Table of Content

Share This Article

- Reading Time: 10 Minutes

- Published: September 23, 2024

- Last Updated: January 20, 2025

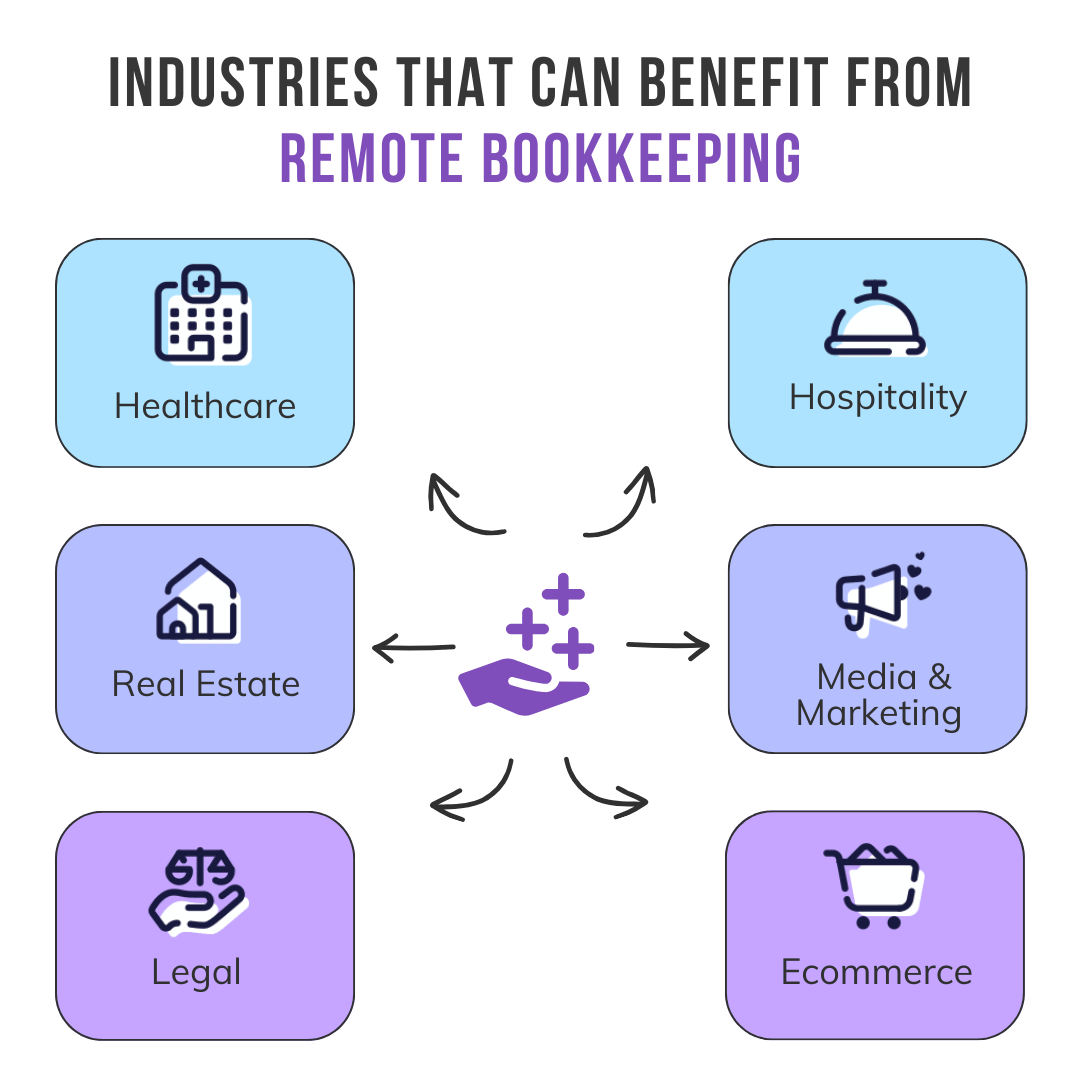

In almost every sector, remote work is more prominent than ever, especially for important tasks such as bookkeeping. The process of accounting and bookkeeping, which is often regarded as a very important task, is, in fact, a core element of financial operations and planning. It is much like a GPS, which helps navigate toward growth and success. Remote bookkeepers are affordable to hire compared to having a full team and helping firms manage their finances irrespective of location. If bookkeeping tasks are managed by companies remotely, it helps cut costs and decentralize operations and growth. In this blog, we will provide all the information you need if you are considering hiring a remote bookkeeper.

What is Remote Bookkeeping?

Remote bookkeeping is the process of managing financial records and transactions for businesses from a remote location using cloud-based accounting software. A remote bookkeeper is a professional who works remotely and handles tasks like entering data, processing invoices, and preparing financial reports. This enables firms to obtain financial information promptly and securely without an in-house bookkeeper.

Remote bookkeeping services are convenient and inexpensive because the bookkeeper’s location does not matter, and rent and utilities are not incurred. Companies and organizations can concentrate on the main aspects of operation while their remote bookkeeper handles their financial records well. It is of greater value for small to mid-sized businesses that require professional bookkeeping services but may not want to hire full-time, in-house employees. Hiring remote bookkeeping services can help organizations optimize their business solutions as they get accurate and up-to-date financial information.

How does Remote Bookkeeping Work: Process

- Provide Access:

- Data Analysis:

- Understanding Requirements:

- Processing of Data:

The first activity is to grant access of your data to the individual who is providing remote bookkeeping services to you. This can often be done through secured cloud-based accountancy packages where both parties get an actual-time view.

Once authority is obtained the remote bookkeeper goes through the company’s historical records to determine the condition of the books at the current stage and whether there are gaps or problems.

A virtual accountant understand the bookkeeping business requirements that he needs to provide, be it monthly financial reports, expense statements or preparation of taxes, are clearly understood.

The remote bookkeeper analyzes financial data to record the money flow through the business and creates an analysis and an action plan based on the client’s requirements.

Finally, financial reports are prepared more specifically, with certain recommendations regarding the state’s financial position, these reports are given to the client at the agreed time.

Tasks Handled by a Remote Bookkeeper

A remote bookkeeper performs several important financial chores given below:

- Preparing Financial Statements:

- Reconciling Accounts:

- Invoice Processing:

- Accounts Payable Management:

- Creating Invoices:

- Accounts Receivable:

- Bank Reconciliation:

- Payroll Processing:

- Financial Recordkeeping:

- Balance Sheet Maintenance:

- Profit & Loss Reporting:

- Cash Flow Management:

Preparing and posting correct accounts of expenses and revenue, as well as creating statements of financial position such as income statement, balance sheet and cash flow statements.

A remote bookkeeper makes sure that all accounting records match the current bank statements and all other supporting documents that may be viewed to support the result obtained.

A virtual bookkeeper handles the entire process, from creating purchase orders for vendors to processing their invoices, ensuring both tasks are managed correctly.

Remote bookkeeping services handle vendor management efficiently, from reconciling balances and paying bills to addressing vendor queries or disputes.

Issuing invoices to clients or customers, involving sending invoices for products or services sold or for work done.

Remote bookkeeping services take care of everything, from managing invoice acknowledgments and following up on overdue payments to maintaining clear communication with customers.

Checking whether all the records in your business bank account correspond with the financial transactions made.

Managing employee remuneration by paying employees as and when due and in the right amount.

Managing and keeping all business financial records in a systematic order.

Ensuring the balance sheet contains correct data to represent the company’s financial situation.

Ensuring the profit and loss for the business is accounted for and reported correctly

Controlling and supervising money movement in and out of the business.

Software Used by Remote Bookkeepers

Remote bookkeepers use different software because their work requires them to consider the most effective approach when performing their duties. Here are some of the most popular tools used by remote bookkeeping services:

1. Xero:

Xero Accounting Software is simple and effective for small and medium enterprises. Xero focuses on cloud-based accounting solutions that are useful for bank feeds and simple invoicing for a remote bookkeeper.

2. QuickBooks:

Most outsourced accounting and bookkeeping firms are familiar with QuickBooks as it is user-friendly and suitable for small businesses and anyone whose book is kept remotely for Payroll and other expenses.

3. Zoho:

Most suitable for small and mid-sized businesses, Zoho Books simplifies invoicing and expense tracking and is suitable for a remote bookkeeper.

4. FreshBooks:

FreshBooks is designed for independent workers and small entrepreneurs and is exceptional for invoicing and project control.

5. NetSuite:

When a remote bookkeeper uses NetSuite for larger enterprises, he easily tackles complicated accounting tasks such as financial planning and inventory management.

Challenges Faced in Setting up Remote Bookkeeping

Outsourcing bookkeeping to an online bookkeeper can be beneficial, but as with any change in work practices, it brings with it certain problems that are important to consider:

- Data Security Concerns:

- Communication Barriers:

- Access to Technology:

- Time Zone Differences:

- Training and Onboarding:

- Tracking Productivity:

- Compliance Issues:

Protecting important financial information during remote access is sometimes difficult due to cyber threats.

Work-from-home employees may not communicate clearly or efficiently, resulting in misunderstanding or slow processing of financial tasks.

Some businesses or remote bookkeepers may lack the appropriate software or hardware to establish sound remote operations.

However, planning shifts and deadlines will be challenging if your remote bookkeeper is in another time zone.

Offering sufficient training to a virtual bookkeeper on your firm’s operations may sometimes be time-consuming and involve additional costs.

The problem is that without performance monitoring tools or timely follow-ups, it can be hard to track that distant bookkeepers, for instance, are working efficiently.

The management of local tax legislation and standards from a distance can be challenging and must be done with knowledge and vigilance when operating in different areas. There are over 10,000 different sales tax jurisdictions in the USA, making it crucial for businesses to stay updated on local tax laws to ensure compliance.

Steps to Set Up Remote Bookkeeping for Your Business

Assess Your Business Needs:

Start by determining what specific needs your business entails regarding bookkeeping services. Are you looking for routine services such as Payroll and issuing invoices or additional services such as preparing for taxes and balance sheets? This will assist you in determining the specific tasks to be assigned to the remote bookkeeper.

Choose the Right Accounting Software:

Choose accounting software on which you and the online bookkeeper can work on easily. Some of the top cloud accounting software that are frequently used by small businesses are Xero, QuickBooks, Zoho Books, and NetSuite, which can give you real-time data in terms of your financial status.

Hire Remote Bookkeeper:

Are you looking for a reputable remote bookkeeping services provider with expertise in your business? With a reputable firm, you will be provided with a dedicated remote bookkeeper even if you have fewer transactions. They should have previously worked on your preferred software and managed comparable business requirements.

Implement a Secure Data Exchange:

You need to make sure that the process for sharing financial documents is secure. As for data transfer between the parties, it is safe to share files using encrypted services such as Google Drive, Dropbox, or any features offered by the accounting software.

Establish Communication Protocols:

Agree and establish appropriate check-ins, status and progress updates, and reporting frequency through Zoom, Microsoft Team, or Email. This helps your remote bookkeeper remain in touch with your financial objectives.

Monitor and Review Regularly:

Check your financial reports frequently and check whether your bookkeeping function is properly organized. Your outsourced bookkeeping firm must consistently report cash flow, financial reports expenses, and other important business information.

Best Practices for a Remote Accounting and Bookkeeping Firm

Here are some of the best practices to follow:

- Use the Right Software:

- Create a Clear Workflow:

- Maintain Secure Communication:

- Backup Data Regularly:

A remote bookkeeper needs the right equipment to perform the financial jobs well. Software such as Xero, QuickBooks, Zoho, and others allow for creating records, tracking expenses, and preparing reports. These tools also enable remote access, assisting the virtual bookkeeper.

The clients describe the accounting and bookkeeping activities that need to be performed and what are the deliverables they expect from the bookkeeper. For a remote bookkeeper, this entails proper handling of invoices, payments, Payroll, reconciliations, reporting and taxes, among others.

Slack or MS Teams make it easier for the team and clients since they are informed of any progress. Communication is an essential aspect when working on a project, especially when it comes to remote bookkeeping.

Every online bookkeeping company providing remote bookkeeping services must be extra cautious regarding data security because they must back up all important files continuously. This prevents the system’s loss of information and data and allows for business continuation in case of other technical problems.

Benefits of Hiring a Remote Bookkeeper

- Enhanced Security:

- Informed Business Decisions:

- Stress Reduction:

- Access to Expertise:

- Flexibility and Scalability:

- Cost and Time Savings:

- Employee Turnover:

The good thing about hiring a remote bookkeeper is that your financial data will be processed securely. Some remote bookkeeping services use state-of-the-art technologies that have enhanced cloud services with well-enhanced encryption and data privacy measures. This is much more secure than conventional in-house Data processing for bookkeeping and is less prone to hacking.

By using remote bookkeeping services, you receive timely and routine financial reports, and your remote bookkeeper offers suggestions for decisions based on data. This approach allows you to focus on other important aspects of your business without worrying about financial management.

Running your business separately in terms of bookkeeping and hiring a remote bookkeeper can ease much of the pressure of managing its finances. Since the online bookkeeper manages most everyday transactions, business owners can dedicate their efforts to other strategic aspects and growth. The team chat application may also help in achieving frontline communication.

A remote bookkeeping services provider facilitates you to hire experienced bookkeeping personnel who have knowledge of implementing efficient accounting practices. An attractive aspect is that you can get professional financial services on a high level without training and hiring in-house personnel.

Outsourced bookkeeping enables businesses to manage their bookkeeping budget while efficiently managing their financial records. Remote bookkeeping services offer flexibility, adapting to full-time, part-time, or project-based needs, making them an ideal solution for businesses of any size.

One of the biggest benefits for the businesses when they hire remote bookkeepers is that it saves time and money. Online bookkeeping solutions safeguard the company’s resources from direct expenses and expenses for in-house employees like rent of premises, their taxes and insurance.

Hiring a remote bookkeeper minimizes employee turnover issues, as businesses rely on outsourced professionals instead of in-house staff. This ensures consistent bookkeeping services without disruptions caused by staff changes or training costs.

Final Word

Choosing remote bookkeeping services has several benefits for businesses: substantial cost reduction, improved security of data, and opportunities to work with specialists. With the help of cloud solutions, a remote bookkeeper can guarantee the effective execution of financial operations, freeing up time for business operations and its development. Remote bookkeeping is an excellent choice for businesses of all sizes because of its scalability and versatility. Professional bookkeeping services help save money by hiring in-house staff while ensuring efficient financial management. Nevertheless, there are issues like communicational restrictions and cyber security concerns. Remote bookkeeping services promote organizational efficiency to make the right choices that would enable the business to sustain itself continually.

Additional Tips for Remote Bookkeeping

1. Hire an Indian bookkeeping firm:

Choosing an Indian accounting firm provides several benefits, it offers highly skilled professionals at competitive rates, and with favorable currency exchange rates, they become a cost-effective option for businesses seeking remote bookkeeping services.

2. Hire a firm, not a person:

A firm provides a team with diverse expertise and ensures continuous support, reducing the risk of delays due to individual availability.

3. Read reviews and feedback:

Checking client reviews and feedback gives you a clear understanding of the firm’s performance, reliability, and customer service, helping you choose the best fit for your business.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Remote bookkeeping involves handling financial records and transactions virtually, using cloud-based accounting software like Xero, QuickBooks, or Zoho. Bookkeepers access data remotely, ensuring accurate records, timely reporting, and real-time financial tracking for businesses.

Remote bookkeepers use encrypted cloud-based software, secure access protocols, and two-factor authentication to safeguard financial data, ensuring confidentiality and compliance with industry security standards.

A remote bookkeeper, also called a virtual bookkeeper, manages financial records, processes invoices, reconciles accounts, runs payroll and prepares reports, all through cloud-based software. They ensure accurate financial tracking, handle Payroll and provide insights into cash flow while working remotely.

Remote bookkeeping refers to services provided by a bookkeeper working from a different location, while virtual bookkeeping typically involves using cloud-based software to manage financial records.

Yes, bookkeeping can be done remotely using digital tools and software. Remote bookkeepers manage financial tasks from any location, ensuring accurate and timely record-keeping for businesses.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.