bookkeeping and accounting:

1. DIY Accounting vs. Cloud-Based Software:

While spreadsheet-based accounting may seem cost-effective, it quickly becomes insufficient as a business grows. In contrast, cloud-based accounting software automates many processes, reducing errors and saving time. It securely stores data online, offers access from anywhere, and scales your business. Also, it integrates with various apps, enhancing efficiency. Investing in this software pays off by providing a comprehensive Amazon accounting solution that supports long-term growth.

2. Separation of Business and Personal Accounts:

Mixing personal and business finances leads to confusion and inaccuracies in reporting. This practice can make assessing your business’s financial health difficult and complicate tax filings. By separating these accounts, Amazon accounting becomes clearer, simplifying audits and potentially increasing the business’s valuation for future sale opportunities.

3. Poorly Created Chart of Accounts:

A well-structured chart of accounts is essential for accurate financial tracking. It should reflect the unique aspects of your business and categorize income and expenses. A disorganized chart leads to misclassified transactions, skewing financial insights and affecting strategic decisions. Regularly reviewing and updating your chart of accounts is important for Amazon accounting process as your business evolves.

4. Failing to Account for Amazon Fees:

Amazon fees, such as referral and fulfillment, can greatly reduce profit margins. Overlooking these fees during Amazon bookkeeping can result in overestimating profitability. Consistently tracking and recording these fees in your financial system ensures a more realistic understanding of earnings, enabling informed pricing and sales strategies.

5. Not Tracking Damages and Product Returns:

Returns and damages are a part of doing business, especially in e-commerce. Ignoring these factors can lead to inflated inventory and revenue figures. Monitoring returns and damages helps adjust sales strategies, manage inventory more efficiently, and maintain accuracy in financial reports.

6. Inaccurate Purchase Cost Recording:

Recording the purchase cost of every product correctly is essential to understanding your inventory’s value. Misrecording costs can skew profit calculations and result in inaccurate financial statements. Consistent and precise tracking of purchase costs is vital for reliable Amazon accounting.

7. Incorrect COGS Calculation:

Calculating COGS accurately is crucial for determining product profitability. Errors in this calculation can lead to misleading insights about your business’s performance. Ensure all direct costs associated with product production and acquisition are included in COGS calculations.

8. Relying Solely on Settlement Statements:

Amazon settlement statements provide an overview of transactions but often omit important details like sales tax collected. Relying only on these statements can make Amazon accounting difficult. It’s important to supplement them with detailed internal records for a complete financial picture.

9. Prioritizing Revenue Over Gross Margin:

While increasing revenue is important, it shouldn’t overshadow gross margin. High sales volumes may still lead to poor performance if the costs of goods sold are too high. Focusing on and optimizing gross margins ensures long-term profitability.

10. Not Tracking Customer Acquisition Costs:

Expenses related to acquiring customers, including advertising and marketing costs, directly impact profit margins. Without careful monitoring, Amazon bookkeeping costs can reduce profitability. Regularly reviewing customer acquisition costs helps optimize marketing strategies and improve budget allocation.

Best Practices for Amazon Seller Accounting

Effective accounting is crucial for Amazon sellers to maintain a profitable business while staying compliant with tax regulations. Below are some best practices for Amazon seller accounting to help streamline financial management and improve overall business efficiency:

1. Selecting the Right Accounting Software

Choosing the appropriate accounting software is the first step toward efficient financial management. Look for software that integrates seamlessly with Amazon Seller Central to automate the flow of transactions, track sales, manage expenses, and generate financial reports. Popular options such as QuickBooks, NetSuite, and Xero allow sellers to sync their Amazon data and avoid manual data entry, saving time and reducing errors.

2. Creating an Appropriate Chart of Accounts

A well-organized Chart of Accounts (COA) is essential for accurate tracking of income and expenses. Create categories for different income sources, such as product sales, shipping fees, and refunds, and separate expense categories like advertising, product costs, and Amazon fees. The COA should also include categories for fixed assets, liabilities, and equity to maintain clear financial records. A customized COA tailored to your Amazon business will help you stay on top of your finances and make tax preparation easier.

3. Setting Up the Inventory Tracking System

To ensure accurate financial reporting and cost calculations, set up a reliable inventory tracking system. This system should account for inventory purchases, sales, returns, and adjustments. Many accounting platforms offer built-in inventory tracking features that integrate with Amazon, automatically updating stock levels and costs. Tracking inventory allows sellers to calculate the cost of goods sold (COGS) accurately and avoid over- or underestimating profits.

4. Recording the Purchase of Goods

When you purchase inventory, document the cost of the products, shipping, and any other associated fees. These details should be recorded in your accounting software and reflected in your inventory system. This will help you track the true cost of your goods, which is essential for calculating your profit margins and for accurate tax reporting.

5. Correct Tracking of COGS

COGS is one of the most important financial metrics for Amazon sellers, as it directly impacts your profit margins. It represents the direct costs associated with producing or purchasing the products you sell. Accurately tracking COGS helps in understanding the profitability of each product and monitoring the financial performance. Use an inventory management system or accounting software to track your purchases, sales, and inventory levels, ensuring that COGS is calculated correctly.

6. Recording Portal Expenses

Amazon sellers incur various fees when using Amazon’s platform, including referral fees, storage fees, and advertising expenses. It’s essential to track and record these portal-specific expenses separately in your accounting software. This will help you monitor Amazon-related costs and identify areas where you may be overspending, such as on PPC campaigns or high storage fees. By categorizing and tracking these expenses, you can assess the profitability of your Amazon business more accurately.

7. Regular Reconciliation of Accounts

Reconciliation is a key practice to ensure your financial records are accurate and up to date. Regularly reconcile your Amazon transactions, bank accounts, and credit card statements with your accounting software to identify any discrepancies. This process helps catch errors early, such as missing or duplicate transactions, and ensures that your financial statements are accurate. It also prepares you for tax season, as reconciled accounts provide a clean audit trail and make tax filing smoother.

8. Integration with Amazon and Other Third-Party Applications

Using multiple applications for different aspects of your business, such as inventory management, order fulfillment, or customer service, can lead to inconsistencies in your accounting records. To avoid errors, integrate these tools with your accounting software. This ensures that all your business data flows into one system, improving efficiency, accuracy, and decision-making.

9. Setting Up a Financial Reporting Framework

Establish a robust financial reporting framework to regularly review your Amazon business’s performance. Generate financial reports like Profit and Loss statements, Balance Sheets, and Cash Flow statements to gain insights into your profitability, expenses, and cash flow. Financial reports are essential for tax reporting, identifying areas for cost-cutting, and making informed decisions about expanding or optimizing your business.

Also Read: Essential Accounting Practices for E-commerce Businesses

Financial Metrics to Monitor as an Amazon Seller

As an Amazon seller in the USA, keeping track of key financial metrics is vital in Amazon accounting for the success and growth of your business. These metrics offer insights into your business performance, highlight areas for improvement, and help you plan for future growth. Here’s a closer look at the important ecommerce KPI every Amazon seller accountant should monitor:

Gross Profit Margin for Products Sold

This metric reflects the profit percentage for each product after deducting the COGS. It’s a crucial indicator of how much profit you’re making on sales, helping you assess whether your pricing is appropriate and if your sales are truly generating profit.

COGS for products sold

Understanding the COGS is essential to Amazon accounting for tracking the direct expenses incurred in producing your goods. By monitoring COGS, you can explore reducing production costs, negotiating better terms with suppliers, and improving your overall profit margins.

Profitability by Product Category

Some product categories may be more profitable than others. Tracking profitability by category allows you to identify which areas of your business are performing well and which need improvement. This helps you allocate resources effectively to maximize profitability.

Number of Orders

Monitor the total number of orders to determine customer demand and market reach. While increased orders suggest growth, evaluating this with profit margins is important in Amazon accounting to ensure sustainable growth.

Average Order Value

This metric of Amazon accounting shows the average amount customers spend per order. Boosting your average order value can significantly increase revenue without needing more customers. Strategies like cross-selling and upselling can help raise this figure.

Revenue Growth Rate

This metric measures the speed at which your revenue grows over time, providing an overview of your business’s health. A steady increase in revenue signals successful strategies, while a decline may require re-evaluating your approach.

Best and Poor Performing Items

Knowing which products top sellers and underperforming are helps you make strategic decisions about inventory management, marketing, and product development.

Impact of Ad Spend on Sales

Tracking how your advertising budget translates into sales is critical in Amazon accounting. This metric helps you assess the effectiveness of marketing campaigns and understand the return on investment (ROI) from your advertising efforts.

Average Inventory

Monitoring your average inventory levels ensures you have the right amount of stock. Excess inventory can tie up capital and lead to higher holding costs, while too little can cause stockouts and missed sales opportunities.

Inventory Holding Period

This metric tracks how quickly you sell and replenish your inventory. A shorter holding period indicates high demand and efficient inventory management, which is crucial for maintaining Amazon accounting for healthy cash flow and reducing storage costs.

Holding Costs

These are the costs associated with storing and maintaining your inventory. Keeping these costs under control is vital for preserving profit margins and ensuring operational efficiency.

Net Profit Margin

Net profit margin is one of the most important metrics to track in the process of Amazon accounting, showing your overall profitability after all expenses. It offers a comprehensive view of your business’s financial health and efficiency.

Return on Investment (ROI)

ROI measures the profitability of your investments relative to their cost. A high ROI indicates that your product, marketing, or equipment investments yield profitable returns.

By closely monitoring these financial metrics, you’ll gain a deeper understanding of Amazon accounting that will help to enhance your business’s performance, enabling you to make informed decisions that support long-term growth and success.

Also Read: Must Track Ecommerce KPIs to Monitor Your Online Store’s Performance

How Outsourced Accounting Can Streamline Amazon Seller Accounting?

Managing accounting for your Amazon business can be complex, especially as you scale. An outsourced accounting service provider offers a range of benefits that streamline your financial processes. Here’s how they can help:

Expertise in E-commerce Accounting:

Outsourced accounting providers specialize in e-commerce, understanding the unique financial needs of Amazon sellers, including tracking sales, fees, and reimbursements.

Streamlined Software Integration:

Accounting service providers can integrate accounting tools, such as QuickBooks or Xero, with Amazon, inventory management and order fulfillment tool for seamless financial management across platforms.

Time Savings:

Free up your time by having experts handle the complex and time-consuming aspects of accounting, such as transaction reconciliation, bookkeeping, and tax preparation.

Inventory and Cost Management:

Manage your inventory and related costs effectively, with proper accounting for storage, shipping, and FBA fees.

Accurate Financial Reports:

Get regular, accurate financial reports that help you track profitability, manage cash flow, and make informed business decisions.

Tax Compliance and Filing:

Ensure that you’re fully compliant with tax regulations, including sales tax and income tax, while also maximizing deductions specific to Amazon businesses.

Scalable Solutions:

As your Amazon business grows, an outsourced provider can scale their services to meet your increasing financial needs without the hassle of hiring in-house staff.

Avoid Mistakes and Penalties:

Professionals help minimize the risk of errors in financial reporting and tax filings, reducing the risk of audits or penalties.

Final Thoughts

Managing Amazon accounting can feel like a daunting task, with its complex pricing structures, high transaction volumes, and ever-changing tax requirements. But with the right approach, these challenges can be transformed into opportunities for growth and efficiency.

At Whiz, we specialize in simplifying the intricacies of Amazon accounting, offering tailored solutions that ensure financial transparency, compliance, and strategic insights. Our expert team is here to take the stress out of managing your finances, so you can focus on growing your business. Contact us today and let’s make your financial management as seamless as your success on Amazon!

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Outsourcing Amazon accounting can save you time, improve accuracy, and help you focus on growing your business. With experts who understand Amazon accounting, you get precise records, ensuring you’re always compliant with the US tax laws and reducing stress when tax season arrives.

Amazon accountants handle all fees, including FBA (Fulfillment by Amazon), shipping, and transaction fees. By accurately tracking these expenses, they categorize them to give you clear insights into your profitability, helping you understand your most and least profitable products.

Amazon accounting often includes reports like profit and loss statements, sales summaries, inventory valuations, and expense breakdowns. These reports give a clear financial overview, helping you make informed business decisions and identify growth opportunities.

Common mistakes include failing to track all fees, mixing personal and business finances, not managing inventory costs properly, and neglecting sales tax requirements.

Essential reports include sales reports, transaction reports, settlement reports, tax reports, and inventory reports, all of which help track performance and ensure accurate accounting

Yes! It’s a good practice to keep separate accounting records for your Amazon business and other ventures to avoid confusion, track each entity’s profitability, and comply with tax requirements.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.