Table of Content

Share This Article

- Reading Time: 9 Minutes

- Published: November 8, 2024

- Last Updated: January 22, 2025

As businesses worldwide look at outsourcing from a strategic lens, financial management emerges as one of the top areas where outsourcing can deliver business impact. You can either hire local bookkeepers or handle the bookkeeping tasks yourself. But do you have the bandwidth to juggle multiple tasks and be efficient in all of them?

This is why you should consider outsourced bookkeeping services for expert financial management at a more convenient cost than hiring an in-house expert. You are curious to know more, and we are eager to delve deeper into this phenomenon, so let’s get into it.

What are Outsourced Bookkeeping Services

Outsourced bookkeeping services entail a process of maintaining financial records beyond the bounds of clients’ physical office setting. Instead of having some employee or group inside the business responsible for tasks such as transaction recording, reconciliation, accounts payable, and financial statement generation, businesses hire a service provider to avail those activities. The fact that you can easily access them remotely makes them a convenient and economical solution to ensure your finances are in check.

The third-party takes charge of managing and organizing the business’s financial records, a key component of bookkeeping. This arrangement enables business owners to take care of their expansion and the core of their business while allowing the financial activities to be carried out by experts smoothly and professionally.

Benefits of Outsourcing Bookkeeping

Cost Savings:

Outsourcing bookkeeping services understand what is bookkeeping and how to address the complexities associated with it. The expertise of professionals helps businesses shift their focus to core activities. When dedicated experts are concentrating on stuff where their skills lie, it creates a more productive and lucrative working environment.

Access to Expertise:

Businesses are dynamic in nature and bound by the operational region’s tax laws and accounting standards. Outsourced accounting and bookkeeping services give you access to a team of experts updated with the latest tax laws, regulations, and account standards. This experience ensures that financial reports comply and have accurate financial details.

Higher Accuracy and Reliability:

Another attractive aspect of offshore bookkeeping services is access to state-of-the-art software to ensure accuracy and proper management of financial records.

The software is designed to streamline the strenuous accounting process, allowing experts to do more in less time. Furthermore, the automation capabilities of these tools mitigate the risk of errors, fostering informed decision-making by stakeholders.

Scalability:

As your operations grow, you must invest in proper infrastructure and training and development to keep a skilled in-house team. However, when you have a reliable remote accountant by your side, you don’t have to fuss about scalability.

Your outsourced bookkeeping services can be customized to suit your growing needs. This way you are always ready to capitalize on the right opportunities.

Enhanced Security:

Cyberattacks are the bane remote bookkeepers existence; but with the right security measures in place, these threats can be mitigated. Reliable online accounting and bookkeeping service providers have encrypted platforms and secure systems to safeguard sensitive financial information. With the right Online bookkeeping services, you get peace of mind regarding data privacy and security.

Key Services Provided by Outsourced Bookkeepers

Transaction Recording:

Outsourced bookkeeping services for thriving businesses ensure their system records every financial transaction accurately. This includes keeping sales, expenses, and payment information records to maintain a clear, reliable record of financial information to help businesses make informed choices.

Accounts Reconciliation:

Outsourced accounting and bookkeeping services reconcile the accounts regularly and check the bank statements against company records. It helps to identify and fix discrepancies to avoid errors and ensure financial accuracy.

Payroll Processing:

Payroll must be done efficiently and on time because employees must be paid on time. Outsourced bookkeeping services, especially known for their expertise, manage payroll calculation, deduction, and tax filing processes, which are time-consuming and involve compliance risks.

Financial Reporting:

An outsourced bookkeeper compiles essential financial statements, such as profit & loss statements, balance sheets, and cash flow statements. Even for small businesses there are outsourced bookkeeping services for small businesses that deliver valuable financial reports, these reports provide business owners with valuable insights to evaluate their financial health and develop strategic plans effectively.

Tax Preparation and Compliance:

Online accounting and bookkeeping services guide businesses during tax preparation, ensure records are maintained properely and taxes are filed on time. These professionals keep ahead of tax regulations to ensure that the enterprise adheres to laws and avoids penalties.

Invoicing and Accounts Payable:

Timely invoicing and management of accounts payable are crucial for keeping a healthy cash flow. Offshore bookkeeping services take care of vendor invoices, payments, and reminders, ensuring no bill is missed, and all are paid on time.

Accounts Receivable Management:

Accounts receivable management includes monitoring accounts that are owed money, sending reminders, and making payments on time. outsourced bookkeeping services streamline this procedure to maintain a consistent cash flow.

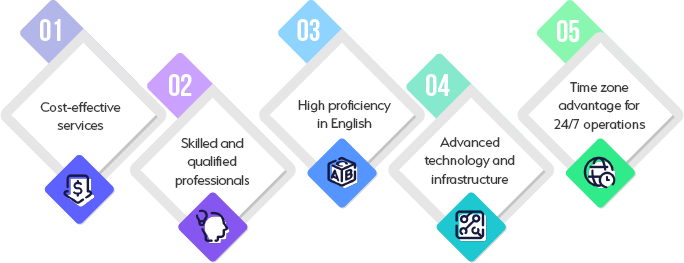

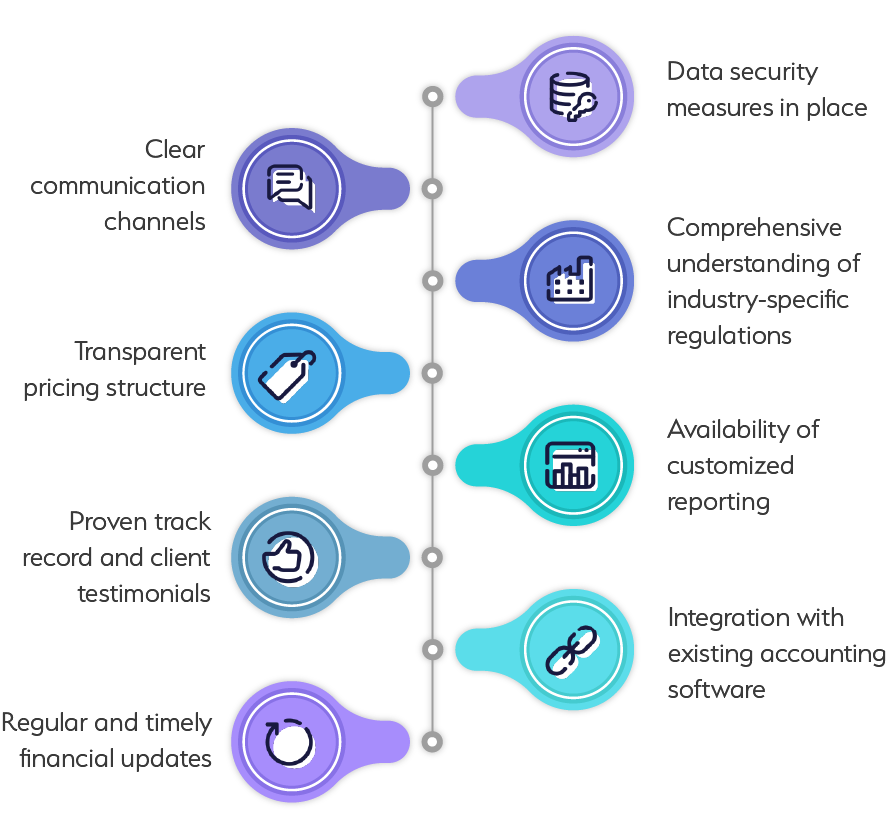

How to Choose the Right Outsourced Bookkeeper

Assess Experience and Expertise:

Look for outsourced bookkeeping services with a proven track record in your industry. Online bookkeepers with relevant experience understand specific regulatory requirements and can offer insights that align with your business needs.

Evaluate Technology and Tools:

The best online accounting and bookkeeping services use advanced software for efficient, secure bookkeeping. Ask potential providers about their tools to manage accounts and ensure compatibility with your systems.

Check for Data Security:

Data protection is crucial when choosing outsourced accounting and bookkeeping services. Verify that the provider uses secure platforms and follows strict data security protocols to protect your sensitive financial information.

Confirm Range of Services:

Different providers may have different areas of expertise, such as payroll, tax preparation, or offshore bookkeeping services. Ensure the potential provider offers a comprehensive suite of services that meets your current needs and can scale as your business grows.

Review Communication Practices:

Regular communication is vital for effective outsourcing. Choose a provider that offers consistent updates, quick responses, and clear contact methods, whether you’re outsourcing bookkeeping services locally or internationally.

Assess Cost-Effectiveness:

Compare pricing structures and ensure the outsourced bookkeeping services align with your budget. Look for fee transparency and avoid providers with hidden charges that could impact your financial planning.

Common Challenges and Solutions in Outsourcing Bookkeeping

Data Security Concerns:

When using outsourced bookkeeping services, data privacy is a top concern.

Solution: Partner with providers who use advanced encryption, secure platforms, and strict access protocols to safeguard your financial information, especially with offshore bookkeeping services.

Communication Barriers:

Time zone differences and communication gaps can lead to misunderstandings.

Solution: Choose online accounting and bookkeeping services that prioritize responsive communication. Set regular check-ins and ensure they offer clear, real-time reporting channels.

Quality Control:

Ensuring accuracy when outsourcing bookkeeping tasks is a big bookkeeping challenge.

Solution: Work with reputable outsourced accounting and bookkeeping services that offer detailed reporting, consistent updates, and a robust quality-check process to prevent errors.

Hidden Costs:

Some providers may charge extra for specific tasks or reports, affecting budget planning.

Solution: Select outsourced bookkeeping services with transparent pricing models and review all terms before signing contracts to avoid unexpected fees.

Adapting to Business Changes:

As your business grows, your bookkeeping needs may expand.

Solution: Partner with outsourcing bookkeeping services that offer scalable plans, allowing you to add services as your business evolves without disruption.

Industries Benefiting Most by Outsource Bookkeeping

Industries Benefiting Most by Outsource Bookkeeping

- Healthcare:

- Real Estate:

- Legal:

- Hospitality:

- Media & Marketing:

- IT:

Medical practices and healthcare facilities handle high transaction volumes and complex billing processes. Outsourced bookkeeping services streamline financial management, ensuring accurate records for insurance claims and regulatory compliance.

Real estate businesses manage property transactions, leases, and commissions. Outsourcing helps track expenses, manage cash flow, and organize financial statements, allowing agents to focus on client services.

Law firms deal with client trust accounts and strict compliance requirements. Outsourced accounting and bookkeeping services help legal professionals maintain accurate records, track billable hours, and ensure regulatory adherence.

With high expenses and fluctuating revenues, hospitality businesses need efficient financial tracking. Outsourcing provides timely cash flow, inventory, and payroll updates, helping hotel and restaurant owners make informed decisions.

Creative agencies often have variable income streams and project-based work. Offshore bookkeeping services can manage billing cycles, track project expenses, and streamline payroll for freelancers, keeping finances organized.

Tech companies, especially startups, benefit from outsourced bookkeeping services as they help manage investment funds, track operational costs, and streamline financial reporting, allowing them to scale efficiently.

Future Trends in Outsourced Bookkeeping Services

Increased Automation:

Automation will play a crucial role in outsourced bookkeeping services, with more firms adopting AI-powered tools to handle data entry, reconciliation, and reporting. This trend reduces errors and speeds up processes, making bookkeeping more efficient and accurate.

Enhanced Data Security:

As cyber threats grow, outsourced bookkeeping services will continue to strengthen data protection through advanced encryption, secure cloud storage, and multi-factor authentication, ensuring client information remains safe.

Personalized Services:

Outsourcing providers are expected to offer more tailored solutions, adjusting services to specific industry needs and business sizes. This personalization helps businesses gain insights that align with their unique financial goals.

Global Reach and 24/7 Support:

The demand for around-the-clock support will increase offshore and nearshore options, providing businesses with constant access to financial updates.

Integration with Business Software:

Future outsourcing services will emphasize seamless integration with CRM, payroll, and ERP systems, allowing a more unified and efficient approach to business management.

Conclusion

Outsourced bookkeeping services are invaluable in a successful business model as they serve as a foundation and expand as a business grows. Outsourcing bookkeeping tasks increases companies’ efficiency and strategic operation by ensuring financial accuracy, enhancing data security, and providing scalable solutions that grow along with the company.

Don’t wait and start streamlining your finances and focus on growth by partnering with our trusted outsourced bookkeeping services today! Contact us to secure your business’s financial future and set the stage for long-term success.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Start by identifying your bookkeeping needs, then research providers with relevant experience. Ensure that outsourced bookkeeping services offer required services, prioritize data security, and use modern software. Finally, set clear communication expectations.

Regularly check financial reports for accuracy, review account reconciliations, and monitor compliance with agreed-upon standards. Schedule periodic updates with your provider to address any questions and track progress.

Costs vary depending on provider expertise, service scope, and business size. Prices can differ based on industry requirements and the complexity of tasks needed.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.