Table of Content

Share This Article

- Reading Time: 11 Minutes

- Published: October 17, 2024

- Last Updated: January 21, 2025

The Software as a Service (SaaS) market in the United States is expected to reach an exponential rate and generate $190.10 billion in sales by 2024. SaaS enterprises are under pressure to efficiently manage their financial operations as the market grows, with an anticipated yearly growth rate of 18.92% until 2029. SaaS accounting services, which assist businesses in streamlining revenue recognition, subscription billing, and tax compliance, are essential to this expansion. SaaS companies can concentrate on growing while preserving accurate financial reporting and being compliant with regulations by utilizing specialized accounting services. This blog will look at how these services can propel your company’s growth in the SaaS industry.

What are SaaS Accounting Services

SaaS Accounting Services is outsourcing of the accounting functions to a professional accountant who has experience in managing the finances of a SaaS company. They are designed to address the specific accounting requirements of the SaaS companies, such as subscription revenue recognition, deferred revenue tracking, and reporting with key financial metrics.

Outsourced accounting services for SaaS companies usually features bookkeeping, financial statement production, cash flow management, tax compliance and preparation, and financial forecasting. SaaS accounting services provide real-time access to financial data, automate repetitive tasks, and scale more efficiently using cutting-edge cloud technology.

The Main Components of SaaS Business Accounting

In SaaS accounting services, several key components and principles must be followed to ensure accurate financial management and compliance. These components are critical for understanding financial health and tracking growth in a subscription-based model.

1. Accounting Methods Followed by SaaS Businesses

SaaS businesses typically follow two accounting methods: cash-basis accounting and accrual accounting:

- Cash Accounting for SaaS

- Accrual Accounting for SaaS

- Timing of Revenue Recognition:

- Deferred Revenue:

- Unbilled Revenue:

- Performance duties:

- Monthly Recurring Revenue (MRR):

- Customer Lifetime Value (CLTV):

- Customer Acquisition Cost (CAC):

- Churn Rate:

- Gross Margin:

- Annual Recurring Revenue (ARR):

- Regularity:

- Consistency:

- Sincerity:

- Permanence of Methods:

- Periodicity:

- Materiality:

- Utmost Good Faith:

- QuickBooks:

- Xero:

- NetSuite:

- Zoho:

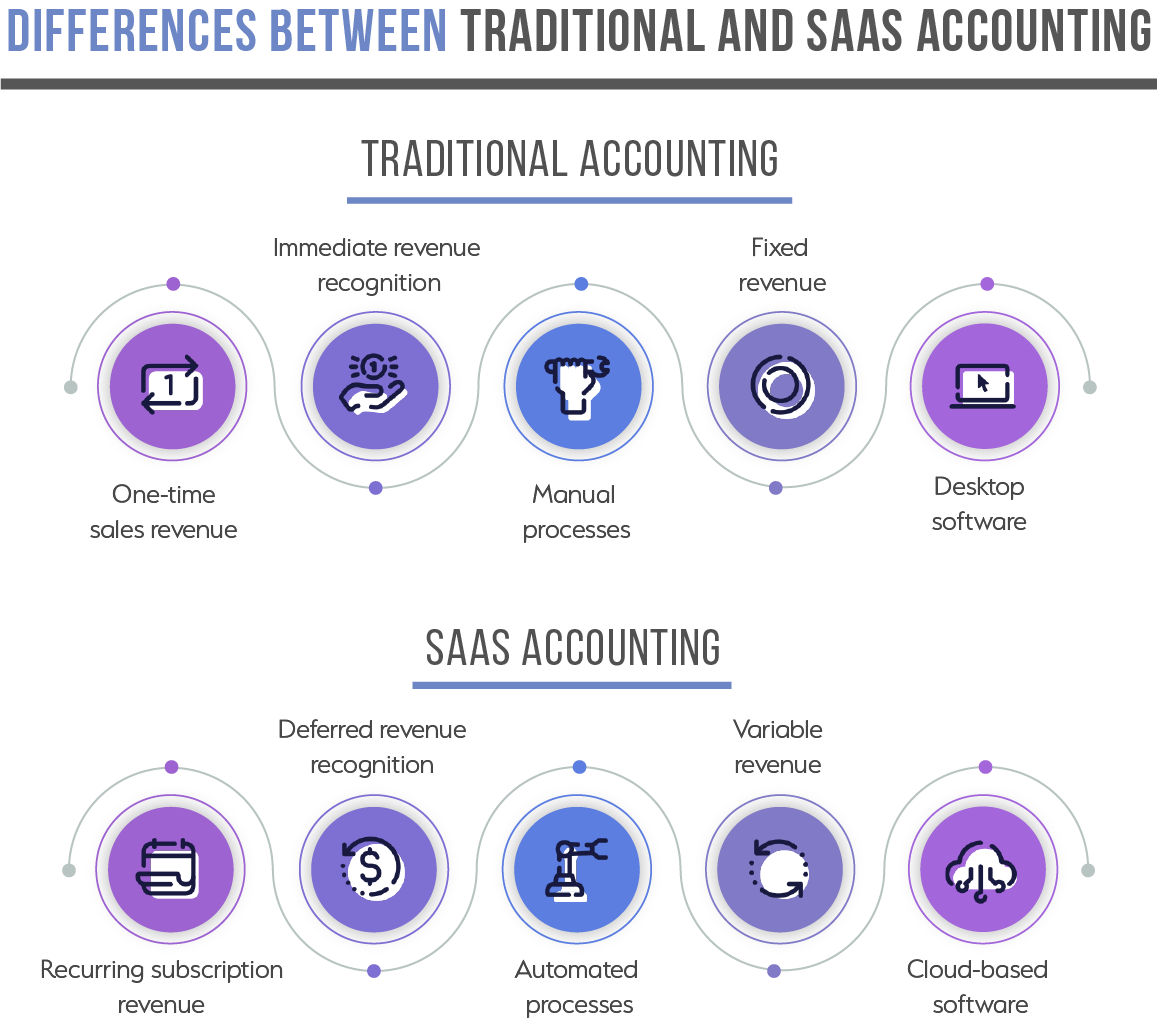

Revenue and expenses are recognized when cash is received/paid under the cash-basis accounting. Cash accounting is simple but doesn’t capture the whole financial position as it leaves out accounts receivable and payable. It is widely utilized by small businesses.

Revenue and expenses are recorded as they’re earned. Accrual accounting records revenue and expenses when they occur. The method provides even more insight into how the company consists financially and is mandatory for businesses producing at least $25 million in annual revenue under IRS rules.

2. SaaS Business Revenue Recognition Principle

In regard to revenue recognition in SaaS accounting services, ASC 606 is applicable. U.S. GAAP establishes ASC 606, “Revenue from Contracts with Customers,” as a standard that offers a framework for how businesses should record revenue from customer contracts, including SaaS models that are subscription-based.

Important Aspects of SaaS Accounting with ASC 606:

According to ASC 606, SaaS businesses start to earn money when the consumer gains ownership of the promised service, which happens frequently as the service is being provided. By adhering to this approach, revenue is acknowledged at the time the service is rendered instead of after payment is received.

In accordance with ASC 606, deferred revenue is a substantial component for SaaS organizations. It describes income that has been pre-paid for—usually through subscription fees—but hasn’t yet been realized since the service hasn’t been rendered in its entirety. Deferred revenue must be reported as a liability under ASC 606 until the business delivers the service.

Another area addressed by ASC 606 is unbilled revenue, which is defined as services rendered but not yet invoiced. Up until the point of invoicing, SaaS businesses keep this on file as an asset. The standard emphasizes that revenue should be recorded as soon as the performance requirements are completed, even if the client hasn’t received a bill yet.

SaaS companies are required by ASC 606 to include specific performance obligations in their contracts. These obligations may include customer support, software updates, or subscription services. Revenue has to be allotted to these responsibilities and recorded once each is fulfilled.

3. Key Metrics to Track in SaaS Accounting

SaaS businesses need to track specific metrics such as Monthly Recurring Revenue (MRR), Customer Lifetime Value (CLTV), Customer Acquisition Cost (CAC), and churn rate. These key performance indicators (KPIs) are tracked by SaaS accounting Services providers that help in understanding business health and guiding future growth explained below:

This reflects the predictable revenue stream from subscriptions and is vital for growth forecasting.

Measures the total revenue a company can expect from a customer over time, helping guide pricing and marketing efforts.

Tracks the cost of acquiring new customers, enabling businesses to assess marketing efficiency.

This is the percentage of customers who cancel their subscriptions, highlighting customer satisfaction and retention issues.

Reflects profitability by subtracting the cost of goods sold (COGS) from total revenue.

Measures the predictable yearly revenue from subscriptions, helping SaaS businesses assess long-term financial health and forecast growth.

4. General Accounting Principles to be followed by SaaS Businesses

Along with complying with ASC 606, Saas businesses should also be vigilant about the fact that other general accounting principles are kept in mind while preparing the financial statements. These principles are the founding guidelines for preparing and recording financials for proper analysis. Hence, for correct financial statements, we need to ensure all the accounting principles are adhered to, as they also ensure consistency.

Some prominent accounting principles are:

Businesses must consistently follow established accounting rules and standards.

Identical transactions must be recorded using the same methods across reporting periods.

Accountants are expected to provide an unbiased, truthful representation of financial data.

Companies should apply the same reporting procedures in all statements for comparability.

Income and expenses must be reported in the period they occur.

Significant financial information that could influence decision-making must be disclosed.

Honesty is expected from all parties involved.

The international equivalent of GAAP is the International Financial Reporting Standards (IFRS), used in over 140 jurisdictions worldwide. While US-based companies must adhere to GAAP, SaaS companies with international operations may need to align with IFRS in those regions.

5. Accounting Software for SaaS Businesses

SaaS accounting software is essential for overseeing SaaS financial operations. It ensures accuracy and adherence to GAAP requirements by automating complicated procedures, including revenue recognition, subscription management, and deferred revenue tracking. Many firms that provide accounting for SaaS software use these software solutions to deliver real-time financial data, assisting organizations in tracking key performance indicators (KPIs) and making well-informed decisions.

Popular SaaS accounting software in the USA includes:

A widely-used platform for small to medium SaaS businesses, offering automation of invoicing, expense tracking, and revenue recognition.

Known for its user-friendly interface and ability to integrate with third-party apps, Xero helps manage cash flow, subscriptions, and KPIs.

Accounting using NetSuite is ideal for larger SaaS companies, offering advanced financial management, including multi-currency support and billing cycle automation.

Zoho’s product, Zoho Subscription, is an ideal platform for managing SaaS businesses’ accounting.

These tools are integral to streamlining accounting tasks and enabling SaaS accounting services to deliver efficient and scalable business solutions.

Best Practices for Saas Accounting

Here are some best practices for optimizing your SaaS accounting processes:

1. Accurate Revenue Recognition

Recognizing revenue in the SaaS business requires adhering to GAAP requirements. For SaaS companies to prevent financial inconsistencies, deferred and unbilled revenue must be appropriately recorded. Putting dependable SaaS accounting services in place helps guarantee that your revenue recognition complies with all legal requirements.

2. Expense Management

Identifying direct and indirect expenses is a must. According to a survey by Sage Intacct, 67% of all SaaS companies could maintain better expense management by enforcing transparent practices for categorizing types of expenses, which in return resulted in the desired up-to-date & financially sound reporting systems.

3. Tracking Key Metrics

It’s critical to keep an eye on key financial indicators, including customer lifetime value (CLTV), monthly recurring revenue (MRR), and customer acquisition cost (CAC). These indicators aid SaaS companies in assessing their financial standing and directing their future expansion plans. You can easily and precisely track these data by using SaaS accounting software.

4. Monitor Deferred and Unbilled Revenue

While unbilled revenue relates to services supplied but not billed, deferred revenue refers to cash received for services not rendered. Precise management of these is essential to avoid reporting inconsistencies, and specialist SaaS accounting services can provide accuracy.

5. Automation

Automation can greatly improve the efficiency of accounting tasks. Automated systems, such as SaaS accounting software, can streamline processes like invoicing, expense tracking, and financial reporting, reducing human error and saving time.

6. Outsourcing

Partnering with SaaS accounting firms for outsourced accounting services can offer expert financial management without the burden of handling it in-house. By automating tasks through outsourcing, you benefit from professional expertise and ensure that repetitive, time-consuming tasks are handled efficiently and accurately.

What are the functions of a SaaS Accountant

An outsourced accounting firm provides specialized services tailored to the unique needs of SaaS businesses. The key functions of SaaS accountants include the following:

1. Revenue Recognition

Accurate revenue recognition is essential in SaaS accounting services. Since SaaS businesses often follow a subscription-based model, where payments are received upfront but revenue is recognized over time, accountants ensure compliance with GAAP standards by properly managing deferred and unbilled revenue.

2. Financial Metrics Monitoring

SaaS businesses depend on tracking specific financial metrics to guide decision-making and growth. Accounting for SaaS software involves monitoring and reporting these metrics, ensuring a clear understanding of the company’s financial health.

3. Automation with SaaS Accounting Software

Implementing the right SaaS accounting software helps automate invoicing, expense tracking, and financial reporting processes. This automation improves efficiency, reduces errors, and ensures that financial data is accurate and current, a key feature of effective SaaS accounting services.

4. Tax Compliance and Financial Planning

SaaS accounting firms also assist with tax compliance, audits, and strategic financial planning. They ensure that SaaS businesses remain compliant with regulations and are well-prepared for future growth, allowing management to focus on their core operations.

Benefits of Outsourcing SaaS Accounting Process

1. Access to Specialized Expertise

Outsourcing to SaaS accounting services provides access to professionals who understand the complexities of SaaS business models. SaaS accountants are skilled in managing revenue recognition, deferred revenue, and subscription billing cycles. Their expertise ensures financial processes are compliant with industry standards and GAAP regulations.

2. Cost and Time Efficiency

Outsourcing reduces the time and effort spent on managing in-house accounting operations. SaaS accounting services utilize automation tools, such as SaaS accounting software, to streamline tasks, minimize errors, and ensure timely, accurate reporting. Outsourcing allows businesses to focus on core operations and growth, saving time and money.

3. Enhanced Scalability and Flexibility

By opting for a reputable outsourced accounting firm, SaaS businesses can easily scale their financial operations to match growth without hiring or training new staff. SaaS accounting firms offer flexibility to adjust services as needed, providing support tailored to the evolving needs of the business.

4. Improved Compliance and Risk Management

Outsourcing ensures companies comply with tax laws, audit standards, and other regulatory requirements. SaaS accounting services help reduce non-compliance risk, avoiding costly penalties or legal issues while maintaining smooth financial operations.

5. Better Financial Insights and Reporting

Outsourcing of SaaS accounting services allows businesses to leverage advanced financial reporting and analytics. With real-time access to key metrics, companies can gain deeper insights into their financial health, cash flow, and profitability. SaaS accounting services help generate customized reports tailored to business needs, enabling better decision-making and strategic planning based on accurate, up-to-date data.

6. Access to Advanced Technology and Tools

SaaS accounting services often utilize cutting-edge software and technology, offering automation and enhanced data security. By outsourcing, companies benefit from these advanced tools without needing to invest in costly infrastructure. The automation provided by SaaS accounting platforms reduces manual errors and improves the efficiency of financial processes, allowing businesses to stay competitive and agile.

Conclusion

In summary, in the quickly growing SaaS sector, SaaS accounting is important to preserving financial transparency and fostering company expansion. Accurate revenue recognition, deferred revenue management, and adherence to GAAP rules are more important than ever as the market expands. Companies providing SaaS accounting services can make wise decisions that lead to long-term success by monitoring important indicators and ensuring that expenses are managed properly.

Using SaaS accounting services can assist automate accounting processes, decrease errors, and keep up-to-date records—all necessary for scalability—in financial operations. Automation is essential for handling repetitive operations like expense monitoring, reporting, and invoicing. Outsourcing Saas Accounting frees up time for businesses to concentrate on expansion and innovation.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

SaaS accounting is different because of its subscription-based business model, which includes complicated billing cycles, deferred revenue, and recurring revenue. SaaS accounting services address these difficulties by guaranteeing correct revenue recognition and adherence to GAAP guidelines.

The two most popular approaches are cash accounting, in which revenue is recorded when cash is received, and accrual accounting, in which income is recognized when earned. Typically, accrual accounting is used by SaaS accountants to manage delayed and unbilled revenue efficiently.

SaaS accounting policies focus on accurately managing deferred and unbilled revenue, with a strong emphasis on proper revenue recognition according to GAAP (Generally Accepted Accounting Principles). These services ensure that, in compliance with financial reporting standards, revenue is recognized only when the services have been delivered or performed.

Yes, SaaS accounting services help ensure your business follows all federal, state, and international tax rules. They handle tax filings, calculate sales taxes, and keep accurate financial records, helping you avoid mistakes and potential penalties.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.