Table of Content

Share This Article

- Reading Time: 7 Minutes

- Published: October 4, 2023

- Last Updated: April 8, 2025

Every business needs a stable cash balance to keep the business afloat. However, managing all the business functions and keeping a healthy cash balance can be complicated. So, as a business owner, do you wish there was a way to improve your cash flow without sacrificing the quality of your products or services? Look no further than managing accounts receivable (AR)! This often-overlooked aspect of financial management can make all the difference in boosting your bottom line. One way to improve this process’s efficiency is to work with process experts, be it in-house accountants or outsourced accounts receivable management services. If you are curious to learn why effective accounts receivable management is critical for any business and how you can boost your cash flow and overall profitability by implementing strategic tactics, keep reading through this blog to learn in detail. Let us dive into the world of AR and cash flow and discover its potential to transform your financial outlook!

What is Accounts Receivable?

Accounts receivable is the total amount of money a company has earned but has not yet received. It could be because the customer has not yet paid their invoice or because the company has not yet invoiced the customer. Understanding the basics of accounts receivable and proper management is important because it can greatly impact a company’s cash flow.

If you are struggling to manage your accounts receivable, speaking to an accountant or financial advisor is a good idea. Furthermore, you can also hire an expert accounts receivable management services provider to help you streamline the process.

Benefits of Efficient Accounts Receivable Management

When it comes to accounts receivable, most businesses focus on two things: getting paid and minimizing write-offs. While these two are important objectives, there are other benefits to managing accounts receivable that are often overlooked. Let us learn about them:

- One of the most important benefits of managing accounts receivable is improved cash flow. By closely monitoring invoices and payments, you can ensure that bills are paid on time and minimize the amount of money tied up in outstanding receivables. This improved cash flow can help your business keep operating smoothly and avoid financial problems down the road.

- Another benefit of effective accounts receivable management is better relationships with your customers. When customers know that you are keeping close tabs on their payments, they are more likely to pay on time and work with you to resolve any issues that come up. It can lead to stronger customer loyalty and improved customer satisfaction.

- In addition, managing accounts receivable can help you identify potential problem areas in your business processes. If you notice patterns of late payments or high write-offs, you can take steps to address these issues before they become bigger problems. By catching these problems early, you can save your business time and money in the long run.

- Efficient accounts receivable management also helps businesses improve their financial reporting. The importance of financial reporting for a business cannot be understated. It helps understand how your business is performing, and accounts receivable is a big part of it as it gives an understanding of the business’s cash position. Relying on financial reporting services to help with your financial analysis and reporting makes your cash management easier by identifying the shortfalls on time.

How Do Accounts Receivable Impact Your Cash Flow?

Accounts receivable (AR) is the amount of money your customers owe you for goods or services you have provided but have not yet been paid for. AR can have a big impact on your business’s cash flow.

If you have a lot of outstanding AR, it can tie up a significant amount of your working capital- the money you need to run your day-to-day operations. That can make it difficult to pay your own bills and take advantage of new opportunities as they come up.

On the other hand, if you manage your AR well, it can actually help improve your cash flow. By creating processes and systems to efficiently track and collect payments, you can ensure that more of the money owed to you actually ends up in your bank account.

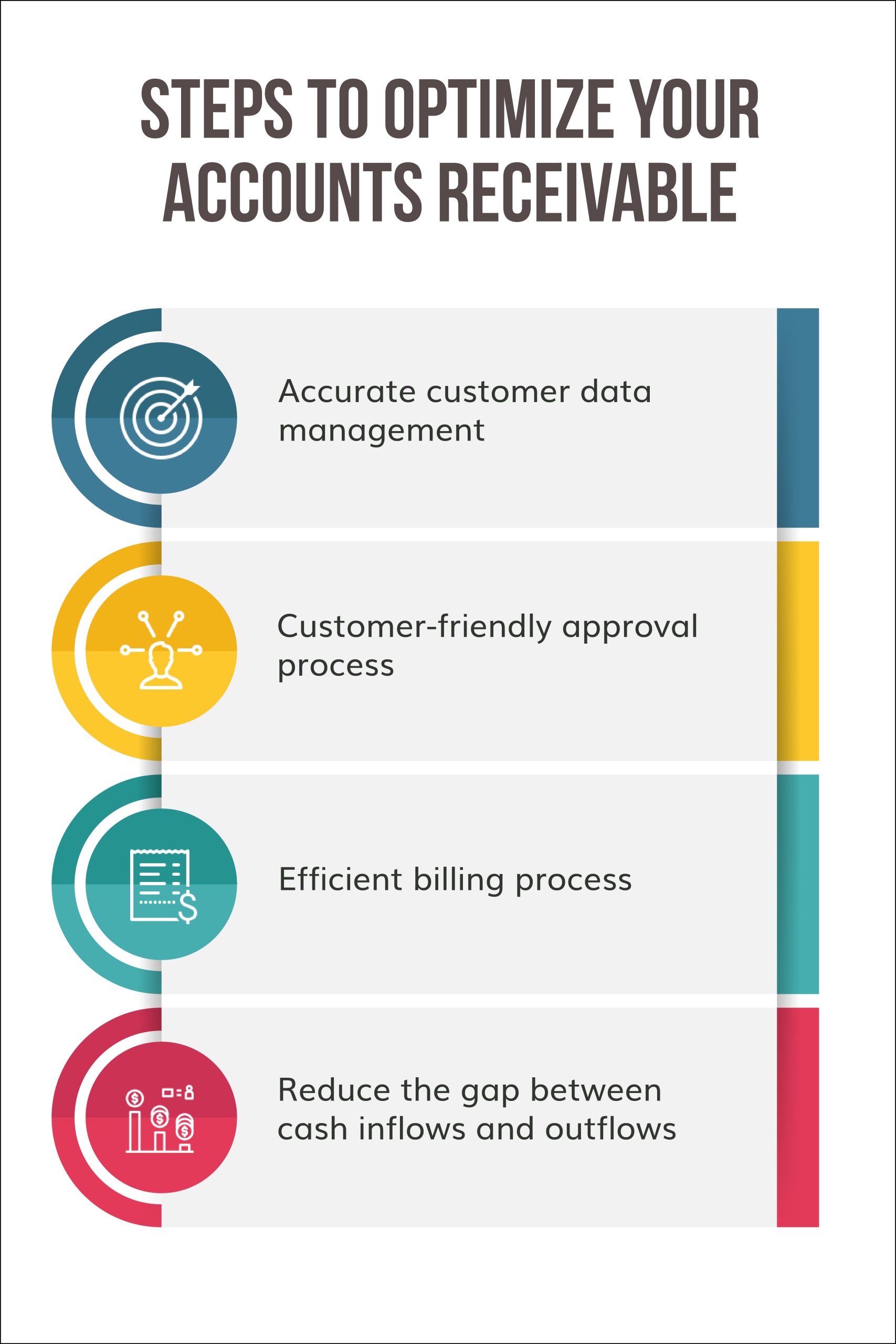

Steps to Optimize Accounts Receivable

Like any other business process, the accounts receivable process also has its own fair share of issues when you try to manage it. However, you can take some simple steps to curb the accounts receivable challenges and simplify the process. Now that we know why accounts receivable is important and how it affects your cash flow let us look at some practices to ensure efficient accounts receivable management.

-

Accurate customer data management:

Accurate customer data management is crucial in optimizing accounts receivable. It involves maintaining up-to-date records of your customers’ contact information, payment history, and creditworthiness. By having accurate customer information on hand, you can avoid payment delays and ensure that invoices are sent to the right person. One way to maintain accurate customer data is by using a Customer Relationship Management (CRM) system. A CRM system allows you to store all relevant customer data in one place and track interactions with them over time. This software lets you quickly generate reports on unpaid bills or late payments, making financial reporting easier. Get help from outsourced financial reporting services if you find it difficult to manage it on your own and enhance the reports’ accuracy. Ensure that your billing address matches the one listed on the invoice when sending out bills. Mismatched addresses can confuse both parties involved and lead to delayed payments.

-

Customer-friendly approval process:

When it comes to optimizing accounts receivable, a customer-friendly approval process can make all the difference. The traditional approach of lengthy approval processes and complicated procedures often leads to delayed payments and dissatisfied customers. One way to simplify the approval process is by providing clear guidelines and instructions to customers on how they can approve invoices. It can be done through email or even text, making it easy for them to quickly review and approve bills with just a few clicks. Another effective strategy is using automation tools that streamline the entire invoicing process. With automated workflows, invoices are automatically sent out, approved, and processed without any manual intervention required from either party. You can also delegate your accounts receivable process to an experienced accounts receivable management services provider to simplify it and reduce your workload.

-

Efficient billing process:

Efficient billing is a crucial part of optimizing accounts receivable and boosting cash flow. An efficient billing process ensures that invoices are sent out promptly, payments are received on time, and any errors or disputes are resolved quickly. Here are some tips to streamline your billing process:

- Simplify the invoice:

Make sure your invoice is easy to read and understand. Include only necessary information such as the due date, payment terms, itemized list of charges, and accepted payment methods. - Automate billing:

Automating your invoicing system can save you time and reduce errors. There are many software solutions available that offer automated invoicing options. - Offer multiple payment options:

Providing customers with multiple payment options makes it easier for them to pay their bills on time. It could include credit card payments, ACH transfers, or e-checks. - Send reminders:

Sending reminders when an invoice becomes past due can help prompt customers to make a payment before additional fees accrue. - Follow up promptly:

If an invoice remains unpaid beyond its due date, follow up promptly with a friendly reminder call or email. It will show customers that you are well aware of your receivables while also reminding them of their outstanding balance.

- Simplify the invoice:

-

Reducing the gap between cash inflows and outflows:

The last thing you can do to ensure a smooth accounts receivable process is to reduce the gap between cash inflows and outflows. The key here is effective budgeting and forecasting. By analyzing past data and predicting future trends, you can create a realistic budget that takes into account all expenses as well as expected revenues. It will help you identify areas where you can cut costs or increase sales to improve your bottom line. Additionally, consider offering incentives to customers for early payments.

Conclusion

It is essential to be proactive in collecting payments from customers while also providing incentives for them to make those payments on time. Put in place a system and, when necessary, take advantage of technology like online invoicing or credit card processing. These tools allow you to easily manage your accounts receivable and ensure your business runs smoothly. Though the accounts receivable process is very important for every business, there is no doubt that managing it yourself can often become complex and overwhelming. In such situations, outsourcing can prove to be quite helpful.

Outsourced accounts receivable services help businesses streamline their AR process and improve cash flow management. There are numerous outsourced service providers that help businesses with managing their books of accounts, one of them being Whiz Consulting. With almost a decade-long experience in offering outsourced accounting and bookkeeping services to businesses from different industries, Whiz Consulting is one of the best in its field. So, contact us if you are looking for a service provider to help you manage your finances while you focus on growing your business.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

We use cookies to improve your experience. By using our site, you agree to our Consent Policy.