Table of Content

Share This Article

- Reading Time: 10 Minutes

- Published: October 23, 2024

- Last Updated: January 21, 2025

Irrespective of the business size, the significance of accurate financial reporting and analysis cannot be overstated. It provides crucial information that reflects the financial performance over a specific time, guiding stakeholders in making strategic business decisions. Financial reporting, a comprehensive phenomenon that includes various documents, is the backbone of sound financial management. In this blog, we delve into the vital aspects of financial reporting and analysis, enlightening you on its importance and best practices.

What is Financial Reporting and Analysis?

Financial reporting and analysis involve a detailed review of an organization’s financial data and statements. This process is important to understand the financial well-being of the company and helps companies make further strategies and decisions. It is important to understand the importance of financial reporting as it impacts on the company’s growth and decision making. While preparing the reports, it’s the responsibility of the financial reporting analyst to:

- Tracks and analyzes the cash flow, income, key financial ratios, etc.

- Report key findings regarding financial performance to the key stakeholders.

- Ensure compliance with accounting and reporting regulations and standards.

- Maintain financial data accuracy to support fund allocation management and strategic decision-making.

Types of Financial Analysis Reports

Depending on the various needs and objectives, financial analysts work with different types of financial reports. Some of the important financial statements includes:

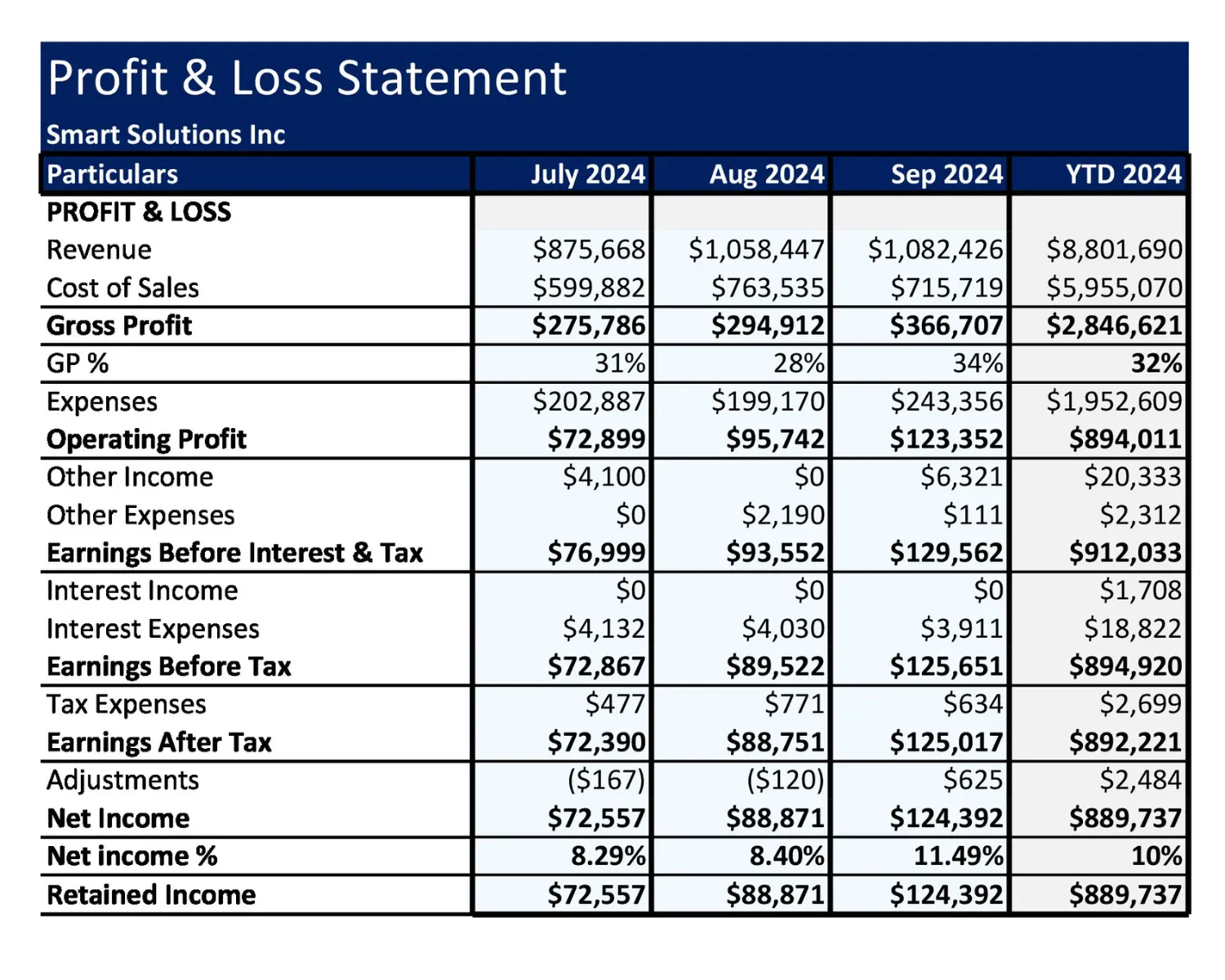

Profit & Loss Statement

The income statement represents a business’s performance across a financial year. It displays sales revenue at the top and then deducts the cost of goods sold to calculate your gross profit. Furthermore, gross profit is impacted by income and operational expenses, which are used to measure net income in the end.

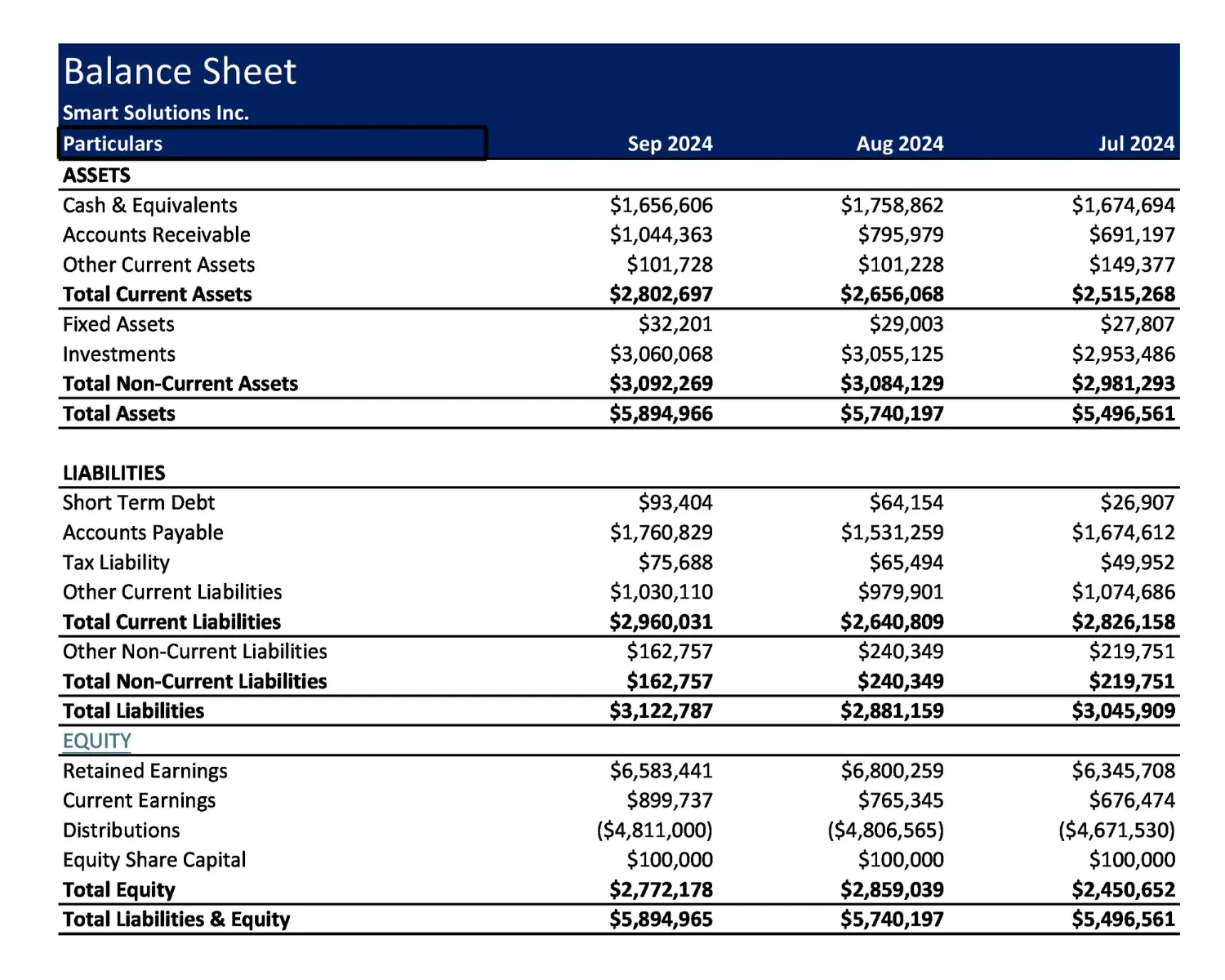

Balance Sheet

The balance sheet is prepared to show the assets, liabilities, and equity of the shareholder. It basically shows what your business owns and what it owes others at a particular time. A balance sheet provides information about assets, liabilities, and equity, representing a company’s liquidity and capitalization.

Assets = Liabilities + Shareholder’s Equity

Cash Flow Statement

A cash flow statement is another important document required to create accurate financial reports. It summarizes the cash inflow and outflow within the company at a certain time. It shows how efficiently the company manages its income, pays debt obligations, and funds operating expenses.

Why is Financial Reporting and Analysis Important for a Business?

Whether it’s the standard or consolidated financial statement, it tells the story of your company’s financial health. This is why companies hire a skilled financial reporting analyst to maintain their financial statements. Here are some of the reasons why financial reporting is important for every business:

A Thorough Performance Evaluation

Consistent financial reporting and analysis assist companies to evaluate their performance against objective set for a specific time. It helps in identifying areas of strength and weaknesses to proactively address hurdles and capitalize on growth opportunity.

Reinforced Financial Control

Financial reporting and analysis ensure regular monitoring of cash flow, working capital, and expenses. This consistency helps companies have better control over their finances, contributing to improved efficiency and profitability.

Enhanced Risk Management

Accurate financial reporting services allow companies to identify risks pre-emptively and take corrective measures. Better financial control allows the risk management team to develop effective strategies to safeguard the financial health of the company.

Support Strategy Building Process

Financial analysis and reporting serve as a basis to build informed strategies to foster growth and sustainability. Timely financial reporting helps decision-makers to evaluate changing trends and gain useful insights to take strategic decisions.

Also Read:Areas where financial reporting and analysis play a pivotal role

Importance of Consolidated Financial Statements in Financial Reporting

Companies that have multiple divisions prepare consolidated financial statements to gauge the overall financial health of their organization. Similar to standard reporting, consolidated financial reports also include income statements, balance sheets, and cash flow statements. But why do conglomerates need consolidated financial statements? To begin with, Generally Accepted Accounting Principles requires companies with subsidiaries to create these reports and for good reasons.

A Streamlined Financial Overview of the Organization

Consolidated financial statements allow financial reporting analysts, business owners, investors, and other stakeholders to get a complete financial performance summary of the parent company. In a single view, they can review how the performance of subsidiaries is impacting the parent company’s financial health.

Compliance with Regulations

Many jurisdictions require companies to prepare consolidated financial statements according to established accounting standards, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Compliance with these regulations is essential for maintaining credibility and avoiding legal repercussions.

Improved Financial Transparency

Consistency in consolidated financial statements helps companies foster transparency in their financial process. This reporting helps the parent company align all their financial information in one place and comply with important standards such as IFRS and GAAP.

What are the Challenges in Financial Reporting?

Whether it is standard financial reporting or consolidated financial reports, many companies face challenges in ensuring efficiency. Here are some common challenges that a financial reporting analyst faces while creating financial reports.

Scattered Data

Lack of data hygiene is one of the biggest challenges in financial reporting and analysis. A Financial reporting analyst must gather data from different systems and store it in various formats. It’s crucial to ensure the data collected is not outdated, duplicated, incomplete, or inaccurate. It takes significant time for analysts to cleanse and consolidate data before they can run the reports.

Arduous Manual Process

Many organizations still rely heavily on manual processes for financial reporting and analysis. This can involve everything from data entry to report generation, which not only consumes valuable time but also introduces a higher risk of human error. Manual processes are often slow and labor-intensive, resulting in delays in reporting and hindering the decision-making process. The likelihood of mistakes increases with manual data entry and calculations, potentially leading to inaccurate financial statements.

Global Operations and Currency Fluctuations

For companies operating internationally, currency fluctuations pose a unique challenge. Reporting financial results across different currencies requires careful consideration of exchange rates and potential impacts on revenues and expenses. Additionally, differences in regulatory requirements in various jurisdictions can further complicate the consolidation process. This is why it is important to ensure financial reporting and analysis are handled by experts who can tackle the complexities of global financial operations.

Lack of Proper Report Design

The way financial reporting is presented determines its effectiveness. What if there are too many details or, worse, not enough data to make a definite conclusion? These reports are shown to stakeholders who may have different preferences on how they want the reports to look.

There is a reason why companies look for financial reporting services instead of relying on their existing staff. Financial analysts understand how these needs can be met without multiple iterations.

Best Practices for Financial Reporting and Analysis

Preparing financial reporting is a complex process, but with the right practices, you can make it more streamlined and organized. Here are some of the best practices for financial reporting and analysis:

Create a Proper Reporting Framework

A well-structured reporting framework lays the foundation for proper financial management. The framework should include reporting objectives, responsibilities, and timelines. A well-defined structure paves the way for data uniformity, accuracy, and traceability across the reporting cycle. Furthermore, it also ensures adherence to various accounting regulations such as International Financial Reporting Standards or Generally Accepted Accounting Principles.

Ensure Consistency and Accuracy

When working with financial data, accuracy is unnegotiable and it can lead to economic loss, penalties and fines, strained business relationships and reputation damage. It is important to perform regular checks and reconciliations to identify discrepancies and fix issues proactively.

Moreover, companies must establish a robust data governance policy to maintain correctness of their financial data. A governance structure also establishes accountability for more efficient internal control while mitigating the risk of fraud and misrepresentation.

Establish Performance Analysis

Performance analysis is important to figure out the strengths and weaknesses of an organization. It’s another goal is to understand how the current performance can be improved. This is done by collecting data, analyzing it, and presenting the outcomes in insightful ways.

Performance analysis must be combined with benchmarking to measure performance against certain standards. Consistent performance analysis and benchmarking are effective ways to track and improve existing financial reporting processes.

Invest in the Right Technology

Technology in the financial industry has come a long way and completely transformed the way the sector used to operate. The manual process of data collection and consolidation has increased the chances of errors and omissions. However, there is robust software that can automate this process and ensure accuracy across your financial data.

Choosing the right technology helps maintain data integration and comply with reporting timelines. Furthermore, you get access to data analytics that provide valuable insights into financial performance and trends to facilitate data-driven decision-making,

Outsourcing Financial Reporting Services

Hiring an in-house financial management staff is only feasible for companies with sufficient resources. Companies juggle multiple tasks, and by outsourcing financial reporting services, they have one less thing to worry about. By outsourcing financial analysis services, you can leverage professional reporting services without the cost of hiring staff and setting up infrastructure.

Also Read: Unlocking the power of cash flow forecasting for business growth

How Financial Reporting Services Helps business in Their Financial Reporting Process?

Financial reporting services offer numerous benefits that can improve the reporting process. It allows businesses to focus on strategy and growth instead of juggling with the intricacies of financial compliance:

Accuracy and Reliability

These reporting services reduce the risk of errors through rigorous checks and balances. They have a thorough process in place to improve reliability of financial reports Additionally, when a dedicated team is working on your financial reports, you can expect consistency and quality in the final documentation.

By outsourcing these services, businesses can focus on their core operational activities and let the experts handle complex reporting tasks.

Access to Advanced Technology

Financial reporting services use advanced accounting tools and software to streamline the reporting process and improve data accuracy. Additionally, these technologies offer real-time financial data, fostering better decision-making.

Comprehensive Reporting

Financial analysis services offer in-depth analysis beyond standard reports, providing more insights into financial trends and performance. These experts can customize reports to cater to various stakeholders’ requirements.

Strategic Financial Planning

Financial experts help in creating forecasts and budgets, allowing businesses to plan effectively. Additionally, financial forecasting services can help in identifying potential risks and offer strategies to mitigate them.

Cost-Efficiency

Outsourcing financial reporting can be more cost-effective than hiring in-house staff, especially for small and medium-sized businesses. Many services offer scalable options that can adapt to the changing needs of the business, allowing better financial management without fixed costs.

Stakeholder Support

Clear and professional financial reports enhance communication with stakeholders, including investors and board members, fostering trust and transparency. Financial reporting services often assist in preparing presentations for stakeholder meetings and ensuring key data is communicated effectively.

Conclusion

Accurate financial reporting and analysis provide key stakeholders with all the right information so that they can make critical decisions. Therefore, it is important to ensure the process is handled with utmost efficiency and integrity. At Whiz Consulting, we offer reliable financial reporting services and help companies gain an accurate overview of their financial health and make business development decisions.

With our FP&A Consulting services we help you build a customized plan that caters to your business’s financial goals. Contact us today to get a free consultation from our expert and let us help you keep your finances in check.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Financial reporting and analysis are a detailed overview of your company’s financial performance. It helps in tracking cash flow, evaluating assets and liabilities and analyzing shareholder equity.

The goal of financial reporting is to help track the income, profitability, cash flow, and viability of a business. Accurate and consistent financial reporting helps businesses track performance, assess financial health, ensure accountability, and support planning and decision-making.

Consolidating financial statements is a process of combining accounting and financial data from various subsidiaries into one set of financial statements for the parent company. The process creates a comprehensive view of financial information of the entire organization to eliminate double counting or transactions, balances, and investments.

Financial reporting is a broader concept that provides a comprehensive view of the financial performance of the company in a specific time. Accounting on the other hand is the process of recording, analyzing and summarizing financial transactions.

It is also known as consistency principle and uses the same accounting principle or method across financial reporting. The objective of the consistency principle is to make it easier for users to compare and make meaningful conclusions from financial reports.

There are many reasons why your financial data is not consistent in annual reports. Some of the common reasons include reporting errors, material misstatement corrections, fraudulent financial reporting, and changes in accounting principles.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.