Table of Content

Share This Article

- Reading Time: 8 Minutes

- Published: May 17, 2022

- Last Updated: January 16, 2025

Accounts payable is one of the most important parts of a business’s accounting function. Accounts payable determine the creditworthiness and reliability of the business in the market. It directly affects the business’s cash flow and its relationship with the suppliers. Nowadays, businesses use accounts payable software or accounts payable outsourcing to manage the entire accounts payable process. Let us know how accounts payable automation helps resolve the challenges related to accounts payable processing.

Accounts payable is defined as the amount a business owes to its suppliers and creditors. It involves credit purchases, for which the supplier sends an invoice with a due date for payment. The business can pay on the due date or before that as well. Accounts payable is a short-term liability that is recorded as “current liability” in the Balance Sheet, as per accrual accounting. This process can be managed by a business in-house or with the help of accounts payable outsourcing service providers.

» Top Accounts Payable Challenges

Accounts payable management is a complex and hectic task. It requires the accounts payable team to handle the collaboration with the suppliers and purchase department of the business. These responsibilities take a lot of time to complete manually, thus affecting the team’s efficiency. Whether managed in-house or via accounts payable outsourcing, manually handling the process is tiresome. Some of the common accounts payable challenges faced by businesses while dealing with them manually include:

1. Misplaced invoices:

One of the biggest issues with manual accounts payable management is the misplacement of invoices. The manual process creates a lot of friction among the team regarding how the invoice was sent, to who it was addressed, whether it has been approved, etc. It can also lead to late payment of invoices or incorrect posting in the income statement, resulting in inaccurate financial statements.

2. Time-taking manual process:

Managing the accounts payable manually is a lengthy process and involves too many human resources. The process involves scanning the invoices, printing and signing the cheques, and confirming the payments. All this task is tedious and error-prone. The payment approval time is lengthy, making the payments slower and resulting in delays in goods shipment, late fees, and unfavorable relationships with the lenders and suppliers. All these issues ultimately affect the growth of the business.

3. Business scaling issues:

Manual invoices and payment processing becomes a bigger problem when the business grows or expands. With a growing business comes an increased number of invoices. Managing this huge number of invoices occupies most of the bandwidth of the accounts payable professionals. It can lead to discrepancies like incomplete, incorrect, missing, or non-matching invoice information, which can be time-consuming and require numerous follow-ups. It will affect the efforts the accounts payable professionals put into the core activities.

4. Physical storage space:

The traditional or manual accounts payable processing involves heavy paperwork as all the documents are prepared on paper. The invoices, cheques, and records about all the payables are prepared on paper, and necessary documents must be properly stored. However, storing paper documents needs a big physical storage space. The storage space must also be well-built and secure. The documents must also be filed accurately in the right cabinet. It results in difficult document tracking and auditing process, with increased labour and storage costs.

5. Invoice duplication:

When the invoices are managed manually, the accounts payable department doesn’t always have visibility about the status of every invoice. It also leads to confusion about whether an invoice has been recorded, causing invoice duplication. Duplicate invoice leads to duplicate payments, which is bad for any business. Duplicate invoice payments can be caused due to inaccurately entered supplier information, discrepancies with the invoice amount, or incorrect coding of the invoices.

Useful Read: Everything A Business Owner Must Know About Accounts Payable

» What is Accounts Payable Automation?

Accounts payable automation is the process or tool that helps eliminate the manual efforts involved in the accounts payable process by automating it. It can be done either by accounting software like Xero, QuickBooks, etc., or by dedicated accounts payable software like MineralTree, Tipalti, etc. Accounts payable automation focuses on quick and error-free management of a business’s accounts payable. It records the credit purchase invoices, approves them, and executes payment against them digitally.

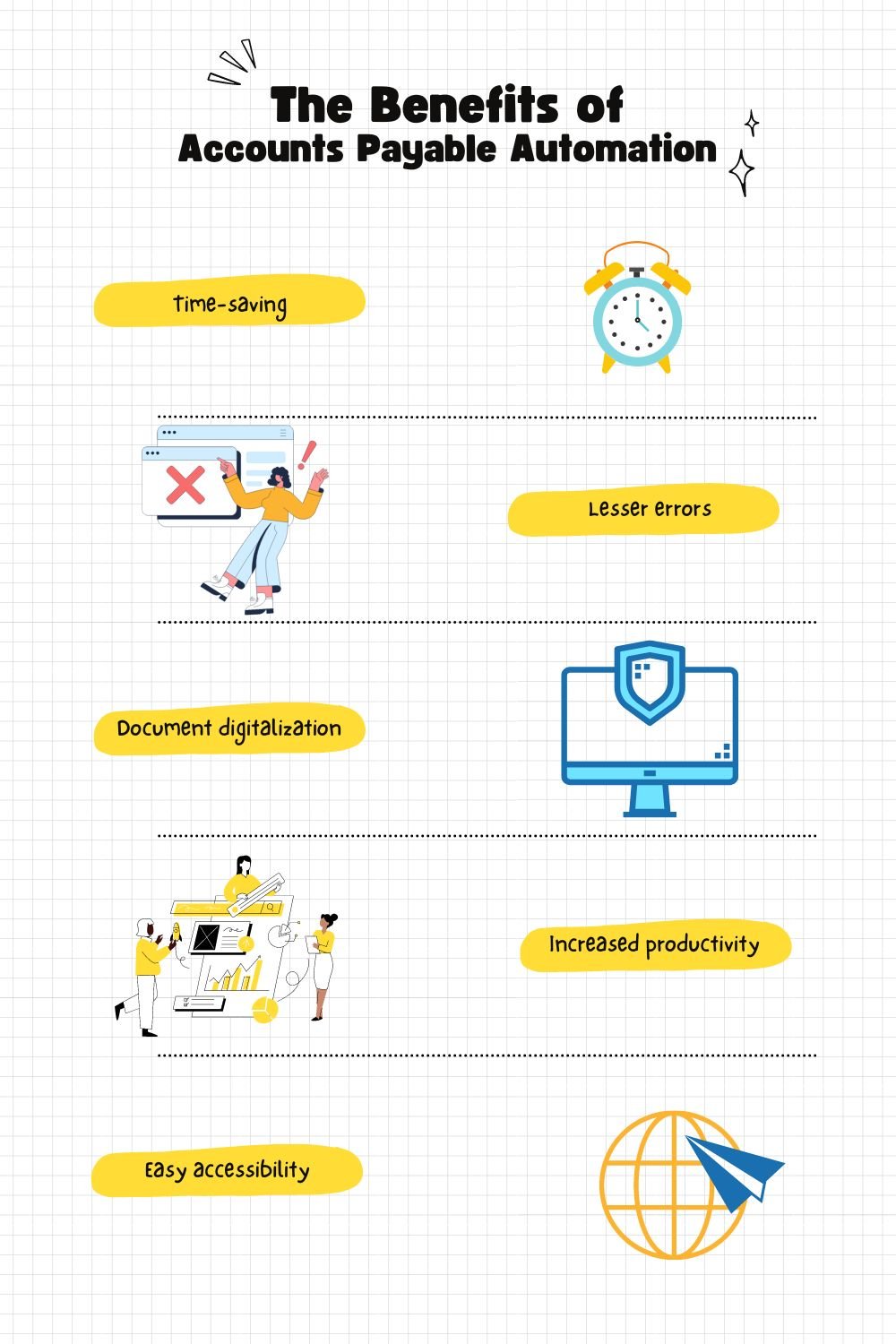

» Benefits of Accounts Payable Automation

Accounts Payable Automation makes things easier for businesses but requires an investment. Even though it justifies and pays off the investment made in it in the long run, it is crucial to know why accounts payable automation is required in the first place. Following are some benefits of using accounts payable automation if implemented properly:

1. Time-saving:

Automation eliminates manual work that is slow and repetitive. Tasks like reviewing purchase order forms and data entry for every form, which used to take a lot of time, can now be completed almost instantly.

2. Lesser errors:

There is always a risk of errors when substantial manual work is involved in a process to be completed by human resources. However, automation software can do numerous repetitive tasks without faults for a long time.

3. Default document digitalization:

When the records are prepared on paper, it requires huge storage space to keep all the data safe. These paper documents are then scanned and mailed around the business when required. But, using accounts payable automation eliminates the use of paper and thus the need for physical storage space. The accounts payable software stores the necessary documents by default and prevents the hectic process of sharing the document within the business.

4. Increased productivity:

With the manual work replaced and time saved, the business can focus on core business activities. More time means increased productivity for the business.

5. Easy accessibility:

Paper documents must be prepared correctly and stored in the right cabinet or tray. However, automation makes documents accessible from anywhere with an internet connection when the software is cloud-based. When the business uses intuitive accounts payable software, the data is accessible to everyone, not just the finance team. Other teams can file purchase orders, saving some time and effort for the finance team.

For accounts payable automation software, a business can check some options like Stampli, Tipalti, MineralTree, etc. Reviewing the features and benefits provided by different software help in choosing the best automation system as per the business needs.

» How to Solve Accounts Payable Problems With Automation?

Nowadays, businesses prefer to outsource their important and complex accounting tasks like accounts payable processing, and all the accounts payable outsourcing services providers use automation. The reason for doing so is that they make the process easier. All the accounts payable challenges mentioned above can be easily resolved with the help of automation. Especially the cloud-based software helps remove the manual task and provides easy access to everyone in the business. It helps increase the business’ efficiency and growth. A business should aim to automate the entire accounts payable process; however, some tasks must be automated to get long-term benefits. The top 3 manual accounts payable tasks to be automated are:

1. Invoice data entry:

Instead of manually recording the invoice information, automation of the process helps save time and reduces invoice coding issues. Accounts payable automation eliminates the risk of errors in invoice data entry. It prevents businesses from any extravagant costs that might be caused due to numerous small inaccuracies. The business doesn’t even need to use spreadsheets to match the data. The accounts payable software integrates with the ERP or accounting software used by the business and automatically syncs all the recorded data. It saves time and eliminates the unnecessary human effort involved in the process. It also ensures there are no misplaced invoices. Automated invoice data entry eliminates the need for any physical storage as the data is stored online on cloud storage.

2. Invoice matching or approvals:

Businesses receive invoices via various methods such as emails, fax, or vendor website portal. All the invoices received need to be matched with every corresponding purchase order and approved. Collecting approvals is a lengthy process and requires juggling through numerous email threads and follow-ups around the department. It is challenging to keep track of all these chains, and it also takes many days to process the approvals. Accounts payable automation removes all these long chains and threads of approval and matching. The invoices are automatically forwarded to the appropriate person for approval, with automatic follow-ups for deadline reminders. The automated system also flags any incorrect information or mismatches for further review.

3. Invoice payment executions:

The invoices are forwarded to the person who executes the payments once they are matched and approved. The person who executes payments must have clear visibility of all the due dates and discounts available on early payments. Accounts payable automation makes it easier to track deadlines and avoid late payments, thus preventing late fees or unfavorable terms with the suppliers. The payments can also be scheduled and automatically completed on the right date. The automated accounts payable management syncs all the data with the business’s accounting software or ERP. As the data is automatically synced, the risk of invoice duplication and duplicate payment is eliminated.

» Conclusion

Automated accounts payable benefits the business in numerous ways. It helps save costs, is faster and more accurate, reduces errors and increases time, efficiency, and expands the visibility of the process. Automation is also helpful in easily scaling the business, meaning managing the accounts payable efficiently when the business is growing.

Whether a business manages its accounts payable process on its own or hires the help of accounts payable outsourcing companies, it is important to move from traditional methods to modern methods. The traditional method, i.e., manually managing the process, is hectic, time-taking, and prone to errors. However, automation increases efficiency, reduces error, helps in compliance monitoring, and enhances process control. It is a better choice to use accounts payable automation for business growth.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

We use cookies to improve your experience. By using our site, you agree to our Consent Policy.