In This Blog Post

Share This Article

- Published: Feb 28, 2025

- Last Updated: Jul 16, 2025

- 🔊 Listen

Quick Reads

- Managing cash flow is important for e-commerce businesses due to the fast-paced nature of online sales and inventory.

- Healthy e-commerce cash flow ensures liquidity for covering day-to-day expenses like inventory, marketing, payroll, and shipping.

- Maintaining a cash reserve helps cover unexpected expenses and gives a financial safety net.

- Improving profit margins through pricing adjustments or cost reductions majorly impacts e-commerce cash flow management.

- Forecasting helps prevent cash shortages by anticipating potential shortfalls and allowing for corrective action.

From Data to Dollars

Elevate Your Ecommerce with Smart Accounting & Analytics

Cash is the king, and you need a good amount of it to sustain your ecommerce operations. Even if your sales are booming, poor cash flow management can quickly put the brakes on your business. In this blog we will dive into why managing your cash flow is absolutely crucial for your e-commerce business success. We’ll explore how to forecast your cash flow and provide you with best practices to keep your finances healthy, so you can keep growing and thriving. Let’s get your cash flowing smoothly!

Importance of Managing Cash Flow for E-commerce

As an e-commerce business owner, you’re constantly juggling supplier payments, platform fees, and marketing costs while ensuring you have enough liquidity to scale. A well-structured financial statement, especially a detailed cash flow statement provides a clear overview of your business’s cash inflows and outflows. This helps you stay on top of your finances, manage expenses effectively and navigate seasonal fluctuations with confidence.

Maintain Liquidity for Operations:

Cash flow ensures that you have enough liquid capital to cover day-to-day expenses like inventory, marketing, payroll, and shipping. Without proper cash flow management, even a profitable e-commerce business can run into trouble if they can’t pay bills or keep operations running smoothly.

Inventory Management:

One of the largest expenses for e-commerce businesses is inventory. If you don’t manage your e-commerce cash flow system properly, you risk over-purchasing or running out of stock at the wrong time, both of which can lead to lost sales or cash being tied up in unsold stock.

Opportunities for Growth:

When you have good cash flow, you are in a stronger position to seize opportunities, like bulk discounts from suppliers or testing out new marketing strategies. A healthy cash flow means you do not have to second-guess every purchase or business decision.

Sustain Customer Experience:

E-commerce cash flow also directly impacts your ability to deliver great customer service. Whether it’s ensuring fast order fulfillment, offering discounts, or providing return policies, having sufficient cash flow helps ensure that your customers remain happy and loyal.

Improves Decision Making:

A solid e-commerce cash flow system means you will have clear visibility into your financial health. This clarity allows you to make more informed decisions about scaling, budgeting, and even choosing the right suppliers or negotiating payment terms.

Best Practices for E-commerce Cash Flow Management

Sales may be booming, but if there’s not enough cash on hand to cover expenses, things can quickly spiral out of control. Suppliers need to be paid, inventory must be restocked, and unexpected costs always seem to pop up at the worst times. That is why keeping a close eye on e-commerce cash flow management is not just a good idea, it is a necessity. Here are some simple but powerful ways to keep money moving in the right direction:

Monitor Cash Flow Regularly:

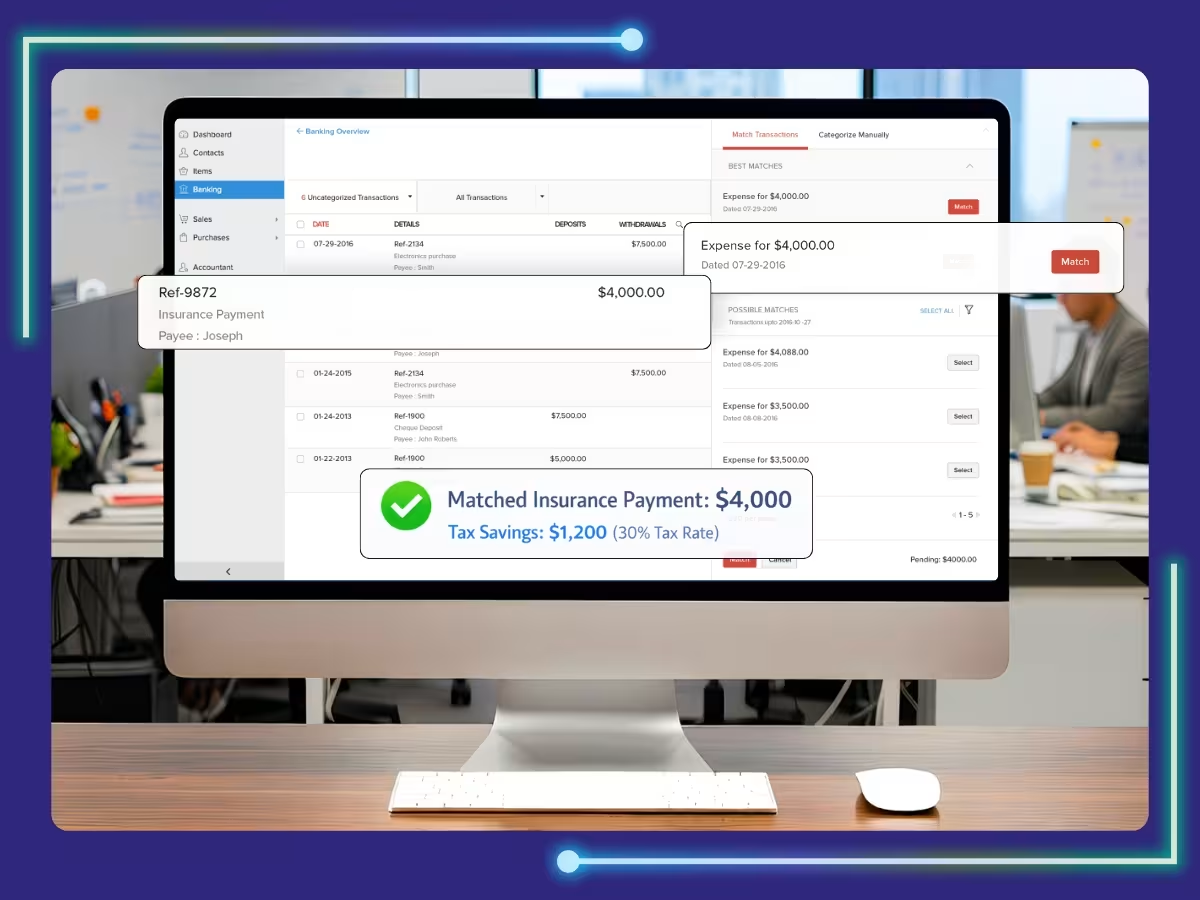

Waiting until the end of the month to check cash flow? That is a disaster waiting to happen. Cash flow should be monitored regularly, weekly or even daily to avoid any issues. With the help of ecommerce accounting software and professional accounting service provider, potential shortfalls can be spotted before they turn into serious financial problems.

Optimize Payments Terms with Suppliers:

Cash flow does not just depend on sales, it also depends on when money goes out. If suppliers are willing to offer extended payment terms, more cash can be kept in the business for longer. On the other hand, if suppliers offer discounts for early payments, and you have extra cash on hand, you should take advantage of those deals as it can lead to long-term savings.

Encourage Faster Customer Payments:

The sooner payments are received, the better it gets. Small incentives, like discounts for early payments, can speed things up. Additionally, opting for faster settlement terms for merchant payout and providing multiple payment options, including digital wallets and buy-now-pay-later services, can make your transactions smoother and quicker.

Maintain a Cash Reserve:

Unexpected expenses are inevitable, and without a backup fund, your business can quickly run into trouble. Maybe a supplier increases prices, an ad campaign flops, or a sudden rush of orders requires extra inventory. Without a cash cushion, these surprises can turn into serious financial problems. Even a small buffer can make a big difference when unexpected costs arise.

Reduce Unnecessary Expense:

Not every expense is essential, and reviewing costs regularly can help keep cash flow in check. Regular expense audits can reveal where money is being wasted. Are there any services that are not really being used? Can a cheaper alternative get the same job done? Reducing unnecessary spending is one of the fastest ways to improve e-commerce cash flow management.

Manage Inventory Efficiently:

Too much inventory means cash is locked away in unsold products. Too little inventory means lost sales. The key is to find the right balance. Tracking e-commerce KPIs like inventory turnover ratio and days sales of inventory (DSI) can help assess stock efficiency and prevent cash from being tied up unnecessarily. Moreover, you should also leverage inventory management software to predict demand, avoid overstocking, and optimize storage.

Clearance of Dead Stock:

Think of dead stock as money just sitting on your shelves, not doing anything for your business. The best way to keep your cash flow strong is to clear it out, run discounts, bundle slow-moving items with popular ones, or even try flash sales. This frees up space and, more importantly, puts that cash back into your business where it can work for you.

Improve Profit Margins:

Finding ways to increase margins, whether by raising prices slightly, negotiating better supplier rates, or cutting production costs can make a significant difference. Also, even small price adjustments, when done strategically, can boost overall e-commerce cash flow management without driving customers away.

Leverage Business Credit Wisley:

Credit is not always bad, but it can actually be a smart tool when used wisely. A business line of credit or short-term financing can help smooth out cash flow gaps without disrupting operations. However, high-interest loans should be avoided whenever possible, as they can lead to unnecessary financial strain. If credit is used, it should be done with a clear repayment strategy in mind.

Automate Cash Flow Management:

Managing cash flow manually is time-consuming and leaves room for errors. Automated invoicing, expense tracking, and financial reporting tools make the process easier and more accurate. Payments can be scheduled, reminders can be sent automatically, and real-time insights can be accessed with just a few clicks. Less time spent on e-commerce cash flow management means more time to focus on growing the business.

Take Experts Advice:

Keeping your cash flow in check is key to running a successful e-commerce business. A professional e-commerce accountant helps by tracking your income, managing expenses, and improving forecasting so you are never short on cash. With their expertise, you can maintain liquidity and make smarter financial decisions effortlessly.

Forecasting Cash Flow

Cash flow forecasting is like planning your budget ahead of time, it helps you see when money will be coming in and going out. Since e-commerce sales can be unpredictable, having a clear forecast ensures you are never caught off guard, can manage expenses smoothly, and always have enough cash to keep things running.

Importance of Cash Flow Forecast for Your Online Store

A cash flow forecast is crucial for an online store because it helps you maintain financial stability, plan for your growth, and avoid unexpected cash shortages. So, let us look why it is so important:

Predicting Financial Health:

Think of a cash flow forecast as a glimpse into the future of your finances! It gives you a look at what is coming in like sales, customer payments and what is going out which is supplier bills, operating expenses. This helps you avoid last minute scrambles when it’s time to pay your bills.

Preventing Cash Shortages:

Even profitable online stores can struggle with cash flow issues if sales do not align with expenses. An e-commerce cash flow forecast lets you anticipate potential shortfalls and take corrective action before they become a problem, such as delaying purchases or arranging for financing.

Building Credibility with Investors:

If you’re looking for investors or trying to get a loan, they will want to see that you have got a handle on your cash flow. A forecast shows them that you are serious, and you have got your ducks in a row.

Managing Seasonal Fluctuations:

You might get a rush of orders during the holidays and then a quiet spell afterward. A forecast helps you prepare for those busy times, so you don’t get caught off guard when the cash flow slows down.

Tracking Your Expenses:

Little things such as subscriptions and shipping cost can rack up a hefty sum. A forecast helps you keep track of those expenses, so you are not left wondering where all your money went.

How to Forecast Cash flow for Ecommerce Business

Forecasting cash flow for e-commerce business is not as scary as it sounds! Think of it as planning a route for your money, figuring out what’s coming in and what’s going out. We’ll make it simple and straightforward showing you how to predict your income and expenses properly:

Step 1: Look at Your Past Performance

The first step is to look at the rearview mirror, check out your past sales and expenses. If you have been in business for a while, this will give you a clear picture of your usual income and expenses. If you are just starting out, try to look at trends in the market or similar businesses for guidance.

Step 2: Estimate Your Incoming Cash

Next, let’s talk about revenue. This is the fun part, figuring out how much cash is going to flow in. Look at your sales projections for the upcoming months based on things like planned promotions, marketing campaigns, or new product launches. Do not get too carried away; keep it realistic. Also, remember the payment terms: if you’re invoicing customers, you might not see the money right away.

Step 3: Forecast Your Expense

You will need to estimate how much money you will spend on things like inventory, shipping, software subscriptions, and marketing. Some of these are regular monthly costs like your website fees, but others might be one-off or seasonal such as extra inventory. Get a clear idea of where your money is going so you can avoid any unexpected surprises.

Step 4: Calculate Net Cash Flow

Once you have got your incoming and outgoing cash lined up, it’s time to do the math. Take your expected revenue and subtract your estimated expenses. That gives you your net cash flow. If you are in the green (positive cash flow); awesome, you have got extra money to reinvest or save. But if you are in the red (negative cash flow), you must bridge the gap, to maintain your cashflow.

Step 5: Plan for Risks and Seasonality

There will be months when sales soar, and others when they drop like a stone; so be proactive and prepared. Make sure you have got a buffer to cover those lean months and keep an eye on seasonal trends. Maybe your business thrives in summer but slows down in winter, plan for that so you are not caught off guard.

Step 6: Review it Regularly

Finally, forecasting is not a “set it and forget it” deal. If your actual sales are way different from what you predicted, or your expenses change unexpectedly, update your forecast. This keeps you on track and helps you adjust quickly if things take an unexpected turn.

Wrapping Up

Managing cash flow is essential for the success of any e-commerce business. It ensures liquidity for daily operations, helps with inventory management, and provides scope for growth.

With a clear understanding of your cash flow, you can make informed decisions and improve profitability. Dedicated ecommerce accounting services are directed towards optimizing finances, and providing insights for growth. Reach to us today and let’s discuss how your business can thrive in the competitive e-commerce landscape.

Get customized plan that supports your growth