Table of Content

Share This Article

- Reading Time: 10 Minutes

- Published: November 18, 2024

- Last Updated: March 10, 2025

Key Takeaways

- Zoho Books simplifies core accounting functions like invoicing, expense tracking, and bank reconciliation, making financial management easier for small and medium-sized businesses.

- Zoho Books provides various reports, from business overviews to sales, profitability and inventory analyses that empower businesses.

- Setting up Zoho Books involves configuring company details, chart of accounts, customers and vendors, and connecting bank accounts.

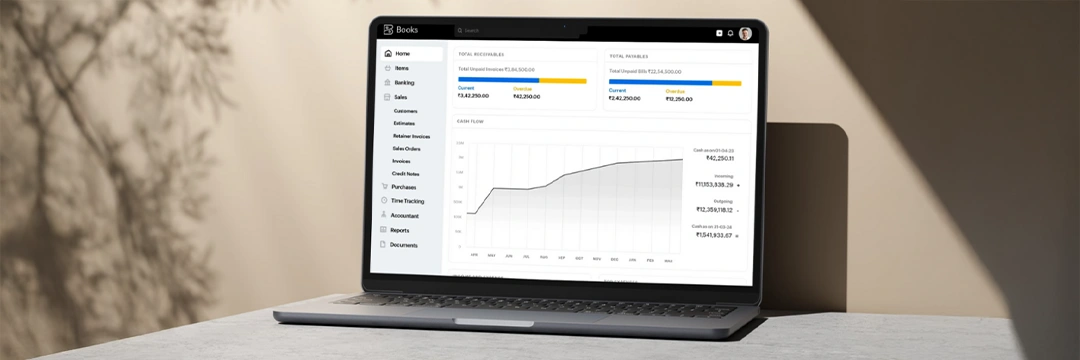

With an abundance of variable elements governing your business, finances are a hard nut to crack. That’s where software like Zoho Books proves to be invaluable. It seamlessly streamlines tasks such as invoicing, expense management, and reporting while being integrated smoothly with sales and inventory. Ideal for startups and conglomerates alike, Zoho Books boosts efficiency, saves time, and gives insightful financial reports. Let’s discover how you can leverage Zoho Books to make accounting a breeze.

What is Zoho Books?

Zoho books is like having a dedicated financial assistant, but without an extra desk! It’s a user-friendly online platform that takes the headache out of managing your business finances. Imagine easily creating professional invoices, tracking every penny you spend, and even keeping tabs on your inventory – all in one secure place. Zoho Books simplifies those essential, yet sometimes tough tasks and gives you a clear picture of your company’s financial health.

More than just a basic ledger, Zoho Books offers a helping hand with the more complex aspects of business, too. From managing projects and handling sales tax (ugh!) to effortlessly reconciling bank statements, it’s designed to streamline your operations. It lets you focus on running your business – while keeping your finances top-notch.

Core Features of Zoho Books Accounting

Zoho Books functionalities are designed to make accounting an easy task. From invoicing, banking, to tracking and inventory management, you can streamline a wide range of accounting tasks. Leveraging this cloud-based accounting software allows you to keep your books accurate and well-managed to make strategic decisions.

Invoicing:

Invoice processing has never been easier. Zoho accounting lets you customize them with your logo and offers templates, so you can send polished invoices in minutes. This helps you look professional and get paid faster.

Expense Tracking:

Say goodbye to a box full of receipts! Zoho accounting makes tracking expenses simple. Snap a photo of a receipt, upload it, and categorize it; perfect for tax season. This tracking feature helps you stay organized and prepared.

Banking:

Connecting your bank accounts to Zoho Books is like having a financial assistant who automatically imports your transactions. This makes bank reconciliation a snap, helping you keep your records accurate and spot any errors quickly.

Inventory Management:

If you’re selling products, Zoho accounting has you covered. Keep track of your stock levels, set reorder points, and get alerts when you’re running low or out of stocks. This feature is a lifesaver for businesses managing warehouses or online stores.

Reporting:

Zoho Books generates insightful financial reports, like profit and loss statements, balance sheets, and cash flow statements. These reports give you a clear picture of your business’s financial health, helping you make smart decisions. They’re also essential for tax time and sharing information with stakeholders.

Online Payments:

Make it easy for customers to pay you by accepting online payments directly through Zoho accounting. This leads to faster payments and a healthier cash flow; a win-win!

Sales Tax Management:

Sales tax can be a headache, but Zoho Books simplifies it. It can calculate sales tax, track what you’ve collected, and generate reports for filing. This helps you stay compliant and avoid penalties.

Project Management:

If you’re working on projects, Zoho accounting can help you stay organized. Track tasks, manage expenses, and bill clients for project-related costs.

Purchase Orders:

Zoho accounting helps your purchasing process by creating and sending purchase orders to your vendors. This helps you track what you’ve ordered and manage your spending.

Document Management:

Keep all your essential business documents (contracts, invoices, receipts) in one secure place. Zoho documents make it easy to find what you need when you need it, which is especially helpful during audits. This Zoho feature is a great organizational tool.

How to Track Inventory in Zoho Books

Beyond basic accounting, Zoho Books also offers effective inventory management. Keeping track of your stock levels is essential for smooth operations and avoiding costly shortages or overstocking.

Enable Inventory Tracking (Organization-Wide):

Before you can track inventory for individual items, you need to turn on the overall inventory tracking feature in Zoho Books. This is done in the Settings menu, under Items within Preferences. Check the “Enable Inventory Tracking” box and specify the date you want to start tracking from. This sets the stage for tracking all your eligible items.

Track Inventory (Per Item):

Now, go to the Items section. Whether you’re adding a new item or editing an existing one, you’ll find the option to “Track Inventory for this item.” This checkbox is key – make sure it’s checked for each item you want to monitor.

- Item-Specific Information: Once you’ve enabled tracking for a specific item, you’ll need to provide some additional details:

- Inventory Account: Choose the appropriate account from your Chart of Accounts where the inventory value will be tracked.

- Reorder Point: This is a crucial setting. Enter the stock level at which you want to be notified that it’s time to reorder. This helps prevent stockouts.

- Opening Stock: Enter the quantity of the item you have on hand at the beginning of your tracking period.

- Opening Stock Rate per Unit: Enter the cost you paid for each unit of your opening stock. This is essential for accurate cost accounting.

Save:

Finally, click Save to record all this information. From this point forward, Zoho Books will automatically update your inventory levels as you create sales invoices and purchase bills. This gives you a real-time view of your stock and helps you manage your inventory effectively.

How to Track Sales Tax Through Zoho Books

Zoho Books also offers effective sales tax management. Keeping track of your sales tax is essential for compliance and accurate financial reporting. Keeping track will avoid surprise tax bills in future!

![]()

Enable Sales Tax Tracking (Organization-Wide):

First things first, you need to make sure Zoho Books is set up to track sales tax. This involves a few quick steps in the settings:

- Access the Tax Settings: Go to the Settings menu (usually a gear icon) and then find “Taxes & Compliance.” Select “Taxes.”

- Navigate to Tax Settings: Within the Taxes section, look for and select “Tax Settings.”

- Enable Separate Accounts: Choose the option to “Track Taxes Under Separate Accounts.” This is key because it tells Zoho Books to keep your sales tax (which they call “Output Tax”) neatly organized in its own account. This separation makes reporting and reconciliation much easier.

Track Sales Tax (Per Transaction):

Now, when you’re creating sales invoices (the fun part!), Zoho Books will automatically calculate and track the sales tax for you. Just make sure you’ve got the correct tax rate selected for each transaction – double-checking this is always a good idea. Zoho Books does the math, so you don’t have to!

What are Various Reports in Zoho Books?

Zoho Books generates a variety of reports that provide a comprehensive overview of your finances. These reports offer valuable data for informed decision-making and strategic planning.

Business Overview:

These reports provide a high-level snapshot of your financial health. The Profit & Loss statement shows your revenue and expenses, while the Balance Sheet details your assets, liabilities, and equity. The Cash Flow Statement tracks the movement of cash in and out of your business. These are core reports for Zoho bookkeeping and essential for understanding your overall performance.

Sales:

These reports break down your sales activity in various ways. See which customers are generating the most revenue, which products are selling best, and how your sales team is performing. This information is crucial for making informed sales decisions.

Inventory:

For businesses managing stock, these reports are essential. The Inventory Summary shows what you have on hand, while the Inventory Valuation Summary calculates the value of your inventory. FIFO Cost Lot Tracking helps you manage inventory costing methods and ABC Classification helps you categorize inventory for better control. Zoho inventory reports are vital for efficient stock management.

Receivables:

These reports help you track what customers owe you. See outstanding balances, identify overdue invoices with aging reports, and get detailed information on specific invoices. Effective management of receivables is critical for healthy cash flow.

Payments Receipts:

Zoho Books reports help you track payments received and outstanding amounts. The customer payments report provides details of all payments received. Additionally, refunds and credit note reports help you manage returns and adjustments. Understanding payment trends ensures better cash flow management.

Profitability:

These reports help in analyzing your financial success. The profit & loss report tracks revenue and expenses. On the other hand, profitability summary highlights profit margins across products, services, or departments. These insights help optimize pricing and cost management for higher profitability.

Activity:

Activity logs provide a record of all actions taken within your Zoho Books account. This is useful for auditing purposes and tracking changes made by different users. This Zoho accounting feature helps maintain transparency and accountability.

What Makes Zoho Books Ideal for Your Business

Let us explore why Zoho Books stands out as an ideal accounting solution for businesses like yours. From its user-friendly interface to its powerful features, it offers a compelling combination of value and functionality.

Productivity Boost

Imagine this: You’re spending way too much time on invoicing, chasing payments, and trying to figure out if your bank account actually matches your records. Zoho accounting software can take all that off your plate. It automates those tedious tasks, so you can get back to what you do best – actually running your business.

Integrated Platform

Instead of juggling a bunch of different apps for invoices, expenses, inventory, document management, projects management and analytics, Zoho Books puts everything you need in one convenient spot. It’s like having a financial command center, where all your data flows together seamlessly. This makes your workflow so much smoother and helps prevent those frustrating data errors.

Real-time Insights

Here’s the cool part: Zoho accounting gives you instant access to your key financial numbers. You can see your cash flow, track where your money is going, and monitor your income in real time. No more waiting for reports or guessing about your finances. You’ll have the information you need to make smart decisions, right when you need it.

Streamlined Reporting

Forget about dealing with spreadsheets. Zoho Books makes it easy to generate professional financial reports with just a few clicks. Profit and loss statements, balance sheets, cash flow analyses – they’re all there, ready to give you valuable insights into how your business is doing.

Enhanced Security

Of course, your data is precious. Zoho Books takes security seriously. They encrypt your information, store it in secure data centers, and back it up regularly. You can rest easy knowing your financial data is safe and sound.

Compliance Made Simple

Finally, compliance. Staying on top of tax laws and regulations can be a real headache, especially in the US. This accounting software helps simplify things with built-in features for tax calculations, audit trails, and other compliance tools. It’s like having a helpful guide to understanding taxes and compliance.

How Zoho Books Accountant Brings Financial Peace of mind?

Picture this: your business finances are perfectly organized, your books are balanced, and you have a clear understanding of your financial health. No more late nights worrying about invoices or scrambling to prepare for taxes. Zoho Books itself can bring much of this peace of mind. As the best software for small business bookkeeping, it streamlines everything from daily transactions and reconciliations to generating insightful reports. With Zoho accounting tools at your fingertips, you can take control of your finances, freeing you to focus on growing your business.

Entrusting your Zoho accounting to a skilled professional through outsourced accounting services brings even greater peace of mind. You gain the expertise of someone who knows Zoho accounting process inside and out, ensuring accurate data entry, efficient workflows, and compliance with regulations. It’s like having a dedicated financial partner who’s always on top of things. Outsourcing gives you the confidence to make informed decisions and sleep soundly at night.

Conclusion

Zoho Books makes accounting easy for businesses of any size. Its essential features, ranging from invoicing and expense tracking to inventory management to project management and reporting, to automating financial processes. Proper setup is the first step of leveraging the most out of this powerful tool. This is where dedicated Zoho Books accounting services can help you in maximizing its utilization and gaining financial control and insight.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

While a direct, seamless integration between QuickBooks and Zoho Books doesn’t exist, you can often import data from QuickBooks into Zoho Books. This usually involves exporting data from QuickBooks in a compatible format (like CSV) and then importing it into Zoho Books. This can help with migrating your financial data to Zoho accounting.

Yes, absolutely! Zoho Books allows you to grant access to your accountant. You can invite them as a user and assign them specific roles and permissions, controlling what they can see and do within your Zoho accounting system. This makes collaboration seamless and efficient.

Bank entries in Zoho Books are typically handled through the Banking module. You can either manually enter transactions or, more commonly, connect your bank account for automatic bank feeds. This facilitates Zoho books bank reconciliation and keeps your records up-to-date.

Zoho Books simplifies bank reconciliation. After connecting your bank account, the platform automatically imports transactions. You then match these imported transactions with your bank statements. This Zoho books bank reconciliation process helps identify any discrepancies and ensures your records are accurate.

Setting up Zoho books recurring invoices is straightforward. Create a new invoice as usual, but before saving, choose the “Recurring Invoice” option. You’ll then specify the frequency (daily, weekly, monthly, etc.) and other details. This automates your billing for repeat customers.

To record a journal entry in Zoho books, navigate to the “Accountant” module. There, you’ll find the option to create manual journal entries. You’ll debit and credit the appropriate accounts to ensure the journal entry in Zoho books balances correctly.

Zoho Books is a comprehensive Zoho accounting solution for managing all aspects of your business finances, including invoicing, expenses, inventory, and reporting. Zoho Expense, on the other hand, focuses specifically on expense tracking and management, including receipt scanning, expense reports, and approvals. While they can work together, they serve different primary purposes.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.